You worry that you need too much cash to start a real estate investment. Real estate crowdfunding platforms let people invest with as little as ten dollars. This post shows you how to use these platforms, run due diligence, and build passive income.

Ready to see if it is a boon or a bubble?

Key Takeaways

- Real estate crowdfunding platforms like Fundrise and RealtyMogul let investors join equity, debt, or preferred‐equity deals with as little as $10. Returns typically run 6–8% per year after 1–2% annual management fees and up to 2% exit fees, versus 10–12% for direct property investments.

- Most offerings lock up funds for three to five years and lack deep secondary markets. Illiquidity and surprise fees can trap cash until a sponsor sells or refinances a property.

- Platforms use due diligence software, AI analytics, and real‐time dashboards to vet sponsors, track rent trends, vacancy rates, and file SEC or DFSA disclosures. Transparent exit strategies and audited reports help reduce risks.

- Market swings in 2008 (S&P 500 down 34%) and 2020 (down 20%) show property values can fall sharply. Tenant defaults, vacancy spikes, and maintenance backlogs can cut passive income payments and stall distributions.

- Since 2020, niche eREITs (student housing, retail, medical offices) and institutional capital from pension funds have driven growth. Independent sponsors now launch $10 minimum campaigns on their own portals, cutting fees by 20–50%.

How Real Estate Crowdfunding Platforms Work

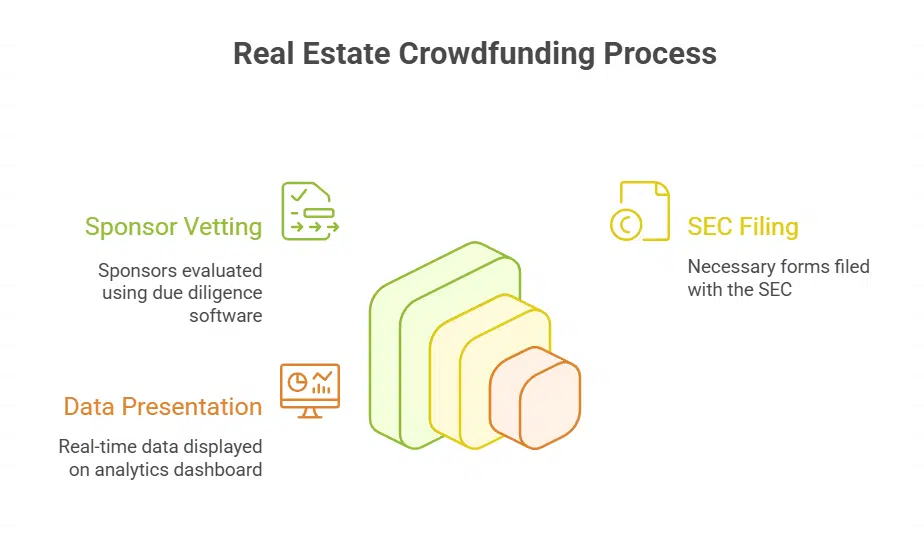

Real estate crowdfunding sites use online portals to pool capital from many investors and fund real estate assets. They vet sponsors with due diligence software, file forms with the SEC, and show you real-time data on an analytics dashboard.

Equity Crowdfunding

Equity crowdfunding lets non-accredited investors buy shares in a rental house or an office tower, pooling as little as $10 in a single holding company. Sponsors pitch deals on licensed portals and file offerings with the commission, so each share acts like a slice of a cash-flow generating property.

Hosts spread out data on projected rental income, cap rate, and exit strategy, giving buyers a peek at real estate returns and property management plans.

Portals gather rent trends, vacancy stats, and market signals to build an empirical view of today’s economy, even running surveys to gauge appetite among high net worth backers. Investors can enjoy passive income, portfolio diversification, and potential capital gains, yet they must brace for illiquidity; shares rarely trade on secondary markets.

Research shows clear factors boost investor willingness, but due diligence remains vital before locking funds in a hard-to-sell equity investment.

