In the high-stakes economy of 2026, securing a Plan B Passport is the single most effective strategy to protect your capital from the “silent thief” of inflation. For decades, investors relied on the traditional 60/40 stock-and-bond portfolio to outpace currency devaluation, but that rulebook has been effectively shredded. Today, persistent fiscal dominance and unprecedented global debt are driving a roaring engine of wealth destruction that standard markets simply cannot outrun.

Investors waking up to this new reality are realizing a critical truth: their greatest vulnerability isn’t market volatility; it is their singular dependence on one government, one currency, and one jurisdiction. If your entire financial existence is tethered to a single nation drowning in debt, you are not diversified, you are exposed.

The Strategic Shift: From Travel Document to Financial Derivative

Once viewed merely as a lifestyle accessory for skipping airport queues, the second citizenship market has undergone a radical transformation. In 2026, wealth advisors and forward-thinking High Net Worth Individuals (HNWIs) no longer classify a second passport under “leisure”; it falls squarely under “sovereign insurance” and “hard asset allocation.”

The thesis for this shift is stark but undeniable. In an era where governments are forced to choose between defaulting on their obligations or inflating away their debt, they are unanimously choosing inflation. A Citizenship by Investment (CBI) program acts as a sophisticated financial derivative. It is the only asset class designed to allow you to legally divorce your accumulated wealth from the monetary policy of a failing state. By providing access to alternate banking systems, tax-neutral jurisdictions, and non-correlated real estate markets, a second passport provides the ultimate hedge against sovereign risk.

The Macro Argument: Why Traditional Hedges are Failing

To understand why a second citizenship is necessary today, we must first appreciate why traditional inflation hedges are failing in the 2026 context.

Historically, investors turned to government bonds as the “risk-free” bedrock of their portfolios. However, in an environment characterized by fiscal dominance, where central banks are forced to keep interest rates artificially low to ensure governments can afford to service their massive debts, bonds offer “return-free risk.” When real inflation is running at 6% or 7%, holding a bond paying 4% guarantees a loss of purchasing power. You are effectively paying the government to hold your money while they debase it.

Furthermore, we are seeing a marked rise in what financial experts term “financial repression.” As Western nations grapple with unsustainable debt-to-GDP ratios, the temptation to implement forms of capital control grows stronger. We are already seeing tighter regulations, aggressive “wealth taxes,” and increasing friction moving significant capital across borders. This creates a sense of financial claustrophobia. If your capital is trapped within a jurisdiction implementing aggressive taxation to combat its own inflationary policies, your wealth is a sitting duck.

The ultimate macro argument for the Plan B passport is the realization of “sovereign risk hedging.” Just as you wouldn’t put 100% of your retirement savings into a single volatile tech stock, you shouldn’t bet your entire life’s work on the continued stability of a single sovereign entity. A second citizenship is a non-correlated asset. Its value, the ability to exit a deteriorating situation, access alternate banking systems, and relocate your tax residence, often increases precisely when your home country’s economy and currency are declining. It is the ultimate insurance policy against your own government’s mismanagement.

Mechanism: How a Passport Hedges Inflation

A Plan B passport is not an abstract concept; it is a practical toolkit for wealth preservation. It functions as an inflation hedge through three primary mechanisms: currency arbitrage, tax arbitrage, and hard asset allocation.

1. Currency and Banking Arbitrage

Inflation is essentially a currency crisis. It is the loss of faith in a unit of account. If you hold a Tier A passport (like US, UK, Canadian, or German), you often face significant friction when trying to open bank accounts in robust, non-Western financial centers like Singapore, the UAE, or Switzerland. Regulations like FATCA (in the US case) and aggressive OECD reporting standards make HNWIs “toxic clients” for many foreign banks due to compliance costs.

