On October 21, 2025, Japan crossed a political Rubicon. As Sanae Takaichi stood before the Diet to deliver her inaugural address as the nation’s first female prime minister, the symbolism was undeniable. Yet her gender, while historic, is not the most consequential element of this story. The real transformation lies in what her leadership represents: a Japan stepping out of decades of reactive diplomacy into a new era of strategic assertiveness.

Takaichi’s Japan is not merely resurgent; it’s repositioned. Armed with an ambitious fiscal program exceeding ¥13.9 trillion (≈ US $92 billion), a determination to achieve “economic security” through technology supremacy, and a renewed alignment with Washington, Tokyo is redefining Asia’s geopolitical chessboard.

In this expanded analysis, we examine how Takaichi’s leadership could reorder the region’s trade corridors, technology alliances, and strategic dependencies — and why the Indo-Pacific may never look the same again.

From Abe to Takaichi: Continuity and Rupture

Takaichi’s ideological DNA traces back to Shinzō Abe, Japan’s most transformative post-Cold War leader. Like Abe, she champions constitutional revision, defense normalization, and a proactive security doctrine. Yet she goes further — fusing nationalism with techno-industrial policy, a combination rarely seen in Japan’s conservative mainstream.

Where Abe sought incremental normalization, Takaichi is constructing economic nationalism 2.0 — channeling state funds into semiconductor, AI, quantum, and defense R&D hubs. Her rhetoric of “crisis-management investment” reflects a sense that Japan’s future security depends as much on chips and algorithms as on missiles and bases.

This shift has political costs. The Buddhist-leaning Komeito party’s withdrawal from the ruling coalition underscores domestic polarization. Takaichi governs with a narrower base and higher stakes — but also fewer constraints. Japan’s center-right is morphing into a hard-edged economic-security coalition.

The Strategic Triad: Security, Tech, and Trade

Takaichi’s doctrine rests on a triptych where military readiness, industrial resilience, and trade architecture converge:

Security

She has accelerated Japan’s long-term plan to raise defense spending beyond 2 percent of GDP by 2027. The new National Security Strategy envisions missile-defense upgrades, cyber-resilience, and space surveillance — a silent but consequential pivot from pacifism to deterrence.

Technology

Economic security is Takaichi’s buzzword of power. Tokyo is offering massive subsidies to semiconductor producers like TSMC and Rapidus and encouraging public-private consortia in AI, quantum, and green tech. The government’s new Economic Security Bureau acts as a fusion cell between METI and the Ministry of Defense.

Trade

Japan now acts as a regulatory gatekeeper in Asia’s trade order — defending CPTPP standards, participating in IPEF digital-trade frameworks, and quietly influencing RCEP compliance. For Tokyo, trade rules are no longer technocratic—they’re strategic ammunition.

Strategic implication: For the first time since 1945, Japan’s security perimeter extends from its missile silos to its microchips.

Semiconductor and AI Supply Chains: The Commanding Heights of Power

Semiconductors are to the 2020s what oil was to the 1970s — and Japan sits on the upstream value chain’s pressure points: photoresists, specialty gases, precision equipment, and advanced materials.

Under Takaichi:

-

Subsidies exceed ¥2 trillion for domestic fabs, with Rapidus and Sony Semiconductors receiving direct support.

-

Export controls align tightly with the U.S. and the Netherlands, targeting China’s access to EUV lithography and AI chips.

-

AI policy integrates economic and defense imperatives, emphasizing compute independence and cloud-sovereignty partnerships with the U.S. and EU.

Winners: Japanese toolmakers (Tokyo Electron, JSR, Shin-Etsu), Taiwan’s TSMC, and ASEAN assembly hubs.

Losers: Chinese foundries, legacy-node exporters, and firms tied to Beijing’s data-center ecosystem.

For global investors, Japan is becoming the linchpin of allied chip sovereignty. Yet its challenge is workforce capacity—an aging demographic and limited AI-engineering talent could slow execution.

Energy, Critical Minerals, and Shipping Lanes

Energy and minerals are the under-appreciated pillars of Takaichi’s national strategy. Facing dual shocks — a weak yen and volatile LNG markets — Tokyo is rebooting its nuclear fleet and investing in hydrogen pilot corridors linking Australia, Indonesia, and Japan.

