Many Romanians want to grow their savings on their phone. They try forex trading or CFD trading with mobile apps. They see high trading fees and clunky platforms. They feel lost and fear a bad trade.

A demo account can let you test a platform with zero risk. Here is a fact: many apps now support MetaTrader 4, copy trading, and bank transfer funding. We rank 6 trading platforms and list key points on trading fees, security, and market access, including fractional shares to help you pick a broker fast.

Read on.

Key Takeaways

- eToro welcomes new traders with a $50 minimum deposit, a demo account loaded with $100,000 in virtual cash, commission-free stock and ETF trades, and social copy trading under CySEC.

- Plus500 offers access to over 2,000 CFD markets, a $100 minimum deposit, a $40,000 demo account, tight spreads, and negative balance protection under FCA and CySEC.

- Skilling delivers a clean mobile app with more than 1,200 CFD markets, zero commissions on forex and CFD trades, a 10,000-unit demo account, and MetaTrader 4 integration.

- IG Markets covers stocks, ETFs, forex, and CFDs, charges $0.02 per share (minimum $10) on US stocks, keeps client funds in segregated accounts, and provides 24/5 support.

- Bitpanda and XM Group let you buy fractional shares from just a few euros; XM adds over 1,400 instruments, spreads from 0.6 pips, up to 1:1000 leverage, and demo accounts on MT4/5.

How to Choose a Reliable Trading App in Romania

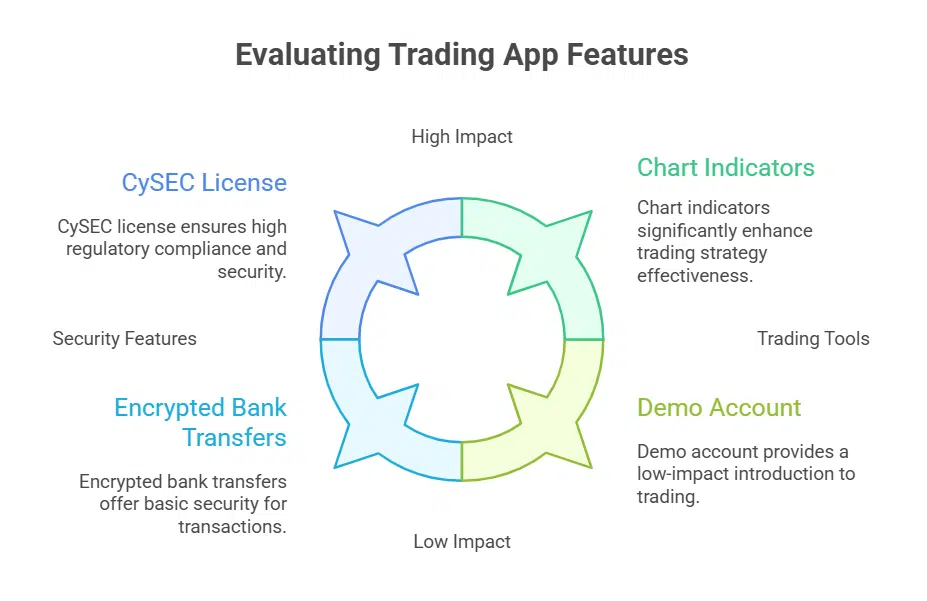

Check for a CySEC license, encrypted bank transfers, and e-wallets in your app’s setup. See how a demo account, low fees, chart indicators, and risk management tools can shape your choice.

Regulation and security

Top apps must meet investor protection rules. They hold licenses from the EU watchdog, the UK regulator, the US broker authority, and the Aussie board. These bodies cap trading fees, require segregated accounts, and back negative balance protection.

You never lose more than you put in.

Apps use two-factor login, SSL locks, and firewall shields to guard your data and bank transfers. You trade forex, stocks, CFDs, crypto, and fractional shares with peace of mind. Demo accounts let you test risk free, so you sharpen trading strategies without spending real money.

User-friendly interface

A user-friendly mobile trading app should show charts, buy buttons, and order history on one screen. Widget rows and clear menus let you find tools fast. This kind of trading platform cuts guesswork.

You switch from forex trading to stock trading with a tap. Such a design supports strong trading strategies in financial markets.

eToro brings social trading feeds right into its dashboard. The software links your mobile wallet and demo account next to those buy buttons. Interactive Brokers has a complex opening process that can slow new users.

