As a high earner in Australia, tax planning is essential to optimizing your financial position. The Australian Taxation Office (ATO) imposes higher tax rates on individuals in the top income brackets, making it crucial to leverage effective tax strategies.

Without a proactive approach, you could be paying more in taxes than necessary.

By implementing smart and legal tax-saving techniques, high-income earners can significantly reduce their taxable income, take advantage of available deductions, and ensure compliance with Australian tax laws.

This guide explores seven essential tax strategies for high earners in Australia for 2025. These strategies will help you reduce your taxable income, maximize savings, boost investments, and secure your financial future.

Each section includes practical insights, examples, and data-backed recommendations to help you make informed decisions.

Understanding Taxation for High Earners in Australia

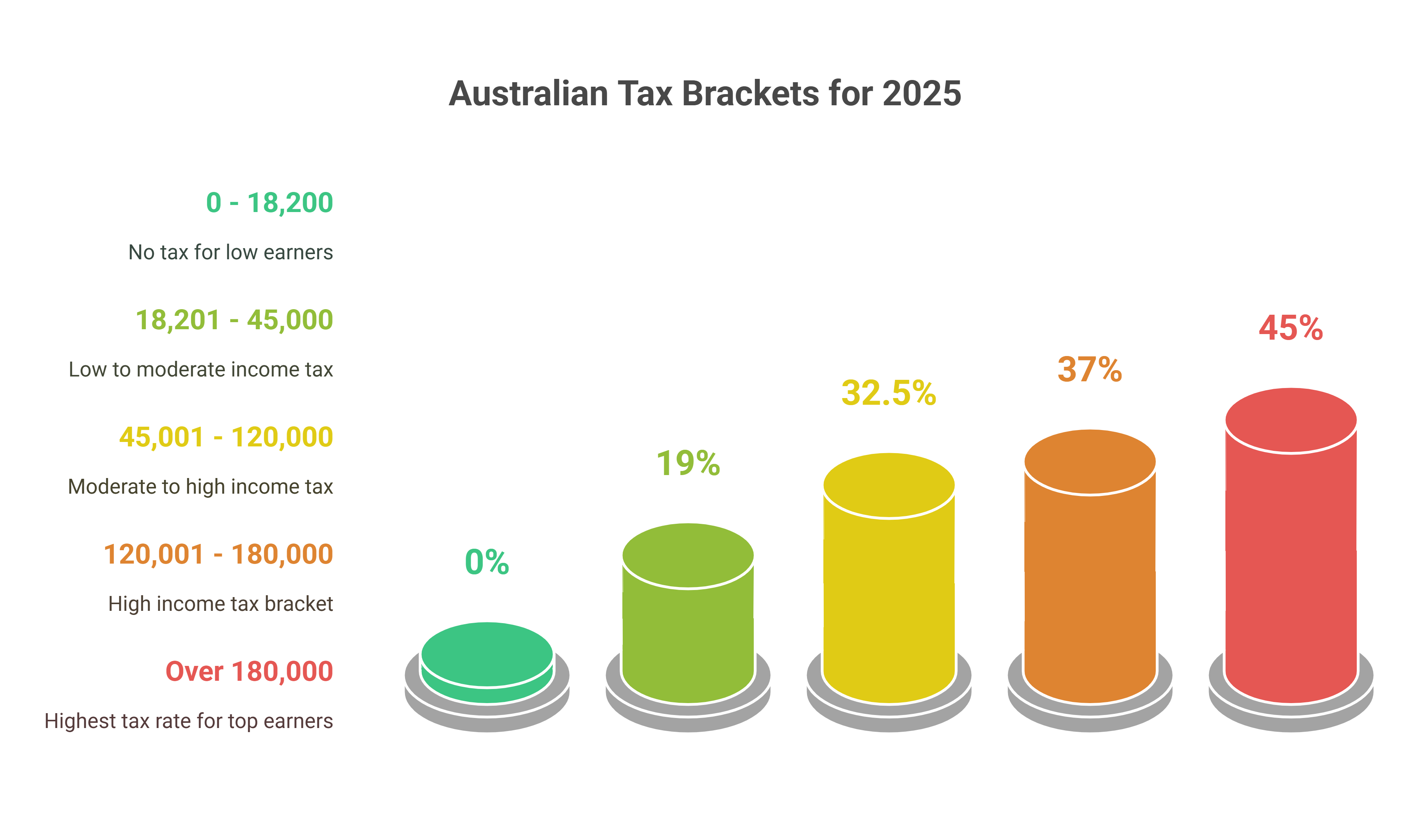

Australia has a progressive tax system where higher incomes are taxed at higher rates. Below is a table illustrating the 2025 tax brackets:

| Taxable Income ($) | Tax Rate |

| 0 – 18,200 | 0% |

| 18,201 – 45,000 | 19% |

| 45,001 – 120,000 | 32.5% |

| 120,001 – 180,000 | 37% |

| Over 180,000 | 45% |

Key Tax Challenges for High Earners

- Higher Tax Liabilities: Earnings above $180,000 are taxed at 45%, which is among the highest tax rates in the world.

