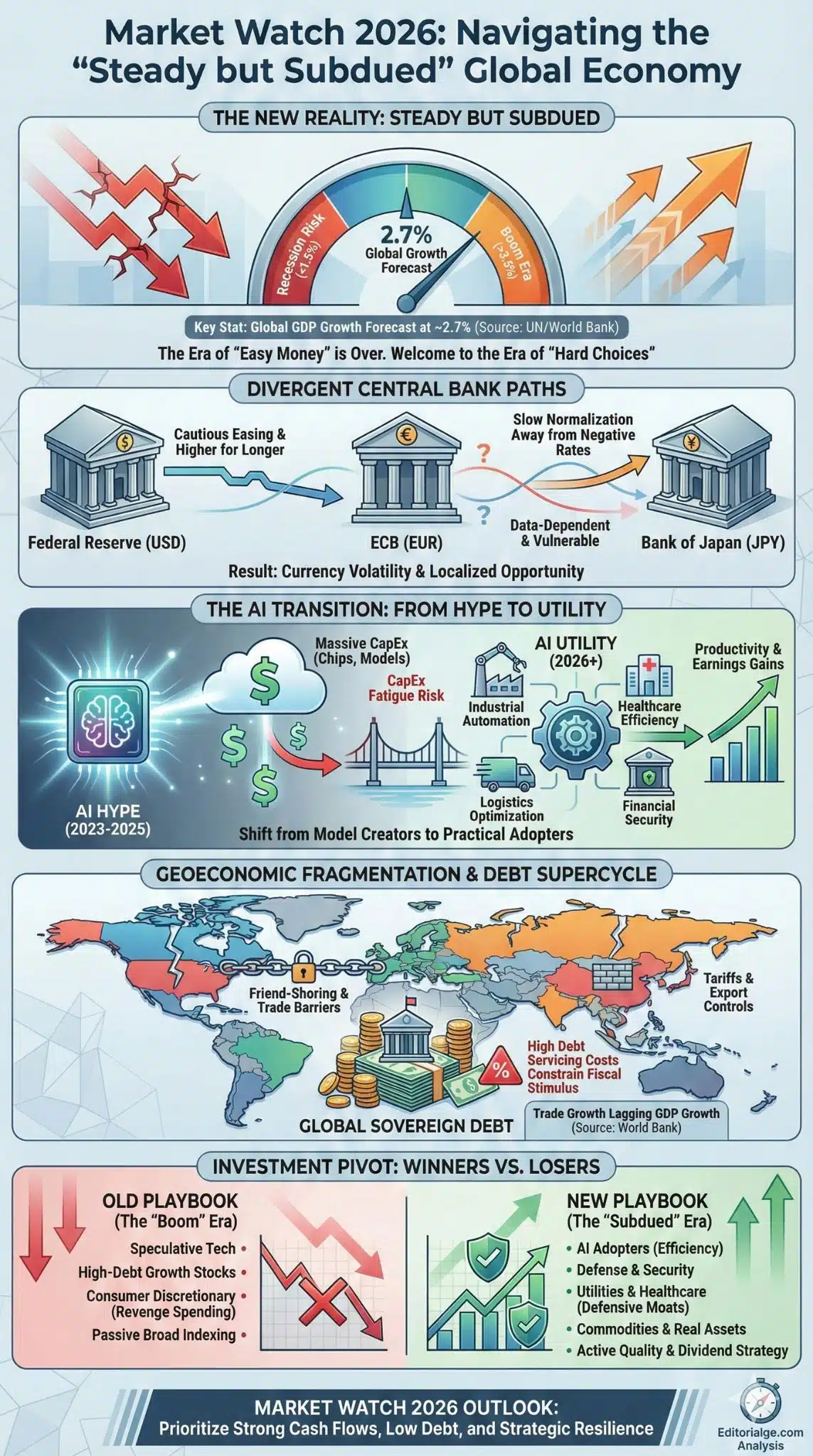

As 2026 begins, the global economy isn’t crashing, but it isn’t booming either. This “steady but subdued” phase—characterized by 2.7% global growth, sticky inflation, and uneven monetary easing—masks a critical transition.

