If you are asking who cancelled more shows in 2025, you are really asking two questions at once. First, which streamer cut the most titles by raw volume? Second, which streamer made the most painful cuts for viewers who wanted long, multi-season stories?

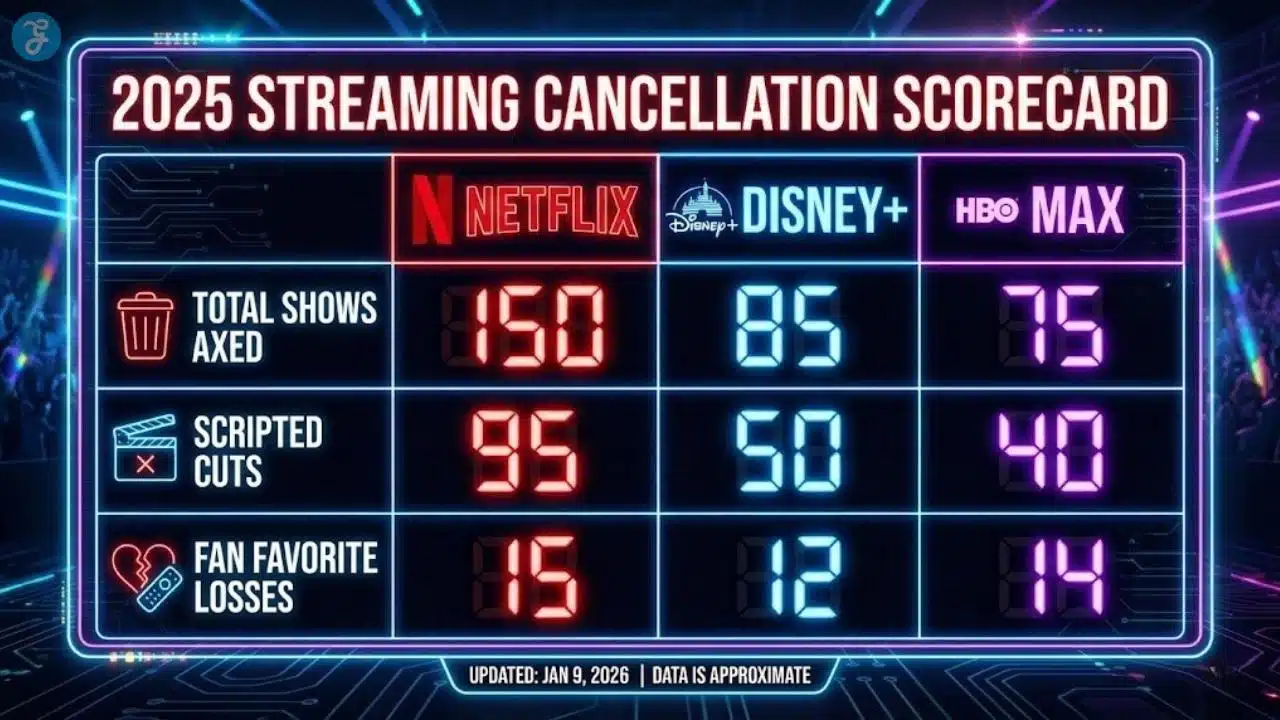

Here’s Netflix Vs. Disney+ Vs. Max. In most practical comparisons, Netflix comes out on top for total cancellations in 2025. Netflix releases far more series across more formats and regions, and that high output creates a higher churn rate. Disney+ and Max cancelled fewer shows overall, but their cancellations often felt sharper because they run smaller slates and put more weight behind each title.

This guide explains the verdict, the counting rules that change the answer, and how to compare Netflix, Disney+, and Max without mixing apples and oranges.

Who Cancelled More Shows in 2025: The Quick Verdict

If you use the audience-friendly definition of cancellation, meaning a show stopped getting new seasons in 2025 without a planned ending, Netflix cancelled more shows in 2025 than Disney+ and Max.

That does not automatically mean Netflix is “worse.” It means Netflix runs a higher-volume machine. When a platform launches more originals, it also creates more opportunities for cancellation.

The more useful takeaway is this: Netflix leads on cancellation volume, while Disney+ and Max tend to cancel fewer shows, but with higher visibility per cancellation.

Why the Answer Changes Depending on What You Count

Two people can look at the same year and disagree because they count different things. If you want to answer who cancelled more shows in 2025 with confidence, you need clear counting rules.

