Buying your first home is an exciting milestone, but it also comes with financial challenges. Fortunately, tax relief for first-time homebuyers in Ireland can make homeownership more affordable by reducing upfront costs and ongoing expenses.

The Irish government offers multiple relief schemes that help ease the financial burden, allowing buyers to access grants, rebates, and reduced tax liabilities.

Understanding these tax incentives can significantly impact the overall cost of buying a home and help first-time buyers make informed financial decisions.

If you’re planning to purchase your first property, knowing about these tax relief options can save you thousands of euros and make homeownership a reality faster than you might expect.

In this detailed guide, we’ll explore eight key tax relief options for first-time homebuyers in Ireland, eligibility criteria, application processes, and expert tips to maximize your benefits.

Additionally, we will provide real-world examples, key tables summarizing important data, and actionable insights to help you navigate the homebuying process with confidence.

Understanding Tax Relief for First-Time Homebuyers in Ireland

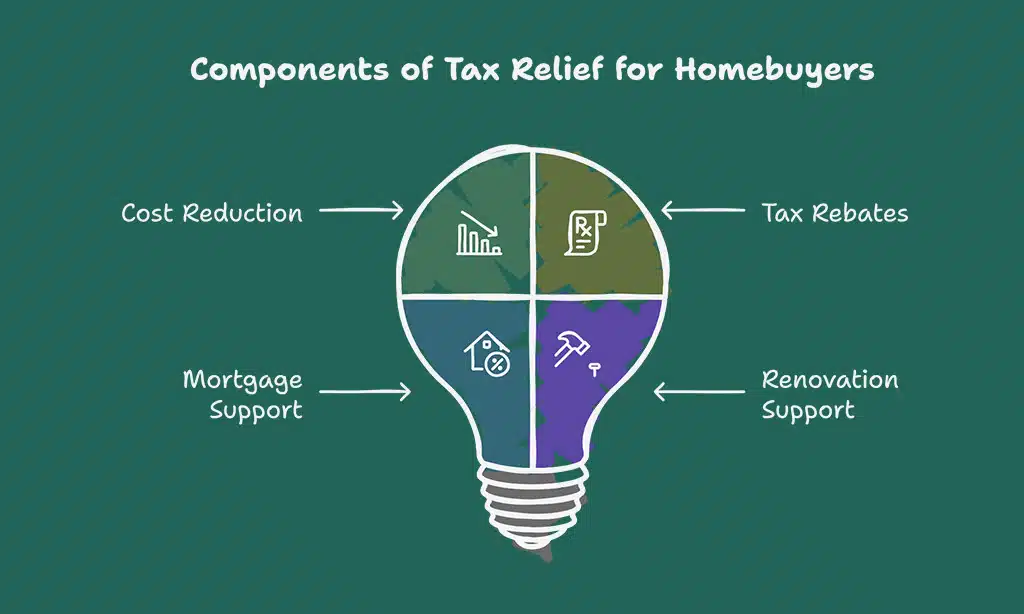

Buying a home involves significant expenses, including deposit payments, legal fees, and mortgage interest. The Irish government provides several tax relief schemes to make homeownership more accessible. These reliefs can:

- Reduce initial costs and financial barriers for buyers.

- Offer rebates on taxes and duties, improving affordability.

- Help secure lower mortgage interest rates through government support.

- Support property renovations and energy efficiency upgrades to lower long-term expenses.

Who Qualifies for First-Time Homebuyer Tax Relief?

To be eligible for tax relief for first-time homebuyers in Ireland, you typically must:

- Be purchasing a home for the first time (not owning any property previously in Ireland or abroad).

- Intend to use the property as your primary residence.

- Meet specific financial and tax requirements.

- Ensure the property is within the price threshold limits (where applicable).

Each tax relief scheme has its own eligibility criteria, which we’ll discuss in detail below.

How to Claim Tax Relief Benefits

Applying for tax relief for first-time homebuyers in Ireland involves these general steps:

- Determine Eligibility – Review the conditions for each scheme.

- Gather Documents – Tax returns, mortgage agreements, proof of residency.

- Apply Online – Most reliefs are accessible via Revenue’s online portal.

- Await Approval – Processing times vary, so apply early.

