Tax season often brings a flurry of questions, and one of the most common in recent years involves a mysterious name appearing on bank statements: TPG Products SBTPG LLC. For many, seeing a deposit from an unfamiliar entity can be confusing, but it is usually a standard part of the modern tax refund process.

Whether you are a tax professional looking to offer more value to your clients or a taxpayer trying to reconcile your refund, understanding the role of Santa Barbara Tax Products Group (SBTPG) is essential. This guide provides a comprehensive overview of tpg products sbtpg llc, explaining how they work, the benefits they offer, and what to expect during the refund cycle.

What is TPG Products SBTPG LLC?

TPG Products SBTPG LLC refers to the financial services arm of Santa Barbara Tax Products Group (SBTPG), a subsidiary of Green Dot Corporation and a partner with Pathward, N.A. . Founded in 1991, the company acts as an intermediary between the Internal Revenue Service (IRS), tax preparers, and taxpayers .

Its primary function is to facilitate “pay-by-refund” services. When a taxpayer uses tax preparation software like TurboTax, TaxSlayer, or H&R Block and chooses to have their preparation fees deducted from their refund, the IRS sends the refund to SBTPG first . The company then deducts the applicable fees and forwards the remaining balance to the taxpayer.

Key Services Offered by SBTPG

SBTPG provides a suite of products designed to streamline tax preparation and payment for both professionals and consumers . These include:

- Refund Transfer: Allows taxpayers to pay for preparation fees, IRS filing fees, and other service charges directly from their federal refund.

- Fast Cash Advance: Provides eligible taxpayers with a short-term loan against their anticipated refund, offering funds in as little as 1-2 days .

- Tax Pro Advances: Offers cash flow solutions and fee advances to qualified tax professionals during the pre-season and in-season .

- AutoCollect: An optional service that facilitates the automatic collection of payments from past-due clients .

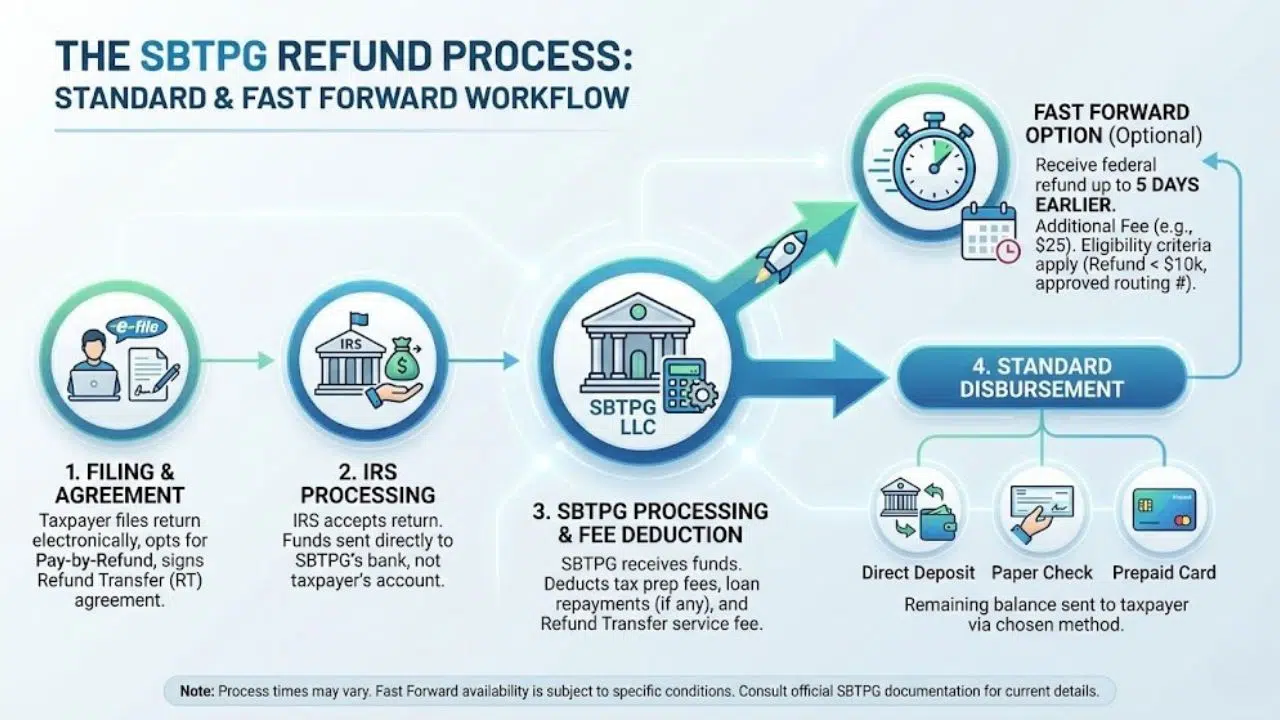

How the SBTPG Refund Process Works

Understanding the workflow of tpg products sbtpg llc is crucial for setting client expectations. The process is straightforward but involves an extra step compared to receiving a refund directly from the IRS .