Here are the big counting decisions that change the scoreboard.

Scripted Only or Scripted Plus Unscripted

Netflix produces a huge amount of reality, competition, docuseries, and sports storytelling. Those formats churn faster than scripted dramas and comedies. If you count unscripted cancellations, Netflix usually looks far more cancellation-heavy. If you count scripted only, Netflix can still lead, but the gap often narrows.

Cancelled Vs Ended

Some shows end on purpose. Others end because the platform pulls the plug. Fans experience both as “it is over,” but the industry does not.

For a clean comparison, treat these as separate categories:

- Cancelled: no renewal, no planned ending

- Ended: the creators or platform planned an ending and delivered it

- Final season ordered: the platform allowed closure, but still chose to stop

One-Season Limited Series

Netflix and Max frequently label series as limited from day one. Those are not cancellations, even if fans want more. Disney+ also uses limited series, especially for franchise storytelling.

If you count limited series as cancellations, every platform looks harsher than reality. If you exclude limited series, your list becomes more accurate.

Paused Indefinitely

Some shows never get an official cancellation statement. They simply stop. In real terms, that is a cancellation for viewers. If you include “indefinite pause” titles, Netflix’s totals often rise because Netflix moves on quietly more often than it issues formal cancellation press releases.

A Simple Rulebook for this Article

To keep this comparison useful, I am using rules that match how viewers experience a cancelled show.

I count a cancellation when:

- A show did not receive a new-season order and the platform moved on in 2025

- The show did not clearly complete its story as a planned ending

- The show was not positioned as a limited series from the start

I do not count:

- Titles marketed and structured as limited series

- Titles that delivered a planned final season as closure

With that rulebook, the answer to who cancelled more shows in 2025 remains Netflix.

