Hey there, are you puzzled by the wild world of cryptocurrency? Maybe you’ve heard of Bitcoin (BTC) or other digital currencies, but the idea of tokenomics feels like a mystery, right?

Let me share a key tidbit with you. Tokenomics is all about the economic rules that shape a crypto asset’s value, set right from the start during its creation.

I’ve got your back with this beginner’s guide, breaking down tokenomics into easy bits. We’ll look at things like token supply, token utility, and how they play into a cryptocurrency’s worth.

Curious to crack this code? Stick around!

Key Takeaways

- Tokenomics is the set of economic rules that shape a crypto asset’s value, like Bitcoin (BTC) with a capped supply of 21 million coins by 2140.

- Token supply and distribution matter, such as Solana (SOL) having 508 million tokens, while fair distribution avoids trust issues.

- Price stability mechanisms, like Binance burning BNB quarterly or Stellar destroying 55 billion XLM in November 2019, help manage value.

- Incentives in tokenomics include staking rewards on proof-of-stake (PoS) chains and liquidity mining on DeFi platforms like Uniswap.

- Token burning, as seen with Ethereum’s EIP-1559 upgrade burning over 430,000 ETH, reduces supply to boost value.

Key Components of Tokenomics

Hey there, wanna know what makes crypto tick? Let’s chat about the core pieces of tokenomics that keep this digital money game rolling!

Token Utility and Functionality

Let’s chat about token utility and functionality, folks. Think of a crypto token as a special key. It opens doors to cool stuff on blockchain networks. With it, you can pay for services, beef up network security, vote on big decisions, or access neat features.

Take Avalanche (AVAX), for instance. It lets you stake your tokens and earn more AVAX as a reward. That’s a sweet deal, right?

Now, picture tokens as the fuel for decentralized finance (DeFi). They’re not just digital currency to hold onto. Their real power lies in what they do. Some, like governance tokens, let you have a say in how things run in DeFi projects.

Others, like meme coins such as Dogecoin, might not offer much use beyond a laugh or quick speculation. So, knowing a token’s purpose helps you see its true value in this wild crypto space.

Token Supply and Distribution

Hey there, folks, let’s chat about token supply and distribution in the wild world of crypto. Think of token supply as the total number of coins or tokens that exist for a project, kinda like the total slices in a pizza pie.

Some projects, like Bitcoin (BTC), cap their total supply at a firm 21 million coins, with the final one expected to pop out around 2140. Others, like Solana (SOL), roll with a hefty stash of 508 million tokens.

Knowing the total supply, along with the circulating supply, which is the amount actually out there in people’s hands, helps you gauge a crypto asset’s value and scarcity.

Now, distribution is just as big a deal, trust me. It’s all about how those tokens get spread among token holders, whether through sales like an initial coin offering (ICO) or other means.

A fair split stops too many tokens from piling up with founders or early investors, which can mess with trust and market vibes. Projects often tweak their supply and demand game to keep things balanced on blockchains, making sure the digital currency doesn’t lose its punch.

Stick with me to see how this shapes the bigger picture of crypto economics!

Incentives and Rewards

Folks, let’s talk about incentives and rewards in tokenomics, a key part of why crypto projects keep humming. These are the goodies you get for joining in, like staking your coins or adding liquidity to pools.

Think of it as a pat on the back, with some sweet digital assets as a bonus, for helping the network grow.

See, in proof-of-stake (PoS) chains, you earn staking rewards just for locking up your coins as a validator. Then, in decentralized finance (DeFi) projects like Uniswap, liquidity mining pays you for tossing your tokens into liquidity pools.

Even play-to-earn (P2E) games hand out new tokens, called emissions, for simply playing. It’s like getting paid to have fun, and these perks push you to stick around and support the system with your token holdings.

Price Stability Mechanisms

Hey there, readers, let’s explore how crypto projects maintain their token prices. Price stability mechanisms are tools that help manage sharp fluctuations in value, making a token more dependable for users like you and me.

Imagine it as a protective layer, supporting a token before it drops too low.

Take a look, some projects use buy-backs to uphold their price. For instance, Maker repurchased MKR tokens in 2023 to increase value and demonstrate assurance. Others employ token burning, which reduces the total supply to encourage rarity.

Binance, for example, eliminates its BNB tokens every quarter, while Stellar destroyed 55 billion XLM tokens in November 2019, triggering a solid 30% price increase in the short term.

These strategies, grounded in supply and demand, are vital in decentralized finance (DeFi) to maintain equilibrium.

