Home insurance is an essential financial safeguard that protects homeowners and renters against unexpected damages and losses. However, despite its importance, many individuals in India either overlook or misunderstand home insurance due to widespread misconceptions.

These misunderstandings can lead to inadequate coverage, financial setbacks, and difficulties during claim settlements.

With natural disasters, burglaries, and unforeseen damages on the rise, understanding the true scope of home insurance is more critical than ever.

This article will debunk five common misconceptions about home insurance in India, provide clarity on policy coverage, and guide you in choosing the right home insurance policy. By understanding the facts, you can make informed decisions that protect your home and possessions effectively.

Understanding Home Insurance in India

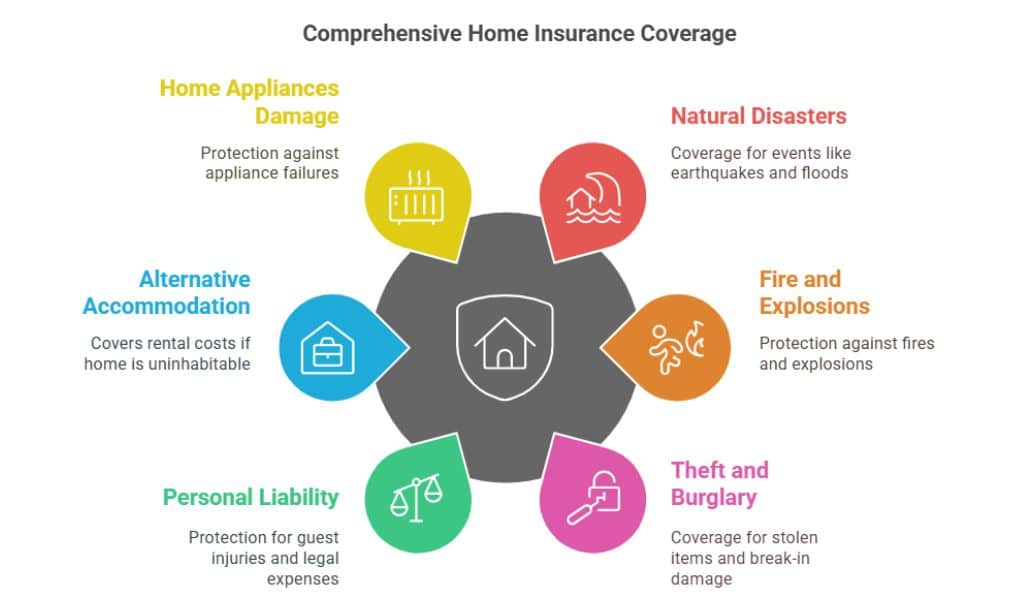

Home insurance is a policy that provides financial protection against damages to a residential property due to natural disasters, theft, fire, and other unforeseen events. It covers both the structure of the home and, in some cases, the contents inside. Many insurers also offer customizable plans to suit different homeowner and renter needs.

Why Home Insurance is Essential in India

- Protection against natural disasters: India is prone to earthquakes, floods, and cyclones, making insurance a necessity.

- Security from theft and vandalism: Home insurance provides financial relief in case of burglary and vandalism.

- Safeguard against fire accidents: Electrical failures, gas leaks, and accidental fires can cause significant damage.

- Liability coverage: Protects homeowners from legal and financial liability if someone is injured on their property.

- Financial support for temporary accommodation: Covers costs for alternative housing if your home becomes uninhabitable.

- Affordable investment for long-term security: Home insurance policies come at reasonable premiums that provide high financial protection.

Despite these benefits, many people hesitate to buy home insurance due to persistent myths and misunderstandings. The following sections will address common misconceptions about home insurance in India and clarify the reality behind them.

5 Common Misconceptions About Home Insurance in India

Home insurance is often misunderstood, leading many homeowners to either neglect getting a policy or opt for inadequate coverage. There are several misconceptions that prevent people from making well-informed decisions about protecting their homes and valuables.

By addressing these myths, individuals can ensure they choose the right coverage that meets their specific needs and circumstances.

Misconception 1 – Home Insurance Covers Only Natural Disasters

Reality Check:

Many believe that home insurance is only meant for catastrophic events like earthquakes or floods. However, home insurance policies provide coverage for a wide range of risks beyond natural disasters, ensuring comprehensive protection. Understanding these factors can help policyholders maximize their benefits.