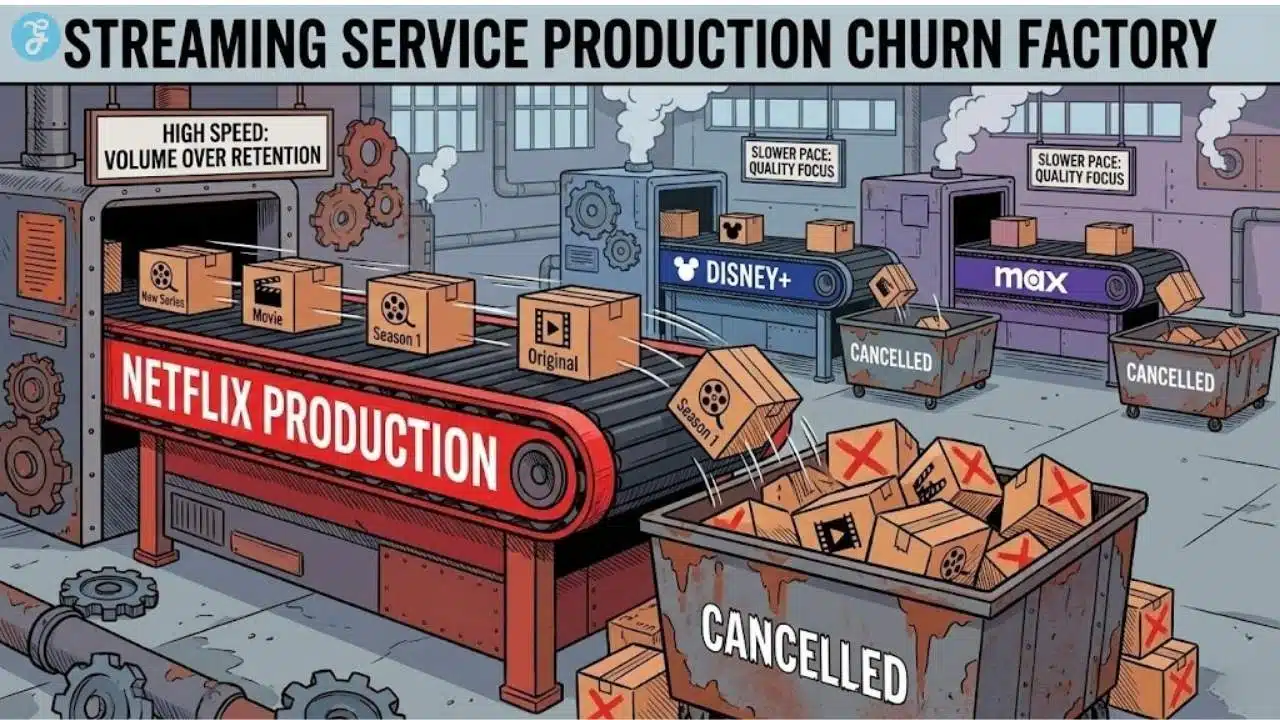

Why Netflix Cancels More By Volume

Netflix cancels more shows mostly because Netflix launches more shows. That sounds obvious, but it matters because people often compare platforms as if they have the same output.

Netflix runs a global pipeline across multiple languages and categories. It experiments constantly, and it quickly reallocates budget toward whatever pulls the strongest engagement.

Netflix also treats many shows as tests. If a title does not convert curiosity into full-season completion quickly, Netflix moves on.

Netflix Operates Like a High-Output Studio System

Netflix’s model creates three cancellation drivers that other platforms feel less intensely.

- More launches mean more misses

- More experimentation means more one-season outcomes.

- Faster decision cycles mean less time for slow growth

When you ask who cancelled more shows in 2025, this operational reality is the first explanation.

Netflix Has a Bigger Unscripted Churn Engine

Netflix reality and doc formats often live on short cycles. The platform can replace an unscripted title faster than it can produce scripted drama. That encourages quicker cuts. A reality series that does not pop becomes easy to retire and replace.

Why Disney+ Cancels Fewer But Still Hurts Fans

Disney+ tends to cancel fewer shows because Disney+ releases fewer originals. Disney+ also depends more heavily on brand alignment and franchise logic.

That does not make Disney+ safer. It makes Disney+ different.

Disney+ can shelve projects earlier in development, or it can quietly stop investing in a show that does not fit the long-term franchise strategy. Those moves create fewer public “cancelled after Season 1” moments, but they still reduce the number of shows that grow into multi-season runs.

Disney+ Often Treats Series as Brand Extensions

Disney+ shows frequently function as:

- franchise bridges

- character spotlights

- brand-safe family programming

- event series that support a larger ecosystem

When a show does not support the ecosystem, Disney+ has less incentive to keep it alive. The platform may prefer to shift resources toward a higher-certainty franchise title.

Disney+ Uses Fewer Low-Commitment Experiments

Netflix can launch more experiments because Netflix expects churn. Disney+ usually launches fewer experiments because Disney+ wants a stronger brand fit. That difference alone explains why Netflix often wins the raw count when you ask who cancelled more shows in 2025.

