Debt is a common challenge faced by many people at some point in their lives. Whether it’s credit card debt, student loans, medical expenses, or personal loans, it can feel overwhelming to manage. But paying off debt is not just a distant dream—it is entirely possible with the right strategies and mindset.

In this article, we explore 7 success stories of people who paid off debt and the detailed steps they took to achieve financial freedom.

These stories are filled with actionable tips, real-life strategies, and key takeaways that you can apply to your own financial journey. If you’re feeling stuck under the weight of debt, these stories will show you that it is possible to break free and gain control of your financial future.

Let’s dive into these inspiring success stories and the proven steps that led these individuals to become debt-free.

Success Story 1 – From Credit Card Debt to Financial Freedom

Credit card debt is one of the most common types of debt people carry, and it can quickly accumulate due to high-interest rates and revolving balances. Laura, a young professional in her early 30s, found herself burdened with nearly $30,000 in credit card debt after years of overspending. Despite her good salary, she felt trapped by her mounting balances.

The Struggles with High-Interest Debt

The real issue was the high interest rates, which often made it difficult for Laura to pay off her balances, even when she tried to pay above the minimum amount. Each month, her payment barely made a dent in her principal. With credit card debt, even a small balance can grow exponentially due to the interest, making it feel like an insurmountable mountain.

The Plan: Budgeting and Cutting Expenses

To regain control, Laura decided to tackle the problem head-on. First, she created a detailed budget that tracked every penny she earned and spent. She found areas where she could reduce costs—she canceled unnecessary subscriptions, stopped eating out, and switched to a more affordable apartment. Laura also adopted the debt snowball method, which focuses on paying off the smallest debts first to build momentum.

Key Takeaways:

- Budgeting: Tracking all income and expenses is essential to find areas for savings.

- Debt Snowball Method: Pay off smaller debts first to build confidence and motivation.

- Cutting Expenses: Lowering monthly expenditures frees up more money for debt repayment.

| Action | Details |

| Create a Budget | Track every expense and identify savings opportunities. |

| Use Debt Snowball | Pay off smallest balances first, then move to larger ones. |

| Cut Unnecessary Costs | Cancel subscriptions, downgrade services, and eat in more. |

The Outcome: Debt-Free After 3 Years

After three years of hard work, Laura was able to completely eliminate her credit card debt. Her disciplined approach to budgeting, along with the debt snowball method, helped her stay on track.

Success Story 2 – Overcoming Student Loan Debt

Student loans are a major source of debt for many people, especially those who graduate with large amounts of loan debt and limited job prospects. Mark, a 28-year-old with a communications degree, faced $50,000 in student loan debt upon graduation. He had tried to make minimum payments, but the loan balance didn’t seem to shrink. It wasn’t until he took a more strategic approach that he was able to pay off the debt quickly.

The Weight of Student Loans and Financial Strain

Mark’s loan payments took up a significant portion of his monthly income, making it challenging to save or invest. Like many graduates, he was overwhelmed by the thought of paying off such a large sum. The interest kept compounding, and he felt stuck in a cycle of debt.

The Strategy: Extra Payments and Refinancing

Mark took several steps to expedite his repayment:

- Refinancing: He refinanced his student loans to secure a lower interest rate, which significantly reduced his monthly payments.

- Extra Payments: Mark also started making extra payments whenever possible, putting any bonus or tax refund directly toward the loan balance.

- Side Gigs: To further accelerate his repayment, Mark took on freelance work and side jobs, which helped him earn additional income.

| Action | Details |

| Refinance Loans | Lower interest rates reduce the total amount paid over time. |

| Make Extra Payments | Apply bonuses, tax refunds, and extra earnings directly to loans. |

| Increase Income | Use side jobs or freelancing to earn additional income. |

The Outcome: Paid Off in 5 Years

By refinancing, making extra payments, and increasing his income, Mark paid off his student loan debt in just five years—much sooner than he initially anticipated. His story highlights how refinancing and additional efforts can make a massive impact on debt repayment.

Key Takeaways:

- Refinance loans to lower the interest rate.

- Increase income by taking on freelance work or side gigs.