For investors, the danger is no longer immediate recession, but a slow erosion of returns caused by geopolitical friction, high public debt, and the delayed productivity payoff of AI. The era of “easy money” is over; the era of “hard choices” has arrived.

Key Takeaways

- Growth Plateau: Global GDP is forecast to grow at roughly 2.7%, well below the pre-pandemic average of 3.2%, signaling a long-term shift toward slower expansion.

- Divergent Policies: While the U.S. Fed eases rates cautiously, the ECB remains data-dependent, creating currency volatility and localized opportunity.

- Sector Rotation: The “AI hype” trade is maturing into an “AI utility” phase; investors must pivot from speculative tech to companies with actual earnings growth and defensive moats.

The narrative of “soft landing” that dominated 2025 has effectively concluded. We have landed. The question now is: what is the terrain we have landed on? The global economy has avoided the catastrophic recessions predicted in earlier years, but it has not returned to the dynamic expansion of the 2010s. Instead, we face a “mid-cycle transition”—a period where growth is positive but uninspiring, and where the primary drivers of economic activity are shifting from consumer revenge-spending to government industrial policy and capital expenditure.

This specific moment is the result of three converging historical forces. First, the aggressive interest rate hikes of 2022-2024 successfully curbed hyper-inflation but left borrowing costs permanently higher than the previous decade. Second, the fracturing of global trade—accelerated by tariffs and “friend-shoring”—has introduced permanent friction into supply chains, raising the floor for costs. Third, the massive fiscal stimulus used to fight the pandemic has left governments with record debt loads, limiting their ability to spend their way out of future slowdowns. We are here because the emergency brakes worked, but the engine hasn’t fully restarted.

The “Steady but Subdued” Reality: A Deep Dive

1. The Growth Ceiling: Why 3% is the New 4%

The most striking feature of the Market Watch 2026 outlook is the lowered ceiling for growth. According to recent data from the UN and World Bank, global output is projected to grow by just 2.7% to 3.0% this year. This is not a recession, but it is a “growth recession”—a state where the economy expands too slowly to generate robust wage gains or absorb new entrants into the workforce efficiently.

This sluggishness is structural, not cyclical. In the United States, growth is moderating to roughly 2.0% as the labor market softens. The European Union struggles with a 1.3% forecast, hamstrung by energy transitions and export weaknesses. China, once the engine of global demand, is managing a controlled deceleration to roughly 4.6%, pivoting away from property-led growth. For investors, this means the “rising tide lifts all boats” strategy is dead; alpha must now be generated through sector-specific selection rather than broad index exposure.

2. The Interest Rate Illusion

Markets entered 2026 anticipating aggressive rate cuts, but the reality is more nuanced. Central banks are no longer moving in lockstep. The Federal Reserve faces a unique dilemma: cutting rates to support employment while tariff-induced inflation lingers. This has led to a “higher for longer” baseline where the neutral rate is perceived to be above 3%.

Conversely, the ECB and Bank of Japan are on divergent paths. Europe’s economic fragility may force faster cuts, weakening the Euro, while Japan continues its slow normalization away from negative rates. This divergence creates significant FX volatility, impacting multinational earnings. The days of synchronized global easing are over; policy is now fiercely local.

3. The AI Reality Check

For the last two years, Artificial Intelligence has been the singular prop for equity markets. In 2026, we are entering the “Show Me” phase. The massive capital expenditures (CapEx) by hyperscalers like Microsoft and Google must now translate into productivity gains for the broader economy.

Goldman Sachs research indicates that while AI is transformative, the macro-level productivity boost is likely still years away. This creates a risk of “CapEx fatigue” where investors punish companies that continue to spend billions without immediate revenue uplifts. The investment thesis is shifting from the creators of models (Chipmakers, LLM developers) to the adopters—traditional industries (healthcare, logistics, finance) that can use AI to defend margins in a low-growth world.