A Plan B passport from a neutral jurisdiction (such as St. Kitts & Nevis or Antigua) can significantly lower this drawbridge. It allows the investor to engage in jurisdictional arbitrage, opening accounts and holding assets in jurisdictions that are not actively debasing their currency to fund deficits. It facilitates holding wealth in stronger currencies, precious metals vaults, or decentralized financial instruments outside the immediate reach of your home country’s struggling banking system. It is a key tool in the growing trend of “de-dollarization” among private investors seeking shelter from the weaponization of finance.

2. Tax Arbitrage: The Real Return Booster

Inflation is a hidden tax, but governments often compound it with explicit taxes to try to curb demand or service debt. In high-inflation environments, “bracket creep” pushes earners into higher tax brackets even though their real income hasn’t risen. Furthermore, governments desperate for revenue often turn to aggressive capital gains taxes and wealth levies.

Many premier Citizenship by Investment jurisdictions operate on entirely different fiscal models. Countries like Antigua & Barbuda, St. Kitts & Nevis, or residents of the UAE often enjoy zero capital gains tax, zero inheritance tax, and zero tax on worldwide income for non-residents.

Consider the math in 2026: If inflation is at 8%, and your home country taxes your investment gains at 30%, you need an astronomical gross return just to break even in real terms. By legally shifting your tax residency utilizing a Plan B infrastructure to a zero-tax jurisdiction, that 30% saving immediately becomes retained wealth that outpaces inflation. In a high-tax, high-inflation world, tax neutrality is the single highest-yielding “investment” you can make.

3. Real Estate as a “Hard” Asset Allocation

Many of the most popular wealth preservation passport programs, particularly in the Caribbean and parts of Southern Europe, require a qualifying investment in government-approved real estate.

This forces an allocation into a “hard asset.” Unlike fiat currency held in a savings account, which is guaranteed to lose value daily due to inflation, real estate has historically acted as a strong inflation hedge. As construction costs rise (materials and labor), replacement values increase, pushing up existing property prices. Furthermore, these investment properties, often luxury resorts or villas, generate rental yields, frequently in stable currencies pegged to the US Dollar or Euro.

You are not just buying a paper document; you are exchanging depreciating cash for equity in tangible property in a growing tourism economy, with the passport serving as an incredibly valuable “dividend.”

Traditional vs. Plan B Wealth Preservation [2026 View]

| Feature | Traditional Strategy (Single Citizenship) | The “Plan B” Strategy (Dual Citizenship) |

| Inflation Defense | Hope stocks outpace CPI; hold losing bonds. | Hold hard assets (real estate) and diversify currency exposure globally. |

| Tax Efficiency | Vulnerable to rising local taxes and “wealth levies.” | Access to 0% tax jurisdictions and lawful tax optimization. |

| Banking Access | Restricted by home-country regulations and compliance friction. | Broader access to international banking hubs (Singapore, UAE, Switzerland). |

| Mobility | Dependent on one government’s diplomatic standing. | Global visa-free access; ability to relocate immediately during crises. |

| Asset Class Type | Correlated Financial Assets. | Non-Correlated Sovereign Insurance. |

The “Great Repricing”: The 2026 Market Landscape

If you are researching this topic in 2026, you must understand that the landscape has shifted dramatically over the last 24 months. We have witnessed the “Great Repricing” of second citizenship, a phenomenon driven by intense geopolitical pressure and surging global demand.

The Caribbean Consolidation

The era of the sub-$150,000 Caribbean passport is effectively over. In a historic move formalized throughout 2024 and fully implemented by 2025, the “Caribbean Five” (St. Kitts & Nevis, Antigua & Barbuda, Grenada, Dominica, and St. Lucia) signed a Memorandum of Agreement (MoA) to standardize regulations, enhance due diligence, and crucially, set a higher price floor on investments.

Under pressure from the EU and the US to ensure the integrity of their visa-free treaties, these nations significantly raised their entry thresholds. For example, St. Kitts & Nevis, the platinum standard of CBI, doubled its minimum donation requirement.

