Many people worry about the risks of investing in crypto. One fact is that these digital assets are not backed by a government or central bank. This post will guide you on how to manage those risks.

Keep reading to learn more.

Risk #1: Market Volatility

Crypto prices swing wildly in short periods. These swings challenge investors to keep their cool and make smart moves.

Understanding the unpredictable price swings in cryptocurrency.

Digital assets like cryptocurrencies experience big price changes. These swings can happen quickly and without warning. For example, from January 2019 to December 2021, the total market value of cryptos fell by more than 20% on nine different days.

On March 12, 2020, the spot value of digital currencies dropped by 43% due to the COVID-19 pandemic restrictions. However, within 14 months, the market shot up by over 1600%. During this recovery time, prices jumped by more than 10% on seven occasions.

These sudden shifts are because of several factors. Speculation plays a big role. The maturity level of the crypto market also contributes to its instability. Other reasons include challenges with liquidity (how easy it is to buy or sell something without affecting its price), minimal regulation, outside forces like government actions or global events, and advances in technology.

Fear and greed often drive traders’ decisions during these times of uncertainty, leading to significant losses for some while providing huge gains for others.

Strategies to manage volatility and mitigate losses.

Market volatility can pose significant risks for cryptocurrency investors. Here are several actionable strategies to manage this volatility and mitigate potential losses.

- Diversify your portfolio. Spreading investments across various cryptocurrencies reduces the impact of price fluctuations on any single asset. Include larger currencies like Bitcoin and Ether, which typically offer higher liquidity.

- Employ stop-loss orders. This strategy automatically sells your digital assets when they reach a certain price point. It helps limit potential losses during sudden market downturns.

- Conduct regular portfolio rebalancing. Adjusting your investments periodically keeps your asset allocation aligned with your financial goals. This practice ensures you don’t overexpose yourself to volatile markets.

- Understand liquidity risks thoroughly. Knowing how easily you can access funds is crucial in times of market stress. Choose crypto assets with stronger trading volumes, as these generally allow quicker transactions without significant price impacts.

- Break large trades into smaller ones. Executing sizable trades in chunks can help reduce the risk of market manipulation and prevent drastic price swings.

- Stay informed about market trends and news. Monitoring changes in blockchain technology or updates from regulatory bodies increases awareness of factors affecting crypto assets.

- Limit emotional decision-making in trading practices. Staying disciplined helps avoid panic selling during extreme price movements, which can lead to greater losses.

- Set achievable investment goals based on solid research and understanding of cryptocurrencies like non-fungible tokens (NFTs) and decentralized finance (DeFi). A clear strategy provides direction amid volatility.

- Use a secure crypto wallet for transactions and storage purposes, protecting assets against theft or hacks associated with security breaches.

- Educate yourself about common scams such as Ponzi schemes and phishing tactics that target cryptocurrency users, helping you make well-informed decisions while managing the market effectively.

Risk #2: Lack of Regulation

Crypto investments often face uncertainty due to weak regulations. Investors should keep an eye on changes in laws and rules that affect virtual currencies.

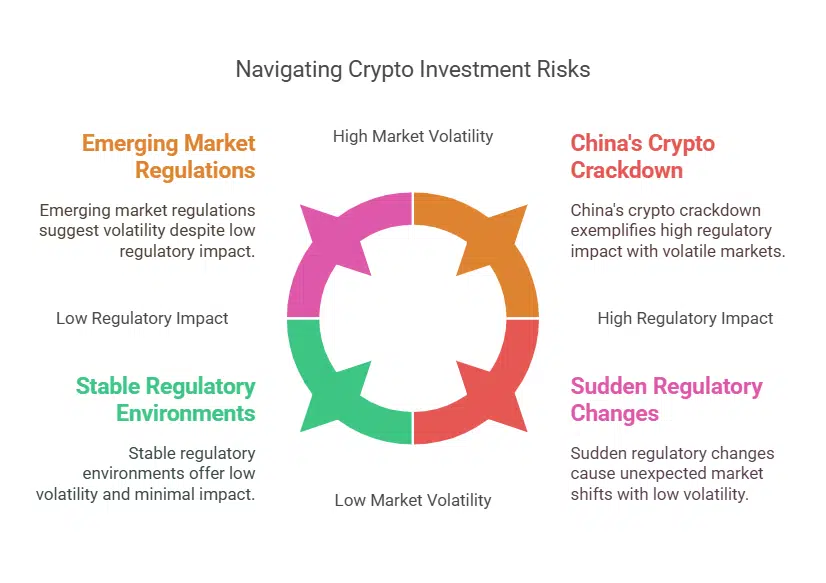

The impact of regulatory uncertainty on crypto investments.