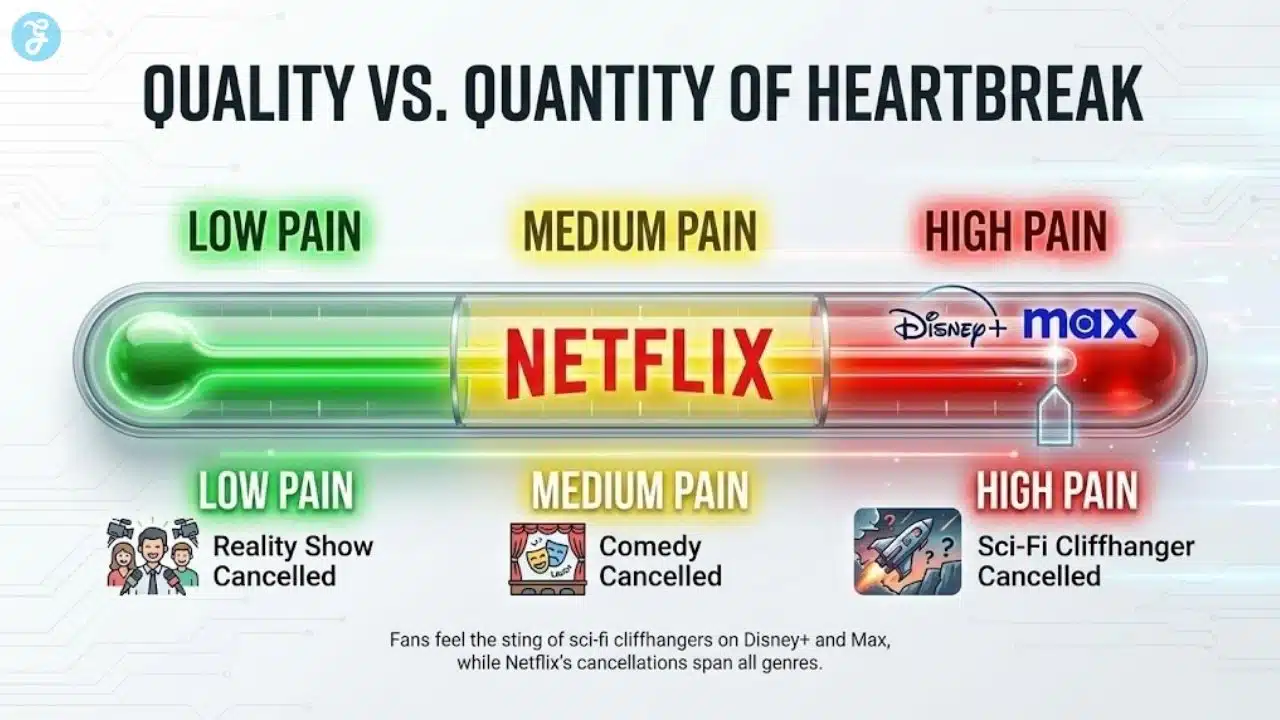

Why Max Cancels Fewer But Feels Brutal When It Does

Max runs a smaller slate than Netflix, and it often markets itself with a premium identity. That combination can make cancellations feel louder. A smaller slate creates a spotlight effect. Each cancellation looks bigger because there are fewer parallel launches to dilute attention.

Max also sets a high bar for renewal. If a show cannot justify cost and brand value, Max tends to make a clean decision rather than letting it drift.

Max Cancellations Feel Like Prestige Losses

When Max cancels, viewers often feel surprised because they associate the platform with quality. Quality does not guarantee renewal, though. Max is still a business. It still weighs cost, audience size, and strategic value. It simply does it within a smaller portfolio.

