Freelancing in Estonia offers incredible opportunities, especially with its digital-forward approach and tax-friendly business environment. However, understanding how to navigate the tax system effectively can be the difference between maximizing profits and overpaying on taxes. This guide covers 10 simple tax-saving strategies for freelancers in Estonia, helping you legally minimize tax liabilities and make the most of Estonia’s entrepreneur-friendly policies.

With a flat income tax rate of 20%, no corporate tax on retained earnings, and a fully digital tax filing system, Estonia is one of the best places for freelancers to thrive. Yet, without the right knowledge, freelancers can end up paying more taxes than necessary.

This guide breaks down practical, proven tax-saving strategies that will help you keep more of your hard-earned money while staying compliant with Estonian tax regulations. Whether you’re a local freelancer or an e-resident, these insights will ensure your freelance business remains financially efficient and sustainable.

Understanding Taxation for Freelancers in Estonia

Estonia has one of the most innovative tax systems in the world, offering a transparent and efficient approach for freelancers. Here’s what you need to know:

- income Tax: Estonia has a flat income tax rate of 20%, applicable to all personal income.

- Social Tax: Freelancers are responsible for social tax contributions, which amount to 33% of taxable income, covering health insurance and pension contributions.

- VAT (Value-Added Tax): If your annual revenue exceeds 40,000 EUR, you must register for VAT, which is typically 20%.

| Tax Type | Rate | Who Pays? | Key Details |

| Income Tax | 20% | Freelancers & Employees | Flat rate, applied to taxable income |

| Social Tax | 33% | Freelancers | Covers health and pension contributions |

| VAT | 20% | Businesses earning over 40,000 EUR | Mandatory above threshold, optional below |

Understanding these basics is the first step to implementing effective tax-saving strategies for freelancers in Estonia.

Why Tax Planning is Essential for Freelancers

Many freelancers overlook tax planning, leading to unnecessary expenses, penalties, and financial stress. Proper planning ensures:

- Compliance with Estonian tax regulations

- Maximized deductions on business expenses

- Efficient financial management and higher take-home income

Now, let’s explore the 10 simple tax-saving strategies for freelancers in Estonia to optimize your tax obligations.

10 Tax-Saving Strategies Every Freelancer in Estonia Should Know

As a freelancer in Estonia, understanding the local tax system and utilizing available strategies can significantly reduce your tax burden. Estonia’s tax environment offers several opportunities for freelancers to save money and reinvest in their businesses.

Below are 10 essential tax-saving strategies every freelancer in Estonia should know to maximize their savings and ensure compliance with Estonian tax laws.

1. Registering as an OÜ for Tax Efficiency

Many freelancers operate as sole proprietors, but transitioning to an OÜ (private limited company) can lead to significant tax benefits, including 0% corporate tax on retained earnings, reduced personal liability, and improved business credibility.

Unlike sole proprietorships, where personal and business finances are intertwined, an OÜ provides a clear legal separation, protecting personal assets from business risks.

Additionally, freelancers operating under an OÜ may find it easier to collaborate with international clients who prefer working with legally established entities. Understanding the long-term financial and operational advantages of forming an OÜ is crucial for freelancers aiming for sustainable growth and greater tax efficiency.

Sole Proprietorship vs. OÜ Tax Comparison

| Feature | Sole Proprietorship | OÜ (Private Limited Company) |

| Tax Rate | 20% on income | 0% on retained earnings, 20% when distributed |

| Social Tax | 33% | No social tax on undistributed profits |

| Liability | Unlimited personal liability | Limited liability |

Key Takeaway: If your income is substantial, registering an OÜ allows you to defer taxes on reinvested profits and limit personal liability.

2. Taking Advantage of Estonia’s Unique E-Residency Program

If you’re a freelancer living outside Estonia but want access to its favorable tax system, E-Residency is a game-changer. This digital initiative allows non-residents to establish and run a business in Estonia without being physically present.

By becoming an e-resident, freelancers can leverage Estonia’s 0% corporate tax on retained earnings, enjoy a simplified online tax filing system, and gain credibility in the European market.

Additionally, E-Residency provides access to international banking solutions, making it easier to manage cross-border transactions efficiently. This program has been widely adopted by digital nomads, consultants, and tech entrepreneurs seeking a tax-efficient and hassle-free business environment.