What home insurance typically covers:

| Coverage Type | Included Risks |

| Natural Disasters | Earthquakes, floods, storms, cyclones |

| Fire and Explosions | Short circuits, gas leaks, accidental fires |

| Theft and Burglary | Stolen valuables, damage due to break-ins |

| Personal Liability | Injuries to guests, legal expenses |

| Alternative Accommodation | Covers rental expenses if your home is uninhabitable |

| Home Appliances Damage | Electrical failures, voltage fluctuations |

Example: Ramesh, a homeowner in Mumbai, faced water damage in his apartment due to a leaking pipe. His home insurance policy covered the repair costs, saving him from an unexpected financial burden.

Misconception 2 – Home Insurance is Only for Homeowners

Reality Check:

A common myth is that home insurance is beneficial only for homeowners, leaving renters vulnerable. In reality, tenants can opt for renter’s insurance, which covers their personal belongings inside the rental property. Even landlords can protect their property structure by opting for a separate landlord insurance plan. This distinction ensures that all parties involved receive adequate financial protection.

Homeowners vs. Renters Insurance:

| Feature | Homeowners Insurance | Renters Insurance |

| Property Structure | Covered | Not Covered |

| Personal Belongings | Covered | Covered |

| Liability Protection | Covered | Covered |

| Fire & Theft | Covered | Covered |

| Additional Living Expenses | Covered | Covered (if opted) |

Example: Priya, a tenant in Delhi, had her laptop stolen during a break-in. Her renter’s insurance policy covered the cost of a new laptop, minimizing her financial loss.

Misconception 3 – Claim Process is Too Complicated

Reality Check:

Many homeowners avoid purchasing insurance due to the misconception that filing a claim is a complex and time-consuming process. However, modern insurers have streamlined the process with digital services, making it quick and hassle-free.

Steps to file a home insurance claim:

- Notify the insurance provider immediately after an incident.

- Provide necessary documents (e.g., FIR for theft, photographs of damage, receipts for valuables).

- Allow the insurer to assess the damage through a surveyor.

- Get approval and settlement within a stipulated time frame.

Average Claim Settlement Timelines of Top Indian Insurers:

| Insurance Provider | Average Claim Settlement Time |

| ICICI Lombard | 7-10 days |

| HDFC ERGO | 5-7 days |

| Bajaj Allianz | 6-9 days |

Misconception 4 – Home Insurance Covers Market Value of Property

Reality Check:

Many homeowners assume that their home insurance policy will cover the market value of their house. However, insurers calculate compensation based on the reinstatement value—the cost of rebuilding the house in case of damage.

Key Differences:

| Value Type | Includes |

| Market Value | Land cost, property appreciation, demand in locality |

| Reinstatement Value | Reconstruction cost, materials, labor |

Example: Rajesh’s villa in Pune was partially damaged in a fire. Instead of receiving the current market price, his insurance covered the exact amount needed to rebuild the damaged sections.

Misconception 5 – All Home Insurance Policies are the Same

Reality Check:

Home insurance policies vary significantly in terms of coverage, add-ons, and exclusions. Assuming all policies are identical can lead to inadequate protection. Researching and comparing policies ensures that homeowners choose the best coverage.

Factors that differentiate policies:

| Factor | Impact on Policy |

| Coverage Scope | Varies from basic fire insurance to comprehensive plans |

| Premium Costs | Depends on location, property type, and risks |

| Add-ons | Includes burglary, pet insurance, appliance insurance |

| Claim Settlement Ratio | Higher ratio indicates a reliable insurer |

Tip: Compare multiple home insurance policies to find one that best fits your needs. Look for policies with high claim settlement ratios and flexible coverage options.

Takeaways

Home insurance is an essential investment that safeguards one of your most valuable assets. However, common misconceptions about home insurance in India often lead to confusion and hesitation in purchasing the right coverage.

By debunking these myths, homeowners and tenants can make informed decisions and secure their properties effectively.

If you are considering home insurance, compare policies, read the fine print, and choose a plan that aligns with your financial goals and risk factors. Don’t wait for an unfortunate event to realize its importance—secure your home today!

Would you like assistance in comparing home insurance policies or understanding coverage options? Let us know in the comments!