Freelancing offers unmatched flexibility, creativity, and global opportunities. But in Portugal, navigating taxes can feel daunting without the right knowledge.

Tax-saving strategies for freelancers in Portugal are essential for optimizing income, managing expenses, and ensuring legal compliance while avoiding unnecessary penalties.

This comprehensive guide offers actionable tips, real-life examples, and insightful data tailored to freelancers in Portugal.

From leveraging the Non-Habitual Resident (NHR) regime to maximizing deductions and VAT optimization, we’ll explore every strategy you can implement today to save money and grow your freelance business.

Understanding the Tax System for Freelancers in Portugal

Before diving into tax-saving strategies, freelancers must first understand their tax obligations in Portugal.

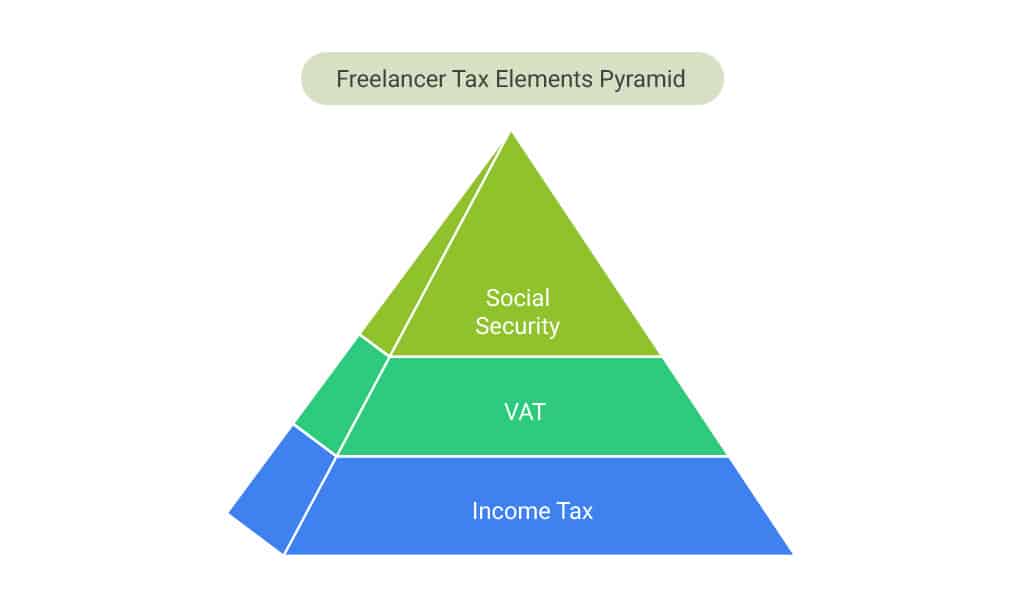

Freelancers, categorized as self-employed professionals, fall under a specific tax regime that dictates income tax (IRS), VAT (IVA), and social security contributions.

| Key Freelancer Tax Elements | Details |

| Income Tax (IRS) | Progressive rates from 14.5% to 48%, depending on taxable income. |

| VAT (IVA) | Standard rate is 23%; reduced rates (13% or 6%) apply to specific goods or services. |

| Social Security | Freelancers contribute 21.4% of taxable income; discounts may apply for new or low-income workers. |

Tax Residency Rules in Portugal

Tax residency determines your liability:

- Tax Resident: If you live in Portugal for 183+ days a year or own a permanent home, you’re taxed on worldwide income.

- Non-Tax Resident: If you reside elsewhere but earn in Portugal, you’re only taxed on Portugal-based income.

Pro Tip: Consider dual residency treaties to avoid double taxation if you earn globally.

10 Comprehensive Tax-Saving Strategies for Freelancers in Portugal

Here’s how freelancers can save on taxes effectively while staying compliant:

1. Leverage Portugal’s NHR (Non-Habitual Resident) Tax Regime

Portugal’s Non-Habitual Resident (NHR) program is a game-changer for new residents. This initiative attracts international professionals by offering significant tax benefits.

- Key Benefits for Freelancers:

- A flat 20% income tax rate for “high-value-added” professions (e.g., IT, consulting, creative fields).

- Tax exemptions on foreign income like dividends, royalties, and pensions.

- Valid for up to 10 years, creating long-term tax savings.

Real-Life Insight:

Sara, a graphic designer from the U.S., relocated to Lisbon. Under the NHR regime, she reduced her taxes from 40% in the U.S. to 20%, saving over €10,000 annually while enjoying Portugal’s sunny lifestyle.

| Criteria for NHR Eligibility | Details |

| Residency Requirement | Must not have been a tax resident in Portugal in the last 5 years. |

| Eligible Professions | IT, engineering, architecture, medical services, and creative fields. |

| Duration of Benefits | Up to 10 years from the date of registration. |

2. Keep Accurate Records of Business Expenses

Freelancers can deduct expenses directly related to their work, reducing taxable income. The more detailed your records, the better your chance of maximizing deductions.