Key Benefits and Steps to Apply for Estonia’s E-Residency

| Benefit/Step | Description |

| Open a Business Remotely | Register and manage a business in Estonia from anywhere in the world. |

| 0% Corporate Tax on Retained Earnings | No tax on profits that remain within the company, allowing for growth. |

| Digital Tax Filing System | A fully digital system to simplify tax filings, making it efficient and easy. |

| Credibility in European Market | Operating under Estonia’s business laws enhances international trust. |

| International Banking Solutions | Access to online banking, making cross-border transactions simpler. |

| Step 1: Apply for E-Residency | Visit the E-Residency website and submit your application. |

| Step 2: Receive Digital ID Card | After approval, receive your digital ID card to access e-services. |

| Step 3: Register Your Company Online | Use your digital ID to register your company and start operating in Estonia. |

Steps to Apply:

- Apply for E-Residency via the official website.

- Receive your digital ID card.

- Register your company online and start operating.

3. Maximizing Business Expense Deductions

Deductible expenses lower your taxable income, reducing the overall tax burden and ensuring you keep more of your hard-earned money. By categorizing and tracking expenses properly, freelancers can significantly cut their taxable income while staying compliant with Estonian tax laws. Key deductible expenses include office rent, equipment purchases, internet bills, business travel, professional services, and even certain educational courses.

To maximize these deductions, freelancers should maintain detailed receipts, invoices, and expense logs to provide accurate documentation in case of a tax audit. Using digital accounting software can streamline the process and help identify further tax-saving opportunities.

Common Tax-Deductible Expenses

| Expense Type | Examples | Deductibility Notes |

| Home Office Costs | Rent, utilities, internet | Must be proportional to business use |

| Work Equipment | Laptop, software, office furniture | Essential tools for work |

| Professional Services | Accounting, legal fees | Fully deductible |

| Travel & Meals | Business trips, client meetings | Must be directly business-related |

Keeping proper documentation is essential to claim these deductions effectively.

4. Utilizing the 0% Corporate Tax on Retained Earnings

One of Estonia’s biggest advantages is 0% tax on undistributed corporate profits, making it an attractive destination for freelancers and entrepreneurs looking to grow their businesses without immediate tax burdens. This unique tax structure allows freelancers who operate as an OÜ (private limited company) to reinvest profits back into their business without paying corporate tax until distributions are made.

This means that money kept within the company for expansion, hiring, or purchasing assets remains untaxed, allowing freelancers to scale their operations more efficiently.

Comparison of Tax on Retained vs. Distributed Earnings

| Tax Type | Retained Earnings (Not Withdrawn) | Distributed Earnings (Withdrawn as Salary/Dividends) |

| Corporate Tax | 0% | 20% (on gross amount) |

| Social Tax | Not applicable | 33% (if taken as salary) |

| Dividend Tax | Not applicable | 20% |

For freelancers who do not need immediate personal withdrawals, this strategy helps in long-term financial planning and wealth accumulation while keeping the business tax-efficient.

- If you run an OÜ, you only pay tax when you withdraw profits.

- Reinvesting earnings into business growth keeps your tax rate at 0%.

This strategy allows freelancers to grow wealth tax-free while delaying taxation until necessary.

5. Optimizing VAT Registration

VAT registration is mandatory for freelancers earning over 40,000 EUR annually but can also be voluntarily registered for tax advantages. Freelancers who voluntarily register for VAT can benefit from input tax deductions, allowing them to reclaim VAT paid on business-related expenses such as software, equipment, and professional services.

However, VAT registration also comes with additional administrative responsibilities, such as submitting periodic VAT reports and keeping accurate transaction records. Freelancers serving international clients, particularly those outside the EU, may find VAT registration beneficial as many cross-border services are zero-rated, reducing their overall tax burden while still enabling them to reclaim input VAT.

