In a fragmented global economy defined by “structural volatility,” the IMF’s upward revision of 2026 global growth to 3.3% is not a sign of returning to business as usual—it is a signal of a new industrial arms race. At the heart of this shift lies Supply Chain Structural Volatility, where disruptions in energy, semiconductors, data flows, and cloud infrastructure are no longer cyclical shocks but permanent strategic constraints. This analysis dissects why nations are rushing to treat computing power as a sovereign utility, decoupling from foreign cloud dependence to secure their economic future.

The Great Recalibration: From Globalization to Techno-Nationalism

To understand the 2026 landscape, we must look at the convergence of three crises that peaked between 2024 and 2025: the weaponization of trade routes, the energy transition bottleneck, and the concentration of digital power.

For decades, globalization relied on a seamless flow of data and goods. However, the dominance of a few US-based hyperscalers (Amazon, Microsoft, Google) created a “digital unipolarity.” By 2025, governments realized that relying on foreign clouds for critical national data (healthcare, defense, finance) created an unacceptable vulnerability—a phenomenon experts call “Techno-Colonialism.”

Simultaneously, global supply chains entered a state of “Structural Volatility.” Disruptions—whether from climate shocks, tariffs, or geopolitical conflict—became constant rather than episodic. The IMF’s revised forecast acknowledges that the only way to grow in this environment is to build “Digital Iron Domes”: sovereign AI infrastructures capable of navigating this volatility.

The CapEx Super-Cycle: Why the IMF Lifted Forecasts to 3.3%

The International Monetary Fund’s (IMF) decision to lift the 2026 global growth forecast to 3.3% is structurally different from previous boom cycles. It is not driven by consumer demand or trade liberalization, but by CapEx (Capital Expenditure) super-cycles in Artificial Intelligence infrastructure.

This growth is heavily weighted toward “AI Industrialization.” Governments and corporations are spending billions not just on software, but on the physical layer of AI: concrete, steel, copper, and cooling systems for sovereign data centers. This spending acts as a massive Keynesian stimulus, propping up GDP even as consumer spending in Western markets softens.

