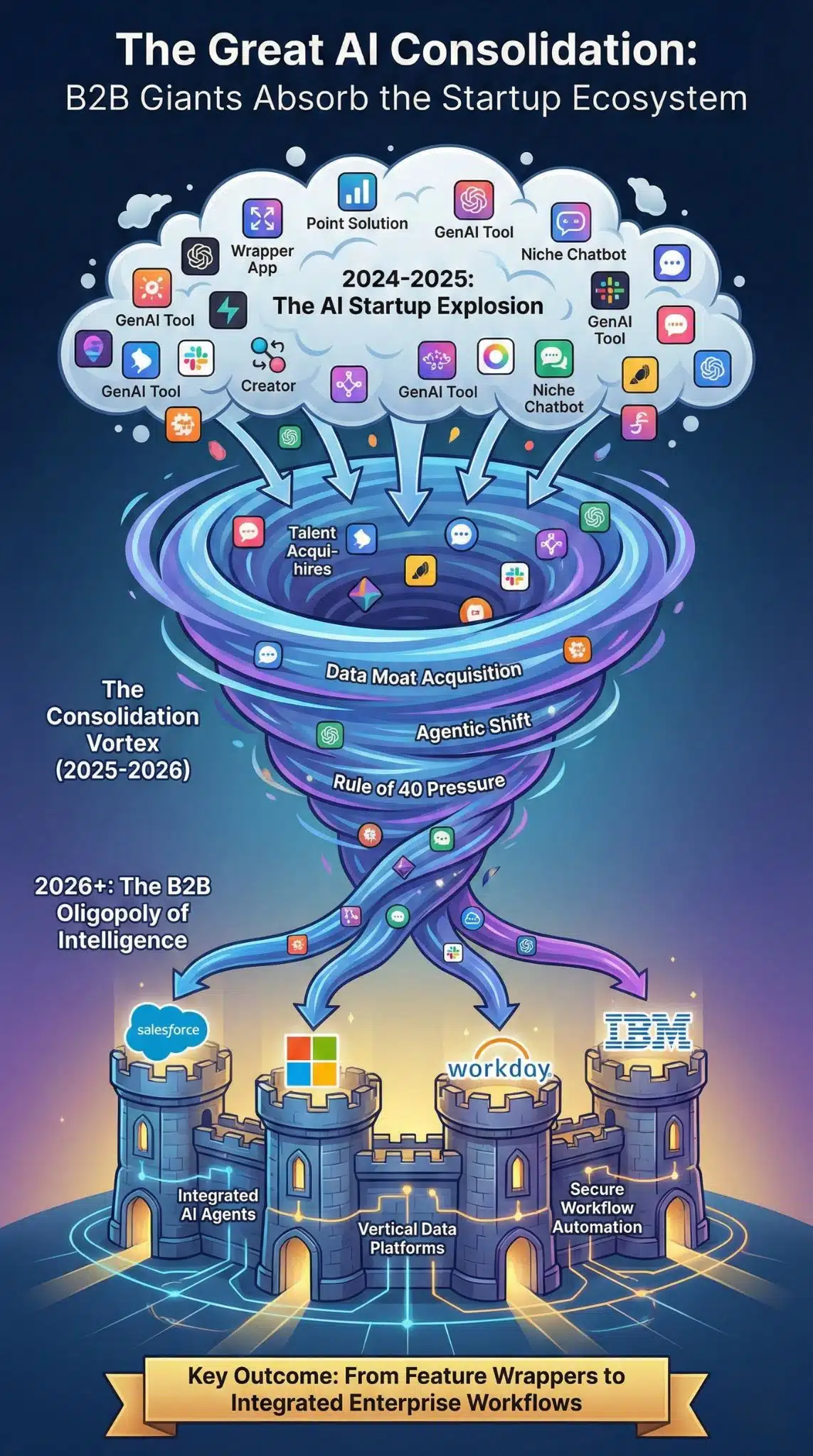

The “Summer of AI” has given way to the “Winter of Consolidation.” By January 2026, the artificial intelligence landscape has fundamentally shifted from a Cambrian explosion of startups to a rapid centralization of power. It is no longer about who can build the best model, but who can own the workflow.

As interest rates stabilize and venture capital for “wrapper” applications dries up, major B2B incumbents—Salesforce, Workday, IBM, and Microsoft—are aggressively absorbing the most promising AI talent and technology. This isn’t just a market correction; it is a defensive restructuring of the entire B2B tech stack to secure dominance for the next decade. This phase of SaaS Consolidation signals that platform control, not product novelty, will determine long-term winners in enterprise AI.