Debt Crowdfunding

Debt crowdfunding, a type of real estate crowdfunding, lets investors fund residential mortgages, office buildings or other commercial real estate deals as a group. Platforms pool funds from non-accredited investors and high net worth individuals to back those loans.

Investors earn interest payments each month, similar to bonds. Fees go to fund managers as management fees for loan underwriting and property management. Track record data helps evaluate rate of return and capital appreciation.

Peer to peer lending tools push empirical evidence on risk and return.

You can invest with as little as ten dollars for real estate investments and portfolio diversification. This hands off investment can suit those who seek passive income streams. Illiquidity stands as a major drawback because secondary market options remain scarce.

Due diligence steps, exit strategy planning and legal reviews cut down on surprises. Loans often carry fixed interest rates near bank loan figures. Economic recessions or rental income shortfalls can lead to defaults.

Preferred Equity Crowdfunding

Preferred equity crowdfunding gives investors a senior claim on dividends ahead of common shares. It pools funds through crowdfunding platforms, so non-accredited investors can join property investments with as little as $10.

Investors often lock in annual returns near 8%, blending passive income with capital appreciation. Platforms also manage assets and handle property management tasks, easing the process for hands-off real estate investors.

Lockup periods can last three to five years, so you can’t tap rental income or capital gains early. DFSA or SEC rule changes and platform failures pose real risks to your equity investments.

You can spread risk by picking multiple deals across sectors, from commercial real estate to office buildings. Seek platforms with clear track records, solid due diligence, and defined exit strategies before you invest.

Pros of Real Estate Crowdfunding

Equity-based crowdfunding opens doors for small investors to join office building projects and chase higher internal rate of return. You can track rental income, run due diligence on a slick dashboard, and set up an exit strategy with clear secondary market options.

Accessibility for Small Investors

Small investors can join real estate crowdfunding with as little as ten dollars. Sites like Fundrise and RealtyMogul let non-accredited investors tap rental income and property appreciation.

They pool cash for office buildings and multiunit developments. These ventures yield passive income and portfolio diversification with low entry costs.

These crowdfunding platforms share details on internal rate of return and exit strategy. They tap unmet appetite from high net worth and everyday savers. Crowdfunding sites break capital barriers, deconstruct investment norms and bring real estate returns to more wallets.

Portfolio Diversification

Diversifying a portfolio cuts risk. Real estate crowdfunding lets you spread cash across debt deals, equity stakes, and preferred equity pools. You can back an office tower, a retail strip mall, a multifamily complex, or a student housing project.

Platforms let you join with as little as $10. That opens up deals to non-accredited investors.

Crowdfunding pools resources from many people so you share costs. This mix may balance capital gains, rental income, and passive income. You might book steady rents from a suburban rental, boost returns with a fix-and-flip, and grab long-term growth from commercial real estate.

A lead sponsor handles fund management and property tasks, so you stay hands-off.

Passive Income Opportunities

Crowdfunding platforms let small investors pool as little as $10. They split rental income from office buildings, retail centers or multifamily units, then deliver passive income. The platform hires property managers, tracks leases and maintenance, and sends monthly dividends.

Both non-accredited and accredited investors tap capital appreciation and pay low management fees via an eREIT or equity share.

Debt crowdfunding can pay fixed interest of 5 to 8 percent per year. Equity crowdfunding can offer dividends plus property appreciation over time. A secondary market can help investors cash out early.

These investment vehicles let real estate entrepreneurs fund commercial real estate projects, while investors gain steady rental income without landlord hassles.

Professional Management

Real estate crowdfunding platforms assign a team of vetting experts and property management specialists to each project. They run due diligence, review mortgage loans, pool capital from dozens of investors, and forecast rental income and capital appreciation.

Investors can start with as little as $10 on eREIT funds or investment trusts. This hands-off real estate investment cuts the entry point and opens access to commercial real estate, office buildings, and mixed-use developments.