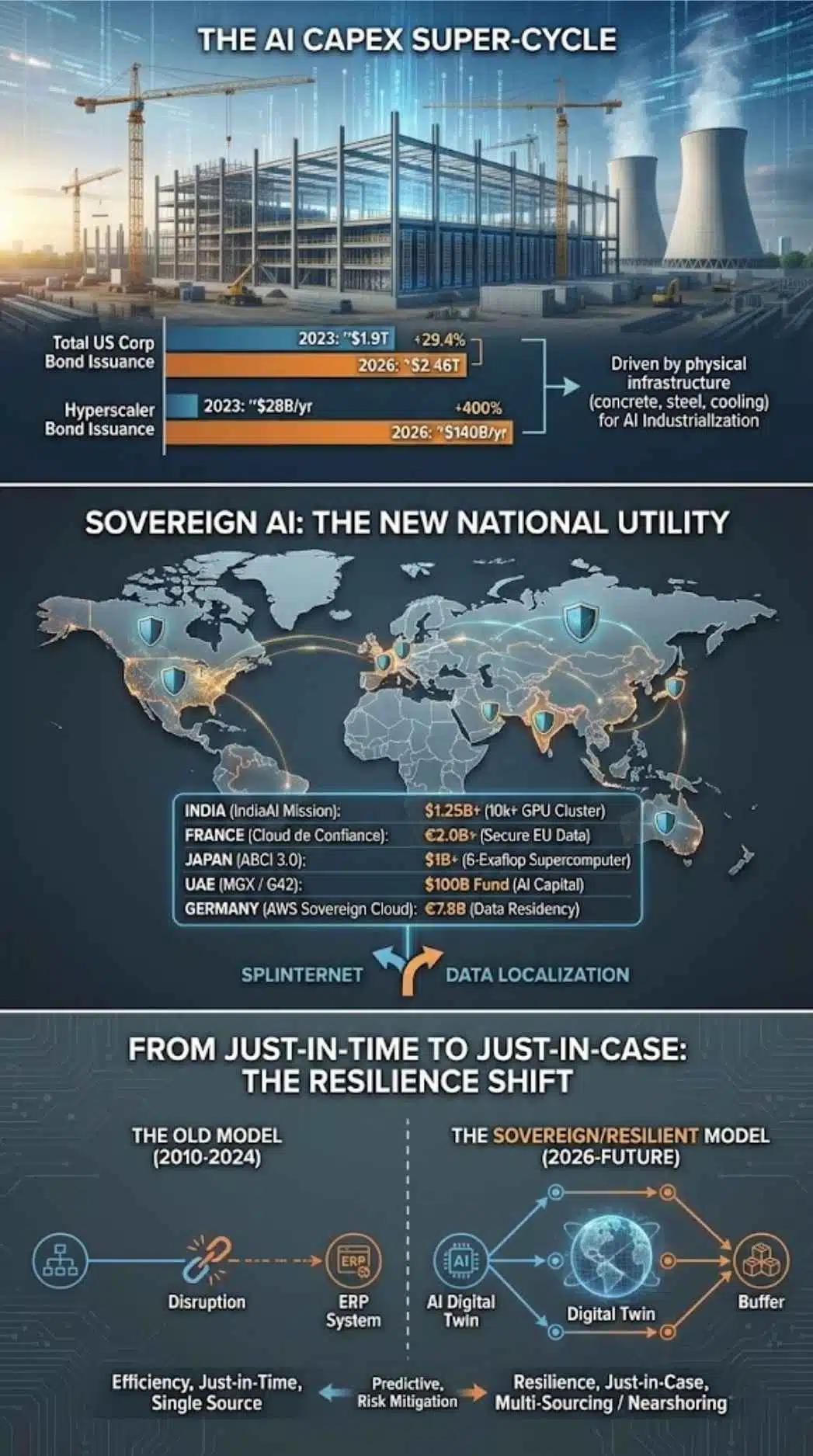

Corporate Bond Market Activity (2025-2026)

The surge in AI investment has triggered record activity in US corporate bond markets, as hyperscalers and sovereign funds raise cash to fund infrastructure.

| Metric | 2023 (Historical) | 2026 (Forecast) | % Growth |

| Total US Corp Bond Issuance | ~$1.9 Trillion | $2.46 Trillion | +29.4% |

| Hyperscaler Bond Issuance | ~$28 Billion/yr | ~$140 Billion/yr | +400% |

| Primary Driver | Refinancing / M&A | AI Infrastructure & Compute | N/A |

| Key Issuers | Banking / Energy | Microsoft, Meta, Google, Oracle | N/A |

Analysis: If the AI productivity boom is delayed, this growth is built on debt-fueled infrastructure spending. However, if AI delivers the anticipated 15-20% efficiency gains in logistics and energy management, this 3.3% floor could become a launchpad for a decade of high growth.

Sovereign AI: The New National Utility

The most significant geopolitical shift of 2026 is the reclassification of “Compute” from a commercial service to a National Utility. Just as a nation must secure its own water and electricity, it must now secure its own “Intelligence.”

Nations are increasingly rejecting the “rent-seeking” model of US tech giants in favor of Sovereign AI. This involves building domestic data centers, training models on local languages and laws, and keeping data within national borders.

Global Sovereign AI Initiatives (2025-2026 Snapshot)

| Country | Initiative / Project | Est. Investment | Core Strategic Objective |

| India | IndiaAI Mission | $1.25B+ | Building a 10,000+ GPU cluster for startups; datasets in Indian languages (Bhashini). |

| France | Cloud de Confiance | €2.0B+ | Securing European data from US CLOUD Act; expanding Jean Zay supercomputer. |

| Japan | ABCI 3.0 | $1B+ | 6-Exaflop supercomputer integrating AI with robotics and industrial automation. |

| UAE | MGX / G42 | $100B (Fund) | Pivoting from oil to compute; aiming to be the AI capital of the Global South. |

| Germany | AWS Sovereign Cloud | €7.8B | Localized infrastructure ensuring data residency and strict German privacy compliance. |

Why this matters: This shift is fracturing the global internet into a “Splinternet,” where nations prioritize data residency over global connectivity. It forces multinational companies to navigate a complex web of local AI compliance laws.

From “Just-in-Time” to “Just-in-Case”: The Resilience Shift

The term “Structural Volatility,” popularized by the World Economic Forum, implies that instability is now a feature of the system, not a bug. In this environment, Resilience is not just insurance; it is a competitive advantage that drives growth.