A neat interface keeps you in the action and off long setup pages. This ease reduces errors and builds more confidence.

Low fees and charges

eToro offers zero commission for stocks and ETFs, and it sets a $5 fee for withdrawals. Traders grab fractional shares, trade CFDs and buy mutual funds. The app adds negative balance protection and shows clear trading fees.

This platform also gives a demo account to practice.

Interactive Brokers charges $0.0035 per share, with a $0.35 minimum. This rate suits active forex traders and equity fans. You can fund your account with Apple Pay or bank transfer.

The broker includes risk management tools and portfolio management.

Range of investment products

Many apps pack a wide mix of trading instruments. This platform lists over 2,000 stocks, exchange traded funds, cryptos, and CFDs. Interactive Brokers links you to options contracts and futures, forex pairs, bonds, commodities, and indices.

Fractional shares let you buy bits of Apple or Tesla for a few dollars. Traders can use a demo account to test algorithmic trading and market analysis. Regulators like CySEC and the European Securities and Markets Authority watch over investor protection.

Customer support availability

Great trading apps offer help any time. eToro, Interactive Brokers, and XTB staff reply by live chat, email or phone. Traders open the mobile trading app and tap help center in seconds.

Fast feedback cuts downtime and trims trading fees. Support reps guide users through forex trades, CFD trades and risk management features. Demo account specialists fix glitches right away.

eToro: Best for Beginners and Copy Trading

eToro hooks beginner traders with a clean, vibrant smartphone platform and a free demo account that mimics live forex and stock moves. Its copy trading lets you shadow skilled investors and test winning strategies with peer trading tools.

Key Features of eToro

This platform suits new traders and pros via its mix of tools. It makes copy trading and commission-free trading easy.

- Social trading feature lets beginners follow pros, copy trades in real time under CySEC regulation.

- Commission-free stock and ETF trades let investors buy fractional shares of S&P 500 firms, with a $50 minimum deposit.

- CFD trading for currencies, commodities, and crypto offers risk management tools and negative balance protection.

- Crypto hub holds multiple tokens, gives safe wallets, low conversion fees, and fast deposit methods such as bank transfers.

- Demo account with $100K in virtual cash trains users on forex brokers, options trading, and intraday trading without risk.

- Mobile trading app shows real time charts, price alerts, and syncs across iOS and Android for on the go access.

- Up to 4.3% interest on USD cash makes idle funds work harder, while no inactivity fee applies if you trade monthly.

- Segregated accounts protect client funds and back investor protection schemes in the EU for added confidence.

Pros & Cons of eToro

Here is a quick look at eToro’s strengths and weaknesses for Romanian investors.

| Pros | Cons |

|---|---|

|

|

Plus500: Best for International Trading

Plus500 offers over 2,000 CFDs on forex, stocks, and indices with tight spreads and low trading fees. It stores client funds in segregated bank accounts and backs each trade with negative balance protection under CySEC.

Key Features of Plus500

Regulators FCA and CySEC oversee this app. Traders open an account with $100.

- Licensed platform: FCA and CySEC supervise operations, funds stay in segregated trust, and negative balance protection guards accounts.

- Commission-free trading: conduct CFD trading and stock trades without commission, spreads stay tight, and no deposit fees apply.

- Wide product range: trade forex pairs, share CFDs, index contracts, cryptocurrency CFDs, and commodity CFDs under one login.

- Practice demo: access a free demo account loaded with $40,000 of virtual funds, test strategies without risking capital.

- Advanced charting: use candlestick charts, technical indicators, and drawing tools to guide market analysis.

- Mobile interface: run the app on iOS or Android, track positions, set price alerts, and place orders on the move.

- Low minimum: start live trading with a $100 deposit in USD or EUR, and choose from credit cards or bank transfers.

- Risk management: set stop-loss, take-profit, guaranteed stop orders, and trailing stops to cap potential losses.

- Live quotes: see real-time prices from Nasdaq, forex markets, and major index benchmarks to spot timely opportunities.

Pros & Cons of Plus500

Plus500 shows clear strengths and weak spots for Romanian traders.

| Pros | Cons |

|---|---|

| No commissions on trades | High overnight fees apply |

| Practice account provided | 82% of retail Contract for Difference accounts lose money |

Skilling: Best Mobile Trading Experience

Skilling packs a slick mobile platform with one-tap orders and clear graph tools for stocks and forex. You get CFD trading, risk controls, and a practice account on the go.