VAT registration

| Scenario | VAT Registration | Benefit |

| Revenue < 40,000 EUR | Optional | Can reclaim VAT on purchases |

| Revenue > 40,000 EUR | Mandatory | Must charge VAT to clients |

| Mostly international clients | Not needed | No VAT for non-EU clients |

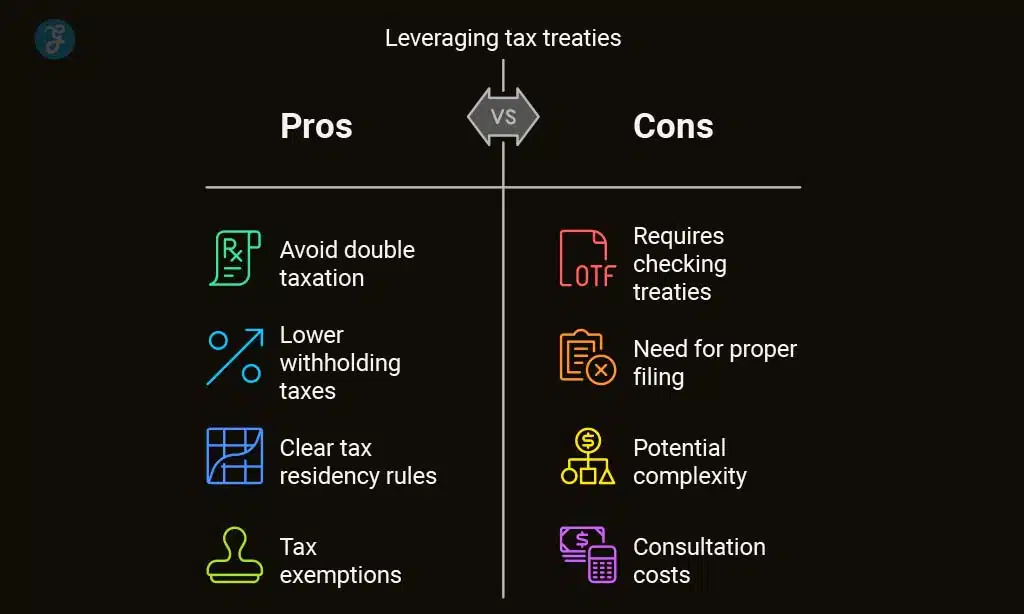

6. Leveraging Tax Treaties to Avoid Double Taxation

Freelancers working internationally should be aware of Estonia’s tax treaties with over 60 countries, which help prevent double taxation and ensure that freelancers do not pay tax on the same income in both Estonia and their home country.

These treaties define which country has taxing rights over different types of income, such as business profits, dividends, and royalties. By leveraging tax treaties, freelancers can legally minimize their tax obligations and avoid unnecessary financial burdens.

Key Benefits of Tax Treaties

| Benefit | Explanation |

| Avoiding Double Taxation | Ensures income is taxed only in one country or allows for a tax credit |

| Lower Withholding Taxes | Reduces tax rates on dividends, royalties, and interest payments |

| Clear Tax Residency Rules | Defines where a freelancer is considered a tax resident |

| Tax Exemptions | Certain types of income may be exempt from taxation in one of the countries |

Freelancers should check whether their home country has a tax treaty with Estonia and ensure they file the correct forms to claim exemptions or deductions. Consulting a tax advisor can help navigate these agreements efficiently.

- Check if your country has a treaty to avoid double taxation.

- File tax forms properly to claim tax credits on foreign income.

7. Setting Up a Business Bank Account for Tax Efficiency

Keeping personal and business finances separate is one of the most effective ways for freelancers to streamline tax management, minimize accounting errors, and maintain financial clarity. By having a dedicated business bank account, freelancers can easily track income, expenses, and deductions, ensuring a smooth tax filing process while reducing the risk of audits. When personal and business finances are mixed, it can lead to compliance issues, missed tax deductions, and difficulty proving business-related expenses during audits.

Freelancers in Estonia should consider opening a business-specific bank account to facilitate better financial organization and compliance with tax regulations. Many Estonian banks and online financial platforms offer tailored solutions for freelancers, such as multi-currency accounts, digital invoicing, and automated tax calculations.

Best Business Bank Accounts for Freelancers

| Bank | Key Features |

| LHV Pank | Ideal for Estonian entrepreneurs, offers easy integration with tax systems |

| Wise | Best for international transactions with low conversion fees |

| Swedbank | Traditional banking with robust business support services |

| Revolut Business | Great for managing multiple currencies and online payments |

By choosing the right financial institution and keeping business transactions separate, freelancers can optimize tax efficiency, gain financial credibility, and ensure compliance with Estonia’s tax laws.

