Hey there, are you stressing about a low credit score? Maybe you’ve been turned down for a loan, or you’re just tired of feeling stuck with bad credit. It’s a real drag, right, like carrying a heavy backpack everywhere you go.

Here’s a cool tidbit: Traceloans.com Credit Score is changing the game by making credit scores easy to understand and access, especially for folks like you with poor credit. This platform isn’t just about numbers; it’s about giving you a fair shot.

We’re here to guide you through boosting your creditworthiness with simple tips on Traceloans.com. Stick around, we’ve got actionable steps to help you shine. Keep reading!

Key Takeaways

- Check your credit score on Traceloans.com, where over 1 million consumers have accessed their scores.

- Pay bills on time since it’s 30% of your score on Traceloans.com; late payments stay on your report for 7 years.

- Keep credit usage below 30% on Traceloans.com, as it’s 25% of your score and shows control to lenders.

- Avoid multiple loan applications to prevent hard inquiries that lower your score on Traceloans.com; they process loans in 24 hours.

- Use Traceloans.com tools like real-time updates and score simulators to track and plan your financial progress.

How to Check Your Credit Score on Traceloans. com

Moving from why your Traceloans.com Credit Score matters, let’s get into the nitty-gritty of checking it on a handy site. I’m talking about traceloans.com, a platform that makes this super easy for bad credit borrowers like you and me.

- First off, hop over to traceloans.com on your browser. It’s a digital lending spot where over one million consumers have checked their scores. Just type in the web address, hit enter, and you’re on your way to seeing your financial health.

- Next up, create an account with them. It’s a quick step; just click the sign-up button, toss in your email, and set a password. This gets you into their system, ready to peek at your credit history.

- Fill out the financial profile form after signing up. This part asks for basic info about your income and debt. Be honest here, as it helps traceloans.com give you a real picture of your creditworthiness.

- Once that’s done, grab your free credit score instantly. Yep, no waiting around; traceloans.com offers real-time score updates. You’ll see where you stand right away, no guesswork needed.

- Keep an eye on the behavioral analysis they provide. This cool tool shows how your payment history and credit usage affect your score. It’s like having a financial coach right on the screen.

- Check back often for those real-time updates. Life changes fast, and so can your score with every bill payment or debt shift. Traceloans.com keeps you in the loop, helping you track progress toward better rates or loan approval.

Tips for Improving Your Traceloans.com Credit Score

Hey there, want to boost your rating on Traceloans.com Credit Score? Stick with me, and let’s get that number climbing fast!

Pay Bills on Time

Got bills piling up? Paying them on time is a big deal, especially on a lending platform like traceloans.com. It makes up 30% of your credit score there. Miss a payment, and it can stick on your credit report for 7 long years.

That’s a tough mark to shake off, trust me.

Take Carmen, a florist, as an example. She nabbed a $9,000 microloan on traceloans.com, all because her payment history was rock solid. Then there’s Martha, a retired teacher, who used her steady utility payment record to snag a home repair loan in just 48 hours.

So, set reminders, pay early, and keep that record clean to boost your creditworthiness for bad credit loans or even mortgage loans.

Reduce Credit Utilization

Hey there, let’s chat about a key way to boost your Traceloans.com Credit Score. Keeping your credit usage low, ideally below 30% of your limit, can work wonders for your financial health.

See, credit utilization makes up a solid 25% of your score on this platform. Use less, and you’re showing lenders you’ve got control.

Think of it like not maxing out a piggy bank. If you’re always close to the brim, it looks risky to anyone watching. So, try to keep that balance down. Using less credit also builds better financial habits over time.

Stick with this, and platforms like traceloans.com will notice the change in your borrower profile.

Avoid Multiple Loan Applications

Stop applying for multiple loans at once, folks. Each application can trigger a hard inquiry, and too many of those can ding your credit score fast, especially on platforms like traceloans.com for bad credit borrowers.