Key Features of Skilling

This platform runs a top-rated mobile trading app that feels smooth on any phone. It packs in forex trading, CFD trading, and stock options in one place.

- It has a clean layout, so you spot key charts fast.

- Users access over 1,200 contract for difference markets in real time.

- Traders see 40 currency pairs, 20 digital tokens, and 500 equities as diverse trading instruments.

- A demo account gives you a safe space to test strategies.

- Risk management tools like stop loss and take profit guard your wallet.

- Low equity fees and no inactivity charge keep your costs down.

- Integration with MT4 lets you run custom indicators and scripts.

- Fast deposits via card, bank wire and e-wallets speed up your trades.

- Customer support staff reply in minutes through live chat or email.

Pros & Cons of Skilling

Here are the main pros and cons of Skilling.

| Pros | Cons |

|---|---|

|

|

IG Markets: Best for Transparency and Trust

IG Markets holds client cash in separate bank accounts and uses negative balance protection under CySEC rules. It displays live forex quotes and CFD fees on its web and mobile platforms.

Key Features of IG Markets

Clients see clear prices and live charts on IG Markets. They get tools for cfd trading, forex trading, and stock exchange access.

- Regulated by FCA and ASIC, which guards investor assets and upholds strict rules.

- Offers a wide product mix covering stocks, ETFs, forex, and CFDs for trading platforms.

- Charges $0.02 per share and a $10 minimum on US stocks and applies low trading fees on other markets.

- Protects traders with negative balance protection to block unexpected losses beyond the deposit.

- Keeps client cash in segregated accounts at top banks to secure funds from broker insolvency.

- Supplies a free demo account with virtual cash so new traders can test strategies without risk.

- Packs a mobile trading app with live charts, alerts, and one-tap execution for mobile trading app fans.

- Integrates MetaTrader 4 and an API for custom trading bots and algorithmic trading.

- Provides 24 hour support on weekdays via phone, email, and live chat to answer questions fast.

Pros & Cons of IG Markets

IG Markets offers a first-class platform for cfd trading and forex trading. The platform includes negative balance protection and segregated accounts for client funds. Traders can open a free demo account to practice market analysis and algorithmic trading tools.

About 70% of retail accounts that trade CFDs lose money, so risk management tools matter a lot. High trading fees on some instruments can trim profits fast. Beginners and advanced traders need solid strategies to stay in the game.

Bitpanda: Best for Small-Scale and Fractional Investing

Bitpanda lets you grab slices of big stocks, funds, or digital coins from just a few USD. The app pairs a neat interface with EU oversight and segregated accounts for your funds, so you can grow your nest egg bit by bit.

Key Features of Bitpanda

The platform fits tight budgets. Beginners and pros find it easy and clear.

- Friendly interface: It runs fast on desktop and on mobile. It shows neat charts, custom lists, and simple menus.

- Low minimum deposit: You start with a few euros. You test strategies without risking big sums.

- Fractional investing: You buy parts of companies. You get equity units and bits of big names.

- Diverse asset range: You pick digital tokens, equity units, investment funds, commodity lots in one place.

- Transparent cost structure: You see all trading fees. You dodge hidden charges.

- Licensed platform: It follows EU rules. It holds client funds in segregated accounts and offers negative balance protection.

- Learning resources: You read guides and watch videos. You join webinars to learn market analysis, risk management, and algorithmic trading basics.

Pros & Cons of Bitpanda

Bitpanda suits small-scale investors and those seeking fractional shares. It lets users buy bits of stock with no minimum deposit. It also offers commission-free trading across assets. It works on a mobile trading app with a clear interface.

Drawbacks do not stand out in public facts. Fee details on non-trading charges are not clear. Investors should read the terms or use a demo account to spot extra costs.

XM Group: Best for Education and Accessible Trading

XM Group teaches market analysis and contract trading with clear video lessons. It gives traders a demo account, smart risk tools, and CySEC oversight.

Key Features of XM Group

Clients can trade over 1,400 instruments. They see spreads from 0.6 pips and leverage up to 1:1000.

- CySEC and IIROC license protect funds under strict Cyprus Securities and Exchange Commission rules.

- Segregated accounts keep client deposits apart from company capital in reputable banks.

- Negative balance protection stops traders from owing more money than they deposit.

- Free demo account offers unlimited virtual funds for forex trading, CFD trading, and algorithmic strategies.

- Multiple platforms include desktop charting tool and mobile terminals for MetaTrader 4 or MetaTrader 5 use.

