Stablecoin is a cryptocurrency that tends to have support in the form of a reserve asset to ensure the stability of token value. As their name suggests, stablecoins are designed to be a price-stable cryptocurrency.

Stablecoins differ from traditional cryptocurrencies in terms of investor perception. Unlike traditional cryptocurrencies, stablecoins can maintain value and hedge risk for other volatile assets, meeting the different needs of investors. Holders of cryptocurrency pegged to assets own a portion of it. That means the value of the cryptocurrency will follow the value of the reserve asset. Compared to a regular contract, transactions occur instantly.

Stablecoins are also called asset-backed coins, although in their technical function, they do not carry the same characteristics as crypto coins, but have token functions. In most cases, stablecoins are provided with fiat money, such as the US dollar, euro, pound sterling, etc. Most often, collateral occurs at a ratio of 1:1, which means that one stablecoin is equal to one unit of currency (for example, a dollar). In addition to stablecoin backed by fiat currencies (USDC, Tether, EUROS), a stablecoin can be provided by other cryptocoins (DAI, WBTC, EOSDT) with 2:1 security, algocoins (AMPL, FRAX), in which case stability is formed through algorithms and smart contracts engaged in token issuance management activities, and can also be provided with traditional assets such as oil or gold (PAXG, DGX).

The Use of Stablecoins

Stablecoins have a wide range of applications:

- International payments: they can be used for quick and cheap international transfers without the need to go through bank intermediaries.

- Decentralized Finance (DeFi): Stablecoins are a key element of DeFi, where they are used as collateral for lending, liquidity, and insurance.

- Trading cryptocurrencies: Stablecoins are often used on cryptocurrency exchanges as a way to preserve value during trading.

- Value storage: Investors use stablecoins to preserve value and avoid volatility in the cryptocurrency market.

- Start-up financing: Some companies provide an opportunity for investors to buy stablecoins in exchange for participating in future revenue or project success.

The Role of Safe-Haven Assets During Periods of Volatility

Safe-haven assets are investments that help reduce risk in your overall investment portfolio. In the traditional market, such assets are gold, cash, or government bonds. In the crypto market, these are stablecoins.

Investors are buying safe-haven assets in the hope of maintaining their value over time and growing in a downturn or when the cryptocurrency market is unstable. As fears of a downturn in the US and around the world grow, these assets are gaining more attention because they can protect capital in a time of economic uncertainty.

Safe-haven assets tend to be great for diversifying the portfolio. This is due to their high liquidity or their ability to easily buy and sell on the open market. High liquidity allows investors to convert an asset into cash if and when it’s necessary.

Such assets are in limited quantities with constant demand, which allows their value to grow steadily over time. Finally, regardless of the economic climate, safe havens can generate income over a long period of time due to their high quality and constant demand.

Reasons for Volatility

While someone became a Bitcoin millionaire, another lost everything and got stuck in loans. Thanks to the volatility. The digital currency is subject to sharp price fluctuations. There are several reasons for this, in this section, we will touch on the main ones.

- Market size: The cryptocurrency market is small compared to traditional asset markets. It looks more like individual companies (which is true for cryptocurrencies with authors). Bond markets and currency pairs are much larger. A small market is manipulated, and more dependent on fluctuations in supply and demand. Even small inflows change the price: one big investor or group can create a price jump.

- Low liquidity: to eliminate it, you need to attract more market makers to exchanges.

- Regulation: The government can close markets and reduce liquidity. For example, this was the case with China when the exchanges were closed by the decision of the government.

- News: When the news is positive, it stimulates investor interest and encourages market participants to buy coins, raising its price. For example, news about the launch of futures attracts people, and reports of bubbles, scam projects, or hacks reduce the price.

- Change in market mood: mainly related to regulation and news.

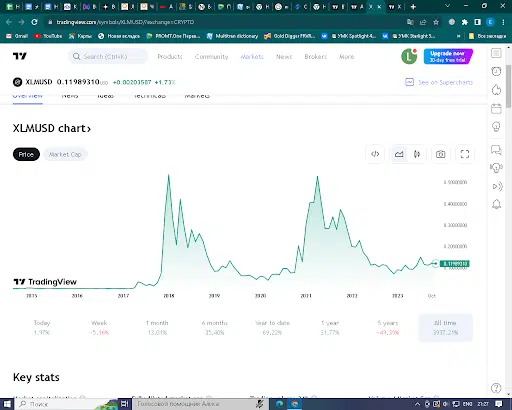

For an example of high volatility, let’s note the Stellar (XLM), which during its existence several times reached a peak, then dropped to the bottom.