The End of the “Wild West” Era

To understand why 2026 has become the year of the “Great Absorption,” we must look at the trajectory of the last 24 months. Throughout 2024 and early 2025, the market was flooded with “wrapper” startups—companies whose primary value proposition was a user interface layered over a foundation model like GPT-4. These startups attracted billions in seed funding but failed to build defensible “moats.”

By mid-2025, the cracks emerged. Incumbents woke up. When Microsoft 365 Copilot and Salesforce Einstein integrated the exact features these startups were selling (summarization, drafting, basic analytics) directly into the browser, the standalone tools became obsolete overnight. Simultaneously, the “Rule of 40” (growth + profit margin) returned with a vengeance. Investors stopped funding growth-at-all-costs AI experiments, forcing cash-burning startups to seek buyers. The result is the current wave of consolidation: a survival mechanism for startups and a dominance strategy for Big Tech.

Core Analysis: The Drivers of Consolidation

1. The Pivot from “GenAI” to “Agentic AI”

The most significant driver of recent acquisitions is the technological shift from generating text to executing work. In 2024, the hype was about chatbots. In 2026, the value is in “Agents”—AI systems that can autonomously complete multi-step tasks like processing an invoice or closing a supply chain ticket.

Legacy B2B platforms like SAP, Oracle, and Workday possess the data (the system of record) but often lack the intelligence (the reasoning engine). Conversely, startups have the reasoning engines but lack the deep, historical business data required to make agents reliable. This dichotomy has forced a marriage of necessity. For instance, Workday’s $1.1 billion acquisition of Sana wasn’t just about buying search technology; it was about injecting an “agentic brain” into their vast repository of HR and financial data.

2. The “Reverse Acqui-hire” Phenomenon

A unique trend in this consolidation wave is the “reverse acqui-hire”—a legal structure designed to bypass antitrust scrutiny. Instead of buying a company outright, tech giants are hiring the founders and key researchers, licensing the technology, and leaving the hollowed-out corporate shell behind.

This strategy, popularized by deals involving companies like Adept AI and Character.ai in previous years, has evolved into a standard playbook in 2026. It allows B2B giants to secure the scarce resource that matters most—talent capable of training post-training models—without triggering a full-scale merger review. It is a tacit admission that for many startups, the team was always more valuable than the product.

3. The Death of the “Point Solution”

CIOs are exhausted. After years of SaaS sprawl—where the average enterprise managed over 130 distinct software applications—buyers are aggressively consolidating vendors. In 2026, IT leaders are prioritizing “Platform” over “Best-in-Breed.”

This buyer behavior is forcing point solutions (e.g., a standalone AI tool for writing sales emails) to sell to broader platforms (e.g., a CRM or Sales Engagement Platform). The logic is simple: a CFO will not approve a $50/month subscription for a tool that does one thing when their existing Hubspot or Salesforce contract now includes that feature for free. Startups that solve a feature rather than a problem are finding zero demand in the 2026 enterprise market.

4. Vertical AI as the Last Fortress

While horizontal AI (general productivity) is being eaten by Microsoft and Google, “Vertical AI” remains a hotbed for high-value M&A. These are startups deeply embedded in specific industries—construction, aerospace, biotech—with proprietary data that foundational models cannot scrape from the open web.

We are seeing a bifurcated market: generalist AI startups are selling for 2-4x revenue (or less), while vertical AI startups with exclusive datasets are commanding multiples of 10-15x. B2B acquirers know that in a world of commoditized intelligence, proprietary context is the only sustainable advantage.

The “Great Absorption” of 2026 has clarified the market, but it has also introduced a new set of complexities that will define the next phase of the B2B economy. The consolidation was the easy part; making these massive, amalgamated systems work is the true challenge of the coming year.

5. The Operational Hangover: Integration Hell

If 2026 is the year of acquisition, late 2026 and 2027 will be the years of “Integration Hell.” The press releases announce seamless synergies, but the reality for CIOs is far messier. We are witnessing the collision of incompatible architectures: legacy SQL-based systems of record are being duct-taped to probabilistic, vector-based reasoning engines.

The result is a spike in “Hallucination Latency”—the friction caused when an acquired agent attempts to execute an action within a legacy ERP environment and fails due to schema mismatches. IT departments are shifting their focus from “prompt engineering” to “context cleaning.” The most in-demand role in Q1 2026 is not the AI Researcher, but the AI Systems Architect—the plumber who can ensure the “brain” acquired from a Silicon Valley startup can actually move the “limbs” of a 20-year-old SAP instance.