Mechanisms in Tokenomics

Hey there, let’s chat about how tokenomics keeps a crypto project running with cool tricks like inflation tweaks and token burning! Keep scrolling to uncover more on this wild ride.

Inflation and Deflation Mechanisms

Governments often print more money to tackle financial troubles, but this can spark inflation and lower the value of cash. Think of it like flooding a market with apples; too many, and each one’s worth drops.

Bitcoin (BTC), on the flip side, fights this with a clever trick. Its mining rate cuts in half every four years until 2140, slowing down the supply and easing inflationary pressure.

That’s a neat way to keep value steady, right?

Ethereum takes a different path with its deflation tactics. After the EIP-1559 upgrade, they’ve burned over 430,000 ETH, pulling tokens out of the total supply. This creates a negative inflation rate, kinda like trimming dead branches off a tree to help it grow stronger.

With token burning as a tool, the supply shrinks, and that can push the value up through basic supply and demand. So, while inflation adds more digital currency, deflation mechanisms like these aim to balance the economic model in decentralized finance (DeFi).

What do you think of these wild swings in crypto?

Token Burn Mechanisms

Hey there, let’s chat about token burn mechanisms, a cool trick in the crypto world. Basically, token burning means taking some tokens out of circulation for good. Think of it like shredding old dollar bills; it boosts scarcity and can lift the value of the remaining tokens.

This idea plays with supply and demand, making the crypto asset more rare.

Check this out, Stellar torched a huge 55 billion XLM tokens back in November 2019. That’s a massive cut to their total supply! Also, Binance does a regular cleanup by burning its native token, BNB, every quarter.

These moves shrink the circulating supply, often sparking interest among token holders. Isn’t it wild how burning digital currency can heat up market vibes?

Types of Tokens in Tokenomics

Hey there, let’s chat about the different kinds of tokens, like utility tokens, that power the crypto world. Curious to know how they work and what makes them tick? Stick around for more!

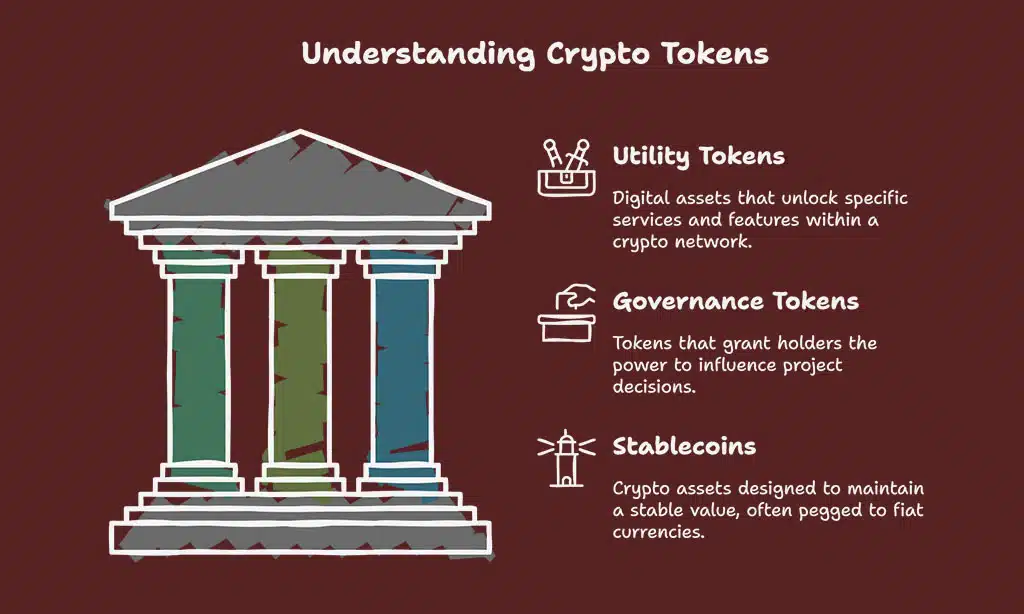

Utility Tokens

Utility tokens are digital assets with a specific purpose in a crypto network. Think of them as keys that unlock cool stuff! They let you pay for services, boost network security, or access special features.

For instance, in some projects like Avalanche (AVAX), these tokens play a big role. You can use AVAX to stake and earn extra rewards, sweetening the deal.

Ever wondered about a ticket to your favorite ride? That’s utility tokens in the crypto space, plain and simple. They’re tied to token utility, driving how a system works in decentralized finance (DeFi).

