Tax season can be stressful for many Americans, but online tax calculators make the process much easier. Whether you’re an employee, self-employed, or a small business owner, using a tax calculator can help you estimate your tax liability, deductions, and refunds accurately.

These tools help you avoid mistakes, maximize deductions, and prepare for filing season without unnecessary stress.

Many people overpay or underpay their taxes due to a lack of proper planning. Online tax calculators can help users better manage their finances, ensuring they withhold the correct amount and qualify for deductions they might have overlooked.

This article presents 10 online tax calculators for USA taxpayers that are not only free but also incredibly user-friendly, making tax calculations effortless for everyone.

Why Use Online Tax Calculators?

Quick and Easy Tax Estimations

- Online tax calculators provide instant results, helping you understand your tax obligations without complex calculations.

- They allow you to plan your finances better by estimating refunds or the amount owed.

- Many calculators include federal and state tax assessments, helping taxpayers make well-informed financial decisions.

Maximize Deductions and Credits

- Many tax calculators incorporate deductions, credits, and exemptions, ensuring you don’t miss out on savings.

- Some tools help you compare tax scenarios to determine the best filing strategy.

- Personalized recommendations can help taxpayers optimize their tax refund or reduce their tax liability.

Reduce Human Errors in Tax Filing

- Using these calculators minimizes the risk of mistakes that can lead to IRS penalties or delays in processing your return.

- Automated calculations ensure accuracy based on the latest tax laws.

- Helps detect common filing errors before submitting tax returns.

Saves Time and Money

- Instead of hiring an accountant for basic estimations, online tax calculators offer quick results for free.

- They help you determine whether professional tax services are necessary for your situation.

- Ideal for individuals with straightforward tax situations who don’t require full-service tax professionals.

Key Features to Look for in a Tax Calculator

Before choosing a tax calculator, consider these essential features:

| Feature | Importance |

| IRS Compliance | Ensures that the tool follows updated tax laws, reducing legal risks. |

| User-Friendly Interface | Makes it easy for users to input their details and get accurate results. |

| Up-to-Date Tax Laws | Reflects current tax brackets, deductions, and exemptions. |

| Security & Data Protection | Ensures that personal financial information remains confidential. |

| Mobile Compatibility | Provides access to tax calculations on smartphones and tablets. |

1. IRS Tax Withholding Estimator

Best for: Estimating federal tax withholding.

The IRS Tax Withholding Estimator is an official tool provided by the IRS to help taxpayers determine the correct amount of federal tax that should be withheld from their paychecks. This ensures they neither owe a large amount at tax time nor overpay throughout the year. The tool is user-friendly and considers various income sources, deductions, and credits to provide a more accurate estimate of tax liability.

By regularly updating this estimator, the IRS ensures taxpayers have the most up-to-date tax regulations incorporated into their calculations. This calculator is especially useful for employees who have multiple income sources, those with significant tax deductions, or individuals who experience frequent changes in their financial circumstances.

Features

| Feature | Description |

| Official IRS tool | Ensures compliance with federal tax laws |

| Up-to-date tax information | Incorporates the latest tax brackets and regulations |

| Free to use | No cost for taxpayers |

| Helps prevent over- or underpayment | Ensures proper withholding to avoid surprises at tax time |

| Personalized recommendations | Adjusts for personal and financial changes |

Link: IRS Withholding Estimator

2. TurboTax Tax Calculator

Best for: Quick and accurate tax refund estimates.

TurboTax offers one of the most user-friendly tax calculators, providing instant tax refund estimates for individuals. This tool is especially useful for those with W-2 income and helps users understand how deductions and credits impact their tax liability. TurboTax also offers the advantage of integration with its full tax preparation services, allowing seamless filing for users who decide to use their software.

Additionally, the calculator provides insights into various tax-saving opportunities, making it ideal for taxpayers who wish to optimize their deductions. The platform is known for its accuracy and secure handling of financial information, making it a trusted choice for millions of users.

Features

| Feature | Description |

| User-friendly | Simple interface for all users |

| Quick refund estimate | Provides an instant calculation of potential refunds |

| Integration with TurboTax | Easily transfers information for full tax filing |

| Free to use | No cost for tax estimation |

| Deduction insights | Identifies available tax credits and deductions |

Link: TurboTax Tax Calculator

3. H&R Block Tax Calculator

Best for: Comparing refund scenarios.