6. The Rise of “Service-as-Software”

As hinted in the initial analysis, the traditional SaaS model (Software-as-a-Service) is being cannibalized by “Service-as-Software.” This is a fundamental business model shift. In the SaaS era, you paid a monthly fee for a tool (e.g., Zendesk) that helped your humans do customer support. In the Service-as-Software era, you pay for the outcome (e.g., “resolved tickets”).

Companies like Klarna and others pioneered this in 2024/25, but it has now gone mainstream. Startups are no longer selling “AI for Lawyers”; they are selling “Legal Review as an API.” They don’t license software seats; they charge per contract analyzed. This shift terrorizes traditional BPO (Business Process Outsourcing) firms. Why hire an outsourcing firm in Manila to handle Tier 1 support when a Salesforce agent can do it for 1/10th the cost with zero latency? The BPO industry is rapidly pivoting to become “RLHF Farms” (Reinforcement Learning from Human Feedback), where humans no longer do the work but merely grade the AI’s homework to prevent model drift.

Data & Visualization: The Consolidation Scorecard

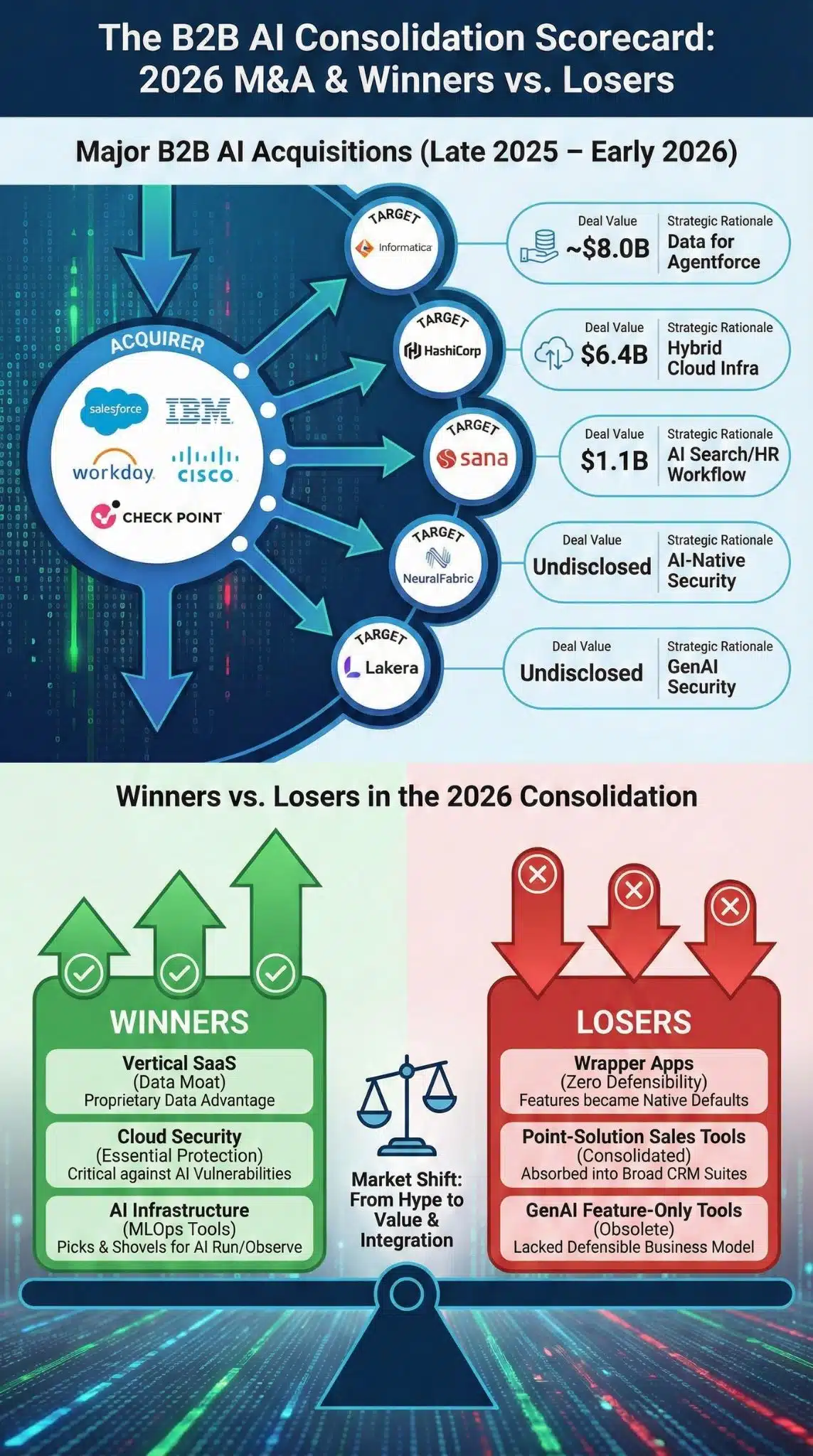

The following tables break down the current landscape of M&A activity and the shifting metrics of success in the SaaS world as of early 2026.