Regulatory uncertainty greatly affects crypto investments. Cryptocurrencies lack backing from any government or central bank, making them riskier. Changes in regulation can lead to abrupt price shifts.

For example, China’s crackdown on cryptocurrency caused panic selling among investors due to concerns about capital flight and environmental impact.

Investors must stay vigilant about global regulations that could influence their holdings. Keeping up with news can help navigate the twists of regulatory risks. Markets in crypto-assets remain volatile as laws evolve, creating both opportunities and threats for those investing in digital assets.

How to stay updated on global and regional regulations.

Staying informed about regulations helps you make better investment decisions in cryptocurrency. Different regions have various rules that can change often.

- Follow reliable news sources. Use trusted websites to get updates on cryptocurrency regulations. Sites like Fidelity.com and Fool.com provide valuable insights into changes affecting digital assets.

- Join online forums and communities. Platforms such as Reddit and Telegram host discussions about regulatory news. Engaging with other investors keeps you aware of global trends.

- Subscribe to newsletters from financial institutions. Many banks and organizations share monthly or weekly updates regarding cryptocurrency laws. These can offer helpful summaries of key changes.

- Monitor government websites regularly. Keep an eye on updates from the U.S. Securities and Exchange Commission (SEC). Their announcements can directly impact your investments in virtual currency.

- Attend webinars or seminars focused on cryptocurrency regulation. These events often feature experts discussing current laws and upcoming changes in blockchain technology.

- Utilize social media for real-time alerts. Twitter accounts of industry leaders or regulatory bodies share timely updates on compliance issues, helping you stay informed about market manipulation or fraud risks.

- Educate yourself through courses related to crypto regulations. Online platforms offer classes that explain federal securities laws and other important topics concerning your investment strategies in decentralized finance (DeFi).

- Follow reputable influencers within the cryptocurrency space for insights on new developments and scams related to Initial Coin Offerings (ICOs). They often give perspectives that help you understand regulatory risks better.

- Participate in discussions within local investment groups or clubs focused on cryptocurrencies, as sharing knowledge with others enhances understanding of legal tender issues across different areas.

- Watch for advisory announcements relating to scams involving virtual currency kiosks or Bitcoin ATMs, as these warnings stem from regulatory bodies committed to investor protection against bad actors in the market.

Risk #3: Scams and Frauds

Scammers target cryptocurrency investors with various schemes. They create fake websites or messages to trick people into giving away their funds. Look out for red flags, such as unrealistic promises or poor grammar in communications.

Protect your digital wallet by using strong passwords and two-factor authentication.

Common cryptocurrency scams and how to identify them.

Many people fall victim to cryptocurrency scams. Understanding these scams helps protect your investment.

- Pump and dump schemes involve artificially inflating a cryptocurrency’s price. Scammers hype up coins to lure investors in, then sell off their holdings, causing prices to plummet.

- Rug pull scams occur when developers abandon a project after attracting investment. They take funds and vanish, leaving investors with worthless assets.

- Romance scams use fake identities on dating sites. Fraudsters build trust and ask for money using cryptocurrencies as the payment method.

- Phishing scams trick users into revealing private keys or passwords. Scammers create spoofed websites or emails that mimic legitimate platforms.

- Business opportunity scams promise unrealistic returns on investments in exchange for upfront fees. These often require investments in dubious projects without proof of legitimacy.

- Fake social media accounts spread misleading information about cryptocurrencies. Always verify claims before acting on them, especially if they promise quick profits.

- Man-in-the-middle attacks happen during transactions when hackers intercept communications between parties. Secure your connections by using trusted networks and encryption techniques.

- ICO fraud involves fraudulent initial coin offerings that lack real projects behind them. Check the development team’s credentials and look for genuine business plans before investing.