Trust me, it’s like poking a bear; you don’t want to wake up a lower score.

Keep it simple with just one solid application through traceloans.com. Their Borrower Marketplace makes the process easy, and they process loan applications within 24 hours. Plus, they cap loan amounts based on your stability to lower credit risk, so stick to their system and avoid the urge to shop around too much.

Monitoring Your Progress Using Traceloans. com Tools

Hey there, let’s talk about monitoring your Traceloans.com Credit Score. Their tools make it incredibly simple to keep up with your financial performance.

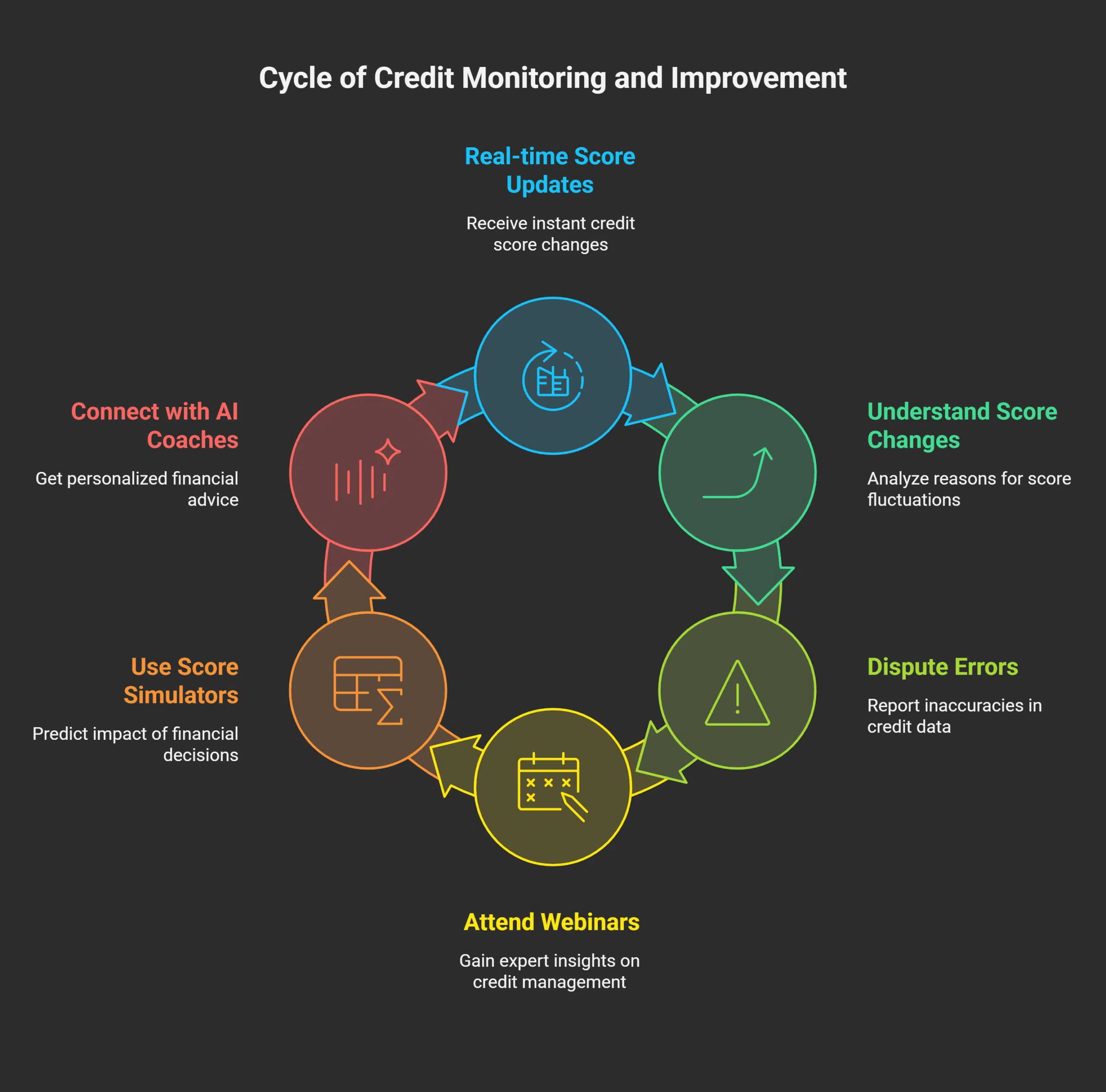

- To start, explore real-time score updates on the Traceloans.com platform. You’ll notice your credit score change the moment updates occur, with no delays. It’s like having an instant tracker for your personal finance targets. Plus, their behavioral analysis explains why your score shifted, making everything perfectly clear.

- Next, appreciate the clarity with in-depth reasons for score changes. Traceloans.com reveals exactly what’s impacting your credit, whether it’s a late payment or a new loan. Think of it as a helpful companion highlighting the obstacles on your financial path.

- Also, make use of the feedback system to dispute or comment on your financial data. Spot an error in your credit history? You can report it directly on the site. It’s like sharing your perspective with the credit bureaus, loud and clear.

- Don’t overlook the monthly webinars with financial planners and credit specialists. Join in to gain insights directly from experts who understand the details of creditworthiness. Set a reminder; it’s a treasure trove for anyone addressing poor credit solutions.

- Take a look at the score simulators for better financial choices. Curious about how a new personal loan could affect your FICO or VantageScore? Enter the details on Traceloans.com and preview the effect before deciding. It’s like a forecast for your finances.

- Lastly, connect with AI coaches for customized guidance on the platform. These virtual assistants analyze your financial habits and provide suggestions just for you. Picture a friend who’s always available to assist with debt consolidation or repayment plans, any time of day.

Takeaways

