Bitcoin and cryptocurrencies have taken the world by storm. But many people are unsure about where these digital currencies are headed next. With so much market volatility, investors often feel stuck or confused when making decisions.

One exciting fact is that Bitcoin has surged 150% in value coming into 2024. Experts even predict it could break $200,000 soon, especially with growing interest from institutional investors.

This blog will explore key trends shaping Bitcoin’s future. You’ll learn about price predictions, market drivers, and potential challenges ahead. Keep reading to discover what’s next for crypto markets!

Current State of Bitcoin and the Crypto Market

Bitcoin prices continue to swing due to changing market sentiments and global events. Crypto-currency adoption grows as institutional investors explore its potential as a store of value.

Recent market trends

Crypto prices are rising quickly. Bitcoin surged 150% in early 2024, sparking a new bull run. Many expect this trend to continue into 2025. Analysts predict it could trade above $200,000 by next year due to growing demand and regulatory clarity.

Bitcoin ETFs are also boosting market sentiment and drawing interest from institutional investors like Ark Invest.

Major coins like Ethereum and Solana might hit new all-time highs soon. Big companies such as Microsoft and Apple entering the space add excitement too. October 2025 forecasts show Bitcoin fluctuating between $99,236 and $100,324 as investor sentiment grows stronger.

Experts highlight blockchain technology’s role in supporting these trends across decentralized finance markets (DeFi).

Key factors influencing prices

Bitcoin prices often shift due to many factors. These drivers shape the market and impact investor sentiment.

Institutional Adoption: Large firms like Microsoft and Apple now enter the digital currency space. This boosts faith in crypto assets and increases demand.

Regulatory Clarity: Clear rules from central banks help investors feel more secure. Countries making Bitcoin legal tender can also push up its value.

Technological Advancements: Upgrades like Bitcoin halving reduce block rewards, limiting supply. Innovations in smart contracts attract more users to blockchain networks.

Market Trends: Recent bullish sentiment raised Bitcoin’s value by 150% in 2024 alone. Analysts predict this growth to continue into 2025.

ETF Approval: Exchange-traded funds for Bitcoin bring investment vehicles to mainstream markets. Experts see ETFs driving future price hikes.

Interest Rates: Rising or falling interest rates affect fiat currencies and crypto coins differently. Lower rates often make Bitcoin a safer store of value.

Global Events: Issues like trade wars or economic downturns increase demand for safe-haven assets like digital gold.

Investor Behavior: Support levels play a major role in shaping valuations during price fluctuations. Risk tolerance greatly influences big moves in cryptos.

Bitcoin Price Predictions

Bitcoin’s future prices could see big shifts due to market trends. Experts debate if it will remain a “digital gold” or face stronger challenges.

Short-term predictions (2025-2030)

Short-term price predictions for Bitcoin from 2025 to 2030 reflect optimism and cautious speculation. The market is expected to see significant growth influenced by institutional adoption, technological progress, and regulatory clarity. Below is a concise breakdown:

| Year | Price Range (USD) | Key Factors Driving Growth |

| 2025 | $99,236.17 – $100,324.77 |

|

| 2026 | $120,000 – $150,000 |

|

| 2027 | $150,000 – $180,000 |

|

| 2028 | $180,000 – $200,000 |

|

| 2029 | $200,000 – $220,000 |

|

| 2030 | $220,000 – $250,000 |

|

Prices could cross key thresholds like $200,000 by 2028, while institutions continue accumulating. Major tech companies and evolving regulations may further fuel this upward trend.

Long-term predictions (2031-2040)

Bitcoin’s potential beyond 2030 looks highly ambitious, with new forecasts pointing to significant growth. Experts project its price could achieve extraordinary milestones, driven by adoption, innovation, and increased market confidence. Below is a succinct overview of long-term predictions for Bitcoin between 2031 and 2040.

| Year | Predicted Price | Key Influencers |

| 2031-2035 | $300,000 – $500,000 | Institutional adoption, Bitcoin ETFs, and global financial integration play major roles.