- Make extra payments whenever possible to reduce principal faster.

Success Story 3 – Paying Off Medical Debt with Discipline

Medical debt is one of the most insidious types of debt. Even with insurance, out-of-pocket medical costs can add up quickly. Sarah, a 35-year-old mother of two, found herself saddled with $25,000 in medical debt after a series of unexpected emergency surgeries. She knew that ignoring the debt would only make the situation worse.

How Medical Bills Can Accumulate Quickly

In Sarah’s case, the medical expenses from her surgeries weren’t fully covered by insurance, leaving her with substantial bills. Between the hospital fees, outpatient charges, and medications, the costs quickly added up. While medical providers were willing to work with her, the sheer volume of debt was overwhelming.

The Solution: Negotiating Bills and Setting Up Payment Plans

Sarah’s approach to handling her medical debt involved a few key strategies:

- Negotiating: She contacted the hospital billing departments and successfully negotiated some of her bills, reducing the overall amount owed.

- Setting up Payment Plans: She set up a structured payment plan, allowing her to pay smaller amounts each month without defaulting.

- Using the Debt Avalanche Method: Sarah focused on paying off the debts with the highest interest rates first to save on long-term costs.

| Action | Details |

| Negotiate Bills | Contact providers and negotiate reduced amounts or discounts. |

| Set Up Payment Plans | Work out manageable monthly payments to avoid default. |

| Use Debt Avalanche | Prioritize high-interest debts to save on interest over time. |

The Outcome: Paid Off in 2 Years

Thanks to her persistence, negotiation skills, and strategic approach, Sarah was able to pay off her medical debt in just two years. This success story emphasizes the importance of negotiating and being proactive when dealing with medical bills.

Key Takeaways:

- Negotiate medical bills to reduce your overall debt.

- Set up a manageable payment plan to avoid missing payments.

- Use the debt avalanche method to pay off high-interest debts first.

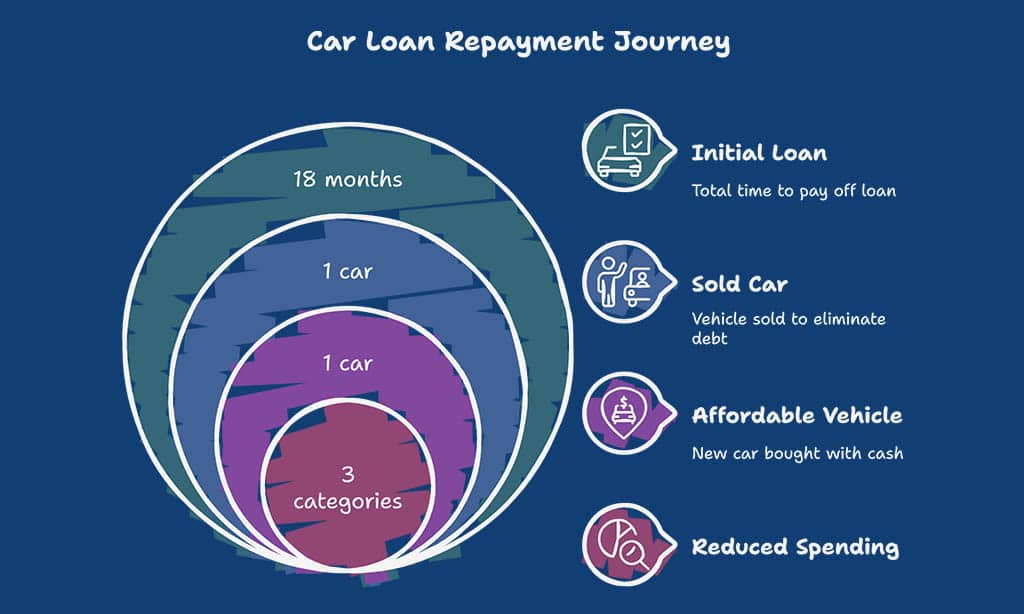

Success Story 4 – Conquering Car Loan Debt

Car loans are another common source of debt, but the monthly payments can sometimes feel like they’re holding you back from financial progress. John, a 40-year-old father of three, found himself stuck with a $20,000 car loan that he couldn’t seem to pay off fast enough. The high monthly payment was preventing him from saving or making other financial advancements.

