The Married Women’s Property Act (MWP) allows married men to secure their family’s financial future through term insurance. This special provision protects life insurance proceeds from creditors and ensures the payouts reach the intended beneficiaries without legal complications.

The policyholder cannot change or cancel the policy without beneficiaries’ consent once it’s established under MWP. Moreover, it provides potential tax benefits. This article explains some important reasons why married men should consider MWP in their term insurance planning.

Reasons to Choose MWP in Term Insurance

The following are some important reasons that make MWP valuable for a married man:

Complete Protection from Creditors

Business owners and professionals often find themselves exposed to financial risks. If the policyholder goes bankrupt or into insolvency, the creditors cannot make any claim against the proceeds of the MWP term insurance policy. The proceeds, by law, belong to the wife and children completely.

With an MWP term insurance policy, one can get assurance that the family can get the entire amount irrespective of the policyholder’s financial situation. Moreover, no court can attach or seize the amount of insurance to settle debts or legal claims.

Tax Benefits Under Section 80C

MWP term insurance premiums qualify for tax deductions like any other insurance policy premiums under section 80C of the Income Tax Act of 1961. The policyholder can claim deductions up to a maximum of ₹1.5 lakh in a financial year.

The proceeds received by beneficiaries are also tax-free under Section 10(10D). Additionally, because of the double tax advantage, MWP term insurance may be suitable for tax planning purposes.

Prevents Family Disputes Over Insurance Amount

Property disputes are common in Indian families after someone’s death. MWP creates a clear legal framework where the wife and children are the sole beneficiaries. This prevents other family members from claiming insurance proceeds.

The act eliminates confusion and legal battles. Additionally, the beneficiaries receive the funds directly without any court process.

Joint family systems may create complications when handling insurance claims. With MWP, the wife and children have exclusive rights to the term insurance proceeds. In-laws or other relatives cannot interfere or make claims on the insurance amount.

Affordable Premium Structure

Term insurance under MWP offers the same low premiums as regular term plans. Additional legal protection doesn’t increase the cost. Furthermore, young married men can secure substantial coverage for their families at very affordable rates.

Starting early means lower premiums throughout the policy term. For instance, a 30-year-old man can get ₹1 crore coverage for just a few thousand rupees annually under MWP.

Flexibility in Premium Payment

MWP term insurance policies offer various premium payment options. These include:

- Annual premium payment

- Monthly premium payment through ECS

- Limited pay options (10 or 15 years)

- Single premium payment

This flexibility allows policyholders to choose payment methods that suit their cash flow. Additionally, monthly payments make it easier to manage the family budget while maintaining coverage.

Simple Documentation Process

Creating an MWP policy requires minimal additional documentation. The policyholder must clearly mention during the application that the policy is to be registered under the MWP Act. Standard KYC documents and marriage certificates are sufficient. Moreover, many insurance companies provide ready formats for MWP declarations.

Immediate Coverage Activation

MWP term insurance provides immediate life coverage from the policy start date. Unlike investment-linked policies, there’s no waiting period for the full sum assured. The family receives complete protection from day one.

This immediate coverage is crucial for young families with loans and financial responsibilities. Even if something happens in the first year, the beneficiaries receive the full benefit amount.

Builds Long-term Family Wealth

While term insurance doesn’t provide maturity benefits, MWP creates a wealth transfer mechanism. The wife can invest the claim amount to build long-term wealth for the family. These proceeds can fund children’s education, marriage expenses, or retirement planning.

The tax-free nature of claim proceeds means the full amount is available for investment. With proper financial planning, this can create generational wealth for the family.

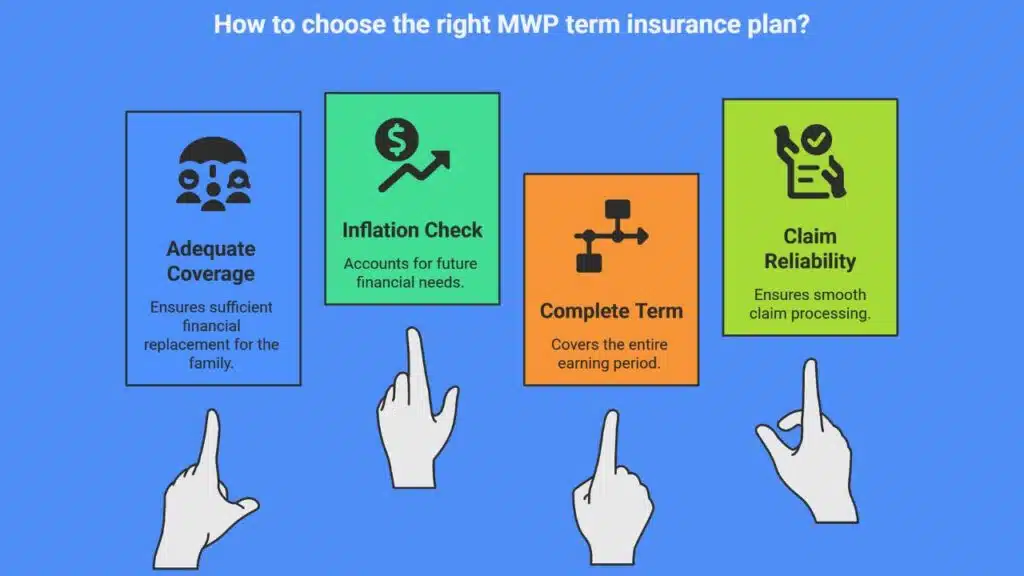

Choosing the Right MWP Term Insurance Plan

When selecting an MWP term insurance policy, consider these factors carefully.

- Adequate Coverage: The coverage amount should be 10-15 times the annual income. This ensures adequate financial replacement for the family.

- Inflation Check: Additionally, consider inflation and future financial needs when deciding the sum assured.

- Complete Term: The policy terms should cover the earning years completely. This ensures protection during the family’s most vulnerable financial period.

- Claim Reliability: The claim settlement ratio of the insurance company matters significantly. Choose companies with high claim settlement ratios and good customer service records. This ensures smooth claim processing for the beneficiaries.

Conclusion

The MWP Act in term insurance helps married men provide financial protection for their families. It combines legal security, tax benefits, and financial independence for wives and children. Trusted platforms such as Tata AIA offer term insurance plans that can be taken with an MWP declaration. This allows the policyholder to ensure that the insurance amount goes directly to the wife and children, without any external claims. It is important to review and compare available term insurance options carefully, and to consider including the MWP policy.

Disclaimer: The information provided above is for informational purposes only and is not intended as professional or legal advice. The Insurance Regulatory and Development Authority of India (IRDAI) is not responsible for any decisions made based on the information.