In the world of high finance, the American Express Platinum or the Chase Sapphire Reserve are not the finish line—they are merely the starting blocks. For the ultra-high-net-worth individual (UHNWI), a credit card is not a tool for borrowing money or earning 2% cash back. It is an identity signal. It is a key that unlocks private jets, closes luxury retail stores for private shopping, and secures reservations at Michelin-star restaurants that have been booked out for months.

As we enter 2026, the landscape of exclusive banking has shifted. The barrier to entry is no longer just high income; it is asset depth and relationship currency. We are talking about cards you cannot apply for, made of materials that set off airport metal detectors, with credit limits that theoretically do not exist. This is the definitive, data-backed list of the 6 most exclusive credit cards in the world for 2026.

1. American Express Centurion Card (“The Black Card”)

The Original Status Symbol

- Material: Anodized Titanium

- Est. Initiation Fee: $10,000 USD

- Est. Annual Fee: $5,000 USD

There is the credit card market, and then there is the Amex Centurion. Despite technically being a “charge card” (meaning the balance must be paid in full monthly), it remains the undisputed king of wallet grandeur.

Why It’s Number One

While other cards may have higher asset requirements, the Centurion holds the crown for cultural impact. It is the card referenced in rap lyrics and flashed in Hollywood blockbusters. But in 2026, Amex has pivoted the Centurion from a pure status symbol to a “lifestyle remote control.”

2026 Eligibility & Fees

You cannot apply for the Centurion. You must be invited.

- The “Secret” Spend Threshold: While Amex never publishes criteria, data points from 2024 and 2025 suggest you need to spend between $250,000 and $500,000 annually on your Amex Platinum or Business Platinum cards to trigger an algorithm that alerts a relationship manager.

- The Cost: The barrier to entry has risen. New cardholders in 2026 face a roughly $10,000 initiation fee plus the $5,000 annual fee. That is $15,000 just to open the box.

The “Secret” Perks

The perks go far beyond airport lounges. Centurion members access a tier of service that essentially functions as a high-end personal assistant:

- Equinox & Gyms: Complimentary Equinox Destination Access membership (valued at over $3,000/year).

- The Private Suite (PS) at LAX: This is a private terminal where you skip the main airport entirely. You are driven to your commercial flight on the tarmac in a BMW. Centurion members get complimentary annual membership and trial visits.

- Saks Fifth Avenue: A substantial quarterly shopping credit, significantly higher than the Platinum card.

- Delta Platinum Medallion Status: Automatic high-tier status without flying a single mile.

Insider Insight: The true value of the Centurion is the Concierge. Unlike standard card concierges who just Google phone numbers, the Centurion Concierge has specific relationships. They don’t just ask for a table; they have a “Centurion table” held at top restaurants specifically for members.

2. J.P. Morgan Reserve Card

The Private Banker’s Handshake

- Material: Laser-etched Palladium and Gold (formerly known as the Palladium Card)

- Est. Annual Fee: $595 (Often waived for Private Client members)

- Requirement: ~$10 Million in Assets Under Management (AUM)

If the Amex Centurion is for the celebrity, the J.P. Morgan Reserve is for the quiet billionaire. This card is arguably harder to get than the Black Card because spending money isn’t enough—you have to have money. A lot of it.

The $10 Million Requirement

This card is strictly available to clients of J.P. Morgan Private Bank. While there is no published “rule,” bankers rarely extend an invitation to clients with less than $10 million in investable assets managed by the bank.

This creates a unique exclusivity. You can’t just “spend your way” to a Reserve card by buying ads for your business. You must trust J.P. Morgan with your generational wealth.

Material & Design

Originally minted as the “Palladium Card,” it was made of palladium and gold, costing the bank over $1,000 just to manufacture a single card. The modern version is a heavy metal composite that still carries that distinct “clink” when dropped on a table. It is understated, elegant, and almost unknown to the general public—exactly how its users like it.

