Managing taxes can be tough for self-employed professionals in Australia. Did you know that the Australian Taxation Office (ATO) has specific rules just for sole traders and contractors? This guide covers helpful tax tips to make filing easier, save money, and stay compliant.

Continue reading to learn how to simplify your tax season!

Understanding Tax Requirements for Self-Employed Individuals

Self-employed professionals in Australia, like sole traders and contractors, must follow specific tax rules set by the Australian Taxation Office (ATO). You need to report all personal income and business revenue on your tax return.

The financial year ends on June 30, and you can lodge your income tax return between July 1 and October 31. Failing to meet deadlines could lead to penalties.

Having an Australian Business Number (ABN) is essential for most independent contractors. If your annual revenue exceeds $75,000, you must register for Goods and Services Tax (GST).

Those in certain industries may also have extra requirements—for example, builders or construction workers need to submit a Taxable Payments Annual Report (TPAR). Following these steps ensures you’re compliant with current tax laws while managing taxable income efficiently.

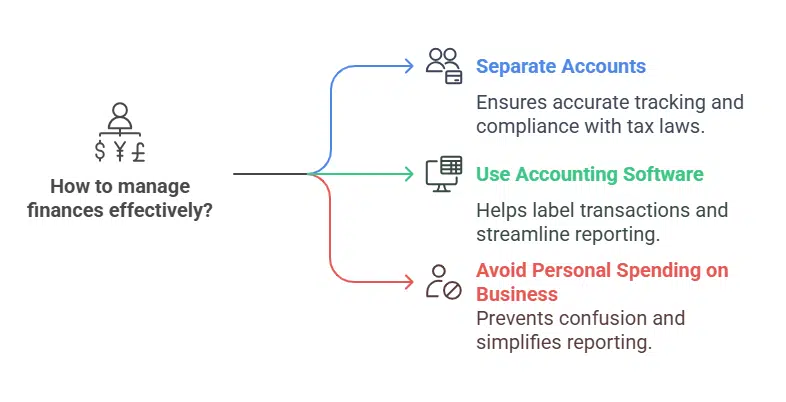

Distinguishing Between Personal and Business Finances

Mixing personal and business finances can lead to confusion during tax season. Keep separate bank accounts for your Australian Business Number (ABN) activities and daily living expenses.

This separation ensures accurate tracking of income, expenses, and deductions for your tax return.

Use tools like accounting software to label transactions as “personal” or “business.” Avoid spending personal money on business expenses to streamline reporting to the Australian Taxation Office (ATO).

Proper distinction also helps calculate taxable income with ease while staying compliant with tax laws.

Maintaining Accurate Financial Records

Good record-keeping helps you track taxable income and claim tax deductions. The Australian Taxation Office (ATO) requires income tax records to be kept for at least five years. You should store receipts, invoices, bank statements, contracts, and other financial documents related to your business expenses for at least five years.

Keep personal finances separate from professional records to stay organized.

Regular backups protect against data loss. Save digital copies on secure cloud platforms or external drives. For physical documents, use fireproof storage or keep duplicates in a different location.

This process ensures compliance with ATO rules and makes tax filing easier during the financial year.

Explore Working-from-Home Tax Deductions

Working from home can reduce your tax burden. Claiming deductions for home office expenses is easier with the right knowledge.

- Use the Revised Fixed Rate Method to claim 67 cents per hour. This rate applies from July 1, 2022, and covers electricity, gas, phone, and internet usage.

- Keep detailed records of hours worked at home. The ATO now requires precise tracking to support claims under this method.

- Deduct costs for office furniture and tools. Items like desks, chairs, or printers qualify as depreciating assets if used for work.

- Use the actual cost method if it suits you better. This approach requires specific receipts and calculations for each expense category.

- Include occupancy costs like rent or land taxes only if you have a dedicated home office space not shared with personal use.

- Claim household utilities, such as heating and cooling, that are used directly during working hours at home.

- Please ensure all necessary documents are filed correctly by tax season to avoid any penalties related to incorrect tax compliance claims.

- Seek advice from a tax agent or tax professional to ensure all eligible expenses are claimed accurately under tax laws in Australia.

Track and Deduct Costs for Self-Education

Investing in self-education can boost your skills and add to your taxable income deductions. Australian tax laws make it simple to claim these expenses if they relate to your work.

- Self-employed individuals can deduct course fees for training or education that improves job-related skills. For example, accountants taking advanced tax courses can claim this cost.

- Textbooks, study guides, and reference materials purchased for the course are tax-deductible. Ensure you keep receipts for all purchases.

- Travel costs, like public transport fares or car expenses to attend workshops or classes, can be deducted. Use a logbook to track mileage if you drive.