While some investors balk at the higher costs, savvy wealth managers view this as a positive development for wealth preservation. The repricing has eliminated the “race to the bottom,” ensuring these programs remain sustainable and reputable. A more expensive passport, backed by rigorous due diligence, is a more secure asset with a lower risk of losing its crucial visa-free travel privileges in Europe.

The End of “Easy” Europe

Simultaneously, Europe has largely closed its doors to passive real estate investors seeking residency or citizenship.

- Portugal: The immensely popular Golden Visa program removed real estate investment as a qualifying route, pushing investors toward higher-risk venture capital funds (€500,000 minimum).

- Spain: Following suit to combat local housing inflation, Spain moved to eliminate its real estate Golden Visa route.

- Greece: While still open, Greece raised the minimum investment threshold in prime areas (like Athens and popular islands) to €800,000, making it a significant capital commitment.

The takeaway for 2026 is clear: Scarcity has arrived. The window to acquire these assets is not closing, but the entry price for quality sovereign insurance is rising rapidly. Waiting has already cost hesitant investors hundreds of thousands of dollars.

The Great Repricing: CBI Cost Comparison [Approximate Figures]

| Jurisdiction | Typical Minimum Investment (c. 2023) | Typical Minimum Investment (2026) | Trend Analysis |

| St. Kitts & Nevis (Donation) | $125,000 – $150,000 | $250,000+ | Focus on premium exclusivity and reputation. |

| Antigua & Barbuda (Donation) | $100,000 | $200,000+ (aligned via MoA) | Increased standardization across the region. |

| Grenada (Real Estate) | $220,000 (Share) | $270,000 – $350,000+ | Higher real estate values reflect inflation. |

| Portugal Golden Visa | €280k – €500k (Real Estate) | €500,000 (Investment Funds Only) | Shift from passive property to active financial risk. |

Strategic Options for the Inflation-Wary Investor

In 2026, there is no “one-size-fits-all” Plan B. Investors must choose a pathway that aligns with their liquidity needs, risk tolerance, and ultimate wealth preservation goals. Here are the three primary strategies employed today.

Option A: The “Fiat Hedge” [The Donation Route]

This is the most direct pathway, favored by those who value speed and simplicity over asset accumulation. You make a non-refundable contribution to a sovereign government’s national development fund.

- The Strategy: You are taking a depreciating fiat currency (like USD or Euros), which you know is losing purchasing power annually, and exchanging it once for a permanent, non-inflatable asset: citizenship for life for you and your family. It is an immediate lock-in of value.

- Best Jurisdictions (2026): St. Kitts & Nevis remains the premier choice for speed and reputation, despite the higher price tag. Antigua & Barbuda offers excellent value, particularly for larger families looking to hedge collectively.

Option B: The “Tangible Hedge” [The Real Estate Route]

This route is preferred by investors who dislike the idea of a “sunk cost” donation and prefer their inflation hedge to be backed by dirt and mortar.

- The Strategy: You invest in government-approved luxury resorts or high-end properties. You must hold the asset for a statutory period (usually 5-7 years). During this time, you often receive rental yield, and at the end of the holding period, you are permitted to sell the property to recover your capital, while keeping your citizenship forever. In a high-inflation decade, holding a hard asset that appreciates in nominal terms is a far better store of value than cash in a bank.

- Best Jurisdictions (2026): Grenada is highly sought after because its real estate market is robust, and it offers the unique “E-2 Bridge” (see below). Look for developers offering guaranteed buy-back options after the holding period, providing a clear exit strategy for your capital.

Option C: The “E-2 Bridge” Route [Market Access]

This is a niche but powerful strategy for those whose wealth preservation depends on accessing the world’s largest consumer market, the USA, without incurring worldwide US taxation.

- The Strategy: Citizens of certain countries hold treaties with the US, allowing them to apply for an E-2 Investor Visa. This is a non-immigrant visa that allows you to live and run a business in the US, but crucially, if managed correctly, avoids triggering global US tax residency (unlike a Green Card).

- Best Jurisdictions (2026): Grenada and Turkey are the primary CBI nations possessing this treaty. Investors acquire Grenadian citizenship first, then use that passport to apply for the US E-2 visa, creating a powerful transatlantic business and lifestyle bridge.

