UK-based digital banking giant Revolut, one of the world’s fastest-growing financial technology companies, has officially confirmed plans to apply for a full commercial banking license in South Africa. The move represents the company’s first licensing application in Africa, highlighting the importance of the region to its long-term strategy of becoming a truly global digital bank.

The announcement was made during the opening of Revolut’s new global headquarters in London on 23 September 2025. It forms part of the firm’s larger commitment to expanding into new markets worldwide and reaching 100 million customers by mid-2027, up from its current base of more than 65 million users.

South Africa has been identified as the entry point for Revolut’s African ambitions, chosen for its combination of a diversified economy, advanced financial sector, and growing consumer appetite for digital-first financial services.

Why South Africa Matters

South Africa is one of the most competitive banking markets in the world, dominated by long-established players such as Standard Bank, FirstRand, Absa, Nedbank, and Capitec. Alongside these incumbents, the market has also seen the emergence of digital-only banks like TymeBank, Discovery Bank, and Bank Zero, which have steadily grown their customer bases in recent years.

Revolut’s entry introduces a formidable new challenger. Its mobile-app-based banking model has disrupted traditional systems across Europe, Asia, and the Americas by offering low-cost, transparent, and tech-driven services. Bringing this model to South Africa could intensify competition, potentially lowering fees and improving innovation across the sector.

According to fintech analysts, South Africa also provides a strong regulatory framework through the South African Reserve Bank’s Prudential Authority, which ensures stability while allowing innovation. By applying directly for a full commercial banking license rather than operating under limited permissions, Revolut aims to establish itself as a long-term player in the market from day one.

Services Revolut Could Bring to South Africa

If approved, the banking license would allow Revolut to provide the same wide range of services that it currently offers in other licensed regions. These include:

-

Traditional Banking Products: full checking and savings accounts, lending options, and deposit protection.

-

Payments & Transfers: domestic and international transfers with competitive exchange rates.

-

Cards & Everyday Spending: debit and credit card products linked to the app.

-

Trading Services: access to stock trading and cryptocurrency markets directly through the app.

-

Budgeting & Personal Finance Tools: smart money management features, real-time spending analytics, and subscription controls.

-

Premium Tiers: subscription packages that unlock travel insurance, airport lounge access, and higher withdrawal limits.

Such services could differentiate Revolut from South Africa’s existing digital banks, which are still building their ecosystems, and align with younger, tech-savvy consumers seeking all-in-one financial platforms.

