You know the feeling, you book the flight, the hotel, maybe a tour, and then you stare at the checkout screen wondering whether you should add travel insurance. Travel Insurance credit card Benefits: What Your Card Actually Covers In 2026 is really about one question: what protection you already paid for, and what gaps can still hit your wallet.

So below, Going to break down what US credit cards commonly cover, where the limits hide, and the quick checks that tell you whether you should buy separate travel protection.

What Is Travel Insurance?

Travel insurance is a bundle of coverages that helps pay you back (or pay on your behalf) when a trip goes sideways.

Most policies combine trip cancellation, trip interruption, some form of baggage insurance, and optional medical or evacuation benefits.

- Trip cancellation: reimburses eligible prepaid travel expenses if you cancel for a covered reason.

- Trip interruption: helps with prepaid losses and extra costs if you have to cut the trip short and get home.

- Baggage delay: helps you buy essentials (like toiletries and clothing) while you wait for your bags.

- Lost luggage: helps replace bags and contents that are lost, damaged, or stolen by a common carrier.

- Medical and evacuation: may cover emergency treatment and/or transportation, depending on the policy.

A key distinction: credit card “travel insurance” is usually a set of card benefits with strict triggers, while a standalone policy is a contract you buy for one specific trip. If you want Cancel for any reason flexibility, that is typically a paid add-on to a standalone policy and often reimburses only 50% to 75% of nonrefundable costs.

Start with your card’s Guide to Benefits, then decide if you need extra coverage for the risks that would actually hurt financially.

How Does Credit Card Travel Insurance Work?

Credit card travel insurance usually activates when you charge eligible travel costs to your card (sometimes the full fare, sometimes at least part of it, depending on the benefit).

Think of it as trip protection with rules: it can be excellent for common disruptions, but it’s rarely a full replacement for a dedicated insurance policy.

| What to check | Why it matters | What to do |

|---|---|---|

| What purchases qualify | Some benefits apply only to common carrier tickets, others include hotels and tours | Confirm whether your hotels, cruises, and tours count as covered travel expenses |

| Who is covered | Coverage may extend to spouse, domestic partner, and dependent children, but definitions vary | Verify “covered traveler” language before you book group travel |

| Time thresholds | Trip delay and baggage delay benefits often require a minimum number of hours | Save the airline’s delay notice or delay statement as soon as it happens |

| Coverage caps | Reimbursement limits can make a “covered” claim still expensive | Compare your nonrefundable costs to the card’s per-person and per-trip limits |

Coverage for trip cancellations and interruptions

Trip cancellation can reimburse eligible prepaid, nonrefundable travel expenses when you cancel for a covered reason, like certain illnesses, injuries, or severe weather.

Trip interruption usually applies after your trip starts, and it can help with unused prepaid costs plus certain extra travel expenses to get you home.

For a concrete benchmark, Chase lists trip cancellation and interruption coverage on Sapphire Reserve at up to $10,000 per covered traveler and $20,000 per trip for prepaid, nonrefundable travel expenses, with terms and exclusions in the policy details.

- Action tip: if your trip has $25,000 in nonrefundable costs and your card caps at $20,000 per trip, plan for a gap (either refundable bookings, separate insurance, or a smaller deposit schedule).

- Common pitfall: “I changed my mind” is not a covered reason. If flexibility is the goal, you’re really shopping for refundable fares or a CFAR add-on.

- Claim speed: keep the cancellation proof from the airline or provider, plus your card statement showing the charge, because reimbursement decisions lean heavily on documentation.

One more reality check: many cards do not offer true CFAR. If you see “cancel for any reason” language, verify whether it’s a real benefit or a separate product sold during booking.

Reimbursement for baggage delays and lost luggage

Baggage benefits split into two buckets: baggage delay (short-term essentials) and lost luggage (replacement of property that’s lost, stolen, or damaged by the carrier).

