Discover 8 tax-saving tips for real estate investors in Austria. Learn strategies to reduce liabilities Investing in real estate is a lucrative venture, especially in a stable and economically strong country like Austria. However, navigating the intricacies of taxation can be daunting for both seasoned and novice investors.

By understanding the local tax landscape and applying strategic tax-saving tips for real estate investors in Austria, you can maximize your returns and minimize liabilities.

This guide delves into eight actionable strategies to help you save on taxes while investing in Austrian real estate.

Understanding the Tax Landscape for Real Estate in Austria

Austria offers a stable real estate market with a transparent taxation framework. As a real estate investor, you’ll encounter the following key taxes:

- Income Tax: Applicable on rental income, with rates ranging from 20% to 55% depending on your income bracket.

- Capital Gains Tax (Immobilienertragsteuer): Levied at 30% for profits made from selling property not used as a primary residence.

- Property Transfer Tax (Grunderwerbsteuer): Set at 3.5% of the purchase price.

- Annual Property Tax: A municipal tax calculated based on the assessed property value.

This structured taxation system ensures fairness and transparency but requires investors to stay updated on applicable rates and deductions to avoid overpaying.

Austria’s Tax Advantages for Real Estate Investors

Investing in Austria comes with certain tax advantages:

- Austria has a network of double taxation treaties to prevent international investors from being taxed twice on the same income.

- Incentives are available for energy-efficient property investments, aligning with Austria’s focus on sustainability.

- Long-term property ownership often benefits from exemptions and lower tax rates, promoting a stable investment climate.

8 Essential Tax-Saving Tips for Real Estate Investors

1. Leverage Depreciation Deductions

Depreciation allows you to write off a portion of your property’s value annually, reducing taxable income. In Austria:

- Buildings used for generating rental income can typically be depreciated at 1.5% per year for residential properties.

- Depreciation applies only to the building’s value, not the land it occupies.

Practical Insight: For example, if you own a rental property valued at €500,000, with €400,000 allocated to the building, you can claim a depreciation deduction of €6,000 annually.

Key Details Table:

| Property Type | Depreciation Rate | Deduction Example |

| Residential Property | 1.5% | €6,000 on €400,000 |

| Commercial Property | 2.5% | €10,000 on €400,000 |

Tip: Hire a tax advisor to calculate depreciation accurately and maximize your deductions.

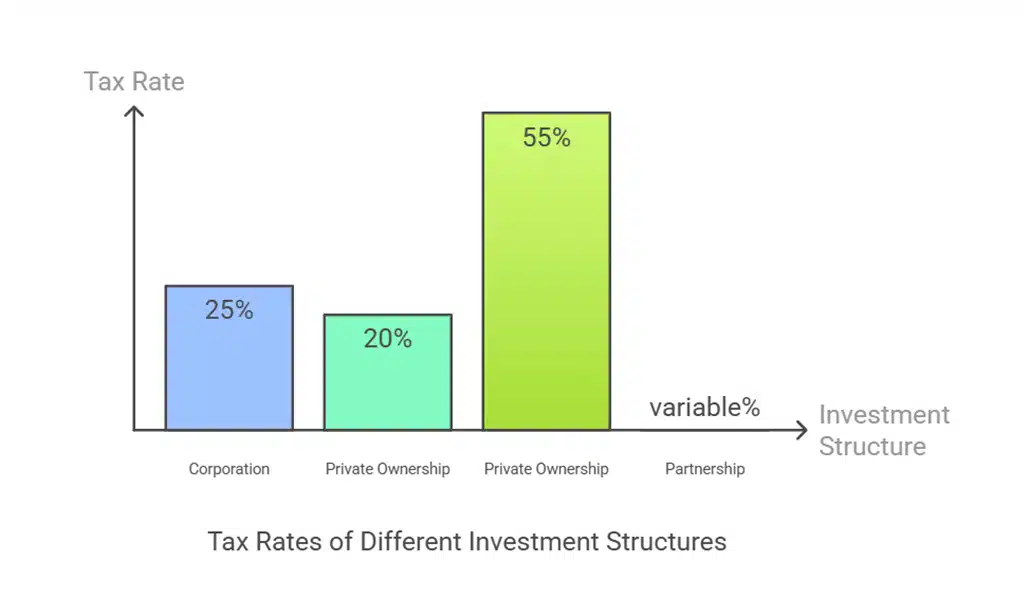

2. Structure Your Investment Through a Tax-Efficient Entity

Choosing the right investment structure can significantly impact your tax liabilities:

- Corporations: Ideal for large-scale investments, offering lower corporate tax rates (currently 25%).

- Private Ownership: Suitable for small-scale investors but comes with higher personal income tax rates.

- Partnerships: Useful for shared ownership, where tax is passed through to individual partners.

Example: A group of investors pooled funds to form a corporation. By leveraging the corporate tax rate, they saved 10% more on taxes compared to individual ownership.

Key Details Table:

| Investment Structure | Tax Rate | Ideal For |

| Corporation | 25% | Large-scale investments |

| Private Ownership | 20%-55% | Small-scale personal investments |

| Partnership | Variable | Shared ownership investments |

Pro Tip: Consult with a legal expert to establish a tax-advantaged entity tailored to your investment goals.

