In a landmark moment for the cryptocurrency industry in the United States, President Donald Trump signed into law the GENIUS Act, the first major federal legislation to provide a clear regulatory framework for digital assets, especially stablecoins. This new law is seen as a defining move in America’s evolving approach to blockchain-based financial technology and reflects a significant shift in Trump’s stance—from a crypto skeptic to a prominent crypto advocate.

GENIUS Act: The New Era for Stablecoins

The GENIUS Act—short for Guiding Emerging National Interests Using Stablecoins—was passed by the House of Representatives on Thursday with bipartisan support, following its approval by the Senate a month earlier. This legislation introduces a structured, transparent regulatory framework specifically designed for payment stablecoins, a category of cryptocurrencies that are backed by stable assets such as the U.S. dollar.

Under this law, banks, financial institutions, and qualified non-bank entities will now have clearer pathways to issue stablecoins legally under federal oversight. The move is expected to not only improve the credibility and safety of stablecoins but also promote public confidence in using them for digital transactions, investing, and remittances.

Historically, stablecoins serve as a middle ground between volatile cryptocurrencies like Bitcoin and traditional currencies. Users often purchase stablecoins using fiat money (such as USD) through their bank accounts. These tokens are then used for trading, investing, or transferring other forms of crypto or assets on blockchain networks.

Trump’s Crypto Pivot and Political Influence

Trump’s endorsement of the GENIUS Act marks a dramatic transformation in his approach to digital currency. Once publicly critical of cryptocurrencies, Trump has now embraced the technology as a core component of his political and economic strategy.

Over the past two years, Trump has taken a proactive role in promoting digital assets, positioning himself as the most crypto-friendly U.S. president to date. On the campaign trail, he often emphasized the importance of American leadership in the digital currency space, framing it as a matter of national innovation and global competitiveness.

Earlier in 2025, Trump launched his own meme coin named $TRUMP, further showcasing his personal investment and enthusiasm for the industry. His administration has also backed proposals aimed at making the U.S. the global capital for cryptocurrency development, mining, and fintech infrastructure.

Financial Ties and Conflicts of Interest Concerns

Despite the GENIUS Act’s popularity among industry leaders, it has sparked concerns about ethical transparency and potential conflicts of interest within the Trump orbit. One of the primary flashpoints involves World Liberty Financial, a cryptocurrency venture in which the Trump family reportedly holds a 60% stake.

The company launched its own stablecoin, USD1, earlier this year. USD1 is a dollar-pegged stablecoin promoted as a fast, secure, and government-aligned digital token. Trump’s image featured prominently on the firm’s website, which initially referred to him as “Chief Crypto Advocate” and later updated the title to “Co-Founder Emeritus.”

Critics, particularly within the Democratic Party, have voiced concerns that the former president and his family could financially benefit from legislation designed to expand the adoption of stablecoins. The bill does not include specific language preventing public officials from launching or promoting private cryptocurrencies while in office, a point of contention among lawmakers.

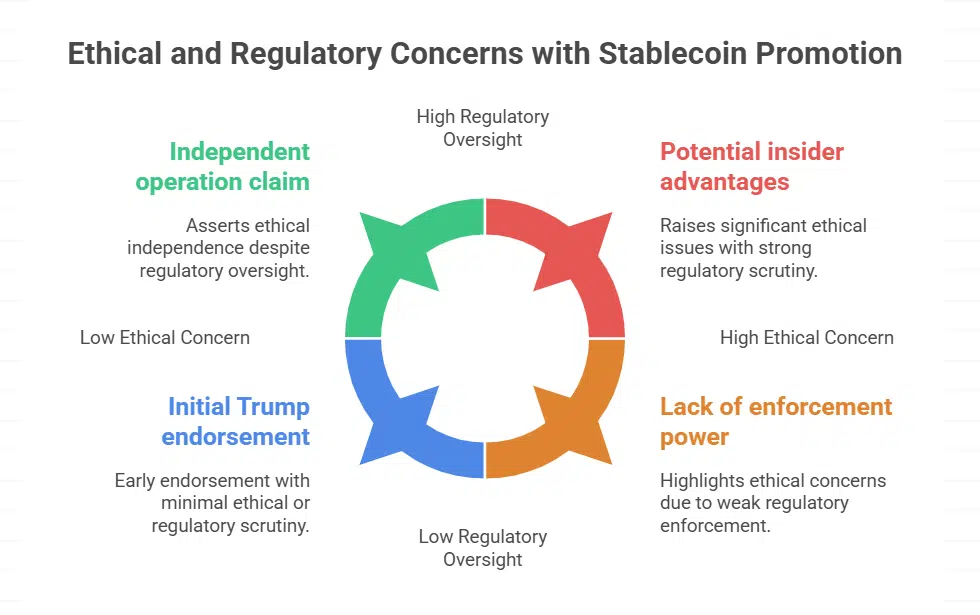

Congresswoman Maxine Waters, the senior Democrat on the House Financial Services Committee, argued that while the GENIUS Act appears to create a legal foundation for stablecoins, it falls short of granting regulators full enforcement power and fails to address potential insider advantages or misuse by politically exposed individuals.

Meanwhile, World Liberty Financial has stated publicly that it is a private entity with no official connection to the U.S. government. The company maintains that it operates independently of Trump’s current or former government roles, and that any references to him are related to his private sector contributions.

What the GENIUS Act Means for the Market

With Trump’s signature, the GENIUS Act officially becomes law, initiating a six-month countdown during which federal regulators must develop detailed rules and enforcement mechanisms. Agencies like the Federal Reserve, Office of the Comptroller of the Currency (OCC), and the Financial Crimes Enforcement Network (FinCEN) are expected to collaborate on shaping a robust and transparent regulatory infrastructure.

Industry analysts believe the law will lead to:

-

Increased legitimacy and stability in the use of stablecoins.

-

Wider adoption of crypto in payment systems and international transfers.

-

Stronger compliance standards for crypto issuers and wallet providers.

-

Greater involvement of traditional banks in the crypto space.

The crypto sector has long requested clearer rules around what is allowed in the issuance and use of digital tokens. By formalizing a national policy, the GENIUS Act is expected to resolve some of the regulatory uncertainty that has previously driven companies to offshore jurisdictions.

The House Also Passes the CLARITY Act

In a related move, the House of Representatives passed the CLARITY Act, a bill that establishes clearer jurisdictional boundaries for digital asset regulation. The CLARITY Act outlines whether a specific crypto asset should be classified as a security under the Securities and Exchange Commission (SEC) or as a commodity under the Commodities Futures Trading Commission (CFTC).

This legislation seeks to end the prolonged debate between the two agencies, which has created confusion and delayed innovation. The CLARITY Act will now head to the Senate, where its fate remains uncertain, though momentum from the GENIUS Act may help push it forward.

What’s Next for U.S. Crypto Policy?

The coming months will be crucial in shaping how the GENIUS Act and CLARITY Act are applied. Financial regulators will now work to draft rules that are fair, transparent, and designed to protect both investors and the broader financial system.

While the laws have been celebrated by many in the crypto world, experts warn that oversight and enforcement will be the real test of their effectiveness. Questions remain about how regulators will detect and prevent money laundering, market manipulation, and conflicts of interest, especially as more public figures and institutions enter the digital asset space.

The GENIUS Act marks a historic shift in American finance, signaling that cryptocurrency is no longer on the fringes but is instead becoming an integral part of the nation’s regulated economic system. As the U.S. moves toward full integration of digital assets into its financial fabric, both opportunities and challenges lie ahead.