Whether it’s covering transaction fees or opening new tools on decentralized exchanges (DEXs), they keep the engine running. Stick around, let’s chat more about their impact!

Governance Tokens

Hey there, folks, let’s talk about governance tokens in the exciting sphere of crypto. These unique tokens, often central to decentralized finance (DeFi) ecosystems, grant you influence over a project’s direction.

Imagine them as your voting ticket in a digital democracy, enabling token holders to impact rules and choices.

Envision yourself holding SushiSwap (SUSHI) tokens, for example. You gain a portion of the protocol’s profits and also contribute to guiding its path. It’s like joining a group where your input counts, and your investment in the game, via governance tokens, drives the entire framework of decentralized decision-making.

Stablecoins

Stablecoins are a special kind of crypto asset that aim to keep a steady value. Think of them as a calm island in the wild sea of price fluctuations that often hit cryptocurrencies like Bitcoin (BTC).

They’re tied to stable things, like the US dollar, to avoid those crazy ups and downs. This makes them super handy in decentralized finance (DeFi), where folks need a reliable medium of exchange.

Their worth comes straight from smart contracts and clever price stability mechanisms, like token burning or buy-backs, to balance supply and demand. For investors, grasping how stablecoins work is key to sizing up long-term value in the crypto space.

They’re not just coins; they’re a bridge to managing market swings with ease.

Challenges in Tokenomics

Hey there, wanna know the bumpy side of crypto economics? Stick around, ‘cause tokenomics isn’t always a smooth ride, and we’ve got some real hurdles to chat about!

Regulatory Uncertainty

Folks, let’s chat about a bumpy road in the crypto world, regulatory uncertainty. This mess can throw a wrench in the plans of any cryptocurrency project. See, rules and laws around digital assets aren’t clear in many places, making it tough for teams to design solid tokenomics.

It’s like building a house on shaky ground, you just don’t know if it’ll stand.

Now, this uncertainty hits hard on compliance and project survival. External factors, like changing regulations, can mess with token distribution or even halt an initial coin offering (ICO).

Imagine working hard on a crypto asset, only to face sudden legal hurdles. It’s a real headache for token holders and decision-makers in decentralized finance (DeFi), trust me on that.

Market Manipulation

Hey there, let’s chat about a sneaky issue in the crypto world, market manipulation. It’s a real problem that can mess with supply and demand, creating wild price swings. Poorly designed tokenomics can open the door to this trouble, making it easy for some to game the system.

Think of it like a rigged carnival game, where the odds are stacked against you.

Now, spot this early and you might dodge a bullet. Bad token mechanics are a red flag, hinting at potential project failure or even shady tricks. Understanding tokenomics lets you see the risks of price instability and market manipulation.

Tokens with clear utility and fair token distribution stand stronger against these schemes. Also, watch out for strategic token burns, they can fight inflation but sometimes get twisted for deceptive gains.

Takeaways

Well, folks, tokenomics is the backbone of any cryptocurrency’s value. Think of it as the rulebook for digital assets like Bitcoin (BTC) or Avalanche (AVAX). Getting a grip on token supply, utility, and incentives can help you spot a solid project.

So, dive right in, ask questions, and keep learning about this wild crypto space!

FAQs on Tokenomics

1. What exactly is tokenomics in the crypto world?

Hey, think of tokenomics as the backbone of any digital currency, like Bitcoin (BTC) or Litecoin. It’s the study of how crypto tokens, such as those on the BNB Chain, work within their economic model, covering stuff like token supply, circulating supply, and maximum supply. So, it’s basically the rulebook for how a crypto asset ticks, from transaction fees to market capitalization.

2. How does token supply mess with value?

Well, it’s all about supply and demand, my friend. A limited total supply can drive up a crypto coin’s worth, while a huge circulating supply might drag it down, kinda like too many apples at the market.

3. What’s the deal with token burning?

Token burning, or a token burn, is like tossing old junk to make room for new. It cuts down the total supply of a crypto asset, often boosting its scarcity and value for token holders. Pretty neat trick in decentralized finance (DeFi), right?

4. Why do governance tokens matter so much?

Governance tokens are your ticket to having a say in a project’s future. They let token holders vote on big decisions, shaping monetary policies or even tweaking smart contracts on decentralized exchanges (DEXs).

5. How do incentive mechanisms keep things rolling?

Picture incentive mechanisms as the carrot dangled in front of crypto users. Through staking rewards, yield farming, or proof of stake systems like on Avalanche (AVAX), they nudge folks to participate, hold, or trade digital assets, keeping the whole ecosystem buzzing with life.