Choosing the right car insurance provider can make all the difference when it comes to peace of mind, financial security, and overall satisfaction. With so many options on the market, it’s essential to focus on top car insurance companies in the U.S. that prioritize customer satisfaction.

This article provides a comprehensive ranking of the best car insurance providers based on customer reviews, industry ratings, and other critical factors.

Dive into the details to find the ideal policy for your needs and explore why these companies are the top car insurance companies in the U.S.

Why Customer Satisfaction is Crucial When Choosing Car Insurance?

Customer satisfaction isn’t just a buzzword—it’s a vital indicator of a car insurance company’s reliability, responsiveness, and overall quality. Here’s why it matters:

The Role of Customer Satisfaction in Insurance

A high level of satisfaction reflects a provider’s ability to process claims efficiently, offer fair pricing, and provide excellent customer service.

Positive experiences foster trust, making it easier for policyholders to feel confident in their coverage.

Customers typically evaluate insurers based on claims resolution, customer support, and premium affordability—all essential metrics when selecting top car insurance companies in the U.S.

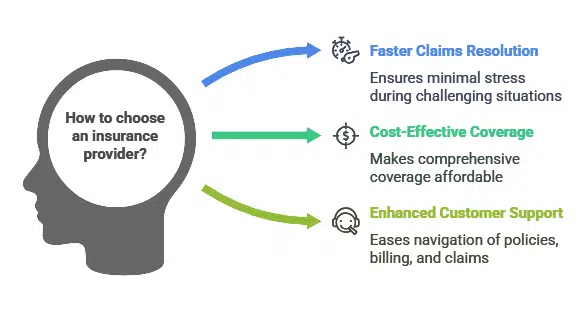

Benefits of Selecting a Top-Rated Insurer

- Faster Claims Resolution: Top companies streamline the claims process, ensuring minimal stress during challenging situations.

- Cost-Effective Coverage: Many leading providers offer competitive pricing and discounts, making comprehensive coverage affordable.

- Enhanced Customer Support: A responsive team can make navigating policies, billing, and claims much easier.

How the Rankings Were Determined?

To identify the top car insurance companies in the U.S., we utilized a rigorous methodology based on reliable data sources and critical performance indicators.

Data Sources and Analysis

- Rankings are derived from surveys conducted by reputable organizations such as J.D. Power, Consumer Reports, and independent customer feedback platforms.

- Metrics include claims satisfaction, affordability, coverage options, and overall customer experience.

Factors Weighed in the Rankings

- Overall Satisfaction Scores: Direct feedback from policyholders plays a key role.

- Reputation and Financial Strength: Stability ensures the ability to pay claims promptly.

- Customer Feedback on Claims and Coverage: Real-world experiences highlight how insurers perform when it matters most.

Top 10 Car Insurance Companies in the U.S.

Below is an in-depth look at the leading insurers based on customer satisfaction and overall performance. Each company listed has earned its place as one of the top car insurance companies in the U.S. for delivering superior service and value to policyholders:

1. Amica Mutual

Founded in 1907, Amica Mutual is one of the oldest mutual insurers in the U.S. It consistently ranks at the top for customer satisfaction due to its unwavering commitment to service excellence.

Key strengths: Exceptional claims process, dividend-paying policies, and personalized service.

Why customers love it: Transparent pricing and the option to receive dividend refunds on certain policies. Amica’s approach makes it a trusted name among the top car insurance companies in the U.S.

| Feature | Details |

| Customer Rating | 9.9/10 |

| Key Offering | Dividend policies |

| Claims Process | Efficient and customer-focused |

2. Auto-Owners Insurance

With over a century of experience, Auto-Owners Insurance is known for its robust financial stability and wide network of independent agents. It caters to customers seeking comprehensive and affordable coverage.

Standout features: Comprehensive coverage options and multi-policy discounts.

Known for: Exceptional customer service and seamless claims handling. Auto-Owners consistently ranks as one of the top car insurance companies in the U.S.

| Feature | Details |

| Customer Rating | 9.8/10 |

| Key Offering | Multi-policy discounts |

| Claims Process | Fast and reliable |

3. Progressive

Progressive has revolutionized the car insurance industry with its innovative tools like the Name Your Price tool and Snapshot rewards. It’s a leading choice among drivers looking for flexibility and digital convenience.

Key strengths: Comprehensive coverage options and exceptional online tools.