Also, demand from investors and enhanced blockchain uses are key drivers. |

| 2036-2040 | $600,000 – $1,000,000 | Technological breakthroughs like quantum-resistant protocols will solidify trust.

Regulatory frameworks may stabilize markets. Growth driven by global recognition as a mainstream asset. |

Bitcoin ETFs are expected to fuel mass adoption. By 2040, many predict Bitcoin could surpass the $1,000,000 mark. Its role as “digital gold” will likely expand as more nations accept cryptocurrency in financial systems.

Factors Driving Bitcoin’s Future

Big investors are showing more interest in Bitcoin, which could push its value higher. New tech and global rules may also shape how Bitcoin is used and traded.

Institutional adoption

More big companies are joining the crypto market. Microsoft and Apple have shown interest in cryptocurrency’s potential. Institutional investors now see Bitcoin as digital gold or a store of value.

The Grayscale Bitcoin Trust and Bitcoin ETFs make it easier for large investors to buy bitcoins.

Demand for cryptocurrencies like Solana (SOL) has also grown among institutions. Companies use decentralized finance (DeFi) tools to improve financial systems. Experts say this shift could push Bitcoin above $200,000 by 2025 and even higher long-term.

Technological advancements

Tech giants like Microsoft and Apple now explore cryptocurrencies. Their moves could push Bitcoin adoption further. Ethereum and Solana continue improving their blockchain technology for faster, cheaper transactions.

Bitcoin halving events also boost innovation. Developers work on enhancements to the Bitcoin blockchain, such as privacy features and scalability upgrades. Exchange-traded funds (ETFs) tied to cryptocurrency might soon reshape trading options too.

Regulatory developments

Governments are setting clearer rules for cryptocurrencies. Bitcoin ETFs, approved in some regions, could bring major changes. These funds allow people to invest without buying actual Bitcoin.

Analysts think this might attract more institutional investors to the crypto market. The U.S., Europe, and Asia are working on laws to regulate trading platforms like Binance and blockchain-based services.

Know Your Customer” policies are becoming strict worldwide. This forces exchanges and wallets to verify user identities closely. In 2025, experts expect better regulation will boost investor confidence.

Trade war fears may also impact cryptocurrency’s role as a safe haven asset during global tensions. Clearer rules could help Bitcoin rise above $200,000 by 2024’s end or sooner if trends continue strongly.