Ready to boost your Traceloans.com Credit Score? Traceloans.com is your trusty sidekick, helping bad credit borrowers climb out of the rut. Picture your score as a garden; with a little care, it blossoms! Keep using the platform’s cool tools, like score trackers, to watch your progress.

Stick with it, and soon, you’ll see doors to better loans swing wide open!

FAQs on Traceloans.com Credit Score

1. How can I boost my creditworthiness on traceloans.com with bad credit?

Hey, if you’re wrestling with traceloans.com bad credit issues, don’t sweat it. This platform offers bad credit solutions by looking at alternative data, not just traditional credit scores. With advanced algorithms, they dig into your financial behavior to find loan options that fit, even if your past credit histories aren’t shiny.

2. What types of loans does traceloans.com provide for folks like me?

Well, traceloans.com isn’t just a one-trick pony; they’ve got various financial products. Think traceloans.com mortgage loans, small loan choices, or even business loan picks for gig workers in the gig economy. Their platform offers competitive interest rates and flexible terms to match your needs.

3. Will applying for a loan on traceloans.com involve a hard credit check?

Nope, not always! Unlike traditional banks, traceloans.com often skips the hard credit pull during the application process, saving your score from extra dings.

4. How does traceloans.com protect my personal info when I apply?

Listen up, in this digital age, security ain’t a joke, and traceloans.com gets it. They use bank-level encryption and tight security protocols to guard your sensitive personal financial information. So, whether it’s mortgage applications or a quick small loan, your user data stays safe across multiple steps.

5. Can I get a loan on traceloans.com if I don’t meet minimum credit score requirements?

Absolutely, that’s their bread and butter! Traceloans.com looks beyond traditional credit scores, using alternative income sources and borrower profiles to craft loan products, even for those who don’t fit the usual eligibility requirements of traditional lenders.

6. How fast is loan processing on traceloans.com, especially during busy times?

Hey, nobody likes waiting around, right? Traceloans.com speeds things up with slick integration with popular systems and smart loan processing, even during peak application periods. So, whether you’re eyeing home financing or need to refinance unsecured debt, you won’t be left twiddling your thumbs.