Why customers love it: User-friendly app and competitive rates for tech-savvy drivers. These features solidify Progressive’s reputation as one of the top car insurance companies in the U.S.

| Feature | Details |

| Customer Rating | 9.7/10 |

| Key Offering | Snapshot for safe driving |

| Claims Process | Streamlined online process |

4. State Farm

State Farm is the largest auto insurance provider in the U.S., offering unparalleled accessibility through its vast agent network. It’s a go-to option for drivers of all ages and profiles.

Standout features: Affordable rates and personalized service for drivers of all profiles.

Known for: Tailored policies and discounts for students and young drivers. State Farm remains a household name among the top car insurance companies in the U.S.

| Feature | Details |

| Customer Rating | 9.6/10 |

| Key Offering | Personalized service |

| Claims Process | Excellent |

5. Geico

Geico is renowned for its affordable policies and innovative digital tools, making it a popular choice for budget-conscious drivers.

Key strengths: Competitive pricing, an easy-to-use mobile app, and extensive coverage options.

Why customers love it: Geico’s 24/7 customer service and multiple discount opportunities, including savings for good drivers, secure its place among the top car insurance companies in the U.S.

| Feature | Details |

| Customer Rating | 9.5/10 |

| Key Offering | Robust Mobile App |

| Claims Process | Very Good |

6. USAA

USAA exclusively serves military members and their families, offering unmatched customer satisfaction and competitive rates.

Key strengths: Comprehensive coverage options, low premiums, and excellent customer service.

Why customers love it: Tailored benefits for military families, including flexible payment plans during deployment.

| Feature | Details |

| Customer Rating | 9.9/10 |

| Key Offering | Military-Focused Benefits |

| Claims Process | Excellent |

7. Allstate

Allstate’s extensive network of agents and innovative rewards programs make it a reliable choice for drivers nationwide.

Key strengths: Accident forgiveness and Drivewise® rewards for safe driving.

Why customers love it: Allstate’s personalized approach to insurance helps policyholders feel secure and valued.

| Feature | Details |

| Customer Rating | 9.4/10 |

| Key Offering | Drivewise Rewards |

| Claims Process | Very Good |

8. Nationwide

Nationwide stands out for its flexible policies and customer-focused features, such as the Vanishing Deductible program.

Key strengths: Customizable coverage options and programs that reward safe driving.

Why customers love it: Nationwide’s commitment to affordability and innovation ensures it remains a leading choice among the top car insurance companies in the U.S.

| Feature | Details |

| Customer Rating | 9.3/10 |

| Key Offering | Vanishing Deductible Program |

| Claims Process | Very Good |

9. Farmers Insurance

Farmers Insurance offers a wide range of customizable coverage options, making it ideal for diverse insurance needs.

Key strengths: Exceptional customer service and innovative add-ons like rideshare insurance.

Why customers love it: Farmers’ unique coverage options and loyalty discounts provide great value for long-term policyholders.

| Feature | Details |

| Customer Rating | 9.2/10 |

| Key Offering | Rideshare Insurance |

| Claims Process | Excellent |

H3: 10. Liberty Mutual

Liberty Mutual combines customizable policies with features like Better Car Replacement®, appealing to drivers looking for tailored coverage.

Key strengths: Flexible options and a commitment to customer needs.

Why customers love it: Liberty Mutual’s unique benefits and easy online claims process make it a reliable contender among the top car insurance companies in the U.S.

| Feature | Details |

| Customer Rating | 9.1/10 |

| Key Offering | Better Car Replacement® |

| Claims Process | Very Good |

Key Features to Consider When Choosing Car Insurance

-

Coverage Options

Comprehensive, collision, liability, and uninsured motorist coverage are vital to protect against unexpected expenses.

Add-ons like roadside assistance and rental car reimbursement can offer extra peace of mind.

-

Pricing and Discounts

Look for multi-policy discounts and rewards for safe driving to maximize savings.

- Claims Process

Providers with high claims satisfaction ratings offer faster and easier settlements, ensuring minimal stress during accidents.

Takeaways

Selecting the right car insurance provider is essential for protecting your vehicle and financial well-being.

By focusing on top car insurance companies in the U.S. ranked by customer satisfaction, you can enjoy reliable service, fair pricing, and comprehensive coverage.

Take the time to compare options and prioritize customer satisfaction to make the best choice. Start exploring today and secure the perfect policy for your needs!