Step-by-Step Breakdown

- Filing the Return: The taxpayer files their return electronically and opts to pay for services using their refund. They sign a Refund Transfer agreement.

- IRS Processing: The IRS accepts the return and, instead of depositing the refund into the taxpayer’s personal account, sends the full amount to the SBTPG bank.

- Fee Deduction: SBTPG receives the funds and deducts the tax preparation fees, any loan repayments (if an advance was taken), and the Refund Transfer service fee.

- Disbursement: The remaining balance is sent to the taxpayer via the chosen method—usually direct deposit, a paper check, or a prepaid debit card .

The “Fast Forward” Option

To remain competitive, SBTPG offers a service called Fast Forward. For an additional fee (typically $25.00), taxpayers can receive their federal refund up to five days earlier than the standard funding date, provided they meet specific eligibility criteria, such as having a refund less than $10,000 and using an approved routing number for direct deposit .

Benefits for Tax Professionals and Consumers

The use of tpg products sbtpg llc offers distinct advantages for both parties involved .

For Tax Professionals

- Cash Flow Management: Programs like “Tax Pro Advances” provide preparers with pre-season capital to cover operational costs.

- Guaranteed Payment: The “Refund Transfer” product ensures that tax preparation fees are collected directly from the refund, eliminating the risk of non-payment from clients .

- Practice Growth: By offering refund advances, preparers can attract clients looking for faster access to their money.

For Consumers (Taxpayers)

- No Upfront Cost: The most significant benefit is the ability to file taxes without paying anything upfront. All fees are deducted from the final refund .

- Speed: Options like “Fast Cash Advance” provide funds in days, not weeks, which is critical for those needing immediate liquidity .

- Convenience: The process is integrated directly into popular tax software, making it seamless from filing to funding .

Why You Might See a Deposit from TPG Products SBTPG LLC

If you check your bank account and see a deposit from tpg products sbtpg llc, do not be alarmed. This is simply your tax refund being processed through a third party .

According to finance expert Michael Ryan, “That’s why you might see a deposit from a company you don’t recognize instead of the IRS” . The deposit amount will likely be slightly less than the refund amount quoted by the IRS because the tax preparation fees and the Refund Transfer fee have already been deducted .

Common Reasons for a Lower Refund

- Service Fees: Deduction of the Refund Transfer application fee (often around $40-$45) and technology fees .

- Loan Repayment: If you took a “Fast Cash Advance,” the loan amount plus interest (APR up to 35.99%) is deducted before you receive the remaining balance .

- Offset Debts: In some cases, outstanding government debts like student loans or child support may be withheld, which will appear on the SBTPG statement .

Frequently Asked Questions

To provide immediate value and optimize for voice search and featured snippets, here are answers to common questions regarding tpg products sbtpg llc.

Why did I get a deposit from TPG Products SBTPG LLC?

You received a deposit from TPG Products SBTPG LLC because you chose to pay your tax preparation fees using your IRS refund. The IRS sent your refund to SBTPG first, they deducted the fees, and then deposited the remaining balance into your account .

Is TPG Products SBTPG LLC a scam?

No, it is not a scam. TPG Products SBTPG LLC (Santa Barbara Tax Products Group) is a legitimate financial services provider and a subsidiary of Green Dot Corporation. It has been operating since 1991 and partners with major tax software companies to process refunds .

How long does it take SBTPG to release my refund?

Once the IRS releases the funds to SBTPG, the company typically releases the money to the taxpayer on the same business day. Deposits usually reach bank accounts within 1-2 business days. If you opted for “Fast Forward,” you might receive it up to 5 days earlier .

Why is my refund less than what the IRS said?

Your refund is less because SBTPG deducted the fees for tax preparation and the Refund Transfer service before depositing the money into your account. If you took a Refund Advance loan, that amount plus interest is also deducted .

Can I track my SBTPG refund?

Yes, you can track the status of your refund through the SBTPG taxpayer portal on their official website. You will need your Social Security number and the exact refund amount to check the status .

What is the “Fast Forward” fee from SBTPG?

The “Fast Forward” fee is an optional charge (usually $25) that allows taxpayers to receive their federal refund up to five days earlier than the standard schedule. It is only available to those using a Refund Transfer or Advance product who meet specific eligibility requirements .

Final Thoughts

TPG Products SBTPG LLC plays a vital role in the tax preparation ecosystem by bridging the gap between IRS payment schedules and consumer needs. While it introduces an intermediary step in the refund process, the service provides undeniable value by allowing taxpayers to file without upfront costs and access their funds faster through advance loans.

For tax professionals, partnering with SBTPG offers a pathway to improved cash flow and enhanced client service. However, transparency is key. Whether you are a preparer or a taxpayer, always review the fee disclosures carefully to understand the final net refund amount.