- Cryptocurrency exchanges can also be targets for scammers who misuse their platforms to manipulate market value through false trades or misleading information about financial health.

- Vigilance is key in protecting yourself from crypto fraudsters, especially with rising incidents like the FTX collapse in November 2022 due to management missteps.

Tips for protecting yourself from fraudulent schemes.

Fraudulent schemes can be tricky. Protecting yourself is essential in cryptocurrencies. Here are some effective tips.

- Use strong passwords for all your digital wallets and accounts. Combine uppercase letters, lowercase letters, numbers, and symbols to create a secure password.

- Enable two-factor authentication (2FA) on your accounts. This adds an extra layer of security against unauthorized access.

- Research investment opportunities thoroughly before committing any funds. Look for reputable sources of information to avoid falling for crypto scams.

- Be cautious of promises that guarantee high returns on investments. If it sounds too good to be true, it likely is.

- Verify URLs before entering sensitive information online. Always double-check that you’re on the correct website to prevent phishing attacks.

- Use secure and reputable trading platforms when buying or selling cryptocurrencies. Check reviews and ratings from other users before proceeding.

- Keep your private keys confidential at all times. Never share them with anyone or store them online where they can be easily accessed by bad actors.

- Avoid using public Wi-Fi networks for accessing your cryptocurrency accounts or making transactions. These networks can expose you to risks of hacking and fraud.

- Stay updated on emerging threats in cryptocurrency by following trusted financial news sources and blogs focused on blockchain technology and cybersecurity practices.

- Report any suspicious activity immediately to the appropriate authorities or platforms you’re using, such as the U.S. Securities and Exchange Commission (SEC). This helps protect others from potential fraud too.

Following these practices will help shield you from risks associated with cryptocurrency fraud while ensuring that your investments remain secure.

Risk #4: Security Breaches

Security breaches pose real threats to crypto investors. Hackers target digital wallets and exchanges, aiming to steal funds. Use hardware wallets for extra protection against these risks.

Always enable two-factor authentication on your accounts. Stay aware of phishing attempts that can trick you into giving away sensitive information. Take steps now to secure your cryptocurrency assets effectively.

The risks of hacking and losing access to funds.

Cryptocurrencies are vulnerable to hacking. Bad actors can exploit weaknesses in cryptographic systems and gain access to your funds. Losing private keys means you can’t retrieve your digital assets.

This loss is permanent, much like losing a credit card without any way to prove ownership. Major security breaches at exchanges have caused significant financial losses for many investors.

Decentralized finance (DeFi) adds another layer of risk, as it lacks central authority or oversight. Without governing bodies enforcing security audits, cryptocurrencies remain open targets for hackers.

Transactions in this space are irreversible, adding more stress when errors occur. Protecting yourself is essential; using hardware wallets or reputable exchanges bolsters your defenses against these risks.

Best practices for securing your crypto assets.

Securing your crypto assets requires careful attention. Following best practices can protect your investments from threats.

- Use both hot wallets and cold wallets for storing cryptocurrency. Hot wallets allow easy access, while cold wallets provide better security by keeping assets offline.

- Hardware wallets offer the highest level of protection for your digital assets. They store private keys securely, preventing unauthorized access.

- Implement strong passwords across all accounts linked to your cryptocurrency investments. Avoid easily guessed passwords and consider using a password manager for complex combinations.

- Enable two-factor authentication (2FA) on all accounts that deal with crypto transactions. This adds an extra layer of security and helps prevent unauthorized logins.

- Stay cautious of phishing scams that attempt to steal sensitive information. Always verify links and emails before clicking, and ensure software is up to date to protect against vulnerabilities.

- Keep private keys confidential at all times. Never share them online or store them in unsecured locations, as this can lead to potential hacks.

- Diversify your storage methods to manage risk effectively. Spread your assets across different wallets or exchanges, reducing the impact of any single point of failure.

- Regularly check the status of your digital wallet and accounts for unusual activity. Quick response can help mitigate losses if a breach occurs.

- Educate yourself about current threats in the cryptocurrency space, like scams or market manipulation strategies used by bad actors.

- Understand the importance of regulatory risks affecting cryptocurrencies and stay informed about any changes that might impact your investment strategies with tools such as the U.S. Securities and Exchange Commission’s updates or news regarding decentralized finance (DeFi).