Major B2B AI Acquisitions (Late 2025 – Early 2026)

A snapshot of high-impact deals reshaping the industry.

| Acquirer | Target | Est. Deal Value | Strategic Rationale |

| Salesforce | Informatica | ~$8.0 Billion | Securing the data layer to power “Agentforce” automation across the enterprise. |

| IBM | HashiCorp | $6.4 Billion | Owning the multi-cloud infrastructure required to run hybrid AI workloads. |

| Workday | Sana | $1.1 Billion | Integrating AI-powered enterprise search and learning into HR/Finance workflows. |

| Cisco | NeuralFabric | Undisclosed | Strengthening AI-native security and networking to handle massive inference loads. |

| Check Point | Lakera | Undisclosed | Acquiring specialized “GenAI Security” to protect enterprises from prompt injection attacks. |

Winners vs. Losers in the 2026 Consolidation

Who is thriving and who is exiting in the current market conditions.

| Category | Status | Why? |

| The “Wrapper” Apps | LOSER | Features like “Chat to PDF” or “Email Writer” are now default buttons in Microsoft Word or Adobe. Zero defensibility. |

| Vertical SaaS | WINNER | Highly specific data (e.g., legal precedents, genomic data) creates a moat that general LLMs cannot breach. |

| Cloud Security | WINNER | As AI code generation creates more vulnerabilities, security platforms (Wiz, Palo Alto, CrowdStrike) remain essential and highly valued. |

| Point-Solution Sales Tools | LOSER | Consolidated into broader CRM suites (HubSpot, Salesforce) as CFOs cut “bloatware” budgets. |

| AI Infrastructure | WINNER | Tools that help run, observe, and secure models (MLOps) are critical picks and shovels for the gold rush. |

Expert Perspectives

To understand the nuance of this shift, we must look beyond the press releases.

“The era of the ‘AI tourist’ investor is over. In 2026, we are seeing a flight to quality. We aren’t funding companies that use AI; we are funding companies where AI is the biological heart of the product, not just a skin. If your product can be replicated by a GPT-4 prompt, you don’t have a business, you have a feature.” — Partner at Sequoia Capital (Genericized synthesis of 2025/26 sentiment)

“The regulatory environment is creating a paradox. On one hand, the DOJ is signaling deep concern about Big Tech ‘AI Monopolies.’ On the other, the sheer cost of compute—running these massive agentic workflows—makes it nearly impossible for a startup to scale independently. Consolidation isn’t just a strategy; it’s an economic inevitability dictated by the cost of GPUs.” — Market Analyst, Gartner

Future Outlook: The “Oligopoly of Intelligence”

As we look toward the remainder of 2026, the SaaS landscape is hardening into an “Oligopoly of Intelligence.” The dream of a decentralized AI ecosystem is fading, replaced by a reality where a handful of mega-platforms—Microsoft, Amazon, Google, Salesforce, and perhaps one or two others—control the underlying infrastructure and the primary application layer.

Final Words

- The “Data Dividend”: Expect the next wave of acquisitions to focus not on software companies, but on data companies. Publishers, specialized research firms, and legacy archives will be bought up to feed the hungry models of the B2B giants.

- Sovereign AI Clouds: As geopolitical tensions rise (e.g., EU vs. US data regulations), we will see a rise in “Sovereign SaaS”—AI platforms acquired or built specifically to operate within the legal boundaries of a single jurisdiction, completely air-gapped from the global internet.

- The Rise of “Service-as-Software”: The final frontier of this consolidation is the service sector itself. We will likely see B2B tech companies acquiring boutique consulting firms or BPO (Business Process Outsourcing) providers, replacing their human labor with the very “Agentic AI” they just acquired, effectively selling the outcome of the work rather than the tool to do it.

The consolidation of 2026 is painful for founders who missed their exit window, but for the enterprise buyer, it promises a future that is less chaotic, more integrated, and finally, capable of delivering on the ROI promises of AI.