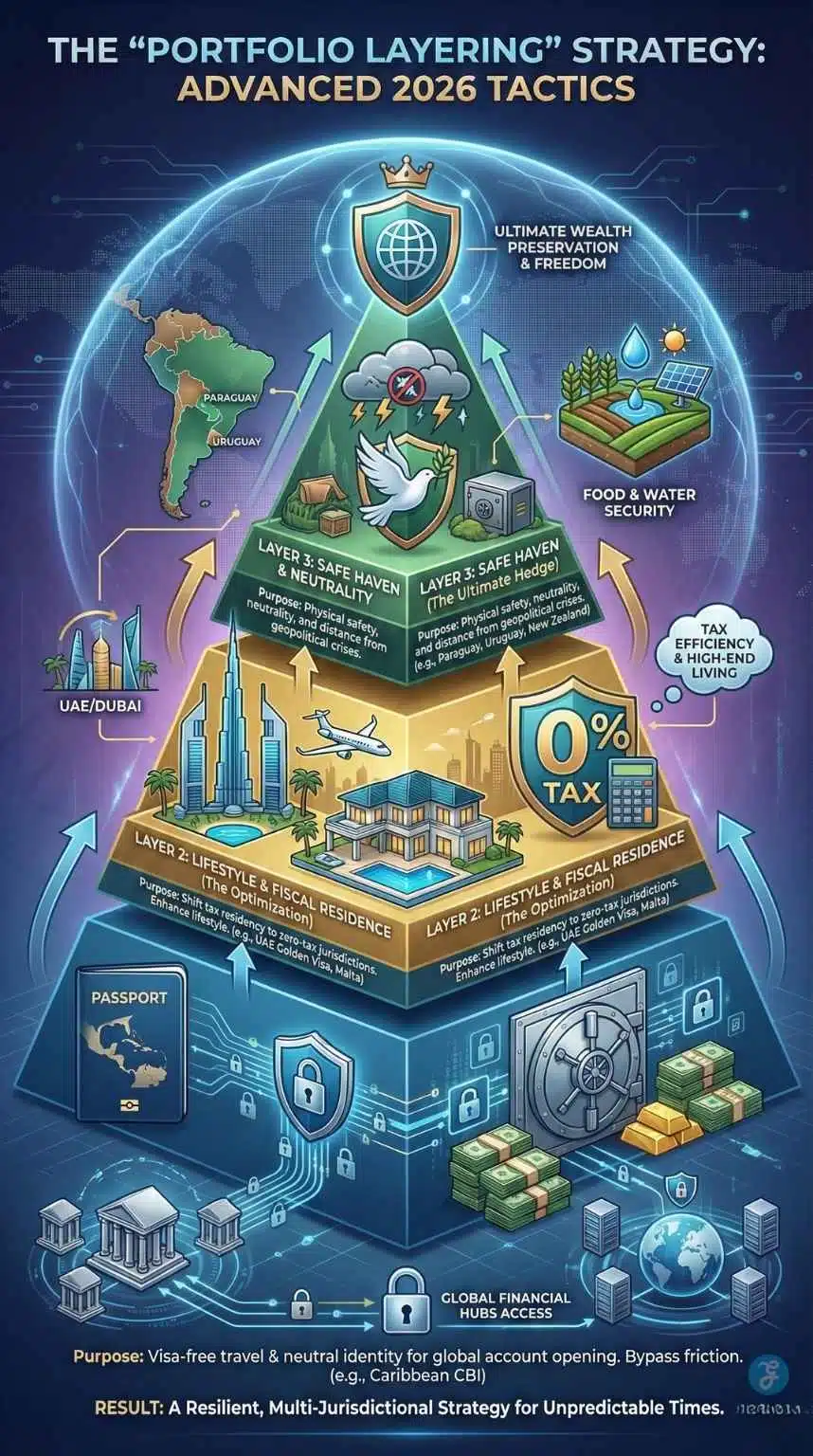

The “Portfolio Layering” Strategy: Advanced 2026 Tactics

The most sophisticated HNWIs in 2026 have moved beyond the simplistic idea of just “getting a second passport.” They are engaging in “Portfolio Layering,” stacking different citizenships and residencies like layers of clothing to handle varied economic weather conditions.