The Smaller Slate Problem

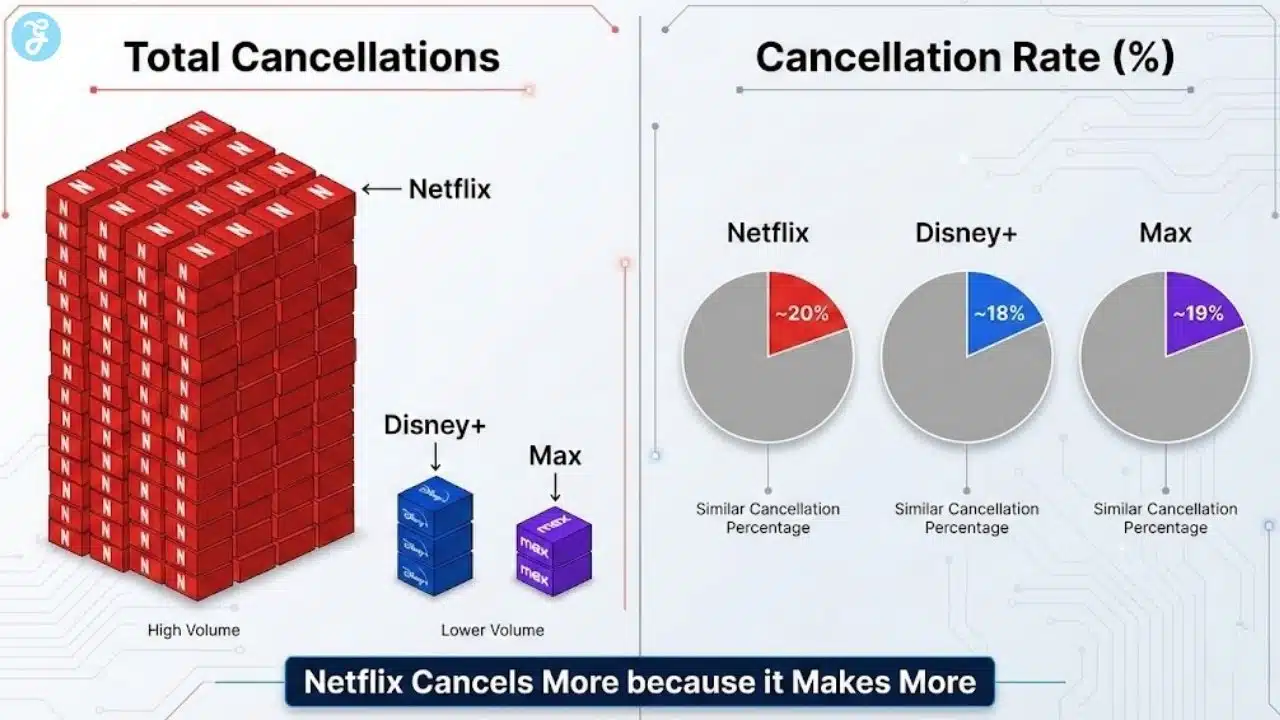

Here is a simple reality: a platform with fewer originals has fewer shows to cancel. That does not make it kinder. It means the cancellation count is naturally lower, even if the cancellation rate per show is similar.

The Real Comparison: Cancellation Volume Vs Cancellation Rate

When people debate who cancelled more shows in 2025, they usually focus on volume. Volume answers the headline question, but it does not explain how risky it feels to start a new show on each platform.

You can compare platforms in two ways:

- Volume: how many shows got cancelled

- Rate: what percent of launched shows failed to continue

Netflix can have the biggest cancellation volume while having a similar cancellation rate to competitors. The platform simply produces more.

A Practical Way to Think About Risk As a Viewer

If you want to reduce heartbreak, do not only ask “which platform cancels more.” Ask:

- Does this platform give shows time to grow

- Does this platform fund closure seasons

- Does this platform keep costs low enough to renew niche hits

- Does this platform treat a season like a complete story

Those questions affect your viewing experience more than raw cancellation totals.

Scripted Vs Unscripted: The Split That Changes Everything

If you count all series types together, Netflix tends to dominate cancellation volume. If you compare scripted only, the picture becomes more balanced, but Netflix often still leads.

The reason is simple. Netflix still produces more scripted series across the world than Disney+ and Max combined in many time windows.

Why Unscripted Inflates Netflix Totals

Unscripted cancellations happen for reasons that differ from scripted cancellations.

- reality formats rely on novelty

- doc formats depend on topical interest

- competition shows face rapid audience fatigue

Netflix can cycle these formats faster. That accelerates cancellations and makes Netflix look harsher in total counts.

Why Scripted Cancellations Hurt More

Scripted cancellations feel worse because:

- stories often end unfinished

- fans invest emotionally in characters

- production gaps make rescues harder

This is why Disney+ and Max can feel more painful even with fewer cancellations. Each scripted cancellation hits harder.

Why 2025 Felt Like a Cancellation Year Across Streaming

Even if one platform cancelled more, 2025 felt harsh everywhere. The industry has become more cost-sensitive and more selective about long-term commitments.

Several pressures contributed to that mood:

- rising production costs

- tighter corporate spending expectations

- audience fragmentation across many services

- weaker patience for slow-burn growth

- heavier reliance on completion and retention signals

This environment makes the answer to who cancelled more shows in 2025 less important than what the pattern means for 2026 and beyond.

What Makes Netflix More Likely to Cancel a Show

Netflix tends to cancel faster when the show triggers one of these red flags.

Low Completion

If viewers start and do not finish, Netflix has trouble justifying a follow-up season. Completion signals satisfaction and return intent.

High Cost Per Episode

Expensive shows must perform at a higher level. If the show is costly and the audience is only moderate, Netflix often chooses to reinvest in cheaper series with better engagement efficiency.

Weak Week Two Retention

A big debut does not guarantee renewal. If the show drops sharply after Week 1, Netflix may treat it as a curiosity spike rather than a sustainable hit.

Limited Global Travel

Netflix commissions globally and wants global performance. If the show works only in one region, Netflix can still renew, but the financial bar rises.

What Makes Disney+ More Likely to Cancel a Show

Disney+ cancellations often reflect strategy more than raw viewership buzz.

Franchise Fit Matters

If a title does not reinforce the platform’s core brands, it can become easier to end. Disney+ often wants series that strengthen a long-term brand ecosystem.

Fewer Slots Create Higher Competition

Disney+ has fewer original slots than Netflix. That creates internal competition. A mid-level performer can lose to a future franchise title even if it has fans.

Family Brand Protection

Disney+ also operates under brand expectations. If a project becomes complicated, risky, or off-brand, it can lose support even if it has creative promise.