4. Geoeconomic Fragmentation

Trade is no longer just about efficiency; it is about security. The “New Trade Order” involves tariffs, export controls, and subsidies that distort market signals. The World Bank notes that trade growth is lagging GDP growth, a reversal of the globalization trend.

This fragmentation creates distinct “winners and losers.” Countries like India, Vietnam, and Mexico are benefiting from supply chain diversification (“China Plus One”). However, multinational corporations face higher compliance costs and the risk of being caught in crossfire sanctions. The risk premium for geopolitical events is currently mispriced by markets that assume conflicts will remain contained.

5. The Debt Supercycle

Perhaps the most underappreciated risk in Market Watch 2026 is the sheer volume of sovereign debt. With interest rates stabilized at higher levels, debt servicing costs are eating into national budgets. In the US, interest payments now rival defense spending. This “fiscal dominance” constrains governments’ ability to stimulate the economy if a shock occurs. It also creates long-term pressure on bond yields, as the market must absorb a flood of Treasury issuance.

Comparative Data: The Shift in Market Leaders

The following table illustrates the rotation in market leadership expected in this subdued environment.

| Feature | The “Boom” Era (2020-2024) | The “Subdued” Era (2026 & Beyond) |

| Primary Growth Driver | Consumer Stimulus & Tech Hype | Industrial Policy & Efficiency Gains |

| Interest Rate Environment | Zero to Rapid Hikes | Stable but Elevated (3-4% floor) |

| Winning Sectors | Speculative Tech, Consumer Discretionary | Defense, Utilities, Healthcare, Commodities |

| Geopolitics | Global Integration (mostly) | Fragmentation & Regional Blocs |

| Investment Strategy | “Buy the Dip” (Passive) | “Quality & Dividends” (Active) |

| Inflation Characteristic | Transitory Supply Shocks | Sticky Services & Wage Inflation |

Expert Perspectives

To navigate this complexity, it is vital to synthesize divergent expert views:

- The Bull Case: Analysts from firms like J.P. Morgan argue that “resilience” is the key story. They point to healthy corporate balance sheets and the fact that a recession has been avoided despite historic tightening. They believe that once policy rates normalize, a new cycle of expansion—driven by green energy and AI—will begin in late 2026.

- The Bear Case: Contrarian voices, including those from the World Bank, warn that the 2020s are on track to be the weakest decade for growth since the 1990s. They argue that the “lagged effects” of monetary tightening are still working through the system, particularly in commercial real estate and private credit, potentially triggering a liquidity event.

- The Realist View: Goldman Sachs suggests a middle path: “Sturdy growth, stagnant jobs.” This view holds that corporations will protect margins by freezing hiring rather than firing, leading to a consumer slowdown that keeps a lid on growth but prevents a crash.

Key Statistics: The 2026 Baseline

- Global GDP Growth: Forecast at 2.7% (Source: UN/World Bank).

- US GDP Growth: Projected at 2.0% – 2.6% (Source: Goldman Sachs/UN).

- Global Trade Growth: Expected to slow to 2.2% due to protectionism.

- Inflation (Global): Projected to moderate to 3.1%, down from peaks but above 2% targets.

- Emerging Market Growth: Forecast at 4.0%, widening the gap with advanced economies.

Future Outlook: What Happens Next?

Looking beyond the immediate quarter, the trajectory for 2026 suggests a year of two halves.

2026 (The Adjustment): The first half of the year will likely be dominated by “adjustment pains.” Markets will recalibrate to the reality that the Fed will not cut rates to zero. We may see volatility in equity markets as earnings estimates are revised down to reflect slower nominal growth. This is the accumulation zone for patient capital.

2026 (The Stabilization): By the second half, the benefits of stabilized supply chains and the initial efficiency gains from AI integration should begin to appear in data. If inflation remains contained, central banks may offer more clarity on the “terminal rate,” reducing bond market volatility.

Final Words

The era of “growth at any cost” is over. The next cycle belongs to “growth at a reasonable price.” Investors must prioritize companies with strong cash flows, low debt, and the ability to pass on costs. The “steady but subdued” economy is boring, but for the unprepared, it is a slow squeeze that can be just as damaging as a crash.