- Track Benefits – Some reliefs require compliance for a certain period post-purchase.

8 Tax Relief Options for First-Time Homebuyers in Ireland

| Tax Relief Option | Key Benefit | Eligibility | Application Process |

| Help to Buy (HTB) Scheme | Up to €30,000 tax rebate for deposit | First-time buyers of new builds | Revenue Online Portal |

| First Home Scheme (FHS) | Up to 30% equity support | Income & property price thresholds met | Application via lenders |

| Local Property Tax (LPT) Exemptions | Up to 3 years LPT relief | Newly built homes, owner-occupied | Register with Revenue |

| Stamp Duty Refund Scheme | Stamp duty refund on self-builds | First-time buyers constructing homes | Claim within 4 years |

| Rent-a-Room Relief | Up to €14,000 tax-free rental income | Renting a room in primary residence | File rental income with Revenue |

| Green Home Grants | Grants for energy-efficient upgrades | First-time buyers investing in eco-friendly homes | Apply via SEAI |

| Home Renovation Incentive (HRI) | 13.5% tax credit on renovation costs | Homes undergoing eligible renovations | Submit receipts for credit |

| Affordable Housing Scheme (AHS) | Discounted home prices | Income limits, first-time buyers | Apply through local authority |

1. Help to Buy (HTB) Scheme

The Help to Buy (HTB) scheme is a government-backed initiative designed to assist first-time buyers in securing their first home by reducing financial barriers. It provides a tax rebate of up to €30,000 or 10% of the property value (whichever is lower), helping buyers cover the deposit requirement for a mortgage.

This scheme is particularly beneficial for those struggling to meet the initial deposit amount required by lenders. Additionally, the HTB scheme is applicable only for newly built homes or self-builds, ensuring that buyers contribute to the housing market’s growth.

To qualify, applicants must be tax-compliant and have paid income tax over the past four years. By leveraging this scheme, first-time buyers can significantly reduce their upfront costs and secure homeownership sooner.

| Criteria | Requirement |

| Property Type | Newly built, self-build |

| Max Purchase Price | €500,000 |

| Mortgage Requirement | At least 70% of home value |

| Application | Revenue Online Portal |

2. First Home Scheme (FHS)

The First Home Scheme (FHS) is a shared equity initiative aimed at assisting first-time buyers who may struggle to afford a home due to high market prices. Under this scheme, the government provides up to 30% of the home price, reducing the amount buyers need to borrow from lenders.

This initiative makes homeownership more accessible by lowering mortgage repayments and improving affordability.

Buyers do not have to make repayments on the government’s equity share for the first five years, and they have the option to buy back the government’s stake over time. Eligibility for the FHS depends on income thresholds, property price limits, and the applicant’s ability to secure a mortgage from a participating lender.

This scheme is particularly beneficial for individuals and families in high-demand urban areas where housing prices are significantly higher.

| Criteria | Requirement |

| Property Type | Newly built homes |

| Max Equity Support | 30% |

| Income Limit | Varies by region |

| Application | Apply via participating lenders |

3. Local Property Tax (LPT) Exemptions

First-time buyers who purchase newly built homes can receive up to three years of LPT exemption, significantly reducing their annual property tax burden.

This exemption allows homeowners to allocate more financial resources toward mortgage repayments, home improvements, or other essential expenses.

The exemption applies to newly constructed properties that are owner-occupied, ensuring that first-time buyers receive financial relief during the initial years of homeownership.

To qualify, homeowners must register with Revenue and provide necessary documentation proving that the property is newly built and serves as their primary residence.

Taking advantage of this exemption can result in substantial savings, making homeownership more affordable in the long run.

| Criteria | Requirement |

| Property Type | Newly built, owner-occupied |

| Exemption Period | Up to 3 years |

| Application | Register with Revenue |

4. Stamp Duty Refund Scheme

This scheme provides a partial refund of 1% to 2% stamp duty paid on eligible properties, significantly reducing the upfront costs for first-time homebuyers.

This refund is particularly beneficial for those who are constructing or extensively renovating homes, as it helps offset the expenses associated with property acquisition and development.