8. Contributing to a Pension Fund for Future Tax Benefits

Investing in Estonia’s pension system is not just a responsible step toward securing your financial future; it also offers significant tax advantages. Estonia’s pension system is designed to encourage individuals to save for retirement while providing various ways to reduce taxable income. Below is a detailed overview of the pension fund contributions and their tax benefits:

Pension Fund Contributions and Tax Benefits in Estonia

| Type of Contribution | Contribution Rate | Tax Benefit | Details |

| Mandatory Contributions | 33% of income | Part of the social tax, 20% allocated to pension | Includes health and unemployment insurance |

| Voluntary Contributions | Varies based on income | Tax-deductible from taxable income | Additional savings, subject to contribution caps |

| Social Tax | 33% of income | Not directly tax-deductible but includes pension | Mandatory for all Estonian workers |

| Tax Relief for Freelancers | N/A | Reduces taxable income through

voluntary pension |

Encourages increased pension contributions |

9. Planning Quarterly Tax Payments to Avoid Surprises

Freelancers must pay taxes quarterly to avoid penalties and manage cash flow efficiently. Unlike traditional employees who have taxes automatically deducted from their paychecks, freelancers are responsible for setting aside and remitting their own taxes on time. Missing deadlines can result in penalties, interest charges, and unnecessary financial stress.

Planning quarterly tax payments involves estimating earnings, calculating tax obligations, and ensuring funds are available when payment is due. Many freelancers use digital tools and automated savings accounts to set aside a portion of their income each month to prevent last-minute financial strain.

Quarterly Tax Payment Deadlines in Estonia

| Quarter | Payment Due Date | Tax Calculation Period |

| Q1 | April 20 | January 1 – March 31 |

| Q2 | July 20 | April 1 – June 30 |

| Q3 | October 20 | July 1 – September 30 |

| Q4 | January 20 (following year) | October 1 – December 31 |

Best Practices for Managing Quarterly Tax Payments

- Set up a dedicated tax savings account to store a percentage of income specifically for tax payments.

- Use financial management software such as Xolo, QuickBooks, or Estonian tax calculator tools to estimate tax liabilities.

- Track all income and expenses in real time to avoid errors and ensure accurate tax calculations.

- Consult a tax professional to ensure compliance with tax laws and leverage any possible deductions.

By proactively managing quarterly tax payments, freelancers can stay financially organized, avoid penalties, and ensure a smoother year-end tax filing process.

10. Consulting a Tax Advisor for Maximum Savings

Hiring a professional tax consultant is a crucial step for anyone looking to optimize their tax strategy and ensure they are fully compliant with Estonian tax laws. While it might seem like an additional cost, the value a tax advisor provides can result in significant savings over time.

Their expertise in navigating complex tax laws, identifying opportunities for tax relief, and avoiding costly mistakes can make a substantial difference to your bottom line.

Key Benefits of Consulting a Tax Advisor

| Benefit | Explanation | Impact |

| Tax Optimization Strategies | Tax advisors help identify opportunities to minimize your tax liability through deductions and credits. | Reduced overall tax burden, more savings. |

| Compliance with Tax Laws | Ensures adherence to Estonian tax regulations and avoids violations. | Avoids penalties, fines, and legal issues. |

| Error Prevention | Reviews and corrects tax filings to prevent mistakes that could trigger audits or penalties. | Avoids penalties and interest due to errors. |

| Personalized Financial Advice | Offers tailored advice on pensions, investments, and business expenses based on your unique financial situation. | Improved financial planning and tax efficiency. |

Final Words

Freelancers in Estonia have a unique opportunity to take advantage of the country’s favorable tax system, offering numerous strategies to optimize their tax savings. By registering as an OÜ, freelancers can benefit from a 0% corporate tax on retained earnings, reduced personal tax liability, and the ability to reinvest profits without immediate taxation. Additionally, Estonia’s E-Residency program, tax-deductible pension contributions, business expense deductions, and other strategies further enhance the potential for significant tax savings.

By strategically planning and utilizing these tax-saving opportunities, freelancers can not only minimize their tax burden but also ensure that they are well-positioned for long-term growth and success.

Whether you’re just starting out or have an established business, understanding and leveraging Estonia’s tax policies is essential for maintaining financial efficiency and compliance. Consulting with a tax advisor is also highly recommended to tailor these strategies to your specific business needs and maximize the benefits.