Regulatory compliance is a growing challenge for financial institutions worldwide. As governments introduce stringent policies to prevent fraud, money laundering, and financial mismanagement, financial organizations must ensure they stay compliant.

However, keeping up with evolving regulations is resource-intensive and complex. Traditional compliance methods often involve manual tracking, reporting, and risk management, leading to inefficiencies and increased operational costs.

This is where RegTech (Regulatory Technology) comes in, providing innovative solutions that streamline compliance, reduce regulatory burdens, and ensure institutions stay ahead of legal requirements.

The rise of AI, blockchain, and data analytics has revolutionized the financial sector’s approach to regulatory challenges.This article explores seven ways RegTech helps financial institutions navigate complex regulations.

We provide real-world examples, industry trends, and key insights to highlight the growing importance of RegTech in the financial ecosystem.

Understanding RegTech and Its Role in Compliance

RegTech, short for Regulatory Technology, refers to the use of cutting-edge technology such as artificial intelligence (AI), machine learning (ML), big data, and blockchain to enhance regulatory compliance processes. It helps financial institutions manage compliance risks, automate reporting, and ensure adherence to regulatory frameworks without excessive manual intervention.

RegTech solutions offer real-time monitoring, automatic fraud detection, and streamlined compliance workflows, enabling financial institutions to meet regulatory demands efficiently.

As global financial regulations become more complex, institutions that adopt RegTech solutions gain a competitive edge by improving risk management and operational efficiency.

Why Financial Institutions Need RegTech

The financial industry operates in a highly regulated environment, and non-compliance can result in severe penalties, reputational damage, and operational disruptions.

The increasing volume of regulatory requirements makes manual compliance processes inefficient.

RegTech offers automation, real-time monitoring, and advanced analytics to help institutions meet compliance demands efficiently and cost-effectively.

| Challenges of Traditional Compliance | How RegTech Solves Them |

| High operational costs | Reduces labor-intensive compliance work through automation |

| Complex and evolving regulations | AI-driven tracking and automatic updates ensure up-to-date compliance |

| High risk of human errors | Machine learning algorithms improve accuracy |

| Slow reporting and decision-making | Real-time data processing speeds up compliance workflows |

7 Ways RegTech Helps Financial Institutions Navigate Complex Regulations

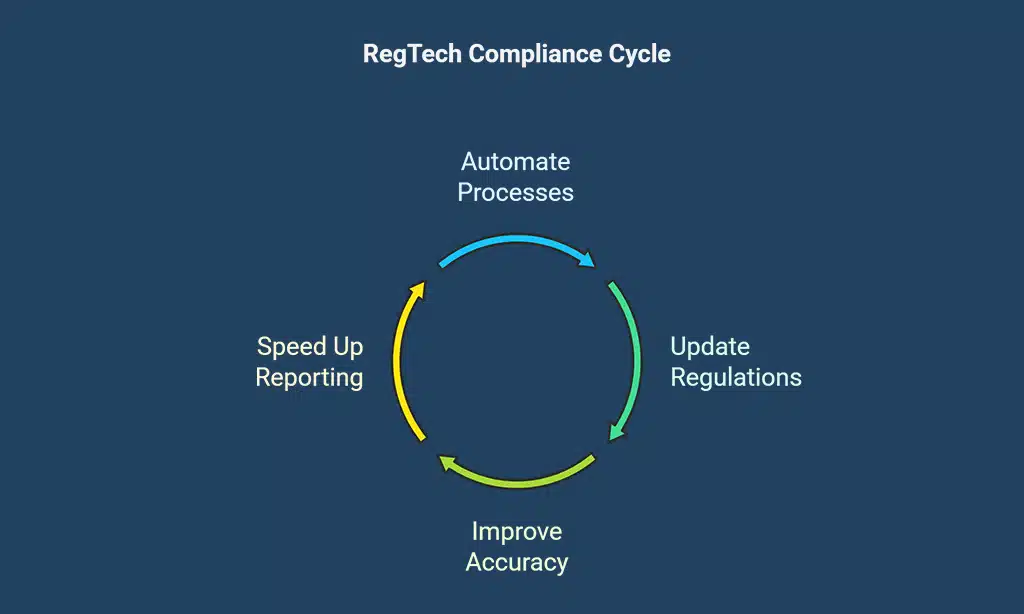

Regulatory compliance in financial institutions is evolving rapidly, and RegTech plays a vital role in streamlining operations.

By leveraging advanced technologies like AI, big data, and automation, financial institutions can navigate complex regulations with ease.