H&R Block’s tax calculator is designed for taxpayers who want to explore different refund scenarios before filing their taxes. This tool allows users to compare various deductions, credits, and income scenarios to see how their tax liability changes. It is ideal for taxpayers uncertain about their filing status or deductions. By entering income, dependents, and deductions, users can get an estimate of their tax refund or amount owed.

The tool is particularly beneficial for those who are self-employed or have complex tax situations, as it provides clarity on various tax brackets and credits applicable to their earnings.

Features

| Feature | Description |

| Free tool | No cost for use |

| Federal and state tax estimates | Provides estimates for both levels |

| Deduction and credit insights | Helps maximize potential tax savings |

| Easy-to-use interface | Designed for users with various tax knowledge levels |

| Refund comparison | Allows multiple tax scenarios to be evaluated |

Link: H&R Block Tax Calculator

4. TaxAct Tax Calculator

Best for: Small business owners and freelancers.

TaxAct’s calculator is particularly helpful for self-employed individuals and small business owners. It provides a detailed breakdown of tax obligations, including estimated quarterly tax payments. This tool is designed to help independent contractors, freelancers, and entrepreneurs understand their tax responsibilities.

By including self-employment tax calculations, it ensures users can accurately budget for their tax payments throughout the year. The tool also provides users with insights on deductions available for business expenses, helping them lower their taxable income.

Features

| Feature | Description |

| Includes state tax calculations | Provides federal and state tax estimates |

| Detailed breakdown of tax scenarios | Ideal for business owners and freelancers |

| Helps estimate quarterly tax payments | Supports self-employed individuals |

| Free to use | No cost for tax estimation |

Link: TaxAct Tax Calculator

5. SmartAsset Income Tax Calculator

Best for: Visual breakdown of tax estimates.

SmartAsset’s tax calculator provides an interactive and visual breakdown of tax liabilities at both the state and federal levels. This is an excellent tool for those who prefer graphical representations of their tax estimates. The platform provides personalized insights based on user input and allows taxpayers to compare their estimated tax burden across different states.

This is particularly useful for individuals considering relocation, as they can determine the best state for optimizing tax savings. Additionally, the tool incorporates tax bracket details, Social Security taxes, and Medicare tax estimates to give a complete picture of overall tax liability.

Features

| Feature | Description |

| Interactive tax charts | Helps users visualize tax scenarios |

| Detailed breakdown per state | Provides state-by-state tax comparisons |

| Free to use | No cost for calculations |

| User-friendly interface | Simplifies tax estimates for all users |

Link: SmartAsset Tax Calculator

6. Jackson Hewitt Tax Calculator

Best for: Estimating refunds and owed taxes.

Jackson Hewitt’s tax calculator is a simple and reliable tool that helps users estimate their tax refunds and determine if they owe taxes. This tool is particularly useful for individuals who want a clear picture of their federal and state tax obligations.

It provides a quick estimate based on user input, making it easy for taxpayers to adjust their withholding or tax planning strategy before filing. The calculator also integrates seamlessly with Jackson Hewitt’s tax filing services, allowing users to transition smoothly from estimation to filing.

Features

| Feature | Description |

| Quick refund and tax estimates | Provides federal and state tax calculations |

| Easy-to-use interface | Simple input process for users of all levels |

| Integration with Jackson Hewitt filing services | Users can proceed with filing directly |

