Buying property in the UAE can be an exciting yet overwhelming experience, especially for first-time buyers.

The UAE’s booming real estate market, tax-friendly policies, and luxurious lifestyle make it an attractive destination for investors and residents alike.

However, the process involves multiple factors, from legal requirements to financial planning.

In this article, we will explore 10 essential tips for first-time property buyers in UAE, ensuring you make an informed and confident decision.

Why the UAE Property Market Is Ideal for First-Time Buyers?

The UAE’s real estate market is one of the fastest-growing globally, with cities like Dubai and Abu Dhabi leading the way.

From residential apartments to luxurious villas, the market offers diverse options for buyers. The demand for property is consistently high, thanks to the country’s growing population, expat-friendly policies, and influx of tourists.

Developers are introducing innovative projects with attractive payment plans to cater to different budgets and preferences.

Investor-Friendly Policies

The UAE’s government has introduced multiple initiatives to attract foreign investors, including freehold property ownership rights for expatriates in designated areas.

This allows non-UAE nationals to own properties outright, offering long-term security and investment opportunities.

Initiatives such as Golden Visas for property investors further enhance the appeal of the market.

Tax-Free Property Ownership

Unlike many other countries, the UAE does not impose property taxes, making it a lucrative destination for property investment.

Buyers only need to account for initial fees such as registration and maintenance costs, making it cost-effective for first-time investors.

Additionally, the absence of capital gains tax on property sales increases the potential profitability of real estate investments in the UAE.

10 Essential Tips for First-Time Property Buyers in UAE

1. Understand Your Budget and Financing Options

Before diving into the property market, it is crucial to evaluate your budget and financing options.

The UAE offers various mortgage solutions for residents and non-residents, but understanding the terms and conditions is essential.

Budgeting should account for down payments, registration fees, and potential maintenance costs.

Practical Tips:

- Calculate your Debt-to-Income (DTI) ratio to understand how much mortgage you can afford.

- Set aside 25-30% of the property price for the down payment and related fees.

Table: Mortgage Providers in UAE

| Bank Name | Interest Rate (Approx.) | Eligibility Criteria | Loan Tenure |

| Emirates NBD | 3.5% | Salary of AED 15,000+ | Up to 25 years |

| Abu Dhabi Islamic | 3.75% | Salary of AED 10,000+ | Up to 25 years |

| Mashreq Bank | 3.4% | Expats and UAE Nationals | Up to 20 years |

| HSBC UAE | 3.6% | International buyers welcome | Up to 25 years |

2. Research the Property Market Thoroughly

The UAE property market is dynamic, so thorough research is crucial. Use online platforms like Bayut, Property Finder, and Dubizzle to explore available options.

Consulting real estate agencies and reviewing government property transaction data can also provide valuable insights.

Understanding the market’s cyclical trends will help you time your purchase better.

Practical Tips:

- Look for areas with upcoming infrastructure developments to maximize property appreciation.

- Track market reports from agencies like JLL and Knight Frank for reliable data.

3. Choose the Right Location

Location plays a vital role in determining the value and livability of a property. First-time buyers should prioritize areas with proximity to schools, workplaces, and amenities.

Safety, accessibility, and lifestyle preferences are equally important.

List: Top Neighborhoods for First-Time Buyers

- Dubai: Jumeirah Village Circle (affordable apartments), Business Bay (central location), Dubai Marina (waterfront living).

- Abu Dhabi: Yas Island (luxury and entertainment), Al Reem Island (urban living), Khalifa City (family-friendly).

- Sharjah: Al Khan (waterfront views), Al Majaz (cultural hub), Muwaileh (affordable housing).

Table: Comparison of Top Neighborhoods

| City | Neighborhood | Average Price (AED) | Key Features |

| Dubai | Jumeirah Village Circle | 800,000 (1-BR apartment) | Affordable and family-friendly |

| Abu Dhabi | Yas Island | 2,500,000 (3-BR villa) | Proximity to Yas Mall and Ferrari World |

| Sharjah | Al Khan | 600,000 (1-BR apartment) | Scenic waterfront views |

4. Understand Property Types

The UAE offers a variety of property types, including apartments, villas, and townhouses. First-time buyers should consider their lifestyle, family needs, and investment goals before making a choice.

For instance, a professional working in Dubai’s financial district might prefer a central apartment, while a growing family may opt for a suburban villa.

Practical Tips:

- Consider the long-term maintenance costs associated with each property type.

- Evaluate the resale or rental potential based on the property type.

5. Know the Legal Requirements

Buying property in the UAE involves understanding the legal framework. Expatriates can purchase freehold properties in designated areas.

It is essential to have the following documents:

Checklist of Legal Requirements:

- Passport copies

- Residence visa (if applicable)

- Proof of income or mortgage pre-approval

- Sale and purchase agreement (SPA)

- No Objection Certificate (NOC) from the developer (for resale properties)

Table: Key Legal Steps for Property Purchase

| Step | Description |

| Initial Agreement | Buyer and seller sign an MOU |

| Deposit Payment | Typically 10% of the property price |

| Title Deed Registration | Processed at the Dubai Land Department (DLD) |

6. Hire a Reliable Real Estate Agent

Navigating the property market can be challenging without professional help. A licensed real estate agent can:

- Provide market insights.