A dedicated asset manager tracks rental property performance, collects rent, handles maintenance, and reports cash flow. Each monthly update shows real estate returns, vacancy rates, and exit strategy progress.

Non-accredited and accredited investors alike enjoy portfolio diversification and passive income without direct landlord duties.

Transparency in Investments

Platforms show detailed property management, budgets, monthly rental income, and occupancy rates. Websites post appraisal reports and pro forma schedules. They file registration statements with the Securities and Exchange Commission and follow Dubai Financial Services Authority guidelines.

Investors can join offerings through an electronic real estate investment trust fund for as little as $10.

Sites disclose all fees, from management fees to origination costs. They outline loan terms, exit strategy, projected IRR, and cash flow. This openness helps non-accredited investors feel at ease.

It also lets buyers track property appreciation and follow passive income distributions in real time.

Cons of Real Estate Crowdfunding

Real estate crowdfunding can lock up your cash for years, thanks to a liquidity crunch and volatile rental streams that even a blockchain ledger can’t fix. Investors face portal risk and surprise fees from the capital gateway, and they often hand over direct control of property moves, relying on virtual data room reports to track the deal.

Illiquidity of Investments

Illiquidity risks appear when investors cannot exit early. They buy stakes or loans on crowdfunding platforms. Platforms rarely let them trade these items. Investors lock their funds for 3 to 5 years, or until the sponsor sells a property.

Crowdfunding pools capital, but it does not guarantee fast cash.

Some offerings require as little as $10, yet they still tie up every dollar. Property managers may hold rental income, but they cannot return principal until exit. Secondary markets remain scarce for most equity deals or eREITs.

Investors must weigh this lack of liquidity against rental income and capital appreciation.

Platform Risks and Failures

Some crowdfunding platforms collapse if they misjudge risk. A thin secondary market can trap cash, even for a $10 stake. Platforms target high net worth individuals, but a collapse hurts big and small backers alike.

Investors lock funds without an exit strategy. A failed platform can halt distributions and leave renters unpaid. Platforms tap risk assessment models to gather data on the economy.

They seek empirical evidence on rental income trends. Yet a sudden vacancy spike can derail passive income streams. Both accredited and non-accredited investors face these failures.

Analytic dashboards and property management tools can miss hidden fees or miscalculate capital appreciation. High management fees can erode real estate returns. A major platform paused withdrawals in late 2023, citing liquidity shortfalls.

This risk hits even those who diversify across deals. A due diligence checklist for platform financial stability can flag red flags. Investors need to vet balance sheets, not just glossy projections.

Lower Returns Compared to Direct Investments

People can invest with as little as ten dollars on real estate crowdfunding platforms. These sites pool many investors into a single office building or apartment project. Each person splits rental income and capital gains on these assets.

They also pay platform and sponsor charges. Fees can cut net real estate returns to six to eight percent each year. Buyers who own property directly keep all rent and gains.

They often earn ten to twelve percent on similar deals. They set their own management costs and loan terms. Many trade bigger yields for portfolio diversification and passive income.

Accredited investors often choose direct deals for bigger profits.

Lack of Investor Control

Real estate crowdfunding marketplaces let investors pool cash for real estate investment with as little as $10. Project leaders steer property management, rental income strategy and capital improvements.

Investors give up decisions on rehab budgets, tenant screening and exit timing once they sign terms. They rely on investment adviser due diligence and on site performance history.

Secondary markets for equity stakes often lack depth, so investors cannot sell positions fast. Illiquid debt instruments or equity stakes can lock up funds for years. Many marketplaces charge management fees, and hide costs in legal or servicing charges.

Non-accredited and accredited investors alike must accept this setup as they chase passive income and property appreciation.

High Fees and Hidden Costs

Investors face steep real estate crowdfunding fees on most portals. A 1 to 2 percent annual management fee can shred rental income and property appreciation. Sites may bill extra legal costs, due diligence charges, and appraisal fees.