Hidden Benefits

- United Club Membership: Full access to United Airlines lounges.

- Contextual Perks: Because this card is tied to your private banker, the “customer service” line is often your banker’s direct cell phone number. If your card is declined, you don’t call a call center; you text your wealth manager.

3. Dubai First Royale Mastercard

The Oil Baron’s Choice

- Material: Gold-trimmed with a .235-carat solitary diamond

- Annual Fee: Invitation Only (Fees vary by contract)

- Credit Limit: None (Theoretically infinite)

The Dubai First Royale is the physical embodiment of opulence. It is less a financial instrument and more a piece of jewelry.

The Diamond-Embedded Status Symbol

The card typically features a real diamond embedded in the center and gold-trimmed edges. It is flashy, aggressive, and undeniably impressive. It signals a connection to the UAE’s royal class or the upper echelons of global oil and gas wealth.

“No Limit” Spending Cap

Most “no limit” cards actually have a shadow limit based on your spending history. The Dubai First Royale is rumored to be different. Tales circulate of members buying yachts or helicopters on a single swipe.

- The Philosophy: The bank’s mantra for this card is allegedly, “You ask, we do.”

Dedicated Lifestyle Managers

Unlike a concierge service shared by thousands of members, Royale cardholders are assigned a dedicated relationship manager. This person’s job is to ensure the cardholder’s lifestyle is frictionless.

- Example: If a cardholder wants tickets to the Oscars last minute, the relationship manager doesn’t just look for tickets; they negotiate with ticket brokers and verify logistics, potentially flying a courier to hand-deliver them.

4. Coutts Silk Card

The Royal Family’s Wallet

- Material: Standard Plastic (Historically), now potentially sustainable materials

- Annual Fee: None (if spending requirements are met)

- Requirement: Banking client of Coutts & Co.

If you are “Old Money” in the UK, you bank with Coutts. Famous for being the bank of the British Royal Family (including the late Queen Elizabeth II), the Coutts Silk Card is a subtle flex.

The Royal Connection

Pulling out a Coutts card sends a specific message in Europe: “My family has been wealthy for generations.” It doesn’t have the flash of the Dubai First or the weight of the Amex Centurion, but it carries immense social capital in aristocratic circles.

Private Banking Requirements

To get the card, you must be a Coutts client. This typically requires £1 million to £3 million in investable assets or heavily verified high disposable income. The vetting process is rigorous and focuses on reputation as much as solvency.

Spending Limits & Rewards

The Silk Card is technically a charge card with a monthly spending limit tailored to the client’s liquid assets.

- The “Thank You from Coutts” Program: Their rewards program is exceptionally curated. Instead of generic gift cards, you redeem points for bottles of rare wine, bespoke tailoring on Savile Row, or private experiences at royal palaces.