The scheme is designed to encourage homeownership and stimulate investment in housing infrastructure. To qualify, buyers must ensure that their property meets the eligibility criteria, including self-builds or major renovations, and submit a claim within four years of paying the initial stamp duty.

Leveraging this refund can make a substantial financial difference, allowing buyers to allocate more funds toward other essential home expenses.

| Criteria | Requirement |

| Property Type | Self-build or extensively renovated |

| Refund Percentage | 1% – 2% |

| Claim Deadline | Within 4 years |

| Application | Revenue Online Portal |

5. Rent-a-Room Relief

Homeowners can earn up to €14,000 per year tax-free from renting out a room, making it an excellent way to supplement mortgage payments or cover household expenses. This incentive allows homeowners to maximize their property’s potential without incurring additional tax liabilities.

The scheme is particularly beneficial for first-time buyers who may be looking for ways to manage their financial commitments more effectively. Additionally, there are minimal legal and regulatory requirements, making it an accessible option for many homeowners.

Those participating in the scheme must ensure that the rented room is part of their primary residence and comply with Revenue reporting requirements if their rental income approaches the threshold.

| Criteria | Requirement |

| Property Type | Owner-occupied home |

| Max Tax-Free Income | €14,000 per year |

| Reporting | Declare rental income to Revenue |

6. Green Home Grants

The Sustainable Energy Authority of Ireland (SEAI) provides grants for energy-efficient home upgrades, helping first-time buyers reduce energy costs while making their homes more environmentally friendly.

These grants cover a wide range of improvements, including home insulation, heating system upgrades, solar panel installations, and energy-efficient windows.

By investing in these upgrades, homeowners can significantly lower their long-term utility bills while contributing to sustainability efforts.

Additionally, properties with higher energy efficiency ratings often have increased market value, making this an attractive option for first-time buyers looking to enhance their investment.

To apply, homeowners must check their eligibility on the SEAI website, arrange for a home energy assessment, and submit an application before beginning any work.

| Criteria | Requirement |

| Property Type | Owner-occupied, energy-efficient homes |

| Grant Coverage | Insulation, heating, solar panels |

| Application | Apply via SEAI |

7. Home Renovation Incentive (HRI) Scheme

The Home Renovation Incentive (HRI) Scheme provides tax credits for home improvement projects, making it easier for first-time buyers to upgrade and personalize their homes.

This scheme allows homeowners to claim a 13.5% tax credit on qualifying renovation expenses, helping to offset the costs of essential improvements such as energy-efficient upgrades, home insulation, and structural repairs.

The HRI scheme is particularly beneficial for those looking to enhance their home’s sustainability and comfort while keeping renovation costs manageable.

To qualify, homeowners must engage tax-compliant contractors and ensure that all work is registered through the Revenue’s online system.

By utilizing the HRI scheme, first-time buyers can enhance their property’s value, reduce long-term maintenance costs, and create a more efficient living environment.

| Criteria | Requirement |

| Property Type | Owner-occupied, primary residence |

| Eligible Costs | Renovation, insulation, heating, windows, etc. |

| Tax Credit | 13.5% of renovation costs |

| Application Process | Apply via Revenue’s HRI portal |

8. Affordable Housing Scheme (AHS)

The Affordable Housing Scheme (AHS) is a government-backed initiative aimed at helping first-time buyers purchase homes at significantly reduced costs through financial assistance and state support.

This scheme provides access to properties at below-market prices, ensuring affordability in high-demand areas.

In addition to price reductions, the AHS may also include shared equity agreements, where the government co-invests in the property, reducing the buyer’s upfront mortgage burden.

These measures help first-time buyers enter the housing market with lower financial strain while promoting long-term homeownership stability.

| Criteria | Requirement |

| Property Type | Designated affordable housing units |

| Price Reduction | Below-market value |

| Income Limits | Varies by region |

| Application Process | Apply through local authority |

Takeaways

Understanding tax relief for first-time homebuyers in Ireland can make homeownership much more affordable. By leveraging available tax credits, exemptions, and government incentives, you can significantly reduce your financial burden. Be sure to research your eligibility, apply on time, and seek expert guidance to maximize your benefits.

If you’re planning to buy your first home, now is the time to take advantage of these tax relief options. Don’t leave money on the table—start your journey to homeownership today!