-

Critical minerals: Japan has signed multi-year offtake agreements with Australia and Canada to secure lithium and rare-earth processing.

-

Maritime control: Japanese insurers and shipbuilders are deepening presence along the South China Sea and Malacca Strait routes to guarantee access to energy supply chains.

-

Green security: By linking clean-tech R&D with geopolitical diversification, Japan is branding decarbonization as defense.

Implication: In a world of weaponized interdependence, Japan is transforming logistical geography into strategic leverage.

Alliance Geometry: The Concentric Rings of Power

Takaichi’s Japan operates through concentric circles of alignment:

-

Inner Ring: A revitalized U.S.–Japan compact featuring joint R&D on hypersonic systems, semiconductor policy coordination, and shared intelligence under the Indo-Pacific Command.

-

Middle Ring: QUAD plus (Australia, India, Japan, U.S.) and AUKUS adjacency for submarine and AI-defense technologies. Tokyo now frames itself as the “connector node” between QUAD’s democratic tech stack and Southeast Asia’s industrial networks.

-

Outer Ring: Economic architectures — CPTPP as rule-setter, IPEF as standard-shaper, and EU partnerships on AI ethics and data flows.

This geometry transforms Japan into a systemic pivot — a country shaping rules, not merely abiding by them.

Regional Ripple Effects

China: Faces sustained export-control pressure, tourism restrictions, and gradual erosion of supply-chain dominance. Retaliation may come via rare-earth leverage or consumer boycotts.

Taiwan: Gains strategic depth. Co-investment in semiconductor resilience and closer defense coordination with Tokyo strengthen deterrence against Beijing.

South Korea: A pragmatic competitor — potential partner in chip alliances but constrained by unresolved historical grievances.

India: Positioned as Japan’s co-architect in resilient manufacturing. Expect more joint corridors, credit lines, and naval coordination under QUAD.

ASEAN: Vietnam, Thailand, and Indonesia are prime beneficiaries of Japan’s China+1 relocation. Singapore is emerging as a digital-trade pilot state.

Australia/EU: Shared tech-standards and mineral partnerships cement Japan’s bridge role between the trans-Pacific and trans-Atlantic blocs.

Japan–U.S. Goods Trade, 2020–2025 (USD billions)

| Year | U.S. Exports to Japan | U.S. Imports from Japan | Total Goods Trade | U.S. Goods Balance |

|---|---|---|---|---|

| 2020 | 64.03 | 119.51 | 183.54 | –55.48 |

| 2021 | 74.73 | 134.80 | 209.53 | –60.07 |

| 2022 | 80.15 | 148.00 | 228.15 | –67.85 |

| 2023 | 75.79 | 147.21 | 223.00 | –71.41 |

| 2024 | 78.98 | 148.37 | 227.35 | –69.39 |

| 2025 (Jan–Jul) | 47.36 | 87.40 | 134.76 | –40.04 |

Sources: Annual totals for 2020–2024 and 2025 YTD from U.S. Census “Trade in Goods with Japan” tables (millions USD; summed by Census) and USTR 2024 summary for cross-check.

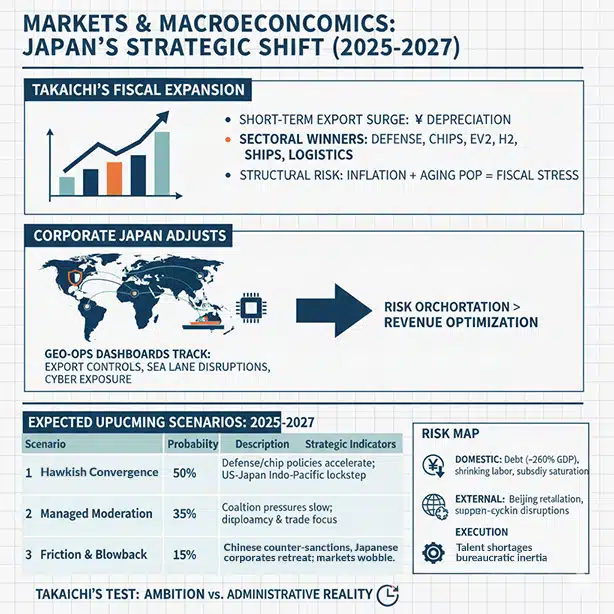

Markets and Macroeconomics

Takaichi’s fiscal expansion will be the largest since Abenomics, fueling:

-

Short-term export surge: Yen depreciation enhances competitiveness.