In the US, you should usually file with the airline first. The US Department of Transportation raised the domestic airline liability limit for mishandled baggage to $4,700 per passenger, which matters because many card policies treat their coverage as secondary to what the carrier pays.

| Problem | What typically helps first | What your card may add |

|---|---|---|

| Bags delayed | Airline assistance, then your receipts | Reimbursement for essentials after a time threshold (often hours-based), up to a daily cap |

| Bags lost or stolen | Airline claim and documentation | Lost luggage reimbursement to repair or replace items, up to the card’s limit |

Example of how the numbers show up in real life: Chase lists baggage delay insurance on Sapphire Reserve at up to $100 per day for up to 5 days when baggage is delayed over 6 hours, and lost luggage reimbursement up to $3,000 per covered traveler per trip.

- Action tip: buy only the essentials you can justify. Toiletries and basic clothing are easier to get reimbursed than “upgrade” purchases.

- Gear warning: if you travel with pricey electronics, instruments, or camera equipment, check per-item limits and category exclusions, then decide if you need separate baggage insurance.

Emergency medical and dental coverage

This is where people get surprised in 2026.

Many US credit cards provide travel assistance (referrals and coordination), but little or no true medical reimbursement coverage. You still pay for care, and then you try to claim what the policy allows.

On the premium end, some cards do list medical reimbursement amounts. For example, Chase lists Sapphire Reserve emergency medical and dental reimbursement up to $2,500 (with a deductible) for covered travelers when you’re far from home, and it also lists emergency evacuation and transportation up to $100,000 for eligible situations.

- Action tip: if you’re traveling internationally, treat card medical coverage as a backup, not your plan. Price a travel medical policy when a hospital bill would be a serious financial hit.

- Decision rule: if you want higher medical limits, shop for a medical-focused policy and keep your card benefits for trip delay and interruption.

Use card benefits for trip disruption reimbursement. Use separate insurance for serious medical risk.

Rental car insurance

Most card “rental car insurance” is really a collision damage waiver or loss damage waiver. It pays for damage to, or theft of, the rental vehicle. It usually does not replace liability coverage.

The biggest decision is primary vs. secondary coverage. Primary coverage can let you avoid involving your personal auto insurer for a collision claim, while secondary coverage may reimburse what your own insurer doesn’t cover, like a deductible.

- To activate coverage: pay for the rental with the card and decline the rental agency’s collision coverage.

- Driver rules: the driver must be listed on the rental agreement, and coverage often excludes certain vehicle types.

- Country exclusions: some cards exclude rentals in certain countries, so confirm before you land and reach the counter.

Chase lists Sapphire Reserve auto rental coverage as primary with reimbursement up to $75,000 for theft and collision damage for most rental vehicles, which is a strong baseline if you rent often.

