Filing for Chapter 13 bankruptcy as a small business owner can be a complex process, but it offers a structured way to reorganize debts and regain financial stability. Compared to Chapter 7, which involves asset liquidation, Chapter 13 lets business owners to establish a repayment plan to settle debts over three to five years. This option is particularly beneficial for small business owners who wish to keep their operations running while addressing financial obligations. However, navigating the legal intricacies of Chapter 13 requires careful planning and professional guidance.

Read on to learn how to file a Chapter 13 bankruptcy as a small business owner.

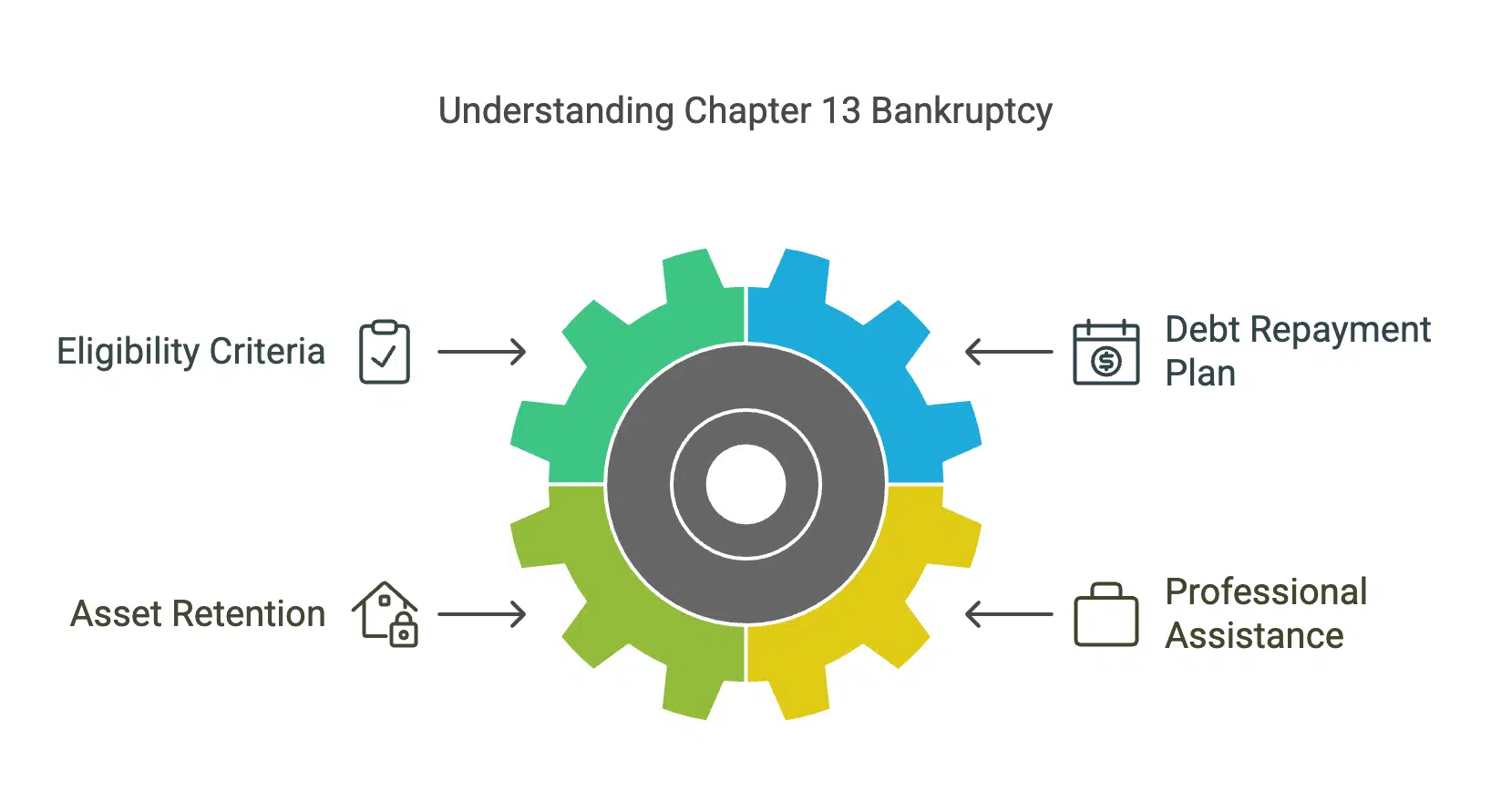

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy, often referred to as a “wage earner’s plan,” is designed for individuals with a regular income who can repay a portion of their debts through a court-approved plan. This means that personal and business debts can be addressed simultaneously for small business owners, provided the business is structured as a sole proprietorship. Corporations and partnerships, however, aren’t eligible for Chapter 13 and must explore other bankruptcy options.