Risk #5: Limited Knowledge and Mismanagement

Many investors jump into cryptocurrencies without adequate knowledge. This lack of understanding often leads to mismanagement of funds and missed opportunities in decentralized finance (DeFi).

The dangers of investing without proper understanding.

Investing in cryptocurrencies without proper understanding poses serious dangers. Many new investors jump into the market, lured by promises of quick profits. They fail to grasp that cryptocurrencies are not backed by any government or central bank.

This lack of backing adds an extra layer of risk. Spot trading might seem easy, but it carries significant risks like price volatility.

A limited knowledge base can lead to mismanagement and losses. Without a solid grasp on blockchain technology and digital assets, you may fall prey to scams and bad actors within the industry.

Comprehensive research is crucial for navigating this largely unregulated market. Ignoring these aspects increases investment risk significantly.

Educating yourself and developing a solid risk management plan.

Investing in cryptocurrency requires a solid understanding of its risks. A well-structured risk management plan can help you address the challenges of this market.

- Understand market volatility. Price fluctuations can happen quickly in cryptocurrencies like Bitcoin (BTC) and solana. Recognizing these swings helps you prepare for potential losses.

- Conduct thorough research on regulatory risks. Stay informed about global and regional regulations that affect your investments. Knowledge about regulatory bodies, like the U.S. Securities and Exchange Commission, is vital.

- Identify common crypto scams. Learn how bad actors operate to steal funds from unsuspecting investors. Protect yourself by recognizing signs of fraud early on.

- Secure your digital wallet effectively. Use strong passwords and enable two-factor authentication for added protection against hacking incidents. Keep your private keys safe and never share them with anyone.

- Develop stop-loss strategies for trading risks. Set specific limits to minimize losses during unexpected price dips or spikes in the market value of your assets.

- Educate yourself on decentralized finance (DeFi). Understanding how DeFi platforms work will help you recognize both investment opportunities and associated risks.

- Monitor institutional investment trends closely. Following major financial institutions’ movements can give you insights into cryptocurrency demand and potential price changes.

- Create a diversified portfolio of digital assets rather than putting all funds into one type of cryptocurrency or blockchain technology project to spread risk effectively.

- Stay updated on tax implications related to cryptocurrency investments, including capital gains taxes in your region.

- Seek dependable financial advice when uncertain about making investment decisions in cryptocurrencies or digital wallets.

Takeaways

Many risks come with investing in cryptocurrency. Market volatility can lead to rapid losses. Scams and security breaches threaten your funds, while a lack of regulation adds uncertainty.

Educating yourself about these dangers is crucial. Create a solid plan to manage your investments wisely and protect your digital assets effectively.

FAQs on Risks Of Investing In Crypto And How To Manage Them

1. What are the main risks of investing in cryptocurrencies?

Investing in digital assets like cryptocurrencies comes with several risks, including price volatility, regulatory risks from financial institutions and governments, potential crypto scams by bad actors, and market manipulation.

2. How is blockchain technology related to cryptocurrency investment opportunities?

Blockchain technology forms the backbone of cryptocurrencies. It uses cryptographic techniques to create decentralized finance (DeFi) systems that enable smart contracts and transactions using various digital currencies against traditional ones like the U.S. dollar.

3. Can I lose my investment due to a crypto scam or market manipulation?

Yes, bad actors can use deceptive practices on blockchain networks for money laundering or other illicit activities, leading to the loss of investments stored in your digital wallet. Additionally, these decentralized blockchains may be susceptible to market manipulation affecting the value of your investments.

4. Are there protections available for investors in cryptocurrency markets?

Unlike traditional stock markets protected by organizations such as the Securities Investor Protection Corporation (SIPC), cryptocurrency regulation is still evolving, making it difficult for investor protection against losses from price volatility or fraud involving bitcoins and other digital assets.

5. How can I manage the risks associated with investing in cryptocurrencies?

To manage these risks, you could set stop-loss orders on your investments to limit potential losses due to price volatility; diversify your portfolio across different types of assets; keep up-to-date with regulations impacting cryptos; secure your digital wallets, avoiding scams; and finally, understand all aspects of DeFi systems before investing.