Global Growth Ambitions

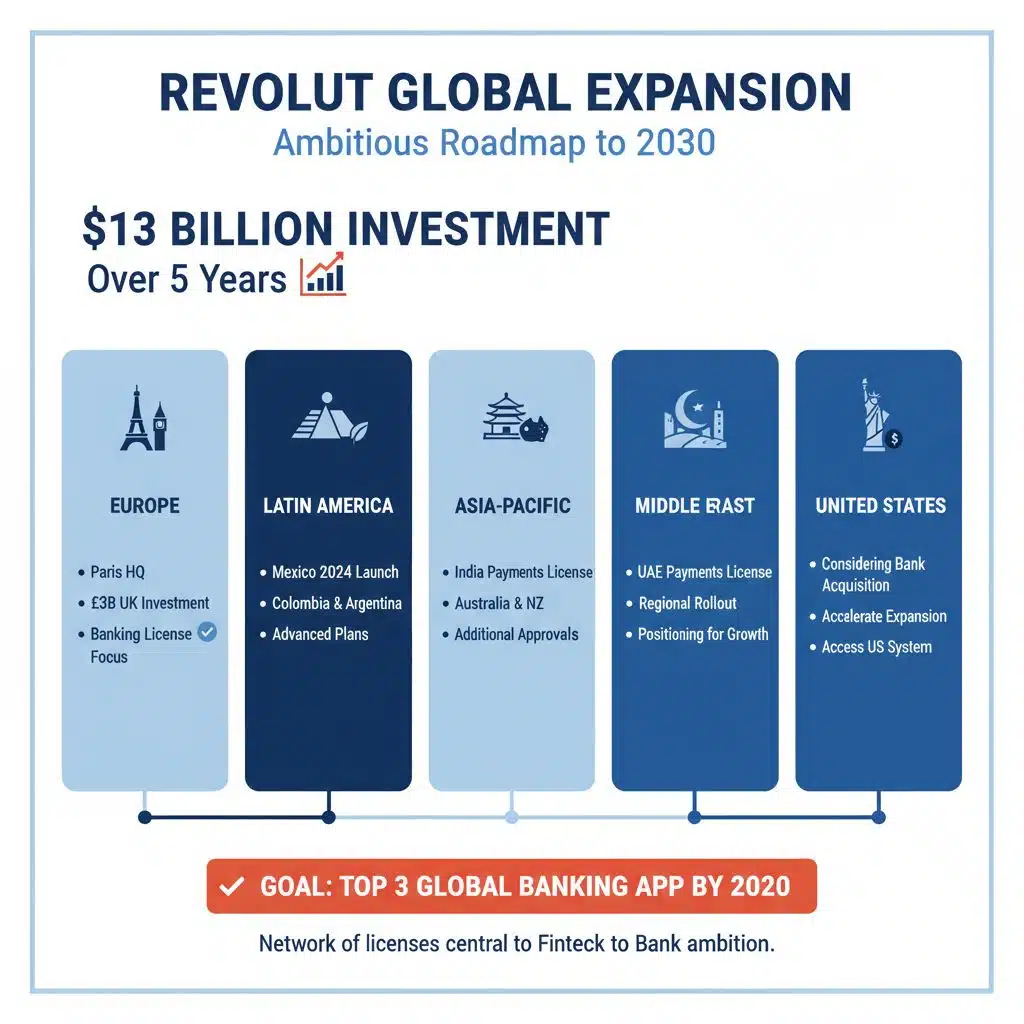

The South Africa plan is just one element of Revolut’s global expansion roadmap. The company has pledged $13 billion in investment over the next five years to support its international growth.

-

Europe: Revolut recently opened a new Western Europe headquarters in Paris and announced a £3 billion UK investment package to prioritize banking license approval in its home market.

-

Latin America: It is preparing to launch banking operations in Mexico next year and has advanced plans to expand into Colombia and Argentina.

-

Asia-Pacific: Revolut has already secured a payments license in India and is working toward additional approvals in Australia and New Zealand.

-

Middle East: The company was recently granted a payments license in the United Arab Emirates, positioning it for further regional rollout.

-

United States: Executives have indicated that Revolut is considering acquiring an American bank to accelerate its expansion and secure access to the U.S. financial system.

This network of licenses is central to Revolut’s ambition of being recognized not just as a fintech app, but as one of the top three global banking apps by 2030.

Challenges Ahead in South Africa

While Revolut’s reputation as a disruptive “neobank” gives it an edge, entering South Africa will not be without challenges:

-

Regulatory Approval – The Prudential Authority enforces strict compliance on capital adequacy, liquidity, and governance. Revolut must meet these standards before being granted a license.

-

Consumer Trust – South Africans are cautious about newer banks, particularly international entrants. Building trust through localized customer service and security assurances will be crucial.

-

Competition – Traditional banks still dominate with deep-rooted customer relationships, while local digital banks are already offering app-driven services tailored to South African needs.

-

Operational Infrastructure – Revolut will need to establish local offices, hire talent, and adapt its app to integrate with South African payment systems.

Successfully addressing these challenges could position Revolut as a serious long-term player, but missteps could hinder adoption.

Broader Implications for Africa

South Africa is just the starting point for Revolut’s African ambitions. If successful, the company is expected to target further expansion across the continent, potentially into markets like Kenya, Nigeria, and Egypt, where mobile banking adoption is already widespread.

By entering Africa with a full license rather than pilot programs, Revolut signals confidence in the continent’s long-term digital banking potential. Analysts suggest this could attract further global fintech players to the region, accelerating innovation in financial inclusion, payments infrastructure, and access to credit.

A Defining Moment for Revolut

Revolut’s decision to pursue a banking license in South Africa highlights both the maturity of the country’s financial sector and the growing importance of Africa in global fintech strategies. With over 65 million customers globally and a target of 100 million within two years, the company is positioning itself as a pioneer among digital banks in new regions.

If its application is approved, South African consumers could benefit from a broader choice of modern, cost-effective, and innovative banking solutions. At the same time, Revolut’s entry would push local incumbents to accelerate digital transformation.

The move underscores Revolut’s ambition to evolve from a European fintech success story into the world’s first truly global bank, reshaping the financial landscape wherever it sets foot.