Struggling with Monthly Car Loan Payments

John’s car loan came with a hefty monthly payment that took up a large portion of his paycheck. The loan also carried a relatively high interest rate, making it even more difficult to pay down the principal. John realized that his car wasn’t as essential to his daily life as he had once thought, and he needed to make a change.

The Strategy: Selling the Car and Reducing Unnecessary Costs

John took several important steps to eliminate his car debt:

- Sell the Car: John sold his car and used the proceeds to pay off the loan.

- Purchase a More Affordable Vehicle: He purchased a used, more affordable car with cash to avoid taking on new debt.

- Cutting Back: He also reduced other discretionary expenses, such as entertainment and dining out, to free up more money for savings and debt repayment.

| Action | Details |

| Sell the Car | Use the proceeds to pay off the loan and eliminate debt. |

| Buy a Used Car | Choose a lower-cost, reliable vehicle to avoid new debt. |

| Cut Discretionary Spending | Reduce unnecessary costs to reallocate funds toward debt repayment. |

The Outcome: Car Loan Paid Off in 18 Months

By selling his car and making significant lifestyle changes, John was able to pay off his car loan in just 18 months. His story demonstrates the power of making sacrifices to reduce debt and regain financial freedom.

Key Takeaways:

- Sell your car if you’re struggling with car loan payments.

- Purchase a more affordable car to avoid further debt accumulation.

- Cut discretionary spending to prioritize debt repayment.

Success Story 5 – Navigating Debt After a Divorce

Going through a divorce can be emotionally and financially draining, and often one of the most challenging aspects is dealing with shared debt. Emma, a 45-year-old woman, found herself drowning in $60,000 of combined debt after her divorce. The debts, which were accrued during her marriage, were now hers to manage alone, and the thought of taking them on was overwhelming. However, Emma was determined to rebuild her financial life.

Facing Debt After Divorce

The most significant challenge Emma faced was the joint debt from her marriage, which included credit cards, personal loans, and the mortgage on their home. After the divorce, the responsibility for these debts fell on her, leaving her in a precarious financial situation. But Emma was not ready to accept that she would be saddled with debt forever.

The Strategy: Creating a New Financial Foundation

Emma approached her debt problem in a disciplined and structured way:

- Debt Negotiation: She contacted creditors to negotiate lower interest rates and even sought some debt forgiveness where possible.

- Downsizing Lifestyle: Emma sold her house and bought a smaller, more affordable property. She also cut back on discretionary spending, limiting vacations and dining out.

- Debt Snowball and Avalanche Combo: Emma used a combination of the debt snowball and avalanche methods. She tackled the smallest debts first to gain motivation, but also worked on paying down high-interest debt to save money in the long run.

| Action | Details |

| Negotiate with Creditors | Seek lower interest rates and possible debt forgiveness. |

| Downsize Lifestyle | Sell property and cut back on discretionary spending. |

| Debt Snowball & Avalanche | Combine methods to gain momentum while saving on interest. |

The Outcome: Debt-Free After 4 Years

Emma’s resilience and disciplined approach paid off. By reducing her living expenses, negotiating her debt, and consistently following her repayment plan, Emma was able to pay off her debt in four years. Her success is an inspiring example of how someone can regain control of their financial life after a major life change like a divorce.

Key Takeaways:

- Negotiate your debt to reduce interest rates and possibly obtain debt forgiveness.

- Downsize your lifestyle to free up more money for debt repayment.

- Combine debt repayment methods [debt snowball and avalanche] for maximum efficiency.

Success Story 6 – Tackling Debt from Personal Loans

Personal loans are often used to cover emergencies or large purchases, but they can quickly spiral out of control if not managed correctly. Jason, a 32-year-old engineer, found himself struggling with $40,000 in personal loan debt. He had used the loans to consolidate other debts and finance a few home improvements. But over time, the loans accumulated interest, and Jason found himself unable to make significant progress on repayment.

