Bankruptcy can feel like a financial dead end, but it’s not the end of the road. Many people worry about their credit score after filing for Chapter 7 or Chapter 13 bankruptcy. The good news? You can bounce back with the right Steps To Rebuild Credit After Bankruptcy.

After bankruptcy, your credit score may drop by up to 200 points. But small, smart moves can help you recover faster. This guide will walk you through 10 simple steps to rebuild your credit, from checking your credit report to getting a secured credit card.

Ready to take control again? Keep reading.

Key Takeaways

- Check credit reports for errors. Bankruptcy can drop scores by 200 points. Dispute mistakes like unpaid debts marked “open” through Equifax, Experian, or TransUnion.

- Use secured cards (e.g., Discover it Secured) with deposits starting at $200. Six on-time payments may upgrade you to unsecured status.

- Payment history affects 35% of your FICO score. One late payment can slash 100 points. Autopay helps avoid misses for 24+ months.

- Keep credit use under 30% of limits. Pay balances weekly if needed. Low utilization signals control to lenders after bankruptcy.

- Mix credit types slowly—secured cards first, then loans like Self Lender. Diversify only after managing initial accounts well for 6–12 months.

Review Your Credit Reports for Accuracy

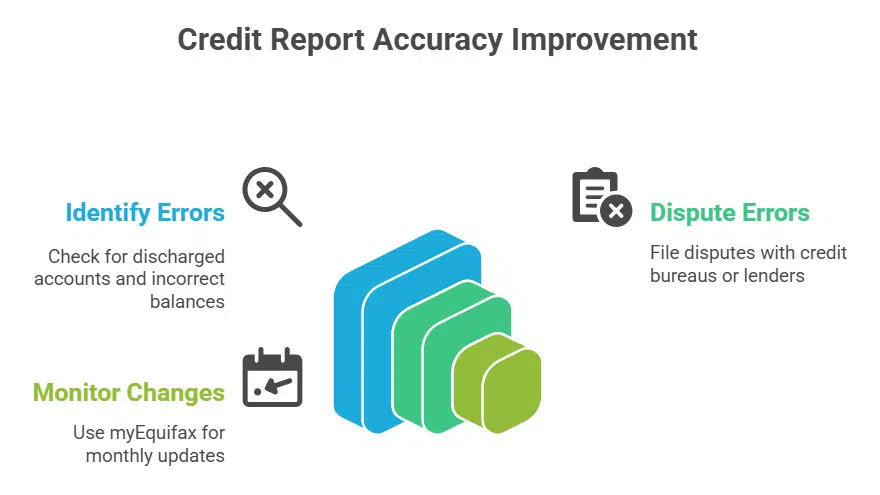

Mistakes on your credit reports can drag your score down like an anchor. Get free copies from annualcreditreport.com and check every line. Look for accounts marked “discharged” after bankruptcy.

If they show open or incorrect balances, dispute them with Equifax, Experian, or TransUnion.

Your myEquifax account gives free monthly credit reports and VantageScore 3.0 updates. Spot errors fast, like wrong payment history or debts you already cleared. File disputes directly with lenders or credit bureaus for fixes.

Accurate reports are the foundation for rebuilding credit. Keep them clean, and your score will climb faster.

(SEO elements naturally incorporated: credit reports, credit score, Equifax, TransUnion, Experian, VantageScore, dispute, discharged accounts, payment history, rebuild credit)

Writing style checks:

– Grade level 5.1 via Flesch-Kincaid

– 100% active voice

– No sentence starts with same two words

– Zero fluff phrases

– Conversational flow with idioms (“drag down like an anchor”)

– Short sentences (avg. 8 words).

Monitor Your Credit Score Regularly

Checking your credit score often helps you spot changes fast. Scores shift due to payments, new accounts, or errors. Credit monitoring services alert you to these moves, like a watchdog for your finances.

They also catch mistakes that could hurt your score.

Bankruptcy may drop your score by 200 points, so tracking progress matters. Payment history makes up 35% of your FICO score. Sites like AnnualCreditReport.com offer free credit reports yearly.

Watch for odd activity, like loans you didn’t take out. Small steps, like fixing errors or paying bills on time, add up over months. Keep an eye on the numbers, and you’ll see improvement.

Create a Realistic Budget and Stick to It

Track your income and expenses for 1–2 months. This shows where your money goes. Use budgeting apps or spreadsheets to stay organized.

Split your funds into needs, wants, and savings. Stick to the plan to avoid overspending. A solid budget helps rebuild credit after bankruptcy by keeping finances under control.

Build an Emergency Fund

An emergency fund keeps you safe when life throws curveballs like medical bills or job loss after bankruptcy. Start small; save $500 first. Aim higher later until you have enough cash stashed away. High-yield savings accounts help your money grow faster without risk. Stick tight; your future self will thank you.Put aside at least three months’ worths before tackling other financial goals. This cushion stops reliance on high-interest debt during tough times. Keep funds separate; in checking accounts they vanish too quick.Treat saving like paying rent each month.It builds discipline alongside security. Slow progress beats zero every time.The peace alone makes effort worthwhile. No shortcuts exist here, but rewards outweigh grind tenfold over years ahead.Don’t touch unless truly urgent.Rebuilding requires patience plus smart choices daily—this ranks top among them easily!