Travel Insurance Benefits: What Your Card Actually Covers In 2026

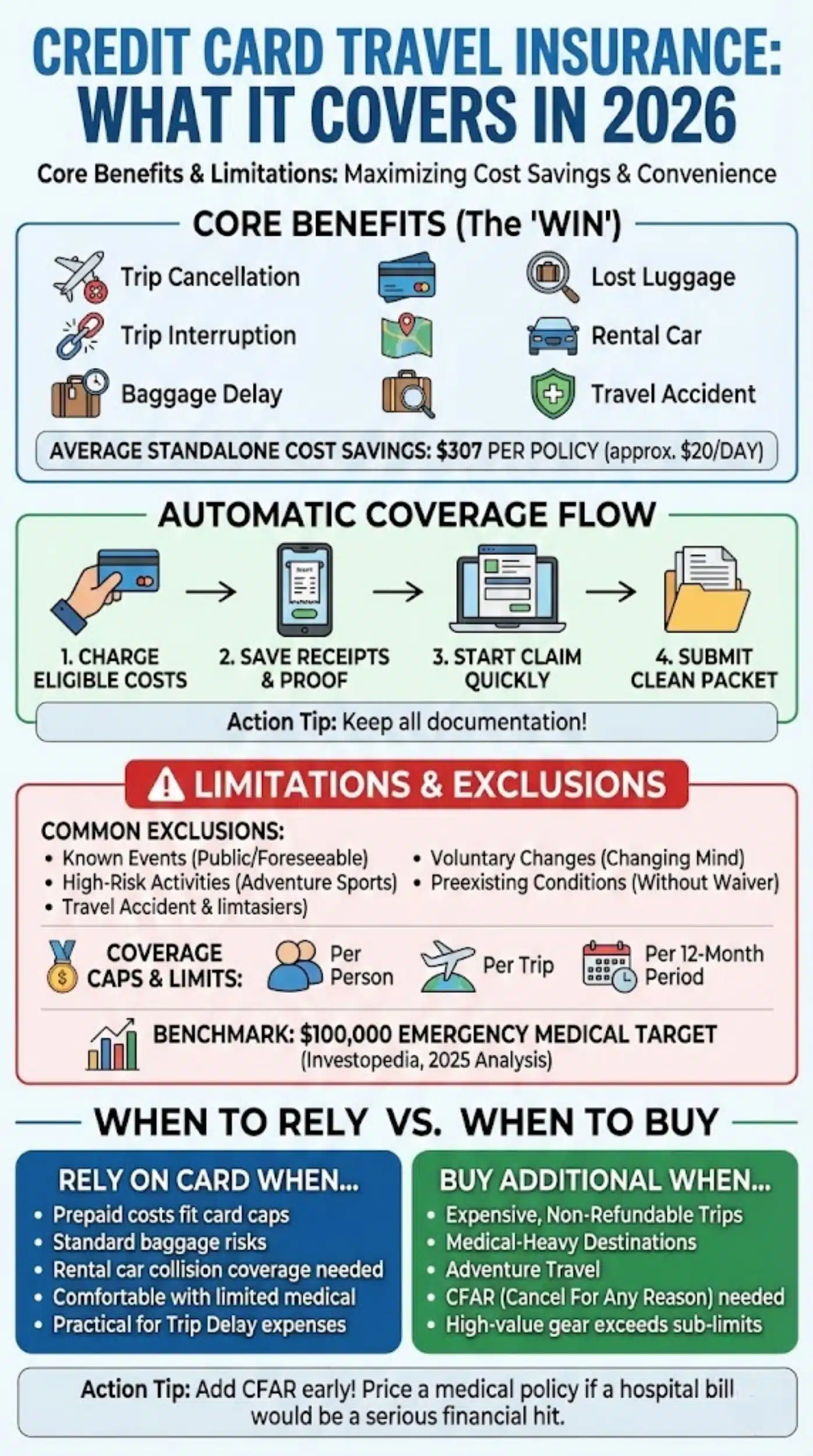

In 2026, the best card benefits still cluster around the same core events: cancellation, interruption, baggage delay, lost luggage, rental car, and travel accident insurance.

The win is cost and convenience, as long as the policy details match the trip you’re booking.

Cost savings on travel protection

When your card already includes trip cancellation and trip delay benefits, you can skip paying twice for the same coverage.

That matters because standalone travel insurance is not cheap. Squaremouth’s 2026 pricing data puts the average travel insurance cost around $307 per policy, which works out to roughly $20 per day on average.

- Action tip: if your trip is mostly refundable, you may only need your card’s trip delay and baggage coverage, not a full policy.

- Action tip: if you’re insuring a big prepaid deposit, compare your deposit to your card’s reimbursement cap before you decide to rely on the card alone.

Convenience of automatic coverage

The best part of card coverage is that it can be automatic once your eligible travel expenses hit the card.

You don’t need to pick deductibles or compare plan tiers. You just need to follow the rules.

- Charge the covered trip expenses to the card (and keep the receipts).