- Depreciation on tools like a laptop or specialized software used for studying is allowable. You must separate personal use from business use.

- No minimum deduction has applied since July 1, 2022, making even minor expenses worth noting. Every small claim adds up during tax season.

- Claim printing and stationery used for assignments or coursework as valid business expenses. Keep a record of what was bought and used specifically for studies.

Benefits of Maximizing Superannuation Contributions

Maximizing superannuation contributions provides significant tax advantages. Contributions are taxed at just 15%, which is often lower than personal income tax rates. Self-employed individuals can also claim tax deductions on their personal super contributions, reducing taxable income and overall liabilities.

There are limits to contributions—up to $30,000 for concessional and $120,000 for non-concessional amounts each financial year. Staying within these caps helps you prepare for retirement while saving on taxes now.

To claim a deduction, a “Notice of Intent to Claim” form must be submitted to your fund before lodging your tax return with the ATO.

Deducting Business-Related Expenses

Claiming business-related expenses is vital for reducing taxable income. Keep track of all expenses to maximize your tax deductions.

- Office supplies, like pens, notebooks, and folders, are fully deductible if used solely for your business activities.

- Immediate deductions apply for tools or equipment costing less than $300—perfect for small purchases like calculators or software tools.

- Include home office expenses like rent, utilities, and internet charges based on the percentage of business use in your claims.

- Vehicle costs can be deducted using either the logbook method or the cents-per-kilometer method (88 cents/km for up to 5,000 km in 2024-2025).

- Business travel—including hotel stays, flights, and meals—can qualify if directly related to earning income. Keep all receipts as proof.

- Insurance premiums for professional indemnity or business insurance are tax-deductible under ATO rules.

- Digital subscriptions or tools needed for your work qualify as deductions too—for example, cloud storage services or online design platforms.

- Training courses tied to improving skills in your field may also count as self-education expenses you can claim during tax season.

Budget for Pay-As-You-Go Tax Installments

Pay-As-You-Go (PAYG) tax installments help manage your tax liabilities throughout the financial year. These payments apply if your business or investment income exceeds $4,000 annually.

The ATO calculates these amounts to match your expected taxable income, spreading payments over time. This prevents a large tax debt during the busy tax season.

Set money aside regularly for PAYG obligations in line with your estimated earnings. Use tools like accounting software to track this closely. Ensure timely submission of Business Activity Statements (BAS), as late lodgment leads to penalties from the ATO.

Having an Australian Business Number (ABN) is essential when dealing with clients and managing PAYG effectively.

Importance of GST Registration for Eligible Professionals

Eligible self-employed professionals in Australia must register for GST if their income exceeds $75,000 AUD yearly. Registration ensures compliance with ATO tax obligations and allows the issuing of tax invoices showing GST amounts, which is mandatory for sales over $82.50.

Voluntary registration benefits those earning below the threshold by letting them claim GST credits on business expenses. Registered professionals also need to file regular Business Activity Statements (BAS) to report collected and claimed GST accurately, staying clear of penalties or fines from the Australian Taxation Office.

Simplify Tax Filing with Accounting Software

QuickBooks makes tax season easier for self-employed professionals in Australia. The accounting software tracks taxes, categorizes expenses, and generates Business Activity Statements (BAS) automatically.

It simplifies PAYG installments and ensures tax compliance with Australian laws.

The mobile app also tracks mileage using GPS, linking it to business expenses. Users can try the software free for 30 days before subscribing. This tool saves time and reduces errors during financial planning or filing a tax return.

The Role of Tax Professionals in Managing Your Finances

Tax professionals assist self-employed individuals in minimizing tax obligations and improving tax compliance. They manage the preparation and filing of accurate tax returns, reducing the likelihood of audits.

Their expertise ensures all qualifying business expenses are deducted, increasing your taxable income savings.

An experienced tax agent offers financial advice for strategies such as maximizing super contributions or managing pay-as-you-go installments. With extensive knowledge of ATO regulations, they assist you with intricate tax laws or capital gains tax matters.

Hiring a professional can save time during tax season while enhancing your financial strategy.

Deductions for Digital Subscriptions and Tools

Using digital tools can lower your tax bill. You may claim deductions for eligible subscriptions and software.

- Digital products used for business can be deducted. Examples include accounting software, editing tools, and communication apps.

- Internet service fees supporting business activities qualify as deductible operating expenses in the same financial year they’re incurred.

- Subscriptions tied to work tasks, like cloud storage or invoicing systems, are deductible if solely for business use.

- Eligible costs spent from March 29, 2022, to June 30, 2023, may claim a 20% bonus deduction under the Small Business Technology Investment Boost initiative.

- Online advertising platforms or social media scheduling tools count if directly connected to generating income.