- Medicare Levy Surcharge: High-income earners without private health insurance pay an extra 1-1.5% levy, increasing their overall tax burden.

- Capital Gains Tax (CGT) Exposure: Investment gains from property, shares, or other assets can result in a significant tax bill if not managed properly.

- Limited Tax Deductions: High earners often face restrictions on tax deductions, making it essential to explore all legal avenues to minimize tax liabilities.

By implementing the right tax strategies for high earners in Australia, you can mitigate these challenges and enhance wealth accumulation.

7 Tax Strategies for High Earners in Australia for 2025

High-income earners in Australia face significant tax burdens, but with the right strategies, they can reduce liabilities while growing their wealth.

The following tax strategies provide practical ways to optimize financial outcomes in 2025.

1. Maximize Superannuation Contributions

Superannuation is one of the most effective tax strategies for high earners in Australia. Contributions made within limits can significantly reduce taxable income and provide long-term financial security.

Key Benefits:

- Concessional contributions are taxed at just 15% instead of your marginal tax rate, which can be as high as 45%.

- Reduces taxable income while growing retirement savings.

- Tax-free withdrawals in retirement after age 60, ensuring significant future tax savings.

Contribution Limits for 2025:

| Contribution Type | Annual Cap ($) |

| Concessional (Pre-tax) | 27,500 |

| Non-Concessional (After-tax) | 110,000 |

Example: If you earn $250,000 annually and contribute the maximum concessional amount of $27,500 to your super, your taxable income is reduced to $222,500, lowering your overall tax burden.

2. Leverage Investment Tax Deductions

High-income earners often have significant investments, and utilizing available tax deductions can help minimize taxable income.

Effective Strategies:

- Negative Gearing: If your investment property expenses exceed rental income, you can deduct the loss from taxable income, potentially reducing tax obligations significantly.

- Dividend Imputation: Invest in Australian shares with franking credits to reduce tax liability.

- Trusts and ETFs: Managed investment structures can distribute income more tax-effectively, minimizing overall tax burdens.

- Depreciation Deductions: Investment property owners can claim depreciation on fixtures and fittings, reducing taxable income over time.

Example: A high-income earner with a negatively geared property can claim interest on the mortgage, depreciation, and maintenance expenses to lower taxable income.

3. Optimize Business Structure for Tax Efficiency

If you’re self-employed or own a business, restructuring your business can help reduce tax burdens.

Business Structures to Consider:

| Structure | Tax Rate | Key Benefit |

| Company | 25-30% | Lower than the personal tax rate of 45% |

| Family Trust | Varies | Income splitting among family members |

| Partnership | Varies | Shared tax liabilities |

4. Utilize Tax Offsets and Rebates

There are several tax offsets available to high-income earners in Australia that can lower your tax liability.

Notable Offsets:

- Private Health Insurance Rebate: Reduces Medicare levy surcharge.

- Low-Income Spouse Tax Offset: If your spouse earns below a certain threshold, you can claim a rebate.

- ATO Small Business Tax Offset: If you’re a small business owner, you may be eligible for a tax reduction, depending on turnover and income levels.

5. Take Advantage of Capital Gains Tax (CGT) Strategies

Capital Gains Tax (CGT) can significantly impact high-income earners, but strategic planning can reduce liabilities.

CGT Reduction Strategies:

- Hold assets for more than 12 months to qualify for the 50% CGT discount, which can cut tax liability in half.

- Offset gains with capital losses from other investments.

- Time asset sales to minimize tax in high-income years, ensuring tax efficiency.

- Consider Main Residence Exemption if selling your primary home to reduce tax liabilities on property sales.

6. Claim Work-Related and Professional Deductions

Many high earners fail to claim all eligible tax deductions. Maximizing work-related expenses can substantially reduce taxable income.

Common Deductible Expenses:

- Home office expenses for remote workers, including electricity, internet, and depreciation of office equipment.

- Work-related travel and professional development costs.

- Memberships and subscriptions to industry organizations.

- Income Protection Insurance Premiums: These premiums are tax-deductible if purchased outside of superannuation.

7. Engage in Strategic Philanthropy for Tax Reduction

Donating to registered charities is an excellent way to support causes while reducing taxable income.

Tax-Effective Giving Options:

- Tax-deductible donations: Donations over $2 to Deductible Gift Recipients (DGRs) are tax-deductible.

- Private Ancillary Funds (PAFs): High-net-worth individuals can create a structured giving plan with long-term tax benefits.

- Charitable Trusts: Setting up a charitable trust can provide ongoing tax advantages while benefiting philanthropic causes.

Final Words

By implementing these seven tax strategies for high earners in Australia for 2025, you can minimize tax liabilities, maximize investments, and secure long-term financial growth.

Take control of your finances today—consult a tax professional to develop a tailored plan that suits your income level and financial goals.

With proactive tax planning, you can build wealth efficiently while staying compliant with tax regulations.