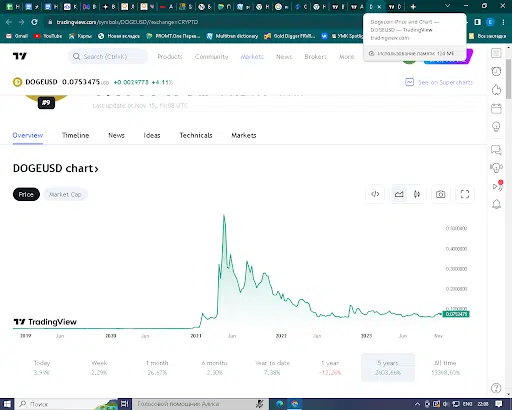

Another example, Dogecoin (Doge), which by the fall of 2023 came to a volatility of about 4-6%. However, for almost ten years of existence, there have been short periods when the figure was 106% (April 2021) and even 175% (January 2014 and February 2021).

Overview of Stablecoins and their Characteristics

As we found out, the main problem of cryptocurrency is high volatility. The rate changes occur under the influence of various factors. Statements by opinion leaders or a report by the IRS on the state of the country’s economy can affect the price of Bitcoin and altcoins. Various economic and political factors also put pressure on the exchange rate of digital currencies. Volatility scares potential investors. They want to keep their funds, which requires stable tools.

The fluctuations of stablecoins are close to zero. After all, this is their main task – to stay at a fixed price always. USDT, USDC, BUSD, and many other fiat equivalents are minimally volatile. Among the most reliable stablecoins are coins pegged to the US dollar.

However, not all stablecoins can serve as an investment tool. There are pending projects without a stable product. Consider some of the most reliable coins in 2023:

USD Coin (USDC)

It is considered the most reliable stablecoin. The collateral currency is the US dollar. The token appeared in 2018 when only USDT was on the market. But Tether had problems with the law and lost trust. Stablecoin is considered the most open and reliable: without the presence of dollars on the deposit, the platform will not issue tokens. At the same time, USD Coin cannot be considered a decentralized asset, the issue is controlled by the developer Circle.

Stablecoin allows you to hedge risks, and reduce the volatility of traditional cryptocurrencies. Used for payment, and settlements between counterparties.

|

Rate |

$1 |

|

Capitalization |

$23,93 bln |

|

In circulation |

about 24 bln |

|

Emission |

unlimited |

|

Blockchain |

Ethereum, Tron, Solana, Stellar, Algorand |

|

Transaction rate |

depends on blockchain: Tron provides more speed, Ethereum – less |

Tether (USDT)

This is the most popular stablecoin. Tether accounts for more than 65% of transactions with stablecoins. In terms of capitalization, it is constantly in the top 10. The collateral currency is the dollar.

Bitfinex and Tether were both sued in 2018. The reason is doubt about the existence of reinforcement of 2.3 billion tokens. The company later acknowledged that USDTs are backed by cash dollars and debt. In 2021, auditors confirmed 100% of the reserves.

In addition to USDT, Tether issues coins with support for yen, euro, yuan, and gold.

|

Rate |

$1 |

|

Capitalization |

$90,55 bln |

|

In circulation |

more than 90 bln |

|

Emission |

unlimited |

|

Blockchain |

Bitcoin, Ethereum, Tron, Solana, Stellar, Algorand, EOS, OMG Network, Bitcoin Cash |

|

Transaction rate |

depends on the platform |

Binance USD (BUSD)

The well-known cryptocurrency platform has done a lot to develop the digital money market. Among Binance’s developments is a stablecoin pegged to the US dollar. The crypto exchange organized the marketing and launch of the project. The Paxos Trust Company, which is licensed by the New York State Financial Regulator, worked on the collateral. BUSD is approved in the United States.

Stablecoin was launched in 2019 on Paxos and Binance platforms. The currency is held by American banks. There are no problems with reserves.

Binance USD ranks 3rd in the list of stablecoins for 2023 in terms of popularity and volume of operations.

|

Rate |

$1 |

|

Capitalization |

$1,85 bln |

|

In circulation |

about 2 bln |

|

Emission |

unlimited |

|

Blockchain |

Ethereum, Binance Smart Chain |

|

Transaction rate |

high, an operation per 1 second |

DAI (DAI)

Stablecoin is created as an alternative to coins that have lost community trust. Different from the previous assets. DAIs are created by users, the reserve is ETH, which is blocked in the smart contract at the rate at the time of the transaction.

The story of stablecoin is related to the Ethereum-based MakerDAO platform, which was created in 2014 by Rune Christensen. In 2017, he developed DAI. The coin is decentralized: no one controls or regulates emissions.

At the same time, Ethereum is used to reinforce coins. The rate is $1 and remains so regardless of the ETH price. If the value deviates from the value specified in the smart contract, excess coins are destroyed or new ones are issued.

|

Rate |

$1, fell to $0,72, reach $1,1 |

|

Capitalization |

$3,86 bln |

|

In circulation |

3,68 bln |

|

Emission |

unlimited |

|

Blockchain |

Ethereum |

|

Transaction rate |

20-40 per 1 second |

So far, assets backed by fiat, in particular the dollar, are leading among stablecoins. However, do not forget about government developments – CBDC. The digital yuan, amid cryptocurrency problems in China, is able to replace the latter as a means of payment. Japan is also keen to keep up and is developing a virtual yen.