- Website hosting or maintenance costs fall under allowable deductions when used for professional purposes.

- Tools that help track work hours or manage customer data also meet criteria for tax deductibility.

- Even training-related subscriptions linked to skill development in your field might qualify if proven essential.

- Software upgrades that enhance productivity can be added as part of annual digital operational expense claims.

- Taxable income reduction through these deductions aids in better tax planning during tax season.

Calculate Deductions for Vehicle and Travel Costs

Vehicle and travel costs can significantly affect your taxable income. To lower tax liabilities, you must know which expenses qualify for deductions.

- Claim up to 5,000 business kilometers using the cents per kilometer method at 85 cents per kilometer in the 2023-2024 financial year. This is simple but does not require detailed fuel or maintenance records.

- Maintain a logbook for at least 12 continuous weeks if opting for the logbook method. This shows the exact percentage of vehicle use for business purposes.

- Do not deduct capital costs like buying a vehicle. Instead, claim depreciation under ATO guidelines for depreciating assets.

- Deduct motor vehicle expenses based on the recorded business use percentage from your logbook. Personal travel must be excluded to stay tax-compliant.

- Keep receipts for fuel, servicing, registration, and insurance costs related to business-use vehicles. These are deductible under business expenses.

- Calculate parking fees and tolls connected with work-related travel as tax-deductible costs during tax season.

- Include other eligible travel, like attending client meetings or conferences, under allowable deductions if directly tied to generating income.

- Exclude commuting between home and regular work locations from deductions since it is classified as a personal expense by ATO rules.

Recognize Non-Deductible Expenses

Entertainment expenses often seem business-related but are non-deductible. For example, taking clients to dinner or buying event tickets usually cannot be claimed unless clearly part of fringe benefits arrangements.

Traffic fines also fall under this category and cannot reduce your taxable income.

Private costs like clothing for personal use or groceries are not valid deductions either. Expenses exceeding $1,000 that cover prepaid goods or services lasting over 12 months must be spread out across years—not fully deducted upfront per ATO guidelines.

Keep these rules in mind to avoid errors on your tax return!

Implement Quarterly Tax Review Strategies

Quarterly tax reviews help self-employed Australians manage cash flow and reduce tax stress. They also ensure compliance with ATO regulations, potentially uncovering new deductions.

- Review your estimated taxable income every quarter. This prevents under- or overpaying taxes during the financial year.

- Track all business expenses regularly. Keeping accurate records can maximize tax deductions, from vehicle costs to digital tools.

- Ensure PAYG installments are correctly calculated. Staying compliant avoids penalties from the Australian Taxation Office (ATO).

- Check for updates on tax laws or ATO guidelines. Changes might impact deductions, super contributions, or marginal tax rates.

- Plan superannuation payments each quarter to boost retirement savings and lower taxable income.

- Reevaluate depreciating assets for potential write-offs under temporary full expensing rules.

- Set aside funds quarterly for unexpected tax liabilities like capital gains taxes or personal services income adjustments.

- Hire a registered tax agent who understands small business needs. Professionals identify hidden deductions and ensure accuracy in filing.

- Use accounting software to simplify tracking profits and expenses throughout the year.

- Verify GST registration if annual turnover exceeds $75,000, as required by Australian business law.

- Monitor changes in exemptions or energy-saving credits introduced by government policies.

- Adjust PAYG installments when experiencing fluctuating income to ensure correct tax payments align with earnings changes.

- Dedicate time quarterly for a full review of personal and business finances separately, preventing errors in financial reporting.

- Watch out for non-deductible expenses like personal gifts or fines, which can’t be claimed on your return as a sole trader.

- Schedule reminders to file early during busy seasons such as January’s holiday period to avoid last-minute rushes before deadlines pass.

- Consult the ATO website quarterly for updated resources regarding tax strategies applicable specifically toward self-employed Australians like you!

Updates on ATO Regulations for Self-Employed Professionals

New ATO rules impact self-employed professionals, including sole traders. Contractors earning over $75,000 a year must register for GST through the Australian Business Register. These updates also stress tracking and reporting taxable income accurately to avoid tax liabilities.

Building and construction workers now need to submit a Taxable Payments Annual Report (TPAR). The ATO also enforces stricter checks on personal services income (PSI). If most of your income comes from one client’s work, PSI rules may apply.

Staying updated with these changes helps maintain proper tax compliance during tax season.

Takeaways

Being self-employed in Australia comes with tax challenges, but smart planning can make it easier. Keep records organized, separate personal and business finances, and claim eligible deductions.

Use tools like accounting software or seek help from a trusted tax professional to stay on top during tax season. Small steps today can bring big benefits when it’s time to file your return.

Make the most of these tips to boost savings and reduce stress!