- Tight spreads start at 0.6 pips on major FX pairs, they cut cost for scalpers and day traders.

- High leverage reaches 1:1000, it boosts buying power on currency and commodity trades with smart risk tools.

- 24/5 live support answers questions on orders, deposit methods, and withdrawal fees in Romanian and English.

- Broad instrument range covers over 1,400 financial instruments, from forex and indexes to commodities and metals.

Pros & Cons of XM Group

XM Group offers extensive educational resources. It hosts forex trading and CFD trading courses, video tutorials, and live webinars. It also gives a free demo account to test strategies. Traders learn risk management and algorithmic trading basics with ease.

This broker lists no cons in its education setup. Study its non-trading fees and inactivity fee to avoid surprises. Check segregated accounts and withdrawal fees before you invest real money.

What to Expect from Trading Apps in Romania

You can test your strategies on a demo account with real derivative, forex, and equity quotes. Mobile platforms bring chart tools, risk management settings, and fractional share access to sharpen your trading edge.

Security measures and app updates

Online brokers in Romania use data encryption, two-factor authentication and SSL to guard client records. FCA, CySEC and ASIC require strong security steps. Developers push updates fast after they spot risks.

The mobile trading app installs patches automatically to protect customers.

eToro offers investor protection up to $85,000 per client in the UK, €20,000 in the EU and $250,000 in the US via SIPC and SEC. Demo account holders see new features instantly. Segregated accounts hold funds apart from platform cash.

Risk management tools like login alerts and security tokens boost safety.

Accessibility of demo accounts

eToro, Interactive Brokers, Plus500, and XTB all offer demo accounts loaded with virtual cash. New traders can test forex trading, cfd trading, and copy trading without risk. eToro lets users copy pros in demo mode.

Interactive Brokers supplies paper trading in its TWS platform. Plus500 grants a web demo with $40,000 to use. XTB extends xStation with virtual funds. Each demo shows real trading fees and tools in action.

DEGIRO skips demo mode entirely. That leaves no practice ground. Some users still pair charts with TradingView. They log tick moves, check spread data, and map trade ideas. Demo accounts cut fee shock and curb hidden costs.

Try paper cash before you risk real funds.

Integration with multiple platforms

Apps link across browser, desktop client, and mobile trading app. You open a forex trading chart in a web page. You then switch to a phone and keep the layout. The eToro app syncs watchlists across iOS and Android.

IBKR offers a desktop hub with advanced tools and a phone client. Both let you test moves in a demo account before live trading. Brokers share an API for algorithmic trading.

Some platforms hook to a browser tab via WebTrader. This runs in Chrome or Edge with no install. You set stop orders, view market analysis, and track CFD positions. You add risk management tools in seconds.

This flow fits both beginner traders and pros.

Takeaway

Pick an app that fits your style and goals. Open a demo account to test strategies. Compare trading platforms by fees and support. Use copy trading, chart tools and risk controls. Start small and grow with smart moves.

FAQs on Trading Apps in Romania

1. Which mobile trading apps do Romanian investors trust?

They pick top trading platforms like Interactive Brokers, a forex brokerage, Saxo Bank A/S, a global broker, Plus500, a CFD broker, and a copy-trading app. These cover social trading, forex trading, cryptocurrency trading, and fractional shares.

2. How do I start forex trading with these apps?

Open an account, pick your base currency, and meet the minimum deposit. Then use the app’s deposit methods. You can trade forex, CFDs, derivatives, stocks, and NFTs. Watch for withdrawal fees and enjoy negative balance protection.

3. Are there apps with commission-free trading and low fees?

Yes, some apps offer commission-free trading for stocks. They add low stock fees for foreign markets, and keep non-trading fees and inactivity fees small. Always do a broker comparison of trading fees before you pick one.

4. Can I use a demo account to learn trading?

Yes, each app offers a demo account. It is like a sandbox, you play and learn, but you keep your real money safe. Beginner traders can test trading strategies in forex trading, CFD trading, and cryptocurrency trading without risk.

5. How do top apps protect my money?

Apps follow CySEC rules for investor protection. They keep your funds in segregated accounts. They also offer negative balance protection and risk management tools. A licensed fund manager oversees security.

6. What trading tools can I use to build my strategy?

You receive market analysis, charts, and news from financial journalism. You can use risk management tools like stop loss orders. Advanced traders use algorithmic trading and copy trading to mirror professional traders.