On Monday, Meta Platforms CEO Mark Zuckerberg appeared in court to testify in a major antitrust trial brought by the Federal Trade Commission (FTC). The U.S. government accuses Meta of deliberately acquiring its rising rivals—Instagram in 2012 and WhatsApp in 2014—in a strategic move to eliminate competition and establish a long-term monopoly in the social media sector.

Zuckerberg, testifying under oath, is expected to speak over two consecutive days, addressing the FTC’s concerns and defending the company’s past acquisition decisions. While he’s no stranger to testifying before Congress or regulators, this case carries significantly higher stakes, including the possibility of Meta being forced to spin off Instagram and WhatsApp, a move that could dismantle its integrated ecosystem and reshape the global digital advertising landscape.

Why the FTC Is Suing Meta: A Strategic Monopoly or Smart Business?

The FTC argues that Meta’s acquisitions were not simply strategic investments but anti-competitive moves to suppress emerging threats. In its opening statements, the agency claimed that Meta pursued a deliberate pattern of acquiring companies that could grow into legitimate competitors, instead of allowing innovation and user choice to flourish in the open market.

At the center of the case are internal emails and communications, including a particularly damning one from Zuckerberg himself. In a 2011 email to Facebook executives, he wrote:

“In the time it has taken us to get our act together on this, Instagram has become a large and viable competitor to us on mobile photos, which will increasingly be the future of photos.”

This email has been cited as direct evidence that Meta was aware of Instagram’s potential to outpace Facebook in the mobile photo-sharing space and acted swiftly to acquire it before it could pose a significant challenge. A similar argument is being applied to the company’s acquisition of WhatsApp, which at the time was gaining momentum as a fast-growing, independent messaging platform.

Meta’s Scale and User Base: A Symptom of Success or a Barrier to Competition?

Meta currently claims over 3.3 billion daily active users across its family of apps—Facebook, Instagram, WhatsApp, and Messenger. The FTC contends that this massive user base is not a natural outcome of competition but rather the result of eliminating meaningful alternatives for consumers.

Government lawyers emphasized that “consumers do not have reasonable alternatives” when choosing social media platforms for connecting with others or messaging. This lack of choice, the FTC argues, harms innovation, suppresses market competition, and limits what users can expect from digital communication services.

In response, Meta’s attorneys have maintained that the social media and digital communication space remains highly competitive, pointing to rivals such as Snapchat, TikTok, YouTube, Discord, and X (formerly Twitter). They also emphasized that the acquisitions were fully reviewed and approved by regulators at the time, which they argue legitimizes Meta’s expansion strategy.

The Evolution of Facebook: From Friends and Family to Interest-Based Content

In a segment of his testimony, Zuckerberg was asked about the transformation of Facebook’s user experience over the years. Originally launched to help people stay connected with friends and family, Facebook has since evolved into a content-driven platform, where groups, news feeds, and trending videos play a central role in user engagement.

Zuckerberg acknowledged this evolution, stating:

“It’s the case that over time, the ‘interest’ part of that has gotten built out more than the ‘friend’ part. (Users are) connected to a lot more groups and other kinds of things. The ‘friend’ part has gone down quite a bit, but it’s still something we care about.”

This shift, according to the FTC, reflects a larger trend in which Meta has moved to control not just social networks but the entire attention economy, building platforms that rely less on organic relationships and more on curated content feeds that keep users engaged longer—thus making its advertising model even more dominant.

Messaging Services at the Center of the Antitrust Debate

A key focus of the FTC’s legal argument is how Meta has developed a highly integrated messaging ecosystem. From Facebook Messenger to Instagram DMs to WhatsApp, Meta’s apps allow users to seamlessly share, forward, and discuss content, effectively locking users into its network of services.

FTC attorney Daniel Matheson asked Zuckerberg whether messaging services were considered complementary to Meta’s platforms. Zuckerberg replied that messaging is “symbiotic”, elaborating that users often want to share what they find online with others, and messaging tools provide a natural and effective means for doing that.