Pax Dollar (USDP)

In 2012, the Paxos Trust Company was established, and regularly conducts reserve audits and publishes reports.

In 2018, the company released Paxos Standart (PAX), backed by a 1:1 dollar. In 2021, the token received a new name Pax Dollar (USDP). It is the world’s first secured asset and is regulated by the government body DFS. Technically, this is the ERC-20 standard token on Ethereum.

Direct cashing can be carried out through the native exchange of the itBit project.

|

Rate |

$1, fell to $0,76, reach $1,18 |

|

Capitalization |

about $1 bln |

|

In circulation |

about 1 bln |

|

Emission |

unlimited |

|

Blockchain |

Ethereum |

|

Transaction rate |

20-40 per 1 second |

(In)Stability of Stablecoins during Volatile Times

Volatility in the stablecoin market is an oxymoron in itself – stablecoins are so-called that they are stable. As practice has shown, this was only a name.

In “The instability of stablecoins” research, the authors analyze the behavior of the courses of the before-mentioned stablecoins. We can observe how stablecoins undergo fluctuations, but return to the $1 mark at different speeds, except for DAI due to its distinctive features.

A historic shock regarding stablecoins was the fall of the UST in May 2022. As a result of which, Terra Altcoin (LUNA) collapsed by 95%, as it was used to stabilize the UST price. In this regard, the USDT stablecoin rate fell by 5%, at the moment falling to $0.95, and temporarily lost its peg to the dollar.

An analysis of the relationship between Terra’s collapse and stablecoin price fluctuations is detailed in “The Intelligent design: stablecoins (in) stability and collateral during market turbulence” research.

After the recovery, the USDT stablecoin regained its position in the market and became the most popular supported by the dollar. However, amid news of tough actions by US regulators against the largest market players in June this year, Tether’s largest market capitalization stablecoin was under pressure again.

The leading stablecoin slightly sank below $1 after the asset balance in the liquidity pool 3Pool the decentralized Curve platform was severely disrupted. 3Pool is the third largest trading pool among all existing trade platforms (decentralized exchange, DEX) in the field of decentralized finance (DeFi) and the largest in the number of stablecoins USDT and DAI.

In the largest liquidity pools in the Uniswap and Curve protocols, there was an active sale of USDT. When sellers flood the market, it can cause the exchange rate to fall even in a “stable” asset. A similar situation was observed during the collapse of Silicon Valley Bank (SVB) when the peg to the dollar rate was lost by the second most capitalized stablecoin USD Coin (USDC), the issuer of which is Circle in partnership with Coinbase. Then the USDC fell to $0.93, only a few days later restoring price parity.

The USDT balance in the 3pool pool of the Curve platform, which consists of USDT, USDC, and DAI stablecoins, exceeded 77% on the morning of June 15. This meant that traders sold a lot of USDT for DAI or USDC, which led to a decline in the USDT. This was an anomalous event for the market. The perfect Curve 3Pool balance should be 33.33 percent for each of the three stablecoins.

The last time the 3Pool balance was broken was in March with active USDC and DAI sales. Last November, the collapse of the FTX cryptocurrency exchange also led to a severe imbalance in the pool.

How to react to this happening? Don’t panic. According to experts, such a situation has already happened and rather resembles the provocation of individual market participants in order to get quick earnings.

As Ardoino wrote in a commentary to The Block, “The market as a whole is very tight right now” Recent news is pushing big players to pull out of cryptocurrency markets, he said. “Tether is a gateway for liquidity, both inbound and outbound. When interest in cryptocurrencies rises, we see an influx. And when the mood in the cryptocurrency market is negative, we see an outflow. But we can’t rule out a direct attack on Tether, as we saw in 2022,” adds Ardoino.

Nevertheless, as we see today, USDT holds a strong position. Can we say that this is a reliable asset? Draw conclusions.

To Sum Up

Stablecoins are a bridge between the world of cryptocurrencies and the traditional financial system. They provide a stable and convenient means of sharing and storing values in the digital world. Their ability to provide value stability and usability makes them valuable tools for traders, investors, and blockchain users. With growing popularity and the development of blockchain technology, stablecoins will continue to strengthen their position as a key element of the digital economy.

Despite the many advantages, stablecoins face challenges, including regulation, transparency, and security. Regulators seek to control the use of stablecoins, especially when they become an alternative to national fiat currencies.

Still, the stablecoin outlook remains encouraging. They are strengthening their position as a key tool in the world of cryptocurrencies and decentralized finance. With the development of technology and regulation, stablecoins can play an increasingly important role in the global economy and finance.