Even a $10 entry point can vanish under multiple layers of small costs.

A secondary market can add a 2 percent exit fee on equity positions. Crowdfunding sites might hit portfolios with transfer costs or refinance charges. Investors see lower real estate returns once they pay taxes on dividends and capital gains tax.

Non-accredited investors must count these hidden expenses before betting on passive income.

Regulatory Uncertainty

Rules around real estate crowdfunding can shift at any time. The Securities and Exchange Commission and DFSA can tweak guidelines overnight. Such tweaks can block non-accredited investors from low-entry deals, some as small as ten dollars.

That move can stall pooled resources that once tapped unmet appetite from high net worth individuals. Platforms use equity crowdfunding, debt crowdfunding, and preferred equity tools to drive passive income and property appreciation.

New rules can stretch exit strategy deadlines and freeze secondary market bids. They can pinch rental income streams and hurt return on investments. Gaps in guidance can also make due diligence more complex for alternative asset class deals.

Fund managers must watch every Federal Register notice and DFSA bulletin.

Key Risks to Consider

Market swings, surprise repair bills, spotty rental checks, shaky platform solvency, and cash-flow gaps in your underwriting model can crash your returns—read on to learn how to shore up your strategy.

Market Volatility

Capital markets can shift fast. The Standard & Poor’s 500 index lost 34% in 2008 and plunged 20% in 2020. Such swings can hammer property values. That drop can sink property appreciation and real estate returns on crowdfunding platforms.

Some sponsors report stalled deals and fewer refinancing options when debt markets freeze.

Many sites let investors start with just $10. They deconstruct projects into small shares. That lack of liquidity traps funds until exit events. You aim for portfolio diversification, but locked positions can magnify losses.

Real estate crowdfunding still offers transparency, but you must weigh rapid market swings.

Unreliable Rental Income Streams

Some crowdfund deals tout stable rental income. Platforms pool resources for real estate investing with as little as $10. Tenant defaults or vacancy spikes often stop distributions.

That holds true in debt or equity structures. Non-accredited investors may wait months for due rental checks. Lack of liquidity on secondary market leaves investors stuck with empty desks, not cash.

Property management services handle maintenance, but backlog or cost overruns can halt your passive income. Missing rent in a downturn cuts real estate returns fast. Excel spreadsheets might flag defaults late.

Crowdfunding sites tap both high net worth and small investors, but some risk models miss local market drops. You need solid due diligence before placing funds in any portfolio.

Maintenance and Vacancy Issues

Properties funded on crowdfunding platforms must stay leased to pay investors. Sponsors hire property managers and use asset management software to handle repairs fast. Crowdfunding platforms let investors put up as little as $10 and share rental income.

Managers track water leaks, door jams, and mechanical breakdowns, then act. Repair delays drain cash reserves and curb capital gains.

Empty units can cut passive income sharply. Projects face vacancy rates near eight percent in some markets. Investors see real estate returns slip when offices or retail units sit idle.

Repair backlogs can freeze the secondary market, leaving investors locked in. Sponsors must fill units fast to protect investor interests and uphold governance.

Platform Financial Stability

Crowdfunding platforms must show steady cash flow over time. Real estate websites like Fundrise or RealtyMogul publish quarterly reports. They need enough capital to cover staff and marketing.

They also deliver passive income streams from rent. Small investors trust platforms that hold reserve funds. DFSA oversees some Dubai sites, while the SEC and FINRA regulate US platforms.

These sites tap both non-accredited investors and high net worth investors.

A platform failure can lock up rental income and capital gains. Members often start with ten-dollar stakes, so a shutdown could freeze hundreds of thousands of dollar pools. Risk hides in off-balance sheet deals and untested loans.

Investors should review audited statements, check compliance records, and track default rates before investing.

Emerging Trends in Real Estate Crowdfunding

Digital funds and yield finders let investors scan deals fast with smart filters. Platforms even use distributed ledger tech under DFSA rules so you can watch real-time stats on each offer.