- Negotiate better deals.

- Handle legal paperwork.

Practical Tips:

- Verify the agent’s license with the Real Estate Regulatory Agency (RERA).

- Read online reviews or get recommendations from trusted sources.

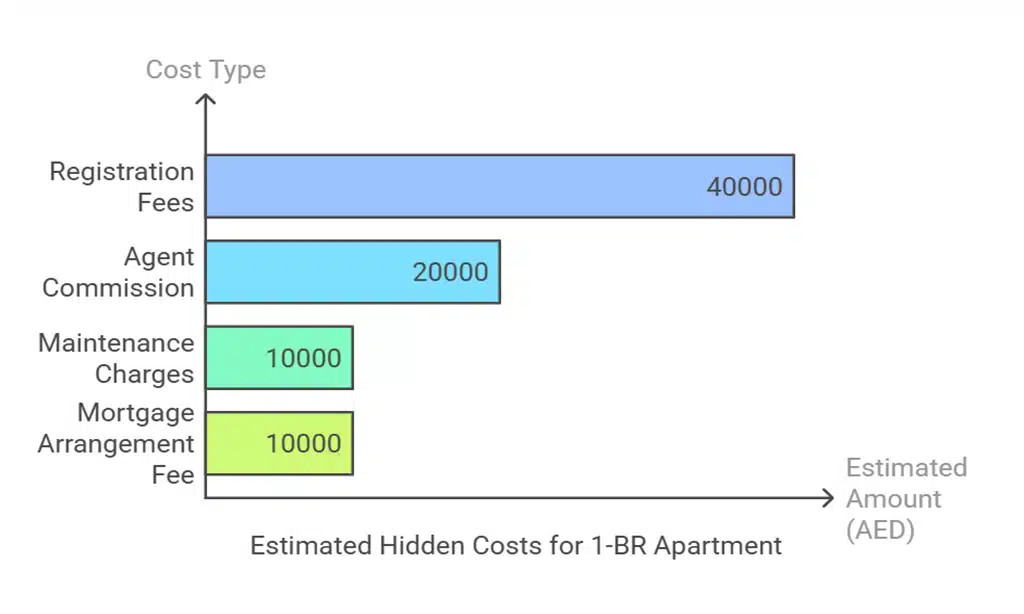

7. Be Aware of Hidden Costs

Apart from the property price, buyers should account for additional expenses, including:

Breakdown of Hidden Costs:

- Registration Fees: Approximately 4% of the property price.

- Maintenance Charges: Vary depending on the property type and location.

- Agent Commission: Typically 2% of the purchase price.

- Mortgage Arrangement Fee: Around 1% of the loan amount.

Table: Estimated Hidden Costs for a 1-BR Apartment (AED 1,000,000)

| Cost Type | Estimated Amount |

| Registration Fees | 40,000 |

| Agent Commission | 20,000 |

| Maintenance Charges | 10,000 annually |

| Mortgage Arrangement Fee | 10,000 |

8. Inspect the Property Before Buying

A thorough inspection is crucial to avoid future issues. Check for:

- Structural integrity

- Quality of materials

- Functionality of utilities (electricity, water, etc.)

Inspection Checklist:

- Are all fixtures and fittings in working condition?

- Is the property free of visible cracks or dampness?

- Are there any signs of pest infestation?

9. Consider the ROI Potential

The UAE’s real estate market offers attractive returns on investment (ROI). Evaluate factors like rental income, occupancy rates, and potential property appreciation before buying.

Practical Example:

A one-bedroom apartment in Dubai Marina can yield a rental return of 6-7%, making it an excellent option for investors.

Table: Average ROI by Location

| Location | Average ROI |

| Dubai Marina | 6-7% |

| Business Bay | 5-6% |

| Yas Island | 5.5-6.5% |

10. Stay Updated on Market Trends

Stay informed about the latest developments in the UAE property market. Regularly check reports from trusted sources like Knight Frank and JLL for market insights. Government initiatives, such as visa reforms and infrastructure projects, often impact market dynamics.

Practical Tips:

- Subscribe to newsletters from real estate platforms.

- Follow announcements on major infrastructure projects, like the Dubai 2040 Urban Master Plan.

Final Thoughts

Buying your first property in the UAE is a significant milestone that requires careful planning and informed decisions.

By following these 10 tips for first-time property buyers in UAE, you can navigate the process confidently and make the most of the country’s thriving real estate market.

From budgeting and location selection to understanding legal requirements, each step is crucial in ensuring a successful investment.

Take your time, do your research, and seek professional guidance where needed. With the right approach, owning a property in the UAE can be a rewarding and profitable experience.