The Weight of Personal Loan Debt

The monthly payments for Jason’s personal loans were large, and the interest rates were not ideal. Like many borrowers, Jason initially struggled with the idea of cutting back on expenses because of his comfortable lifestyle. However, after a year of stagnation in paying off his debt, he realized that he needed to make drastic changes.

The Strategy: Refinancing and Aggressive Debt Repayment

Jason’s approach was methodical and strategic:

- Refinancing Loans: Jason refinanced his personal loans to secure a lower interest rate, which significantly reduced his monthly payment and the total amount he would pay in interest.

- Aggressive Debt Repayment: He also adopted an aggressive approach to repayment, putting any extra money [bonuses, tax refunds, and savings] directly toward his loan principal.

- Budgeting Rigorously: He stuck to a strict budget, cutting out unnecessary expenses like subscriptions and frequent travel.

| Action | Details |

| Refinance Your Loans | Secure a lower interest rate to reduce monthly payments. |

| Aggressive Repayment | Put extra money toward the loan principal to pay it off faster. |

| Budget Strictly | Track and limit expenses to free up more for debt repayment. |

The Outcome: Debt-Free in 3 Years

By refinancing his loans, sticking to a strict budget, and using extra income to aggressively pay down his debt, Jason managed to pay off his personal loans in just three years. His success story proves that refinancing combined with dedicated repayment efforts can help reduce the burden of personal loan debt.

Key Takeaways:

- Refinance your loans to reduce interest rates and lower monthly payments.

- Aggressively pay down debt by using bonuses and extra income.

- Stick to a strict budget to ensure you allocate enough funds toward debt repayment.

Success Story 7 – Paying Off Debt with the Help of a Financial Coach

Sometimes, taking on debt repayment alone can feel overwhelming. For Jennifer, a 40-year-old marketing executive, getting out of debt was a complicated journey. She was carrying nearly $70,000 in credit card and personal loan debt. Jennifer tried various strategies on her own, but her inconsistent efforts weren’t yielding the results she hoped for.

The Struggles with Inconsistent Progress

Despite making monthly payments, Jennifer struggled to maintain consistency and often found herself reverting to old spending habits. She was unsure of how to build a sustainable debt repayment plan that would allow her to stay on track without feeling deprived.

The Strategy: Seeking Professional Help

Jennifer decided to take a different approach by enlisting the help of a certified financial coach. The coach helped her identify her spending triggers, create a tailored debt repayment plan, and develop healthier financial habits. Here’s what she did:

- Set Realistic Goals: Together with her financial coach, Jennifer set achievable monthly debt repayment goals.

- Automate Payments: To avoid the temptation of missing payments, Jennifer automated her debt payments, ensuring consistency.

- Focus on Financial Literacy: Her financial coach helped her improve her financial literacy, empowering her to make more informed decisions about her finances.

| Action | Details |

| Hire a Financial Coach | Get professional guidance to create a tailored repayment plan. |

| Automate Payments | Set up automatic payments to avoid missed or delayed payments. |

| Learn Financial Literacy | Focus on improving your understanding of money management. |

The Outcome: Debt-Free After 5 Years

Thanks to the guidance of her financial coach and her commitment to following the plan, Jennifer was able to pay off her debt in five years. Her story highlights the importance of seeking help when needed and the benefits of having professional support in achieving financial goals.

Key Takeaways:

- Seek professional help if you’re struggling with debt repayment.

- Automate your payments to ensure consistency and avoid missing payments.

- Improve financial literacy to make better financial decisions and avoid falling into debt traps.

Takeaways

These 7 success stories of people who paid off debt prove that getting out of debt is not only possible but achievable with the right strategy, discipline, and mindset.

Whether it’s through budgeting, negotiating bills, refinancing, or using methods like the debt snowball or debt avalanche techniques, each of these individuals took proactive steps toward their financial freedom.

No matter what type of debt you’re facing, these stories demonstrate that persistence, commitment, and a clear plan can lead to success. Start by evaluating your financial situation, set realistic goals, and choose a strategy that works best for you.

Your journey to a debt-free life starts with taking action. By following these proven strategies, you can join the many others who have found success in paying off their debts and achieving financial peace of mind.