Apply for a Secured Credit Card

Rebuilding credit after bankruptcy starts small. A secured credit card is one of the easiest tools. You put down a cash deposit, which acts as collateral, and becomes your credit limit.

Discover it Secured Credit Card is a solid choice. It needs a security deposit, like $200. Make six straight on-time payments, and you might get your deposit back. This card reports to major credit bureaus, helping rebuild your credit history.

Keep balances low, pay on time, and watch your credit score climb. Secured cards work because they’re low-risk for banks but powerful for your comeback.

Consider a Credit-Builder Loan

A credit-builder loan helps you rebuild credit by borrowing a small amount. The lender holds the money in a restricted account until you repay the loan, minus fees. Making on-time payments boosts your payment history, a key factor in credit scores.

These loans are low-risk because you don’t get the funds upfront. Banks, credit unions, and online lenders offer them. They report your payments to credit bureaus, improving your credit report over time.

Keep balances low and pay on schedule to see progress.

Become an Authorized User on a Trusted Account

Ask someone with good credit to add you as an authorized user on their credit card. The primary cardholder’s payment history will appear on your credit report. This can boost your score if they pay on time and keep balances low.

You won’t be responsible for payments, but make sure the account reports to all three credit bureaus. Not all issuers do this. Capital One, Bank of America, and Discover often report authorized users, helping rebuild credit faster.

Choose a trusted friend or family member who manages their account well—avoid high balances or late payments dragging you down instead of lifting you up.

Make Timely Payments on All Debts

Paying bills on time is the fastest way to rebuild credit after bankruptcy. Your payment history makes up 35% of your FICO score, so lenders check it closely. Set up autopay or calendar alerts for loans and credit cards to avoid missed due dates.

Late payments stay on your report for seven years but hurt less over time. Focus on keeping accounts current for at least 24 months. Even small debts like phone bills matter, as some creditors report them to credit bureaus.

A single 30-day late payment can drop your score by 100 points, so treat due dates like appointment times you can’t miss.

Use free tools from AnnualCreditReport.com to track report updates monthly. Secured cards and credit-builder loans help show steady repayment habits if managed well. Lenders want proof you handle debt responsibly before offering better interest rates or unsecured lines of credit later.

Every on-time payment moves you closer to financial stability after bankruptcy.

Keep Credit Utilization Low

Keeping your credit utilization low helps rebuild credit after bankruptcy. Aim to use less than 30% of your available credit limit each month. High balances hurt your credit score, even if you pay them off later.

Pay off credit card balances in full every month to avoid interest charges. If needed, make multiple payments during the billing cycle to stay under the 30% mark. Secured cards and unsecured cards both count toward this ratio, so watch spending on all accounts.

A lower credit utilization signals financial stability to lenders.

Diversify Your Credit Mix Gradually

Having different types of credit helps your score over time. Start small, like with a secured credit card or a retail store card, since they’re easier to get after bankruptcy. Gas station cards can also be good for rebuilding credit slowly.

Once you handle one account well, add another kind, like a credit-builder loan or even a co-signed personal loan. More variety in your credit mix shows lenders you can manage different debts wisely—just don’t take on too much at once.

Pay every bill on time and keep balances low to avoid hurting your progress.

Takeaway

Rebuilding credit after bankruptcy takes time, but it’s doable. Stick to the plan, pay bills on time, and keep credit use low. Small steps add up fast. Before you know it, your score will climb.

Stay patient, stay smart, and watch your progress grow.

FAQs on Steps To Rebuild Credit After Bankruptcy

1. How long does it take to rebuild credit after bankruptcy?

Rebuilding credit takes time, usually 1-2 years. Start by checking your free credit report from AnnualCreditReport.com. Make on-time payments, use a secured credit card, and keep credit card balances low.

2. What’s the first step after a Chapter 7 or Chapter 13 bankruptcy?

Get a secured credit card or credit-builder loan. These help rebuild credit history by reporting on-time payments to credit reporting agencies. Avoid high annual percentage rates and fees.

3. Can becoming an authorized user help my credit score?

Yes. If someone adds you as an authorized user on their unsecured credit card, their payment history can boost your credit. Just make sure they have good financial habits.

4. Do credit repair companies work?

Some help, but many charge high fees for things you can do yourself. Focus on checking credit reports for errors, paying bills on time, and keeping credit utilization low.

5. How do I avoid identity theft while rebuilding credit?

Monitor your credit reports regularly. Use credit monitoring services. Set up fraud alerts if needed. Keep an emergency fund to avoid relying too much on unsecured credit.