A robust sovereign insurance stack might look like this:

- Layer 1: The Banking & Asset Protection Layer. This is typically a fast, reputable Caribbean citizenship (like St. Kitts or Antigua). Its primary function is not necessarily for living there, but to provide the travel document and neutral identity needed to open accounts in global financial hubs outside your home country’s immediate jurisdiction.

- Layer 2: The Lifestyle & Fiscal Residence Layer. This is where you actually spend time to optimize your tax status. In 2026, the UAE (Dubai Golden Visa) remains unparalleled here. By coupling a Caribbean passport with Dubai residency, an investor can achieve a high-quality, zero-tax lifestyle in a global metropolis highly connected to Asia and Europe.

- Layer 3: The “Safe Haven” Layer. This is the ultimate “break glass in case of emergency” option. These are often residencies in nations with high food and water security, geopolitical neutrality, and physical distance from major conflict zones. Countries like Paraguay or Uruguay in South America are increasingly popular for this layer, offering simple residency processes and a secure physical retreat if Western Europe or North America face severe crises.

The Sovereign Insurance Stack [Portfolio Layering]

| Layer Level | Purpose | Primary Benefit | Popular Examples (2026) |

| Foundation (Layer 1) | Banking Identity & Travel | Visa-free Schengen/UK access; bypass banking friction. | St. Kitts & Nevis, Antigua & Barbuda |

| Mid-Tier (Layer 2) | Tax Residence & Lifestyle | 0% global taxation; high-end living standards. | UAE (Dubai Golden Visa), Malta (Residency) |

| Top-Tier (Layer 3) | Physical Safety & Neutrality | Food/water security; distance from geopolitical flashpoints. | Uruguay, Paraguay, New Zealand (if accessible) |

Risks and Due Diligence in the New Era

While the benefits are immense, the path to a Plan B passport is fraught with pitfalls for the uneducated investor. The surge in demand has inevitably attracted bad actors.

The most critical risk in 2026 is the allure of the “grey market” or “under-the-table” passport offerings. Promoters might offer cheap, fast paths to citizenship in nations that do not have official CBI laws (e.g., certain Latin American or Asian nations through dubious connections). These are not inflation hedges; they are legal time bombs. These passports can be revoked instantly with a change of government, leading to a total loss of capital and potential legal jeopardy.

Furthermore, investors must understand the liquidity constraints of the real estate route. Your capital is illiquid for a mandatory 5 to 7-year holding period. While this acts as a forced savings mechanism against inflation, it means that capital is not available for immediate emergencies.

Therefore, due diligence is paramount. Success in this arena requires working with government-licensed agents and focusing only on established, legally enshrined programs that have weathered international scrutiny. In the high-stakes world of sovereign risk hedging, cheap is always expensive in the long run.

Final Thought: The Ultimate Cost of Inaction

As we navigate the financial realities of 2026, one truth has become abundantly clear: inflation is not an accident of the market; it is a policy choice of indebted governments. It is a slow-motion confiscation of wealth from savers to debtors.

Remaining solely dependent on a single citizenship is akin to remaining on a sinking ship because you believe the captain will fix the leak, even as the water rises past your ankles. The “Plan B” passport has transcended its former status as a Jetset accessory to become an essential pillar of modern wealth preservation. It is the only asset that simultaneously protects your freedom of movement, your financial privacy, and the real value of the legacy you have built.

The pricing shifts of the last two years have taught a brutal lesson: the cost of sovereign insurance only moves in one direction. The best time to secure your Plan B was before the “Great Repricing.” The second-best time is immediately, before the doors narrow further.