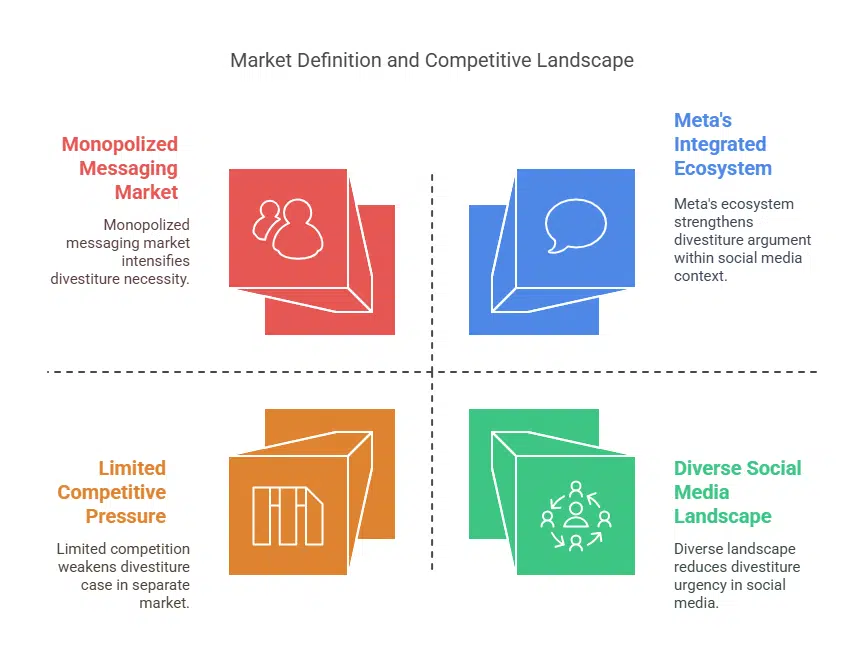

This nuanced view plays a crucial role in defining the market Meta is accused of dominating. If messaging is part of the broader “social media market,” as Meta claims, then competition may exist across platforms. But if messaging is treated as a separate market—which Meta allegedly monopolizes—then the argument for divestiture becomes much stronger.

Zuckerberg’s 2022 Internal Email Reveals Concerns About Facebook’s Future

In a notable segment of the trial, the FTC introduced a 2022 internal email exchange between Zuckerberg, Chief Product Officer Chris Cox, and Facebook President Tom Alison. The conversation centered around Meta’s long-term strategy in response to Facebook’s declining cultural relevance, particularly among younger demographics.

Matheson summarized the email thread as an attempt to define “a vision for Facebook” at a time when Instagram and TikTok were rapidly gaining popularity. Zuckerberg agreed with the characterization, saying:

“That’s generally a good summary.”

This internal dialogue underlines a growing concern within Meta’s leadership that Facebook is losing its foothold as a culturally relevant platform, forcing executives to explore ways to reposition the app to remain competitive. It also adds weight to the FTC’s assertion that Meta’s dominance comes not from innovation alone but from strategic consolidation and reputation management.

What Happens If the FTC Wins? A Potential Breakup of Meta

If the court rules in favor of the FTC, the consequences could be historic. Meta may be ordered to divest both Instagram and WhatsApp, effectively unwinding acquisitions that have defined its trajectory over the past decade. Such a decision would not only alter the company’s business model, which earned $160 billion in ad revenue last year, but also transform the digital landscape.

Breaking up Meta would mean the end of its cross-platform ad targeting, unified user experience, and integrated messaging capabilities. It could also open the door for renewed innovation and new market entrants—something the FTC views as essential for long-term consumer welfare.

The outcome could also set a new legal precedent, empowering regulators worldwide to take stronger action against digital giants accused of stifling competition.

The Broader Implications for Big Tech

Zuckerberg’s testimony is being watched closely not just in Silicon Valley but around the world. The case is viewed as a litmus test for how U.S. regulators plan to handle Big Tech in an era of growing digital consolidation.

Should the FTC succeed, the ripple effects could be felt across other tech behemoths like Google, Amazon, and Apple, all of which have faced criticism for leveraging their scale to absorb or neutralize competitors. A decision to unwind Meta’s acquisitions would be one of the most aggressive antitrust actions taken by the U.S. government in decades, possibly redefining the rules of the digital economy.

A Defining Moment for Zuckerberg and Meta

As Zuckerberg continues his testimony this week, he faces a pivotal moment in Meta’s history. The company’s defense rests on the argument that it has evolved to serve user needs in a competitive marketplace, not on crushing competition. The FTC, meanwhile, seeks to demonstrate that Meta’s scale was deliberately engineered to prevent users from having real alternatives.

Whatever the outcome, this trial is likely to shape not only the future of Meta but the trajectory of tech regulation for years to come.