If you’re planning a career in financial advice in Australia, you’ll quickly come across the term RG146.

This regulatory guideline is a critical part of the framework that ensures financial advisers have the necessary skills, knowledge, and ethical standards to provide quality advice to clients. Whether you’re just starting out or already working in the industry, understanding rg146 is essential for compliance and professional credibility.

Understanding RG146

RG146 stands for Regulatory Guide 146 and is issued by the Australian Securities and Investments Commission (ASIC). It sets out the minimum training and competency requirements for anyone providing financial product advice to retail clients in Australia.

The guide applies to a broad range of financial services professionals, including those in:

- Superannuation advice

- Securities and derivatives

- Managed investments

- Insurance products

- Deposit and payment products

In short, if you give financial advice to retail clients, you must meet RG146 requirements before you can operate legally.

Why RG146 Exists

The primary aim of RG146 is to protect consumers by ensuring advisers are competent, ethical, and well-informed.

- Consumer Confidence: Clients can trust that advisers meet nationally recognised training standards.

- Industry Integrity: Maintains high levels of professionalism within the financial services sector.

- Legal Compliance: Helps businesses and individuals meet obligations under the Corporations Act 2001.

Without these requirements, there would be greater risk of misleading advice and financial harm to consumers.

The Core Competencies of RG146

ASIC’s RG146 outlines specific knowledge and skill areas advisers must master before providing advice. These include:

- Generic Knowledge: Understanding the economic environment, operation of financial markets, and regulatory frameworks.

- Specialist Knowledge: In-depth knowledge of the specific financial products you advise on.

- Skills: The ability to analyse client needs, prepare financial plans, and explain complex concepts clearly.

Advisers are also expected to maintain and update their knowledge through ongoing professional development.

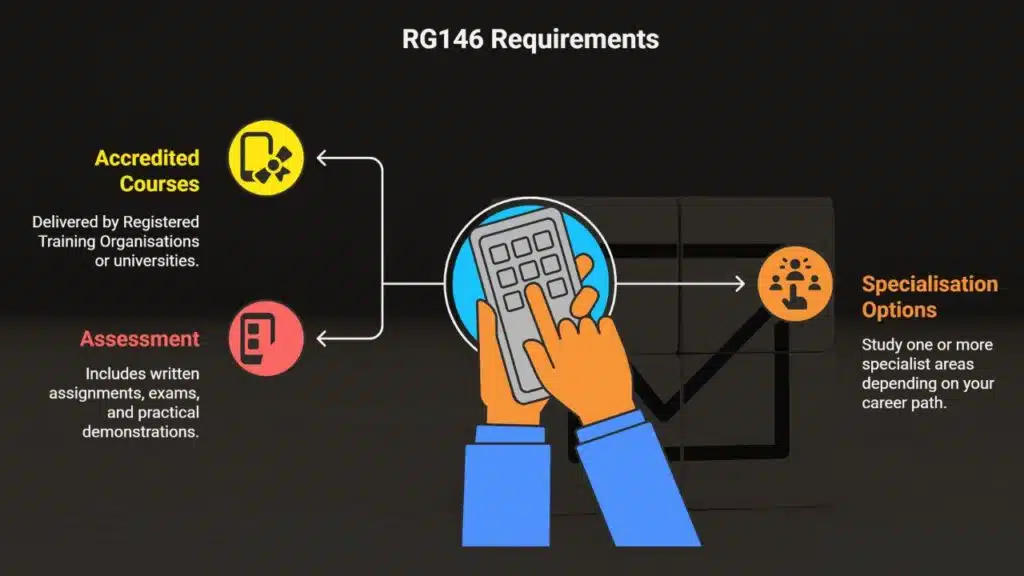

How to Meet RG146 Requirements

Meeting RG146 requirements typically involves completing an ASIC-approved training program.

- Accredited Courses: Delivered by Registered Training Organisations (RTOs) or universities.

- Specialisation Options: You can study one or more specialist areas depending on your career path.

- Assessment: Usually includes written assignments, exams, and practical demonstrations of advice-giving skills.

Once you’ve completed the training, your competency must be assessed by your licensee (financial services provider) before you can advise clients.

RG146 and the Path to Becoming a Financial Adviser

While RG146 is an important step, it’s not the only requirement for becoming a financial adviser in Australia. Since 2019, new education and professional standards have been introduced by the Financial Adviser Standards and Ethics Authority (FASEA).

- Bachelor’s Degree or Equivalent: Advisers must hold an approved qualification.

- Professional Year: A supervised 12-month period of work and training.

- Exam and Ethics Standards: Passing the adviser exam and adhering to a strict code of ethics.

RG146 remains relevant for certain advice roles, especially in niche product areas or for those working under limited licences.

Maintaining Compliance Over Time

Compliance with RG146 isn’t a one-off achievement—it’s an ongoing responsibility.

- Continuing Professional Development (CPD): Regular training to keep up with product changes, legislation, and market trends.

- Monitoring and Audits: Licensees often review advisers’ work to ensure standards are upheld.

- Policy Updates: Advisers must be aware of and follow updates to both RG146 and broader financial services regulations.

This ongoing commitment helps maintain the integrity and trustworthiness of the industry.

Why Businesses Should Care About RG146

For financial services businesses, ensuring staff meet RG146 standards isn’t just about ticking a compliance box.

- Risk Management: Reduces the likelihood of legal action or reputational damage.

- Client Retention: Consumers are more likely to stay with advisers who demonstrate professionalism and expertise.

- Competitive Advantage: Businesses that invest in training can stand out in a crowded market.

It’s both a legal requirement and a smart business strategy.

Final Thoughts

RG146 is a cornerstone of Australia’s financial advice industry, ensuring advisers have the competency and ethical grounding to serve clients effectively. For aspiring financial advisers, understanding and meeting RG146 requirements is a vital first step towards a rewarding career. For businesses, maintaining RG146 compliance safeguards both your reputation and your clients’ trust.

By staying informed, investing in ongoing training, and working within ASIC’s guidelines, you’ll not only meet your legal obligations but also position yourself for long-term success in the financial services sector.