-

Sectoral winners: Defense, semiconductors, EVs, hydrogen tech, shipbuilding, logistics.

-

Structural risk: Inflationary pressure meets aging population — long-term fiscal sustainability under question.

Corporate Japan is adjusting: risk committees are integrating geo-ops dashboards tracking export-control changes, sea-lane disruptions, and cyber exposure. The next phase of corporate strategy will be risk orchestration, not just revenue optimization.

Expected Upcoming Scenarios: 2025 – 2027

| Scenario | Probability | Description | Strategic Indicators |

|---|---|---|---|

| Hawkish Convergence | 50% | Defense budgets and chip policies accelerate; U.S.–Japan lockstep defines Indo-Pacific architecture. | Export-control expansion, fab-subsidy announcements, joint drills |

| Managed Moderation | 35% | Coalition pressures slow pace; focus shifts to diplomacy and trade facilitation. | CPTPP accession signals, parliamentary dissent, moderated defense outlays |

| Friction & Blowback | 15% | Chinese counter-sanctions disrupt supply chains; Japanese corporates retreat; markets wobble. | Customs delays, tourism bans, FX volatility |

Risk Map

-

Domestic: Record debt (~260% of GDP), shrinking labor force, and subsidy saturation may erode fiscal space.

-

External: Retaliation from Beijing or supply-chain partners outside the bloc could hurt exporters.

-

Execution: Talent shortages in advanced manufacturing; bureaucratic inertia in implementation; potential over-centralization of strategy.

Takaichi’s greatest test may be balancing ambition with administrative reality — turning policy vision into operational velocity.

Implications for the Global South: Spotlight on Bangladesh

For emerging economies like Bangladesh, this geopolitical re-wiring presents both opportunity and challenge:

-

Opportunity: Japan’s “friend-shoring” drive can channel electronics assembly, chip-packaging, and logistics into South Asia.

-

Infrastructure leverage: Bangladesh’s ports (Matarbari, Payra) could integrate into Japan-financed supply routes via JICA/JBIC.

-

Human capital: Tokyo’s new visa liberalization for tech workers creates migration and training opportunities.

However, to capitalize, Dhaka must align on standards: ESG compliance, digital-trade governance, and IP protection — prerequisites for entry into Japan’s trusted-supply ecosystem.

Strategic Playbook — What Policymakers and CEOs Should Do

Governments

-

Embed AI ethics and data-flow standards consistent with Japan/EU frameworks.

-

Secure critical-mineral MOUs and ship-insurance partnerships.

-

Develop Indo-Pacific SEZs designed for Japanese SMEs relocating from China.

Corporates

-

Conduct geo-dependency audits (Japan–China exposure).

-

Pursue joint ventures in semiconductors, EV batteries, and maritime tech.

-

Institutionalize scenario dashboards monitoring policy triggers and alliance shifts.

The winners in this new order will not be the biggest — but the fastest to adapt.

Takeaways: The Return of Strategic Japan

Sanae Takaichi’s ascent marks not only a milestone for gender in politics but a pivot point in global order. Japan is discarding its long-standing reticence and emerging as the architect of a new Indo-Pacific equilibrium — one defined by chips instead of coalitions, and by data corridors instead of demilitarized zones.

This is not the old Japan of consensus diplomacy. It’s a Japan comfortable with projection — of power, capital, and standards.

The chessboard is shifting. Washington, Beijing, Delhi, and Singapore are already recalculating moves. The world’s third-largest economy has quietly turned into Asia’s most consequential power broker.

The era of strategic silence is over. Under Takaichi, Japan speaks — and the region listens.