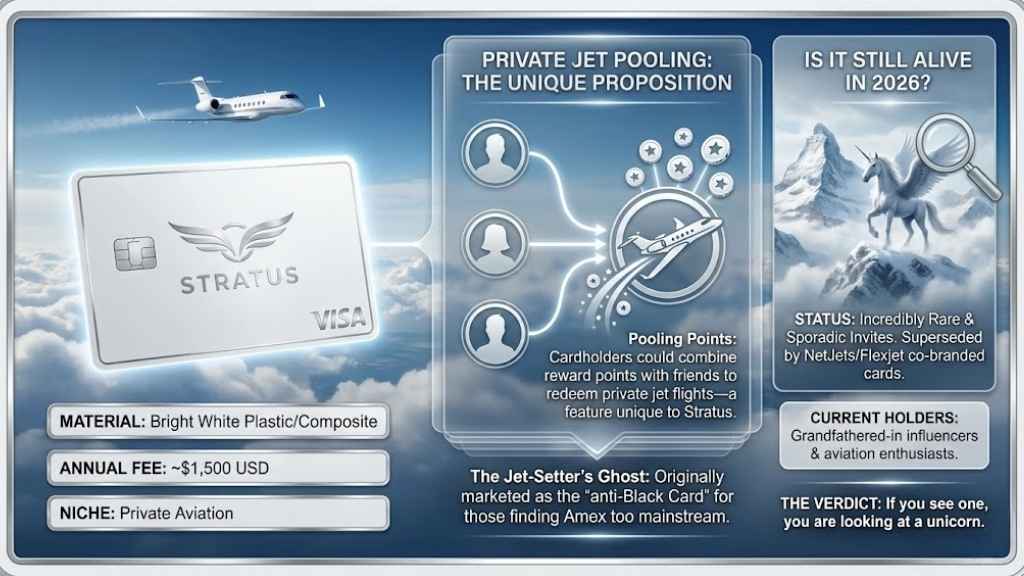

5. Stratus Rewards Visa (“The White Card”)

The Jet-Setter’s Ghost

- Material: Bright White Plastic/Composite

- Annual Fee: ~$1,500 USD

- Niche: Private Aviation

The Stratus Rewards Visa, often called the “White Card,” is the yeti of the credit card world. It was originally marketed as the “anti-Black Card,” designed for those who found the Amex Centurion too mainstream.

Private Jet Pooling

The unique value proposition of Stratus was its partnership with private jet companies (formerly Marquis Jet).

- Pooling Points: Unique to Stratus, cardholders could pool their reward points with other friends who had the card. This allowed groups of friends to combine points to redeem a flight on a private citation jet—a feature no other card offered.

Is it Still Alive in 2026?

As of 2026, the Stratus card is incredibly rare and invites are sporadic. It has largely been superseded by co-branded cards from NetJets or Flexjet, but it remains on the list because it still appears in the wallets of a select group of influencers and aviation enthusiasts who were “grandfathered” in. If you see one, you are looking at a unicorn.

6. Mastercard Gold Card (Luxury Card)

The Attainable Dream

- Material: 24K Gold-Plated Stainless Steel

- Annual Fee: $995 USD

- Requirement: Excellent Credit (Application Open)

This is the only card on this list that you can apply for right now. Owned by “Luxury Card” (a Barclaycard brand), the Mastercard Gold Card is designed for the high-earner who hasn’t yet received a Centurion invite but wants the heavy metal aesthetic.

24K Gold-Plated Construction

This card is heavy (22 grams) and plated in real 24-karat gold. When you put it on the table at a business dinner, it looks more expensive than the Amex Centurion.

Application Process vs. Invitation Only

Unlike the cards above, you do not need a private banker. You need a credit score in the high 700s or 800s and the willingness to pay the ~$1,000 annual fee.

Is It Worth It?

- Pros: It offers excellent travel benefits, including a $200 annual airline credit and a $100 Global Entry credit. The “Luxury Card Concierge” is surprisingly good and accessible via live chat.

- Cons: The annual fee is high compared to the Chase Sapphire Reserve ($550), which offers arguably better points redemption rates. You are paying a premium for the gold and the look.