This results in reduced compliance risks, improved efficiency, and lower operational costs.

1. Automating Regulatory Compliance

One of the most significant ways RegTech helps financial institutions navigate complex regulations is through automation.

Compliance tasks, such as transaction monitoring, reporting, and documentation, are traditionally labor-intensive.

RegTech automates these processes using AI-driven solutions that enhance accuracy and efficiency.

Benefits of Compliance Automation:

- Reduces human errors in compliance reporting

- Saves time and operational costs

- Ensures real-time monitoring of transactions

- Improves transparency with regulators

Case Study: A major European bank implemented RegTech for automated compliance, reducing compliance errors by 40% and cutting operational costs by 30%.

| Traditional Compliance | RegTech-Powered Compliance |

| Manual review of transactions | AI-driven automation for faster, error-free reviews |

| Delayed reporting cycles | Real-time, continuous compliance monitoring |

| Labor-intensive compliance teams | Leaner teams with automated tools |

Actionable Tip: Financial institutions should integrate AI-powered RegTech platforms with their existing compliance infrastructure to optimize efficiency and accuracy.

2. Enhancing Risk Management and Fraud Detection

Financial institutions are prime targets for fraudulent activities, making risk management a top priority. With the rise of digital transactions and sophisticated cyber threats, traditional fraud detection methods are no longer sufficient.

RegTech integrates advanced machine learning models to detect suspicious activities, analyze vast datasets in real time, and provide predictive insights into emerging financial crimes.

Additionally, RegTech enables institutions to automate compliance with anti-fraud regulations, reducing manual intervention and improving response times.

How RegTech Improves Risk Management:

- Real-time fraud detection using AI-powered algorithms

- Behavioral analytics to identify unusual transaction patterns

- Risk assessment models that adapt to evolving threats

- Advanced biometrics for secure identity verification

By leveraging RegTech, financial institutions can proactively address fraud risks, ensuring compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

| Risk Factor | How RegTech Mitigates It |

| Fraudulent transactions | AI-driven fraud detection and instant alerts |

| Identity theft | Multi-layered identity verification systems |

| Regulatory breaches | Real-time compliance tracking and automated reporting |

Example: A fintech startup reduced fraudulent transactions by 60% within six months of implementing an AI-powered RegTech solution.

3. Improving Regulatory Reporting Efficiency

Regulatory reporting is a crucial yet time-consuming aspect of compliance. Financial institutions must gather large volumes of data from multiple sources, standardize them according to regulatory requirements, and ensure accuracy before submission.

Traditional reporting processes often involve manual data collection, analysis, and submission, which are prone to errors, delays, and inconsistencies.

Additionally, regulatory frameworks frequently evolve, making it difficult for financial organizations to keep up with compliance standards in real time.

| Traditional Reporting | RegTech-Powered Reporting |

| Manual data entry | Automated data collection |

| Prone to human errors | AI-driven accuracy |

| Time-consuming | Real-time processing |

| Static reports | Dynamic, updated insights |

Best Practice: Financial institutions should invest in cloud-based RegTech solutions that provide automated data validation and real-time reporting to regulatory bodies.

4. Strengthening Identity Verification and KYC Compliance

Know Your Customer (KYC) regulations require financial institutions to verify customer identities to prevent fraud and illicit activities. This process is crucial in mitigating financial crimes such as money laundering and identity theft.

However, traditional KYC methods often involve time-consuming manual verification and paperwork, leading to delays and inefficiencies.

RegTech enhances KYC compliance by leveraging digital identity verification tools, biometric authentication, and blockchain technology.

These technologies enable financial institutions to automate customer verification, improve data accuracy, and enhance security. Additionally, AI-powered risk assessment tools help institutions detect fraudulent activities more effectively and ensure compliance with global regulations.

Key Benefits:

- Automated KYC verification reduces onboarding time

- Biometric authentication enhances security

- Blockchain technology ensures data integrity and minimizes fraud risks

| Traditional KYC Process | RegTech-Enabled KYC |

| Manual document verification | AI-driven, automated verification |

| Risk of identity fraud | Blockchain-backed security measures |

| Lengthy customer onboarding | Faster, more accurate verification |

Example: A multinational bank integrated RegTech for KYC verification, reducing customer onboarding time by 50% while ensuring strict compliance with AML laws.

5. Ensuring Data Security and Privacy Compliance

With growing data protection regulations like GDPR and CCPA, financial institutions must prioritize data security. The increasing volume of digital transactions and sensitive financial data makes cybersecurity a critical concern.