Growth of Specialized eREITs

Specialized eREITs focus on single sectors like student housing, commercial retail, or medical office buildings. Investors can pool as little as $10 on crowdfunding platforms to fund these niche funds.

Each share grants exposure to property management fees and rental income streams across one asset class.

Niche eREITs expand passive income options and boost portfolio diversification with small stakes. Platforms report a surge in new eREIT launches since 2020, as high net worth individuals and non accredited investors seek alternative investments.

Real estate investment trusts in digital form let many share in asset gains with lower entry points.

Increased Institutional Participation

Big players such as pension funds and insurers now join real estate crowdfunding platforms. They pool capital alongside nonaccredited investors and accredited investors, with stakes starting at $10.

These institutions allocate millions into eREITs, commercial real estate, office buildings, and real estate development projects. They use AI analytics, blockchain tools, and property management teams to speed due diligence.

This move turns crowdfunding into a mainstream alternative.

Major groups pick deals with clear exit strategy and low management fees. They seek steady rental income, capital appreciation, and portfolio diversification. Their bids push up property appreciation and real estate returns.

Platforms now tap unmet appetite from high net worth individuals and large funds. This surge drives long-term growth in passive income markets.

Independent Crowdfunding by Sponsors

Independent sponsors now launch direct real estate crowdfunding campaigns. They set their own terms and gather capital from small and large investors, supporting diversifying investments.

Some deals allow a $10 minimum, so non-accredited investors can join. Sponsors run due diligence on office buildings and apartments. They handle property management and share rental income data.

Sponsors tap into unmet appetite for real estate investment from high net worth individuals and everyday investors. They offer equity or debt shares in commercial real estate, from retail units to multi-family blocks.

Many use their own portals, cutting management fees by 20% to 50%. They aim for steady real estate returns through rental income and property appreciation, with clear exit strategies or a secondary market.

Enhanced Accessibility for All Investors

Some platforms let non-accredited investors start with as little as ten dollars. Real estate crowdfunding pools money from dozens of backers. Investors chase rental income, passive income and property appreciation without buying a whole building.

It simplifies real estate investment. Platforms cut capital barriers from tens of thousands to single digits. They open new avenues for portfolio diversification beyond stocks.

High net worth individuals join alongside beginners. Crowdfunding platforms showcase eREITs and debt offerings in commercial real estate. This setup taps unmet investor appetite for real estate returns.

Users gain empirical data on market trends as they invest.

Advancements in Technology and Analytics

Real estate crowdfunding platforms now use artificial intelligence and predictive analytics to scan thousands of office buildings and retail spaces. Investors see charts on rental income and passive income forecasts.

They can also track projected capital appreciation and exit strategy timelines. Dashboards let non-accredited investors review due diligence in minutes instead of weeks. Developers launch new campaigns with a few clicks.

They tap into demand from high net worth and smaller backers.

Blockchain ledgers track each share and loan, adding a layer of security and transparency. APIs push real time updates to secondary market listings, lowering management fees and boosting liquidity.

Underwriting algorithms learn from past data to flag defaults, cut profit margin risks, and set maintenance budgets for property management. Teams wield portable control panels and internet based analytics to refine offers, making real estate investment a more strategic decision.

How to Choose the Right Platform

Size up the portal team, peek at DFSA filings, and read past deal notes. Then set up a monitoring tool, check rental cash flow, and draft your exit plan.

Evaluate the Team and Sponsors

Check sponsor backgrounds on crowdfunding platforms. Review years in real estate development, count of past deals, and capital gains history. Note sponsors who have managed office buildings and multifamily projects.

Seek teams that register with DFSA or run a reits fund. Look at rental income yields, often 6 to 8 percent, for real estate investment clarity.

Examine property management staff and their hands-off investment approach. Spot sponsors who invest their own capital and pool funds from high net worth individuals and non-accredited investors.

Note platforms that let people start with just $10. Use due diligence and inspect exit strategy and secondary market options. Watch management fees for passive income impact.

