Netflix exceeded Wall Street’s expectations for the first quarter of 2025, reporting robust revenue growth, strong earnings, and a new strategic direction that highlights advertising and overall financial performance instead of just subscriber numbers. This marks a significant transformation for the world’s largest streaming service as it adapts to an increasingly competitive and changing digital entertainment landscape.

First-Quarter Financial Results: Major Revenue and Profit Gains

Netflix reported its earnings for the quarter ending March 31, 2025, and the numbers painted a positive picture:

-

Revenue: $10.54 billion

(Up nearly 13% year-over-year, beating the $10.52 billion expected by analysts) -

Net Income: $2.89 billion

(Up from $2.33 billion a year ago) -

Earnings per Share (EPS): $6.61

(Significantly above the expected $5.71, and higher than last year’s $5.28) -

Operating Income: $3.3 billion

(Surpassing Wall Street estimates of around $3 billion)

This strong growth is largely attributed to two main factors:

-

Higher-than-expected advertising revenue

-

Strong subscription growth following recent price increases

Despite ongoing global economic uncertainties, Netflix managed to achieve record-breaking profitability for the quarter, reinforcing its ability to adapt and thrive under new business strategies.

No More Subscriber Count Reports: A Strategic Pivot

For the first time in over a decade, Netflix chose not to report its total number of subscribers. This is a significant shift for a company that, until now, used subscriber growth as its key performance metric.

Instead, the company stated it would focus on more “meaningful” metrics that better reflect its financial and operational health, including:

-

Revenue Growth

-

Engagement Metrics (like viewing hours)

-

Profitability

-

Advertising performance

This move comes after years of criticism that subscriber counts are a narrow metric that don’t always reflect real performance. Analysts have noted that while subscriber numbers were once a reliable barometer of success, they now offer less insight in a maturing streaming market where revenue, retention, and ad monetization carry more weight.

Impact of Price Hikes Across Subscription Plans

In late January 2025, Netflix raised the prices of its core subscription plans:

| Plan Type | Old Price | New Price |

|---|---|---|

| Ad-supported | $6.99 | $7.99 |

| Standard | $15.49 | $17.99 |

| Premium | $19.99 | $24.99 |

Despite the increases, Netflix did not experience significant customer churn. Instead, the price hikes played a key role in boosting revenue per user, helping drive the 13% year-over-year revenue jump.

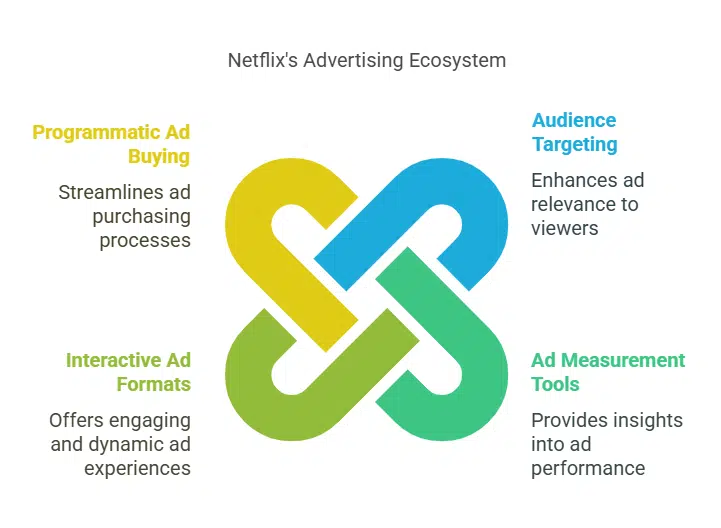

Advertising Takes Center Stage: New Ad Tech Platform Launched

In line with its long-term growth strategy, Netflix officially launched its in-house advertising technology platform in early April in the U.S., with plans to expand globally throughout the year.

The goal? To build a powerful ad ecosystem that rivals other streaming platforms like YouTube, Hulu, and Amazon’s Freevee.

According to the company, the platform will support:

-

Enhanced audience targeting

-

Improved ad measurement tools

-

New interactive ad formats

-

Expanded programmatic ad buying capabilities

Netflix emphasized that it wants to offer brands a more attractive and measurable environment than traditional TV, and early results from its ad-supported tier have been promising. In fact, 55% of all new Netflix signups in markets where the ad-tier is available are now opting for the lower-priced, ad-supported plan.

Global Uncertainty and Resilience Amid Trade Tensions

Netflix’s earnings arrive at a time when traditional media stocks are under pressure due to economic volatility sparked by U.S. President Donald Trump’s trade policies, including ongoing tariffs that are shaking up investor confidence.

However, co-CEO Greg Peters reassured investors during the earnings call that Netflix is not currently seeing any significant impact on its business from these trade dynamics:

“Based on what we are seeing by actually operating the business right now, there’s nothing really significant to note,” Peters said. “We also take some comfort that entertainment historically has been pretty resilient in tougher economic times.”

Peters added that Netflix’s ability to deliver global, on-demand content makes it a relatively safe and appealing option for consumers, even when discretionary spending is tight.

2025 Outlook and Revenue Guidance

Despite macroeconomic headwinds, Netflix reaffirmed its full-year revenue guidance:

-

Expected 2025 Revenue: Between $43.5 billion and $44.5 billion

For the second quarter of 2025, the company projects:

-

Q2 Revenue Estimate: $11.04 billion

(Higher than market estimates)

These figures show investor confidence in Netflix’s evolving strategy, and suggest that the pivot toward ad revenue and pricing optimization is working effectively.

Leadership Changes: Reed Hastings Steps Back

Netflix co-founder Reed Hastings, who had transitioned to Executive Chairman after stepping down as co-CEO in 2023, has now taken on a non-executive chairman role.

This marks a broader leadership shift as Netflix continues to focus on long-term innovation under the leadership of co-CEOs Ted Sarandos and Greg Peters.

Investor Reaction: Wall Street Approves

The market responded positively to the report:

-

Netflix stock rose 2–3% in extended trading after the earnings release.

Investors appeared reassured by the company’s commitment to profitability, its stronger-than-expected revenue, and its promising advertising initiatives.