| Free to use | No cost for estimations |

Link: Jackson Hewitt Tax Calculator

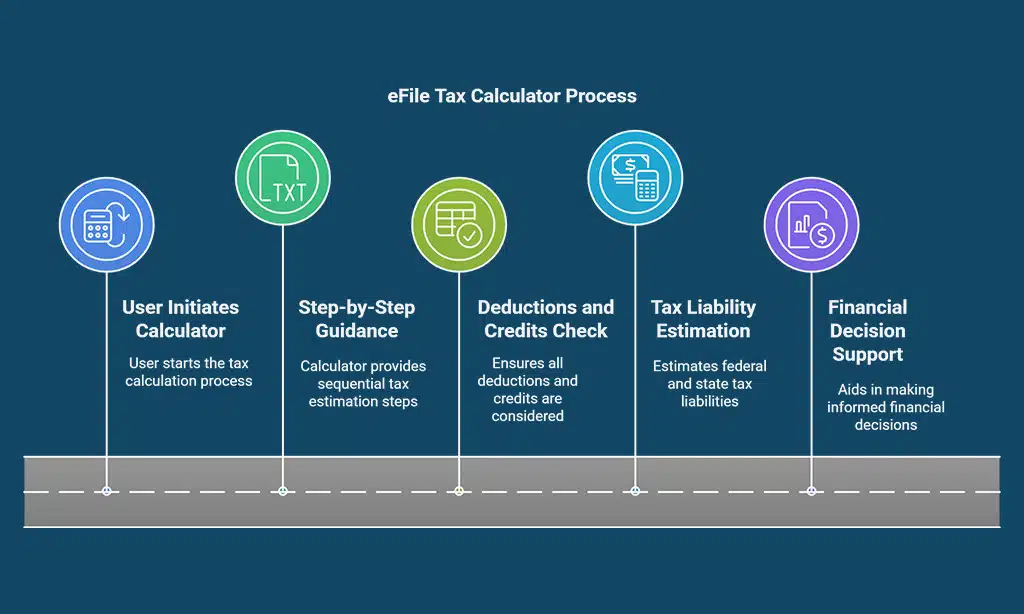

7. eFile Tax Calculator

Best for: Step-by-step tax guidance.

The eFile Tax Calculator is designed for individuals who need step-by-step guidance in estimating their tax obligations. This tool is ideal for beginners as it walks users through each stage of tax estimation, ensuring they don’t overlook any deductions or credits.

The calculator provides an estimate of federal and state tax liability, helping taxpayers make informed financial decisions before filing. With a user-friendly interface, it simplifies the process of understanding tax scenarios and identifying potential savings.

Features

| Feature | Description |

| Beginner-friendly | Walks users through tax estimation steps |

| Ensures deductions and credits are not overlooked | Maximizes refunds and reduces liability |

| Free to use | No cost for tax estimation |

| Provides an easy-to-use interface | Ideal for users with little tax knowledge |

Link: eFile Tax Calculator

8. NerdWallet Tax Calculator

Best for: Tax liability comparisons.

NerdWallet’s Tax Calculator is an excellent tool for individuals who want to compare different tax filing options. It allows users to estimate potential tax liabilities based on different income levels, filing statuses, and deductions.

The tool provides insights into tax-saving opportunities and helps users understand how various financial decisions impact their tax situation. Whether users are salaried employees, freelancers, or investors, this calculator helps them assess their tax burden with precision.

Features

| Feature | Description |

| Provides refund and tax bill estimates | Helps users understand their tax liability |

| Identifies tax-saving opportunities | Offers insights into deductions and credits |

| Free tool | No cost to use |

| Easy-to-use interface | Simple and effective for all taxpayers |

Link: NerdWallet Tax Calculator

9. TaxSlayer Tax Calculator

Best for: Freelancers and budget-conscious filers.

TaxSlayer’s Tax Calculator is known for its affordability and is particularly useful for freelancers, gig workers, and self-employed individuals. This tool allows users to calculate their tax liabilities based on multiple income sources, ensuring accurate estimates for tax filing.

TaxSlayer provides a breakdown of potential refunds, deductions, and credits, helping users maximize their savings. With a simple and intuitive interface, it is an excellent choice for budget-conscious taxpayers looking for an easy way to estimate their taxes.

Features

| Feature | Description |

| Covers multiple income sources | Ideal for freelancers and gig workers |

| Easy-to-use interface | Simple tax estimation process |

| Free tax estimates | No cost to use |

| Provides deduction insights | Helps users maximize refunds |

Link: TaxSlayer Tax Calculator

10. AARP Tax Calculator

Best for: Retirees and senior citizens.

AARP’s Tax Calculator is specifically designed for retirees and senior citizens, offering insights into Social Security benefits, pension taxation, and other retirement-related tax concerns. This calculator helps older taxpayers estimate their liabilities while considering deductions and credits applicable to their financial situation. By focusing on retirement income sources, it ensures accurate tax estimations and helps seniors plan their finances effectively.

Features

| Feature | Description |

| Social Security and pension tax estimates | Tailored for retirees |

| Free to use | No cost for calculations |

| Simple interface | Designed for easy understanding |

| Helps retirees plan tax liabilities | Ensures accurate estimations |

Link: AARP Tax Calculator

Takeaways

Using an online tax calculator can simplify the tax filing process and help taxpayers estimate their liability or refund accurately. Choosing the right tool based on your financial situation ensures a stress-free tax season.

Each of these calculators provides unique features that cater to different taxpayer needs, whether you are a freelancer, retiree, or salaried employee. Utilizing these calculators helps individuals plan their finances better, avoid surprises at tax time, and make informed decisions about their tax obligations.

Before filing, always cross-check the estimates with professional tax advice or software to ensure accuracy.