3. Take Advantage of Capital Gains Exemptions

Capital gains tax can be a major expense, but there are exemptions:

- Primary Residence Rule: If the property was your primary residence for at least two years or used continuously for 10 years, capital gains tax does not apply.

- Long-Term Holding: Properties held before April 1, 2002, are exempt from capital gains tax under specific conditions.

Case Study: An investor who purchased a home in Vienna in 2000 sold it in 2025. Since the property qualified under the long-term holding exemption, no capital gains tax was due, saving the investor thousands of euros.

Key Details Table:

| Exemption Type | Eligibility Criteria | Tax Savings Example |

| Primary Residence | Lived in for 2+ years | €30,000 on €100,000 gain |

| Long-Term Holding | Owned before April 1, 2002 | €50,000 on €150,000 gain |

Quick Reminder: Keep meticulous records to prove eligibility for exemptions.

4. Claim Mortgage Interest and Other Deductions

Financing your property through a mortgage offers tax-saving opportunities:

- Mortgage interest is tax-deductible, significantly reducing taxable rental income.

- Additional deductions include maintenance costs, repair expenses, and property management fees.

Practical Insight: For example, a rental property with annual mortgage interest of €10,000 and maintenance costs of €5,000 can reduce taxable income by €15,000.

Key Details Table:

| Deduction Type | Example Expense | Annual Savings Example |

| Mortgage Interest | €10,000 | €3,000 (at 30% tax rate) |

| Maintenance Costs | €5,000 | €1,500 (at 30% tax rate) |

Actionable Tip: Use a financial tracker to record all deductible expenses.

5. Explore Tax Incentives for Energy-Efficient Properties

Austria promotes sustainability through tax incentives for green buildings:

- Tax credits and grants are available for energy-saving renovations, such as installing solar panels or upgrading insulation.

- Properties certified as energy-efficient may qualify for reduced property tax rates.

Practical Insight: A landlord who invested €20,000 in energy-efficient upgrades, such as solar panels, received a grant covering 20% of the cost and saved an additional €1,200 annually in reduced property taxes.

Key Details Table:

| Renovation Type | Incentive Type | Eligibility Criteria |

| Solar Panel Installation | Tax Credit/Grant | Proof of installation costs |

| Insulation Upgrades | Tax Deduction | Certified energy efficiency report |

6. Maximize Benefits from Rental Income Deductions

Rental income is subject to income tax, but strategic deductions can reduce your liability:

- Deduct property maintenance, advertising costs, and utility bills paid by the landlord.

- Expenses related to leasing agents or property management companies are also deductible.

Case Study: An investor owning three rental apartments claimed deductions for repairs (€10,000), property management fees (€5,000), and advertising (€2,000), reducing taxable income by €17,000.

Key Details Table:

| Deduction Type | Eligible Expense | Documentation Needed |

| Maintenance Costs | Repairs, cleaning | Invoices |

| Management Fees | Leasing agent costs | Contracts, receipts |

| Advertising | Online listings | Proof of payment |

Tip: Maintain a comprehensive record of all invoices and receipts.

7. Utilize Tax-Deferred 1031 Exchange Options

While Austria doesn’t have a direct equivalent to the U.S. 1031 exchange, similar strategies can help defer taxes:

- Reinvest profits from property sales into other Austrian properties to defer capital gains tax.

- Consult a tax advisor for compliance with Austrian tax laws.

Example: An investor who sold a property in Salzburg reinvested the profits into a commercial property in Vienna, deferring €50,000 in capital gains tax.

Key Details Table:

| Strategy Type | Key Requirement | Tax Deferral Potential |

| Reinvestment | Purchase of new property | Up to 100% of gains deferred |

8. Stay Updated on Austrian Tax Law Changes

Tax laws evolve, and staying informed can save you significant amounts:

- Recent amendments include stricter reporting requirements for foreign investors.

- Regularly consult tax advisors or subscribe to updates from Austrian financial authorities.

Practical Insight: A foreign investor who stayed informed on recent tax law changes avoided penalties by filing the correct documentation for rental income.

Key Details Table:

| Change Type | Impact | Recommended Action |

| Reporting Requirements | Higher transparency | Maintain accurate records |

| Tax Rate Adjustments | Varies by income bracket | Consult with a tax advisor |

Interactive Tax Planning Tools and Resources

Tax Calculators for Real Estate Investors

Several online tools can help estimate your tax liabilities:

- Austrian Tax Office Calculator: For income and property taxes.

- Global Property Guide: Offers a comprehensive tax overview.

| Deduction Type | Eligible Expenses | Documentation Needed |

| Mortgage Interest | Interest paid on property loans | Loan statements |

| Maintenance & Repairs | Renovation, painting, minor repairs | Invoices and receipts |

| Energy Efficiency Upgrades | Solar panels, insulation upgrades | Energy certification, cost proofs |

| Rental Property Management | Agency fees, advertising costs | Contracts, invoices |

Takeaways

By applying these tax-saving tips for real estate investors in Austria, you can significantly reduce your tax burden while maximizing returns. Whether leveraging depreciation, claiming deductions, or exploring tax incentives for energy-efficient properties, proactive planning is key.

Consult with a tax advisor to ensure compliance and to stay ahead of any legislative changes. Smart tax management not only boosts your profitability but also positions you for long-term success in Austria’s dynamic real estate market.