RegTech offers robust solutions for data protection and privacy compliance by utilizing AI-driven security measures, automated encryption protocols, and real-time data breach detection.

Additionally, RegTech helps organizations stay ahead of regulatory updates and ensures compliance with international data protection laws, mitigating the risks of non-compliance penalties.

How RegTech Enhances Data Security:

- End-to-end encryption protects sensitive financial data

- AI-powered data monitoring detects security breaches in real-time

- Secure cloud storage with controlled access ensures regulatory compliance

| Regulatory Requirement | RegTech Solution |

| GDPR-compliant data handling | Automated data encryption & anonymization |

| Secure financial transactions | AI-based fraud detection & monitoring |

| User data privacy compliance | Consent management and audit trails |

Actionable Tip: Financial institutions should deploy RegTech solutions that provide real-time data breach detection and regulatory reporting to ensure compliance with global standards.

6. Facilitating Seamless Regulatory Updates and Adaptation

Regulations are constantly changing, making it difficult for financial institutions to keep up. The increasing complexity of financial regulations across jurisdictions adds another layer of challenge, making compliance a continuous effort.

Without efficient tracking and adaptation mechanisms, organizations risk penalties and operational disruptions.

RegTech provides AI-driven regulatory intelligence tools that monitor, interpret, and implement regulatory updates in real-time.

These solutions utilize machine learning to analyze regulatory documents, compare new regulations against existing compliance frameworks, and provide actionable insights.

This helps financial institutions stay ahead of compliance requirements while reducing the time and effort needed for manual monitoring.

Features of AI-Driven Regulatory Updates:

- Automated alerts for new regulations

- Real-time regulatory tracking across multiple jurisdictions

- AI-driven analysis for compliance adaptation

- Smart reporting tools to highlight actionable insights

| Challenge | How RegTech Helps |

| Keeping up with changing regulations | AI-based tracking ensures real-time updates |

| Manual policy adjustments | Automated compliance modifications |

| Cross-border regulatory complexity | Smart dashboards for global compliance insights |

7. Reducing Compliance Costs and Operational Burdens

Compliance costs can be a significant burden for financial institutions. Beyond direct financial penalties, inefficient compliance processes lead to increased operational expenses, resource allocation challenges, and potential reputational risks.

Regulatory reporting, risk assessment, and manual compliance checks often consume a substantial portion of a company’s budget.

RegTech helps reduce these costs by optimizing compliance processes, reducing manual labor, and improving efficiency.

By leveraging automation, artificial intelligence, and machine learning, RegTech solutions not only enhance accuracy but also significantly cut down on administrative overhead.

Institutions can reallocate resources to higher-value activities, improving overall operational performance while staying compliant with evolving regulations.

- Minimizes regulatory penalties by ensuring real-time compliance tracking.

- Enhances scalability by allowing financial institutions to adapt to evolving regulations efficiently.

| Cost Factor | Traditional Compliance | RegTech-Powered Compliance |

| Staff salaries | High (large compliance teams) | Lower (automation reduces manpower needs) |

| Penalties for non-compliance | High risk | Lower risk with real-time compliance tracking |

| Reporting costs | Expensive manual processing | Cost-effective automated reporting |

Example: A leading investment firm cut compliance costs by 35% after implementing a RegTech-driven automated reporting system.

The Future of RegTech in Financial Compliance

The role of RegTech is expected to expand as financial regulations become more complex. Emerging technologies like AI, blockchain, and big data will further revolutionize compliance processes. Financial institutions that adopt RegTech early will gain a competitive advantage in regulatory adherence, cost reduction, and operational efficiency.

Emerging Trends in RegTech:

- AI-driven regulatory predictions for proactive compliance

- Blockchain for immutable compliance records

- Cloud-based compliance solutions for scalability and accessibility

- Cross-border regulatory harmonization tools to streamline international compliance

Takeaways

Navigating complex regulations is a major challenge for financial institutions, but RegTech provides the tools needed to simplify compliance.

From automating compliance tasks to enhancing risk management and reducing costs, RegTech is transforming the financial industry.

Financial institutions that leverage RegTech solutions benefit from improved accuracy, cost reduction, and a proactive approach to compliance.

As regulatory landscapes continue to evolve, institutions that embrace RegTech will be well-positioned for long-term success.

With increasing regulatory scrutiny, financial institutions should proactively integrate RegTech solutions to remain compliant, reduce operational costs, and stay competitive in the market.

Embracing regulatory technology is not just an option but a necessity for future-proofing financial operations.