The digital asset landscape has undergone a radical transformation since the speculative frenzy of the early 2020s. If 2021 was the year of the “Gold Rush,” where pixelated punks and bored apes commanded millions of dollars, 2026 is the year of the “Infrastructure Phase.” The dust has settled, and the State of NFTs in 2026 is no longer defined by hype, but by tangible utility, integration, and maturity.

Gone are the days when a roadmap promising a video game was enough to sell out a collection in minutes. Today, the market demands working products, legally binding ownership, and seamless interoperability. While digital art remains a pillar of the ecosystem, the center of gravity has shifted heavily toward utility—ticketing, gaming, identity verification, and the tokenization of Real-World Assets (RWAs). As we navigate this matured landscape, it becomes clear that the technology has quietly embedded itself into the backend of the internet, becoming less visible but infinitely more valuable.

The Evolution of the Market: From Hype to Utility

The State of NFTs in 2026 is characterized by a “survival of the fittest” dynamic. The crash of 2023-2024 wiped out nearly 96% of collections that lacked substance, effectively cleansing the market of noise. What remains are “Blue Chip” projects that pivoted into media empires and utility-based protocols that solve actual problems.

The Death of Speculation

In 2026, volume is driven by necessity rather than “flipping.” Institutional players have entered the fray, not to buy Monkey JPEGs, but to utilize the underlying technology for supply chain tracking and brand loyalty programs. The market is smaller in terms of raw dollar volume compared to the 2021 peak, but it is far healthier, with sustainable growth metrics and reduced volatility.

The New Standard for Projects

Collectors and investors now evaluate projects based on revenue models and legal frameworks rather than community hype. A project launching in 2026 without a clear legal structure for IP rights or a working prototype is ignored. The narrative has shifted from “community first” to “product first.”

Market Evolution Comparison

| Feature | The Hype Era (2021-2022) | The Utility Era (2026) |

| Primary Value Driver | Scarcity & Hype | Functionality & Access |

| Market Participants | Retail Speculators | Institutions & Gamers |

| Asset Lifespan | Weeks/Months | Multi-year/Perpetual |

| Technology Focus | Static Images (JPEGs) | Dynamic, Interoperable Code |

| Barriers to Entry | High Gas Fees, Complex Wallets | Invisible Tech (Account Abstraction) |

Real-World Assets (RWA): The New Frontier

Perhaps the most significant development in the State of NFTs in 2026 is the explosion of Real-World Assets (RWAs). This sector has successfully bridged the gap between decentralized finance (DeFi) and traditional finance (TradFi), bringing trillions of dollars of value on-chain.

Tokenizing the Physical World

The concept is simple but revolutionary: taking a physical asset—a house, a vintage car, a gold bar—and representing its ownership as an NFT on the blockchain. In 2026, you don’t just “buy” a house; you purchase a token that represents the deed, legally recognized by updated property laws in major jurisdictions. This has democratized access to high-value markets. A $50 million commercial building can now be fractionalized into 50,000 NFTs, allowing retail investors to own a piece of prime real estate for $1,000.

The “Phygital” Economy

Luxury brands have fully embraced this model. Buying a high-end watch or handbag now automatically generates a “digital twin” NFT. This token serves as a certificate of authenticity, a warranty card, and a membership pass to exclusive brand events. If the physical item is stolen, the NFT can be flagged, rendering the physical item nearly unsellable on the secondary market.

RWA Implementation Across Industries

| Industry | Application | 2026 Impact |

| Real Estate | Fractional Ownership | Liquidity for illiquid assets; instant settlement. |

| Luxury Goods | Digital Twins | Elimination of counterfeits; proven provenance. |

| Finance | Bond/Stock Tokenization | 24/7 trading markets; instant settlement. |

| Commodities | Gold/Silver Tokens | Redeemable physical backing without storage fees. |

Gaming and the Metaverse: True Digital Ownership

Gaming remains the “Trojan Horse” for mass adoption. However, the State of NFTs in 2026 shows a pivot away from the unsustainable “Play-to-Earn” (P2E) Ponzi schemes of the past. The industry has settled into a “Play-and-Earn” model where the game comes first, and the earning mechanism is a secondary bonus.