Furthermore, Chapter 13’s primary advantage is that it allows business owners to retain their assets, including business equipment and property, while catching up on missed monthly payments. This is particularly important for small business owners who rely on specific tools or inventory to generate income.

However, given the complexities of Chapter 13 bankruptcy, small business owners are strongly encouraged to seek professional assistance. For instance, working with a reputable bankruptcy law firm in Jacksonville or nearby locations can help you gain invaluable support, from evaluating eligibility to representing the owner in court.

Eligibility Requirements

To qualify for Chapter 13 bankruptcy, small business owners must meet specific criteria. First, the individual must have a steady source of business income, as the repayment plan relies on consistent payments over the designated period. Additionally, unsecured debts must not exceed certain amounts although these amounts are periodically adjusted for inflation.

For small business owners, the business itself must also be a sole proprietorship. If the business is structured as an LLC, corporation, or partnership, the owner can’t file for Chapter 13 on behalf of the business. In such cases, the owner may need to file personally if they have personally guaranteed business debts.

Preparing to File

Before filing for Chapter 13 bankruptcy, small business owners must gather extensive financial documentation. This includes tax returns, profit and loss statements, bank statements, and a detailed list of assets and liabilities. Also, the owner must complete a credit counseling course from an approved agency within 180 days before bankruptcy filing.

Another critical step is creating a realistic repayment plan. This plan outlines how the business owner intends to repay creditors over a three—to five-year period. It must account for priority debts (such as taxes and employee wages), secured debts (like mortgages or car loans), and unsecured debts (such as credit card balances). By working with a bankruptcy attorney, small business owners can help ensure the plan is feasible and complies with legal requirements.

Filing the Petition

The formal process begins with filing a bankruptcy petition in the appropriate federal court. Along with the petition, the business owner must submit several forms, including schedules of business assets and liabilities, a statement of financial affairs, and the proposed repayment plan. Filing fees, typically around USD$310, must also be paid unless a fee waiver is granted.

Once the petition is filed, an automatic stay is being implemented. This legal provision stops most collection actions, including wage garnishments, creditor calls, and even lawsuits. For small business owners, this can provide much-needed relief and allow them to focus on restructuring their finances.

The Role of the Bankruptcy Trustee

After filing, a bankruptcy trustee is appointed to oversee the case. The trustee’s responsibilities include reviewing the repayment plan, distributing payments to creditors, and ensuring compliance with bankruptcy laws. The trustee may also request additional documentation or modifications to the plan.

Small business owners must also attend a meeting of creditors, also known as a 341 meeting, where the trustee and creditors can ask questions about the financial situation and repayment plan. While this meeting is typically straightforward, having legal representation can help address creditors’ concerns.

Confirmation of the Repayment Plan

The court must approve the repayment plan before it becomes effective. During the confirmation hearing, the judge evaluates whether the plan is feasible and meets legal requirements. Creditors may object to the plan if they believe it unfairly prioritizes certain debts or fails to repay a sufficient portion of what’s owed.

Once the plan is confirmed, the business owner must make regular payments to the trustee, who then distributes the funds to creditors. It’s crucial to adhere to the payment schedule, as failure to do so can result in the dismissal of the case or conversion to Chapter 7 bankruptcy.

Completing the Bankruptcy Process

Successfully completing a Chapter 13 bankruptcy requires strict adherence to the repayment plan. After making all required payments, the business owner receives a discharge of remaining eligible debts. This discharge eliminates personal liability for these debts, providing a fresh financial start.

However, not all debts are dischargeable. For example, certain tax obligations, student loans, and child support payments typically remain the debtor’s responsibility. Hence, small business owners should consult with a bankruptcy lawyer to understand which debts will be affected by the discharge.

Takeaways

Filing for Chapter 13 bankruptcy as a small business owner is a significant decision that requires careful consideration and planning. By understanding the process, meeting eligibility requirements, and working with qualified professionals, business owners can navigate this challenging situation and emerge with a stronger financial foundation.