- Save proof of the triggering event (delay notice, cancellation notice, medical note, police report if needed).

- Start the claim quickly, even if you’re still gathering documents.

- Submit a clean packet: itinerary, proof of payment, proof of loss, and itemized receipts.

Peace of mind during international travel

When you’re traveling internationally, disruptions get more expensive fast, rebooking, extra hotel nights, and replacing essentials can stack up in a single day.

That’s where credit card travel protection shines, especially for trip interruption, reimbursement for delays, and baggage issues.

For medical risk, be honest about what would hurt. A 2025 analysis in Investopedia suggested targeting at least $100,000 in emergency medical coverage for international trips, which is far above what most credit card benefits provide.

Limitations of Credit Card Travel Insurance

Credit card travel insurance is valuable, but it has hard edges: exclusions, narrow definitions, and caps that can turn a “covered” event into a partial payout.

If you plan around the limits, you get real trip protection. If you assume it covers everything, you get a surprise.

Exclusions and restricted coverage

Exclusions vary by issuer, but several patterns show up across US travel policies.

- Known events: if a disruption was already public or foreseeable before you travel, it may be excluded.

- High-risk activities: certain adventure sports can be excluded unless a policy explicitly includes them.

- Voluntary changes: changing plans, even for a good reason, often does not qualify.

- Preexisting conditions: many policies exclude them unless you have a waiver through a standalone plan.

Action tip: before you rely on the coverage, search your benefits guide for “covered reasons” and “what is not covered.” Those two sections tell you more than the marketing summary ever will.

Coverage caps and reimbursement limits

Coverage caps are the second place people get caught.

Even strong cards have ceilings for trip cancellation, baggage, and travel accident insurance, and those ceilings can be per person, per trip, and per 12-month period.

| Benefit | Typical cap style | What to match it to |

|---|---|---|

| Trip cancellation | Per traveler and per trip | Your total nonrefundable prepaid costs |

| Trip delay | Per traveler or per ticket, after a time threshold | Your likely out-of-pocket for a missed connection or forced overnight |

| Lost luggage | Per traveler, with category limits | The replacement cost of what you actually pack |

| Emergency evacuation | Per trip maximum | Worst-case transport costs from your destination |

Situations requiring additional travel insurance

Buy additional insurance when the trip has a risk your card is not built to cover.

- Expensive, nonrefundable trips: when your prepaid costs exceed your card’s trip cancellation cap.

- Medical-heavy destinations: when you want higher medical limits than card benefits offer.

- Adventure travel: when activities could be excluded by standard travel policies.

- Flexibility needs: when you want cancel for any reason because your reason to cancel may be personal or unpredictable.

Action tip: if you want CFAR, buy it early. Many insurers require you to add it within a short window after your first trip payment, and it typically reimburses only part of your trip costs.

When Should You Rely on Credit Card Travel Insurance?

Rely on your card when the card’s coverage caps align with your real exposure, and when your biggest risks are the classic travel disruptions.

- You have meaningful prepaid costs, but they fit under your card’s trip cancellation and trip interruption limits.

- You want strong baggage delay and lost luggage reimbursement for standard luggage.

- You want rental car collision coverage without paying at the counter.

- You’re comfortable treating medical coverage as limited and handling it separately if needed.

If your policy includes trip delay reimbursement, it can be one of the most practical benefits to lean on, because a single overnight delay can cost hundreds in meals, lodging, and local transportation.

When Should You Purchase Additional Travel Insurance?

Purchase additional travel insurance when your trip protection needs go beyond what card benefits are meant to handle.

That usually comes down to three gaps: flexibility (CFAR), medical limits, and high-value property.

If losing the trip would hurt financially, insure the trip. If getting sick abroad would hurt financially, insure the medical side too.

- CFAR gap: add a CFAR upgrade if you need the ability to cancel for personal reasons that won’t qualify under covered reasons.