AI is the mechanism that converts volatility into manageable risk. Traditional supply chains were reactive—waiting for a port strike or a storm to happen before scrambling. AI-enabled supply chains are predictive.

- Digital Twins: Companies are creating full digital replicas of their supply chains. If a supplier in Southeast Asia goes offline, the AI automatically reroutes orders to a backup in Mexico within milliseconds, preserving revenue.

- The “Buffer” Economy: AI helps calculate exactly how much inventory buffer is needed to survive a shock without destroying working capital.

Comparative Analysis: The Shift in Supply Chain Strategy

| Feature | The Old Model (2010–2024) | The Sovereign/Resilient Model (2026–Future) |

| Primary Goal | Efficiency (Cost Reduction) | Resilience (Risk Mitigation) |

| Inventory Strategy | Just-in-Time (Lean) | Just-in-Case (Strategic Buffers) |

| Sourcing | Single Global Source (Cheapest) | “China + 1” / Nearshoring |

| Technology | ERP Systems (Historical Data) | AI Digital Twins (Predictive/Real-Time) |

| Data Residency | Cross-border data flows | Strict Data Localization (GDPR++, DPDP) |

The Energy Reality Check: 1GW is the New Unit

The analysis cannot ignore the physical reality of this growth: Energy. The IMF’s forecast implicitly assumes that the energy sector can support the massive load of AI data centers.

- The 1GW Standard: We have moved from measuring data centers in Megawatts (MW) to Gigawatts (GW). A single training cluster now consumes as much power as a mid-sized city.

- The Nuclear Renaissance: To meet this demand without blowing past carbon targets, tech giants and sovereign funds are restarting dormant nuclear plants and investing in SMRs (Small Modular Reactors).

- Gas as the Bridge: In the immediate term (2026), natural gas is seeing a resurgence. “Off-grid” data centers powered by dedicated gas turbines are becoming common to bypass congested national grids.

AI Compute & Energy Consumption Scale

| Metric | 2023 Status | 2025-2026 Status | Impact |

| OpenAI Compute Capacity | ~0.2 GW | ~1.9 GW | 9.5x Increase in power demand. |

| Global Data Center Usage | ~460 TWh | >1,000 TWh | Surpasses Japan’s total electricity usage. |

| Hiring Trends | AI Researchers | Energy Experts | Tech giants hiring energy traders & nuclear engineers. |

| Primary Bottleneck | Silicon (Chip Shortage) | Power (Grid Capacity) | Shift to off-grid gas/nuclear solutions. |

Expert Perspectives

“We are moving from an era where compute was a commodity to an era where it is a strategic asset. If you do not own your intelligence, you do not own your future. The 3.3% growth is not organic; it is the construction cost of the new digital world.”

— Senior Analyst, Global Geotech Center

“The danger of Sovereign AI is fragmentation. If every nation builds its own ‘walled garden’ of data, global innovation slows down. We risk creating AI models that are culturally isolated and prone to nationalistic hallucinations.”

— Chief Economist, European Digital Forum

Future Outlook: What Comes Next?

Looking beyond 2026, the implications of this “Sovereign AI” build-out will define the remainder of the decade.

- 2027 Milestone – The “Compute Cliff”: By late 2027, the gap between energy supply and AI demand will likely cause regional power rationing. Nations that secured energy contracts in 2025/2026 (the winners of the current race) will thrive; others will face “compute brownouts.”

- The Rise of “Data OHEC”: Just as OPEC controls oil, a new bloc of “Data Rich” nations (Global South countries with massive populations) may form cartels to charge for the data needed to train Western AI models.

- Algorithmic Trade Wars: Tariffs will evolve. We will see taxes not just on steel, but on “foreign compute.” A French company using an American AI model might face a higher tax rate than one using a sovereign French model.

Final Thoughts

The IMF’s 3.3% growth forecast is a validation of a new economic doctrine. Resilience is no longer a cost center; it is the engine of growth. By treating computing power as a 21st-century utility, nations are attempting to immunize themselves against structural volatility. However, this race carries high risks: deep debt, energy shortages, and a fractured global internet. The winners of 2026 will not be those with the best AI, but those with the power—literally and politically—to run it.