Many traders feel a knot in their chest when they see a price drop. Big swings in market volatility can fuel that fear. One study found that more than 80 percent of new traders quit in their first year.

This shows that trading psychology truly matters.

In this post, you will learn to build emotional awareness and sharpen your risk management skills. You will see how a simple trading plan and stop loss orders can keep you calm. You will get tips on using a trading journal to spot your triggers.

Keep reading.

Key Takeaways

- More than 80 percent of new traders quit in their first year, showing that trading psychology matters.

- Write a simple trading plan. Include profit targets, max trades, stop-loss orders, and risk per trade.

- Keep a trade journal. Record entry, exit, emotional state, and spot FOMO or revenge-trade patterns.

- Risk just 1 percent of your funds per trade. Use a 1.5 percent stop-loss and a one-to-two risk-reward ratio.

- Build emotional resilience with breathing drills, a fixed 8:30 AM–4:00 PM routine, and a five-trade daily cutoff.

Understanding the Role of Emotions in Trading

Trading stirs deep feelings when market volatility clashes with technical analysis. Fear can nudge you to exit early. Greed pushes you to chase losses or enter riskier investments without proper risk management.

Confirmation bias and sunk cost fallacy cloud judgment and fuel impulsive trades.

You cannot banish emotions from your trading plan, but you can tame them with disciplined position sizing and clear stop-loss orders. Mindfulness and emotional awareness sharpen rational thinking and curb casino mentality and revenge trading.

Behavioral finance shows that a trading journal reveals anxiety spikes and overconfidence bias before you burn through your cash.

The Importance of Developing Emotional Resilience

Emotional resilience acts like a shock absorber in turbulent markets. It guards mental well-being when price swings hit hard. A resilient mind fights emotional impulses such as fear in trading and greed in trading.

It helps traders stick to risk management rules, set stop-loss orders, and make rational decisions. Stress management and coping strategies remain essential to maintain performance and avoid trading addiction.

This kind of mental toughness fuels steady performance across financial markets.

Traders build this skill with mindfulness techniques like meditation, deep breathing. They use a trading journal to track emotional responses to gains and losses. A balanced lifestyle, good sleep, and support networks boost mental resilience.

Peers or mentors can offer a nudge that cuts stress and heightens emotional awareness. Emotional intelligence then strengthens the decision-making process. It keeps a trader centered amid market volatility and frequent losses.

How to Manage Fear and Greed While Trading

Traders spot fear in trading during market volatility. They blame fear that locks them out of good chances and greed that triggers rash bets. They set protective stops to guard against steep drops.

They pick clear risk-reward ratios before each trade. Chart study and lot allocation keep decisions rational. A trade log reveals patterns such as FOMO impulses or revenge trading after a loss.

Breathing drills calm nerves and build emotional awareness. Prospect theory warns that trading after losses can fuel greed and push reckless bets. Adaptive decision-making kicks in when traders pause and check stress signals.

Mindfulness sessions help manage fear in trading and stop FOMO driven orders. You tame fear that holds you back and curb greed that drives you too far.

Building a Disciplined Trading Mindset

A solid routine forces calm in wild market swings. Patience helps you stick to your trading plan and let winners run. Exit triggers guard your cash and curb impulsive bets. Clear position sizing fights the House Money Effect after wins.

Consistent rules sharpen emotional intelligence and smooth decisions. You track moves in a logbook to spot cognitive biases. Simple technical charts guide entry and exit points, trimming stress.

Risk management stays firm when fear or greed nudge your brain.

The Role of a Personalized Trading Plan in Stress-Free Trading

A plan lays out profit targets and risk limits. It lists risk per trade, max trades, and stop-loss orders to shield capital and build emotional awareness. You pick swing, intraday, or position trading, set position sizing and note your strategy.

You use TradingView and backtesting software to test your style. Clear rules help curb impulsive decisions and ease stress during market volatility.

Next you assess your risk tolerance using a simple quiz or chart. Then you set smart financial goals, like three percent max drawdown, to boost rational decision-making under stress.

You write your entry and exit points in an Excel sheet or journal. You review your plan after a losing streak to spot weak rules. Firm rules keep you on track during wild market swings.

Strategies for Creating a Healthy Trading Routine

Good routines keep traders calm. They cut stress and boost performance.

- Set your trading session in a calendar, start at 8:30 AM and end by 4:00 PM, to build a steady schedule.

- Run a chart scan on your platform, note market trends and volatility with technical analysis, write a brief plan and set stop-loss orders for risk management.