- Medical gap: add travel medical coverage if your card does not offer meaningful emergency medical reimbursement.

- Deposit gap: add coverage if your nonrefundable travel expenses exceed the card’s reimbursement cap.

- Gear gap: add specialty coverage if your valuables exceed baggage sub-limits.

Best Credit Cards for Travel Insurance in 2026

The “best” card depends on what you want the card to do: protect a big trip deposit, cover travel delays, cover baggage, or cover rental cars.

Below are a few well-known US cards and what they’re widely used for, based on their published benefits and typical coverage patterns.

Comprehensive travel insurance cards

If you want broad travel protection in one place, prioritize cards with trip cancellation, trip delay, baggage delay, lost luggage, rental car coverage, and emergency evacuation benefits.

| Card | Standout strengths | Best for |

|---|---|---|

| Chase Sapphire Reserve | Strong trip delay threshold, trip cancellation limits, evacuation benefit, primary rental coverage, travel accident insurance | Frequent travelers who want one card to handle most disruption scenarios |

| Chase Sapphire Preferred | High-value trip cancellation limits for many trips, baggage delay and lost luggage coverage, primary rental coverage | Travelers who want strong protections without going fully premium |

Action tip: if you’re choosing between two cards, compare the time threshold for trip delay reimbursement and baggage delay first. Those are the benefits you’re most likely to use.

Mid-tier cards with robust protections

Mid-tier cards can still cover the big-ticket travel expenses, but the caps and covered reasons can be narrower.

Before you decide, match the card’s reimbursement limits to your typical travel expenses, and confirm whether hotels and tours count or only common carrier tickets.

- Good fit: domestic trips, standard luggage, moderate prepaid costs.

- Watch-outs: limited covered reasons, lower trip cancellation limits, and narrower definitions of covered travelers.

Premium cards with specialized perks

Some premium cards focus on a mix of travel perks and travel insurance benefits.

For example, American Express Platinum trip delay insurance is commonly described with a $500 cap per covered trip after a 6-hour delay threshold, and it also offers baggage insurance limits that differ for carry-on vs. checked luggage.

Capital One Venture X is often highlighted for lost luggage reimbursement and trip delay coverage, but you should read carefully for baggage delay benefits, since coverage can vary by product and network terms.

How to Maximize Your Card’s Travel Insurance Benefits

To maximize your travel insurance benefits, treat it like a claims process before you even leave home.

You activate coverage correctly, document the event cleanly, and submit a tight reimbursement request.

Always review your card’s policy details

Before you book, pull the card’s Guide to Benefits and scan four sections: covered reasons, exclusions, coverage caps, and how to file a claim.

- Trip cancellation and trip interruption: confirm what counts as a covered reason and what expenses qualify.

- Baggage insurance: confirm thresholds and per-item sub-limits.

- Rental car insurance: confirm primary vs. secondary and any country exclusions.

- Medical and evacuation: confirm whether it’s true reimbursement, coordination only, or both.

Then decide what to buy separately, if anything, based on your biggest financial risk.

Use your card for travel bookings

Many benefits hinge on charging the trip to the card, so make the purchase path simple.

- Use the card for the common carrier ticket and major prepaid expenses you want protected.

- Save confirmations, itineraries, and receipts in one folder you can access from your phone.

- During a delay or cancellation, request written proof from the airline or provider right away.

- Keep itemized receipts for meals, lodging, toiletries, and replacement essentials for reimbursement.

Final Thoughts

Travel Insurance Benefits: What Your Card Actually Covers In 2026 comes down to one practical move: match your trip costs and risks to your card’s caps and covered reasons. Use card travel protection for trip cancellation, trip interruption, baggage insurance, and travel delays when the limits fit, and buy separate coverage when the gaps matter. I use my card benefits on every trip because the reimbursement process is manageable when I document everything early and follow the insurance policy details.