Interoperability is King

The walled gardens of gaming have begun to crumble. In 2026, leading game studios have adopted open standards that allow players to use a weapon or skin earned in one game across multiple other titles. This interoperability has created a unified “Metaverse economy” where assets have utility beyond their native environment. An NFT sword isn’t just a database entry in Game A; it’s a 3D asset that can be imported into Game B, C, and D.

The Rise of the “Mega-Guilds”

Gaming guilds have evolved into massive digital organizations that act like logistics companies. They manage millions of dollars in in-game assets, leasing them out to players in a revenue-share model. This has created a new gig economy where skilled players in developing nations can earn a living wage by operating high-value assets owned by players in wealthy nations, all governed by smart contracts.

Gaming Sector Key Statistics (2026 Projected)

| Metric | Description | Trend |

| Player Retention | Games with NFT assets | 3x higher retention than traditional games. |

| Asset Portability | Cross-game usage | 40% of new Web3 games support external assets. |

| Market Share | “Freemium” vs. Web3 | Web3 games now capture 15% of the global mobile market. |

| Revenue Model | Secondary Sales | Studios earn perpetual royalties on traded items. |

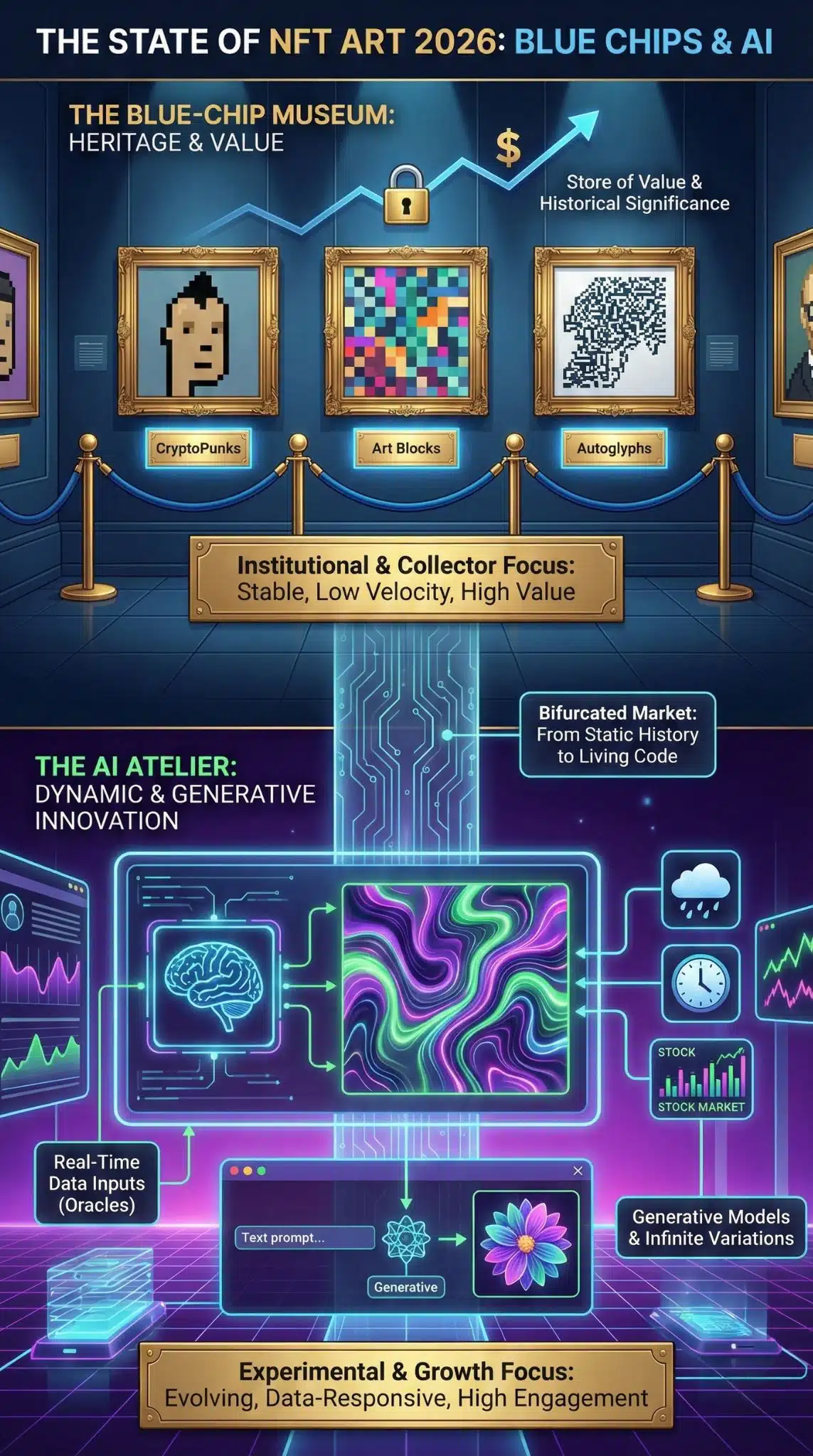

The State of NFT Art: Blue Chips and AI

While utility is the headline, art has not disappeared; it has refined itself. The “profile picture” (PFP) bubble has burst, leaving only the culturally significant collections standing. The art market in the State of NFTs in 2026 is bifurcated: Blue-Chip Heritage and AI-Driven Innovation.

The Blue-Chip “Museum” Grade

Collections like CryptoPunks and early generative art (Art Blocks) are now viewed similarly to Warhols or Basquiats. They are “heritage” assets, held by museums and ultra-high-net-worth individuals as stores of value. Their prices have stabilized, decoupling from the volatility of Ethereum and Bitcoin. They represent the history of the digital art movement and are priced accordingly.

Dynamic and AI Art

The exciting growth is in “Dynamic NFTs.” These are artworks that change over time based on external data inputs (oracles). An NFT landscape might change its weather based on the real-time weather in Tokyo, or a portrait might age as the blockchain grows longer. Furthermore, AI-generated art has its own sub-market, where collectors buy the “prompt” and the “model” rather than just the final image, allowing them to generate infinite variations of the core artwork.

Art Market Segmentation

| Segment | Characteristics | 2026 Status |

| Heritage (Blue Chip) | Historical significance, store of value. | Stable, low velocity, high value. |