- Stop at least once an hour, walk or stretch, clear mental clutter, to fight fatigue.

- Record nightly sleep hours, log exercise reps, meal types, keep a water bottle near your monitor to fuel focus.

- Launch a breathing exercise or meditation app for five minutes, curb racing thoughts before making decisions.

- Log each buy or sell in a journal or spreadsheet, track emotional triggers, position size and profit or loss.

- Check in with a trading buddy, coach, or forum, share challenges and boost emotional resilience through support.

Recognizing and Avoiding Overtrading

Too many trades in one session often lead to exhaustion and rash decisions. Ignoring stop-loss orders spikes risk and drains capital fast. Analysis paralysis from endless research can push traders to overtrade just to make up for lost time.

Overconfidence bias tricks people into chasing losses or jumping the gun on profit-taking.

Set a cutoff, like five trades per day, and obey it to curb impulsive moves. Use position sizing and risk-management rules to guard against wild swings in market volatility. Keep a trading journal to track emotional biases and FOMO patterns.

Patient traders gain more than those who chase every chart flicker.

Coping with Losses: Developing a Positive Mindset Toward Failure

Losses spark fear, frustration, regret, and anxiety. Regret theory notes that regret often drives traders toward revenge trading or chasing losses. Good traders see each loss as a lesson.

They treat the slip as data, not a verdict. This shift feeds a growth mindset, and eases emotional waves. They lean on self-compassion to tame the harsh inner critic. It cuts the sting of a bad trade.

It boosts emotional awareness and regulation. It builds trading psychology muscle over time.

A brief pause after a red day helps clear the mind. A trader can step back, grab a cup of coffee, or take a walk. These small breaks reset stress levels and improve decision-making.

Seeking a mentor or therapist brings fresh perspective. They can spot blind spots in your trading plan. A quick review of entries and position sizing spots weaknesses. You can adjust stop-loss orders or risk management rules.

A simple logbook helps catch emotional triggers. It becomes a guide to smarter, calmer trades.

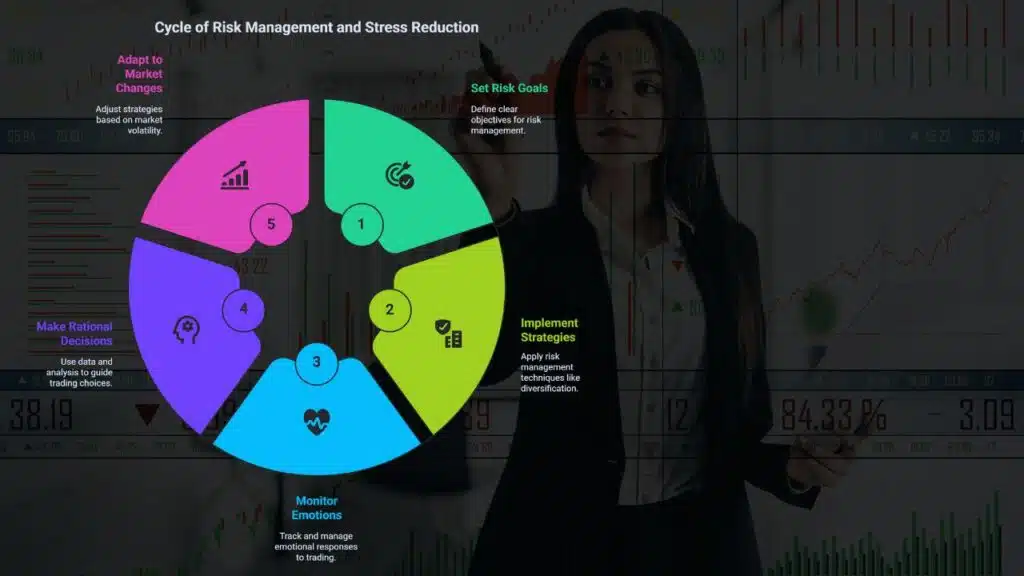

The Connection Between Risk Management and Stress Reduction

Good risk management acts like a seat belt. Trade size at one percent of your funds keeps risk low. A stop-loss at one and a half percent loss caps damage. A one to two risk-reward ratio guides each entry.

Spreading money across stocks, bonds and gold adds protection. Adding a simple option hedge guards your downside. Tame emotional impulses with these moves. Fear in trading falls and greed shrinks.

Clear risk goals calm stress in a wild market. A trading journal holds your plans and feelings. Traders tap trading psychology with each entry. Each move earns a log and a note on emotional triggers.