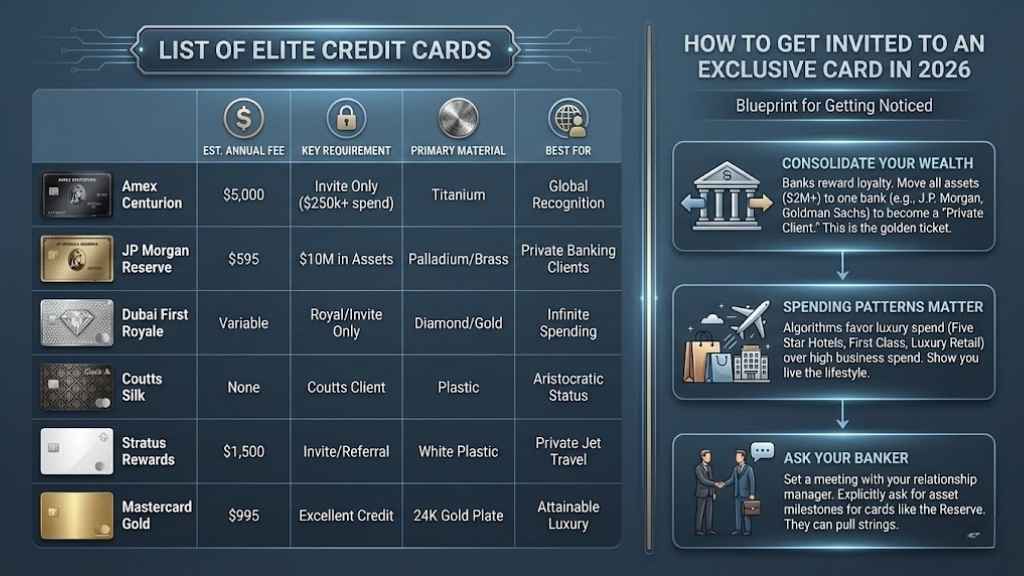

List of Elite Credit Cards

| Card Name | Est. Annual Fee | Key Requirement | Primary Material | Best For |

| Amex Centurion | $5,000 | Invite Only ($250k+ spend) | Titanium | Global Recognition |

| JP Morgan Reserve | $595 | $10M in Assets | Palladium/Brass | Private Banking Clients |

| Dubai First Royale | Variable | Royal/Invite Only | Diamond/Gold | Infinite Spending |

| Coutts Silk | None | Coutts Client | Plastic | Aristocratic Status |

| Stratus Rewards | $1,500 | Invite/Referral | White Plastic | Private Jet Travel |

| Mastercard Gold | $995 | Excellent Credit | 24K Gold Plate | Attainable Luxury |

How to Get Invited to an Exclusive Card in 2026

If you have your eyes on the “Big Three” (Centurion, JP Morgan, Dubai First), simply applying online is not an option. Here is the blueprint for getting noticed:

- Consolidate Your Wealth: Banks reward loyalty. If you have $2 million spread across four banks, you are a “standard” client at four banks. If you move all $2 million to J.P. Morgan or Goldman Sachs, you become a “Private Client.” This is the golden ticket.

- Spending Patterns Matter: Amex algorithms look for luxury spend, not just high spend. $200,000 spent on Google Ads for your business is less impressive to the algorithm than $100,000 spent on Five Star Hotels, First Class flights, and luxury retail. They want to see that you live the lifestyle.

- Ask Your Banker: If you are already a high-net-worth client, set a meeting with your relationship manager. Explicitly ask, “What are the asset milestones required to be considered for the Reserve card?” often, they can pull strings if you are close to the threshold.

Final Thoughts

Ultimately, the world of exclusive credit cards in 2026 isn’t just about heavy metal or diamond-studded plastic. It is about the one commodity that money can buy: frictionless living. For the ultra-wealthy, a $5,000 or $10,000 annual fee is a rounding error if it means a dedicated concierge can secure a last-minute flight when commercial airlines are grounded or open a closed boutique for a private anniversary gift.

While the Amex Centurion remains the loudest signal of success, quieter powerhouses like the J.P. Morgan Reserve offer a level of privacy and financial firepower that appeals to the truly old money. Whether you are actively courting an invitation by consolidating your assets or simply fascinated by the economics of the 0.1%, remember that the best card is the one that serves your lifestyle, not just your ego. As financial technology evolves, the gap between “premium” and “invite-only” will likely widen, turning these cards into even rarer keys to the world’s most closed doors.

In the end, true exclusivity isn’t about the card in your wallet—it’s about the silence in the room when you put it on the table.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Credit card offers, fees, and requirements are subject to change by issuers without notice. Please consult your financial advisor or the issuing bank for the most current terms.