| Generative Art | Code-based, algorithmic. | Curated platforms dominate open markets. |

| Dynamic/Living Art | Changes based on time/data. | High growth, experimental. |

| 1/1 Crypto Art | Individual artist releases. | Niche, highly dependent on artist reputation. |

Regulatory Landscape: Safety and Compliance

The Wild West days are over. The State of NFTs in 2026 is heavily defined by the regulatory clarity that arrived in late 2025. Governments worldwide, led by the US and EU, have implemented frameworks that protect consumers without stifling innovation.

The Innovation Exemption

A key development has been the “Innovation Exemption,” which allows new projects a grace period to decentralize before being classified under strict securities laws. This has encouraged startups to build openly. However, centralized marketplaces now require strict Know Your Customer (KYC) verification. You can no longer anonymously launder money through high-value NFT sales on major platforms.

Consumer Protection

Smart contracts are now subject to audits by regulated firms before they can be deployed on major exchanges. This has virtually eliminated the “rug pull” (where developers drain the liquidity) in the mainstream market. If a project sells an NFT promising future utility (like a game or a tool), it is legally treated as a crowdfunding contract, granting holders rights to refunds if the roadmap is not delivered.

Regulatory Changes Overview

| Regulation Type | Focus Area | Impact on Market |

| KYC/AML | Identity Verification | End of anonymous high-value trading on major platforms. |

| Securities Law | Revenue Sharing NFTs | Clear distinction between “Art” and “Investment Contracts.” |

| Consumer Rights | Roadmap Promises | Legal liability for failed deliverables; refund mandates. |

| IP Rights | Copyright | Standardized on-chain licenses (CC0 vs. Commercial). |

Final Thoughts

The State of NFTs in 2026 is a story of maturation. The technology has successfully shed its reputation as a speculative casino and re-emerged as a foundational layer of the digital economy. The battle between “Utility” and “Art” has largely been won by Utility in terms of volume and adoption, but Art retains its crown in terms of cultural prestige and per-asset value.

For the average consumer, NFTs have become invisible. They are the concert tickets in your Apple Wallet, the deed to your house stored in your bank’s vault, and the sword your avatar wields in your favorite game. The acronym “NFT” is used less frequently, replaced by “digital collectible,” “access pass,” or simply “digital asset.” As we look toward 2030, the integration will only deepen, making the blockchain an inextricable part of our daily digital lives.