Charts and metrics help you make rational decisions. Position size and stop orders adapt as market volatility shifts. This habit eases tight muscles and shaky hands. It shields your mind during price chaos.

Using a Trading Journal to Identify Emotional Patterns

A trader logs every move in a journal after each trade. The record notes emotional state, trade rationale, entry and exit points. Analysis reveals emotional triggers behind greedy moves or panicked exits.

This practice also reveals confirmation bias or availability bias sneaking into decisions. Candlestick charts, from Technical Analysis, blend with personal notes to show links between market volatility and emotional impulses.

Review sessions boost emotional intelligence, deepen trading psychology awareness, and sharpen risk management skills.

Logging both losses and wins uncovers revenge trading or sunk cost fallacy. You can note whether a stop-loss order helped curb losses or if emotions overrode a plan. Journals let you spot overconfidence bias before it costs too much.

Overcoming FOMO (Fear of Missing Out) in Trading

Crowd panic over a hot stock pushes many into panic buys. FOMO, fear of missing out, drives rash, impulsive moves. It strains trading psychology in financial markets. People ignore chart study and skip safety triggers.

They follow herd instinct instead of rational decision-making.

Mindful traders use a playbook and set strict entry and exit points. A logbook reveals past panic buys and bad patterns. Playbook rules tie to risk management, with clear position sizing.

Emotional awareness fights regret avoidance and rash orders. Long-term goals keep focus off short swings and wild market volatility.

Tips for Maintaining Focus and Motivation in Your Trading Journey

Focus fuels disciplined trading. A simple routine cuts stress and boosts motivation.

- Set clear profit targets and risk thresholds. It uses measurable goals to keep you on track.

- Write a trading plan covering entry and exit points, stop-loss orders, position sizing, and risk management.

- Keep a trade log that captures charting software snapshots, emotional reactions, and decision-making steps.

- Review performance data every week to spot market volatility patterns and fix confirmation bias.

- Build daily habits with time blocks for screen review, exercise breaks, and a balanced diet to sharpen focus.

- Join a peer group or find a mentor for emotional support, accountability, and market insight.

- Focus on skill building by mastering technical indicators, pattern recognition, and rational decision-making.

- Use stop-loss orders and precise position sizing to limit drawdowns and curb revenge trading.

- Run timed sessions with a timer app and clear screens to avoid emotional impulses.

- Celebrate each disciplined move to reward patience, not profits, and weaken greed in trading.

How to Stay Detached from Market Volatility

Market swings test emotion. Behavioral finance shows biases drive rash moves. Traders use moving averages, Bollinger Bands and other technical indicators to spot trends and to detach from sudden Black Swan shocks.

A trading plan helps them resist daily noise. Mass psychology can spark panic, yet a clear roadmap blocks herd instincts.

Mindful breathing halts stress spikes. A trailing stop, a stop-loss order type, limits losses in real time. Diversification, such as mixing stocks and bonds, cuts risk and fits risk management.

A logbook shows emotional triggers and curbs revenge trading. Rational decision-making beats impulse during volatility.

Takeaways

Your mind shapes every trade, like a captain steering a ship. You learn to spot confirmation bias. Stop-loss orders catch your worst moves. Emotional intelligence guides each decision.

You now trade with calm focus.

FAQs

1. What is trading psychology?

Trading psychology is the study of the trader mind. It shows how emotions shape moves in financial markets. It covers fear, greed, and biases in decision making. It links investor behavior to results.

2. How do I handle fear in trading?

Fear in trading pops up when you worry about losses. Spot emotional triggers and use a trading plan. Add stop-loss orders, stick to it like glue. This tames fear of missing out and revenge trading urges.

3. What is risk management and why is it key?

Risk management means protecting your cash like a castle wall. Use position sizing and stop-loss orders. Set safe rules for derivatives and riskier financial instruments. Then market swings do not break your bank.

4. How can I deal with market volatility?

Market volatility can feel like a roller coaster, it flips prices fast. Use technical analysis to find entry and exit points. Follow your trading rules. Patience in trading stops impulsive decisions during swings.

5. Why should I keep a trading journal?

A trading journal logs each trade, it notes why you bought or sold. It shows patterns in cognitive biases, like confirmation bias or anchoring bias. It helps you solve mistakes and grow.

6. How does emotional intelligence improve my trading?

Emotional intelligence, self aware and calm, slashes stress. It builds psychological resilience. You spot greed in trading, avoid chasing losses. It lifts trading performance and mental wellness.