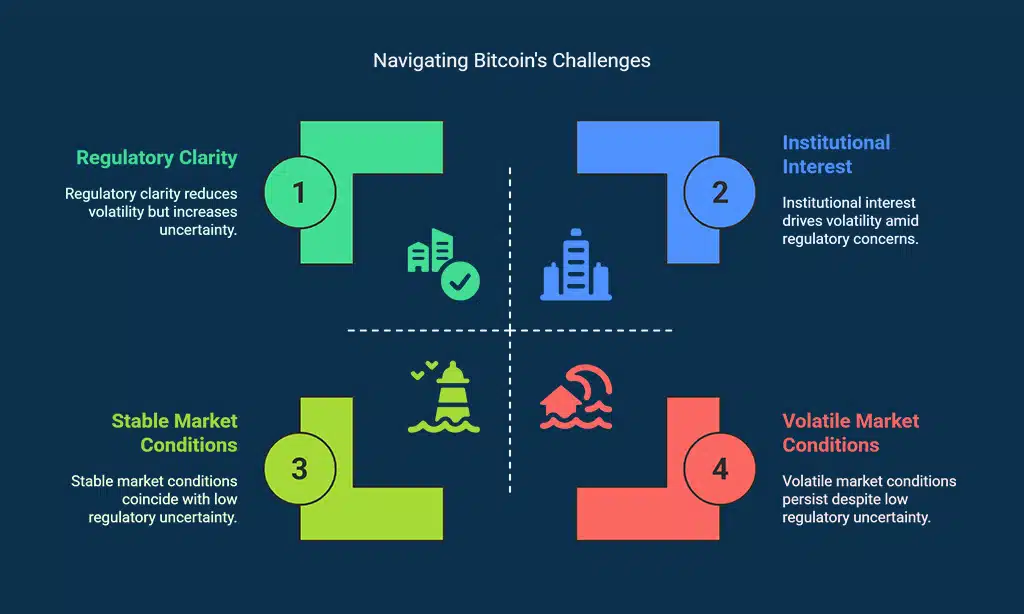

Challenges Facing Bitcoin and Cryptocurrencies

Bitcoin faces sharp price swings that can unsettle investors. Changing rules and green concerns also create hurdles for its growth.

Market volatility

Prices in the crypto market often swing sharply. Bitcoin saw a 150% jump entering 2024, fueled by institutional investors and stronger demand. Yet, these rapid gains also make it risky for some traders.

Changes in investor sentiment or global events—like a trade war or regulatory moves—can quickly affect the market.

Bitcoin’s support level may fluctuate as technical analysis suggests possible dips before big climbs. In October 2025, analysts see prices ranging tightly between $99,236.17 and $100,324.77.

This unpredictability keeps crypto as both an opportunity and a challenge for investors seeking “digital gold.”.

Regulatory uncertainty

Rules for crypto differ in each country. Some governments support it, while others ban or limit its use. This lack of clear rules worries both traders and institutional investors. In the U.S., regulations change fast, making long-term planning risky.

Bitcoin ETFs may help bring clarity soon, but delays from regulators still create doubt.

Unclear laws also affect innovation in blockchain technology and decentralized finance (DeFi). Companies fear fines or shutdowns if they break unknown rules. The Chicago Board Options Exchange (CBOE) has pushed for clearer guidelines to promote derivatives trading safely.

Without solid policies, crypto remains a risk-on asset that scares cautious investors.

Environmental concerns

Bitcoin uses a proof-of-work system, which needs a lot of energy. Mining Bitcoin takes as much power as some small countries use in one year. This raises worries about its carbon footprint and the strain on natural resources.

As more investors enter the crypto market, including institutional investors like Microsoft, energy usage could increase even more.

Some cryptocurrencies, like Solana and Ethereum through proof-of-stake systems, aim to lower their environmental impact. These methods are seen as greener options compared to Bitcoin’s mining process.

Governments may push for regulations on energy consumption or promote sustainable cities powered by digital currencies with cleaner technologies.

Takeaways

The crypto market is buzzing with potential. Bitcoin could hit record highs, fueled by institutional interest and tech growth. Regulatory clarity may shape its future while challenges like volatility remain.

As more investors see it as digital gold, the market’s next chapter looks bright. Big moves are ahead—stay ready!

FAQs

1. What is the current role of Bitcoin in the crypto market?

Bitcoin is often seen as a store of value, like digital gold. It remains central to the crypto market and influences investor sentiment.

2. How does Bitcoin halving impact its price?

Bitcoin halving reduces how much new Bitcoin miners can produce, making it more deflationary. This often raises demand and affects its price over time.

3. Are institutional investors still interested in cryptocurrency?

Yes, many institutional investors see potential in assets like Bitcoin and Solana (SOL), especially for long-term growth or as a hedge against inflation.

4. What risks affect cryptocurrencies like Bitcoin today?

Cryptos face risks from trade wars, stock market volatility, regulation changes, and being seen as risk-on assets during uncertain times.

5. How do decentralized finance (DeFi) and NFTs fit into the crypto space?

Decentralized finance allows users to lend or borrow without banks using blockchain technology. Non-fungible tokens (NFTs) are unique digital items that represent ownership on platforms like Blockchain.com through proof-of-stake systems.