What Makes Max More Likely to Cancel a Show

Max tends to cancel when a title cannot justify its cost and strategic identity.

Premium Identity Has a Budget Reality

Premium storytelling can be expensive. If a show does not bring enough consistent audience, the platform may decide it does not fit the portfolio.

Less Patience for Mid-Tier Engagement

Max can keep a true flagship going. For mid-tier titles, Max can choose clean breaks rather than long uncertainty.

Smaller Slate Means Less Protection

A show on Netflix can hide inside a massive library. A show on Max often stands out more. That visibility can accelerate decisions.

A Clean Scoring Framework You Can Use in Your Pillar Page

If you want your pillar content to stay accurate as titles shift between “cancelled,” “ended,” and “quietly dead,” use a scoring framework rather than a single list.

Cancellation Score Categories

Use these categories for each platform:

- Confirmed cancelled in 2025

- Functionally over in 2025

- Ended in 2025 with a planned final season

- One-season limited series in 2025

This framework keeps your “graveyard” credible. It also helps you answer who cancelled more shows in 2025 without mixing different kinds of endings.

Quick Table: How to Keep Counts Fair

| Counting Choice | What It Improves | What It Can Mislead |

| Scripted only | Cleaner story impact comparison | Ignores Netflix unscripted churn |

| All formats | Reflects total churn volume | Makes Netflix look harsher by design |

| Exclude limited series | Avoids false cancellations | May undercount audience disappointment |

| Include quiet endings | Matches viewer experience | Requires judgment calls |

If you are building a long-lived article, this table helps you explain why totals change as reporting updates.

So Who Cancelled More Shows in 2025 When Readers Want One Answer

When a reader asks who cancelled more shows in 2025, they want a headline. Give them the headline, then give them context.

The headline is Netflix. Netflix cancelled more shows in 2025 than Disney+ and Max in most practical comparisons, especially when you include unscripted churn and quiet non-renewals.

The context is that Netflix’s higher cancellation volume comes from its higher output. Disney+ and Max cancelled fewer shows, but each cancellation stands out more because their slates are smaller and their brand positioning is tighter.

What This Means For Viewers Choosing Where to Start New Shows

If you want to reduce the risk of unfinished stories, use platform behavior as a guide.

How to Watch Netflix With Less Heartbreak

- prioritize shows that feel like complete seasons

- watch early and finish seasons if you want a renewal

- be cautious with expensive genre series that need huge budgets

Netflix can still deliver long-running hits. It simply cancels faster when the numbers do not justify the spend.

How to Watch Disney+ With Less Heartbreak

- look for series with clear franchise support and long-term brand value

- treat some series like event stories, not open-ended multi-season bets

- expect that strategy shifts can end a show even if fans are loud

How to Watch Max With Less Heartbreak

- expect a high bar for renewal

- treat mid-tier shows as more fragile than flagship brands

- prioritize shows that either already have multiple seasons or have a clear ending shape

This does not guarantee safety. It simply aligns your expectations with each platform’s behavior.

The Fair Way to Answer “Who Cancelled More” Without Cherry-Picking

If you are asking who cancelled more shows in 2025, the honest answer depends on whether you are counting volume or cancellation rate. Netflix almost always wins on raw volume because Netflix launches far more originals across far more formats. Disney+ and Max release fewer shows, so they naturally have fewer to cancel.

That is why a fair comparison needs two scoreboards:

-

Total cancellations: the headline number readers want

-

Cancellations per launch: the risk level for viewers starting new shows

When you frame it this way, Netflix looks like the biggest graveyard because it is also the biggest factory. Meanwhile, Disney+ and Max can look “safer” on totals while still cancelling a similar share of what they release.

There is also a format trap. Netflix’s unscripted churn is huge, and reality cancellations inflate the total. If you strip it to scripted only, the gap narrows, but Netflix often still leads.

So the clean takeaway for readers is this: Netflix cancelled more in total, but “more” is partly a function of scale, not only ruthlessness. Netflix tends to make faster renewal decisions, so cancellations surface quickly. Disney+ and Max sometimes keep projects in limbo longer, which can delay the “cancelled” label even when the outcome is basically the same.

And don’t ignore how endings are branded. A “final season” is still an ending, but it reads softer than “cancelled.” Platforms that offer closure can look kinder on paper, even if they are still cutting shows at a similar rate.