Analyze Financial Projections

Investors should review the real estate crowdfunding platform’s cash flow discount model. They load expected rental income, property appreciation rates, exit strategy timelines into a spreadsheet.

Pro forma statements often span five to ten years, with cap rate and management fees built in. A $10 minimum ticket can still show real estate returns from a small entry. Due diligence demands stress tests on vacancy risks, defaulted loans and fee structures.

Analysts may apply XIRR function and Monte Carlo scenario test to gauge upside and down markets.

Review platform track records on rental income streams and property management. Use discounted cash flow formula to compare net present value across deals. Verify each projection for passive income and portfolio diversification benefits.

Run a sensitivity check with varied vacancy rates, maintenance costs and secondary market liquidity. LibreOffice Calc or a Texas Instruments BA II Plus can keep analyses simple. This step builds confidence in your crowdfunding choice.

Review Platform Track Record

Check how many deals each site closed, its win to loss ratio, and exit stats. A solid track record may list 500 projects, steady rental income, and 8% to 12% capital gains. Some platforms let you invest with $10, so non-accredited investors can build passive income and portfolio diversification.

Explore default and delinquency rates next. Use due diligence tools to scan management fees, tax reports, and secondary market listings by property management firms. Watch for DFSA or SEC disclosures, and note any dropped projects or delayed payments.

Pick platforms that show clear profit margins, exit strategy success, and steady real estate returns.

Assess Transparency and Communication

Platforms should post clear reports on rental income and property management fees each month. Dashboards can list total capital pooled and number of backers. Investors can see property appreciation trends.

A solid portal shows capital gains estimates, due diligence checklists, and updates on construction timelines. Sites that allow $10 minimum stakes prove low barriers for non-accredited investors.

The portal must warn about the lack of liquidity in real estate investment shares or loans.

Find published audits by external auditors or DFSA submissions. Portals often share names of top backers, showing appetite from high net worth investors. A team led by seasoned real estate developers or mortgage brokers boosts confidence.

The portal must state exit strategy dates and fund balance sheets. You get email alerts on dividend distributions, vacancy rates, and maintenance costs. Clear talk builds trust and helps you pick the right portal.

Takeaways

This model can bring big gains for small budgets, or snap like a brittle twig when markets shift. Many people treat it like a silent partner in property deals, eager for rental income without the late-night tenant calls.

You can vet sponsors with strict due diligence, then pick a clear exit strategy that fits your goals. Some apps host wealth on shaky platforms, and you might find your funds trapped longer than you planned.

Savvy investors blend this tool with direct stake ownership, and aim for steady growth.

FAQs on Real Estate Crowdfunding Platforms

1. What is real estate crowdfunding and how does it work?

Real estate crowdfunding lets many people pool funds to buy a piece of property. Think of it as a group buying a big pizza. You buy a slice, you share rental income, capital gains, and property appreciation. The deals can cover commercial real estate or home projects.

2. Who can invest in these projects, accredited investors or non-accredited investors?

Some platforms open doors to non-accredited investors with small stakes, others need accredited investors with larger sums. You leverage small sums with the group. Always check the site’s rules before you invest in a real estate investment.

3. What kind of returns and passive income can I expect?

You may earn rental income, passive income, property appreciation, and capital gains. Real estate returns vary, but many projects aim for 6 to 12 percent per year. Past results don’t guarantee future growth.

4. What fees and costs should I watch out for?

Platforms charge management fees for hands-off investment. You may also face property management fees and other expenditure like legal costs. Compare all fees to avoid surprises.

5. How do platforms protect investors and handle due diligence?

Platforms vet each real estate development and real estate developers, check financials, spot non-compliance issues, and follow local rules. They guard your privacy and aim to keep your investment safe.

6. What exit strategy and secondary market options exist?

Each deal spells out an exit strategy, like a five-year hold or sale on a secondary market. You can sell your share if the platform supports resales. This move can help with portfolio diversification.