Examples of Deductible Expenses:

- Office rent or coworking memberships.

- Software and professional subscriptions (e.g., Adobe Creative Suite, Zoom).

- Business-related travel (e.g., airfare, accommodation, car rentals).

- Marketing costs (e.g., website hosting, advertisements).

Actionable Tip: Use expense-tracking apps like QuickBooks, Xero, or Wave to keep receipts organized and ensure no deduction is missed.

| Expense Type | Examples | Deductibility |

| Office Expenses | Rent, electricity, internet. | Fully deductible if solely used for business. |

| Marketing | Ads, SEO tools, website hosting. | Must directly support business growth. |

| Professional Tools | Laptops, software, subscriptions. | Equipment must be work-related. |

3. Optimize Your VAT (IVA) Structure

VAT compliance is essential, and understanding exemptions or reduced rates can significantly lower your costs.

- Exemption Threshold: Freelancers earning less than €12,500 per year qualify for VAT exemption, reducing paperwork and tax liabilities.

- Reduced Rates: Some services, such as cultural activities or digital creative work, are taxed at reduced VAT rates of 6% or 13%.

- Reclaim VAT: You can reclaim VAT on business expenses like supplies, travel, or professional services.

| VAT Optimization Tips | Details |

| Check Your Eligibility | Determine if your services qualify for exemptions or reduced rates. |

| Maintain Accurate Records | Keep invoices and VAT receipts to simplify reclaim processes. |

| File Timely Returns | Avoid late filing penalties by adhering to quarterly deadlines. |

4. Contribute to Social Security Strategically

Social security contributions, though mandatory, can be managed effectively to save money.

Key Details:

- Contributions are 21.4% of declared income.

- Discounts are available for freelancers in their first year or with lower earnings.

- Higher contributions improve your retirement benefits and access to public healthcare.

Practical Tip: If you’re starting with limited income, apply for reduced rates to ease initial financial strain while building your business.

| Social Security Breakdown | Details |

| Standard Rate | 21.4% of taxable income. |

| First-Year Discounts | Reduced contributions for new freelancers. |

| Impact on Benefits | Affects retirement pensions and healthcare. |

5. Use Tax-Free Allowances and Deductions

Portugal provides several allowances and deductions that freelancers can leverage to reduce taxable income.

- Health Expenses: Deduct medical bills, therapy costs, and health insurance premiums.

- Education Costs: Claim deductions for professional training or educational expenses.

- Dependent Allowances: Additional credits are available for children or dependents.

| Tax-Free Allowances | Details |

| Health Expenses | Medical bills, health insurance. |

| Education Costs | Tuition fees, professional training. |

| Dependents | Tax credits for children or dependents. |

6. Claim Professional Training Costs

Investing in skill development benefits your career and reduces taxes.

Examples of Deductible Training Costs:

- Online certifications on platforms like Coursera or Udemy.

- Workshops, seminars, or professional conferences.

- Books or educational materials related to your field.

Case Example: João, a freelance writer, attended a €500 SEO workshop. This cost was deducted from his taxable income, reducing his IRS bill.

7. Open a Separate Business Bank Account

Separating personal and business finances simplifies tax filing, enhances transparency, and reduces audit risks.

Benefits:

- Tracks income and expenses more easily.

- Helps during VAT reclaim processes.

- Builds credibility with clients and lenders.

Pro Tip: Use business banking apps offering analytics, such as Revolut Business or N26 Business.

8. Utilize Tax-Advantaged Savings Plans

Portugal’s Plano Poupança Reforma (PPR) allows freelancers to save for retirement while enjoying tax advantages.

Key Benefits:

- Contributions reduce taxable income.

- Funds grow tax-free until withdrawn.

- Creates financial security for retirement.

9. Consider Hiring a Tax Consultant

Freelancers often underestimate the value of professional tax advice. A tax consultant ensures compliance and identifies opportunities for deductions or optimizations.

Real-Life Example: Ana, a freelance translator, saved €2,000 in taxes after a consultant uncovered overlooked deductions, such as travel expenses and software costs.

10. Plan for Quarterly Tax Payments

Quarterly tax payments help freelancers manage cash flow and avoid penalties.

How to Plan:

- Set aside 25-30% of monthly income for taxes.

- Use tax calculators to estimate liabilities.

- Mark payment deadlines (April, July, October, January).

| Quarterly Tax Tips | Details |

| Set Aside Monthly | Reserve a portion of income for taxes. |

| Use Tax Tools | Tools like TaxScouts simplify planning. |

| Avoid Late Fees | Stay updated on deadlines. |

Takeaways

Managing taxes as a freelancer in Portugal can be complex, but these tax-saving strategies for freelancers in Portugal provide clarity and actionable steps.

From leveraging the NHR program to optimizing VAT and maintaining accurate records, these tips ensure financial stability and compliance.

Take control of your taxes today to maximize earnings and minimize stress!