Hey there, are you tired of stressing over your credit score? Maybe you’ve missed a payment or two, and now you’re worried about getting a good loan or a new credit card. It’s a real headache, I know, watching those numbers dip and feeling stuck.

Here’s a little eye-opener, only 23% of folks have FICO scores of 800 or higher. That’s right, hitting that top tier is rare, but it’s a game-changer for lower interest rates and better credit approval odds.

Stick with me, and I’ll share 12 proven tips to keep your credit history shining and your credit utilization ratio low. These strategies will help you manage debts and boost your credit report.

Ready to jump in? Let’s go!

Key Takeaways

- Pay bills on time since payment history is 35% of your FICO score.

- Keep credit utilization below 30%; top scorers average 11.5%.

- Hold onto old credit accounts as they boost 15% of your FICO score.

- Check credit reports weekly for errors using AnnualCreditReport.com.

- Only 23% of people have FICO scores of 800 or higher.

Pay Your Bills on Time, Every Time

Paying your bills on time is the biggest deal for keeping a top-notch credit score. See, payment history makes up a huge 35% of your FICO score, so messing up here hits hard. Miss a payment by even 30 days, and bam, it gets reported to the credit bureaus.

That’s a mark on your credit report you don’t want, folks.

Set up automatic bill payments to stay on track with every credit card payment or loan. This little trick keeps those on-time payments consistent, showing off your excellent credit management skills.

Trust me, it’s like setting a reminder to breathe, simple but vital. Keep this habit, and your credit history will shine brighter than ever.

Maintain a Low Credit Utilization Ratio

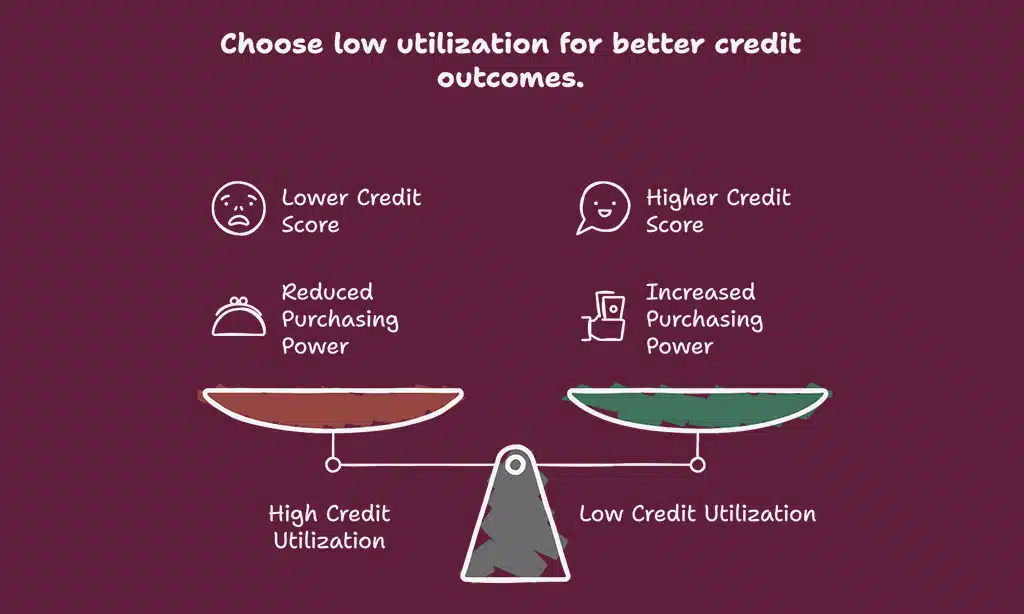

Keeping your credit utilization ratio low is a big deal for an 800+ credit score. This ratio shows how much of your credit limit you’re using. Aim to stay below 30%, folks. Stats reveal that people with top scores, like 800 or more, average just 11.5% utilization.

That’s a tiny slice of their available credit!

Think of your credit card as a pie; don’t eat more than a small piece. A lower credit utilization rate boosts your FICO score by contributing 30% to it. Want better purchasing power? Higher credit limits help, as long as you don’t max them out.

So, use less of your credit line, and watch those high credit scores climb!

Keep Old Credit Accounts Open

Holding on to old credit accounts can really boost your credit score, folks. These accounts add to your credit history length, which makes up 15% of your FICO score. So, don’t rush to close them, even if you’re not using them much.

Stick with those long-standing credit cards or lines of credit, as they help in a big way. Higher credit limits from old accounts keep your credit utilization ratio low. Plus, avoiding closure preserves your available credit, giving your credit report a solid look.

Let’s keep that history alive, shall we?

Limit New Credit Applications

Hey there, let’s chat about keeping those new credit applications in check. Applying for a bunch of credit cards or loans all at once can ding your credit score, and nobody wants that headache.

Each application often leads to a hard inquiry, which might lower your number a bit. So, take it slow, and do your homework before jumping in.

Think of it like fishing; cast too many lines, and you might scare off the big catch. Research your options first to avoid frequent new applications that could pile up unmanageable debt.

Here’s a cool tip: loan applications within two weeks often count as just one inquiry. That’s a neat way to shop around for the best credit card or personal loan without hurting your credit history too much.

Check Your Credit Reports Regularly for Errors

Grab a seat, folks, because keeping an eye on your credit reports is like being a detective for your own finances. Mistakes can sneak in, and those errors might drag down your credit score without you even knowing.

Think of it as a pesky gremlin messing with your hard work. You can get free credit reports every week from Experian, TransUnion, and Equifax through AnnualCreditReport.com. Check them often to spot any odd stuff, like a loan you never took or a missed payment that’s not yours.

If you find inaccuracies in your credit report, dispute them fast with the credit bureaus. Fixing these slip-ups is key to keeping your score high and shiny.

Staying on top of this also guards against identity theft, a real pain if fraudsters get hold of your info. Imagine someone using your name to rack up credit card balances or open new accounts.

Yikes, what a mess! Regular credit monitoring helps you catch weird activity early before it tanks your credit history. Don’t let errors or sneaky scams mess with your financial decisions.

Head to AnnualCreditReport.com, pull those reports from the big three bureaus, and scan every line. Accurate credit reports aren’t just nice; they’re a must for holding onto high credit scores.

Keep watch, and stay in control!

Diversify Your Credit Mix Responsibly

Mixing up your credit types can give your score a nice boost, folks. Think of your credit mix as a tasty stew, with different ingredients like credit cards and installment loans adding flavor.

This mix makes up 10% of your FICO credit score, so it’s worth a peek. A diverse portfolio shows lenders you can handle various debts, from revolving credit to a personal loan.

Lenders dig seeing this variety, and it paints you as a reliable borrower. Just don’t go wild applying for new credit only to improve your credit mix, okay? That can backfire with hard inquiries hurting your score.

Stick to what you need, like a secured credit card or a small student loan, and manage them well.

Pay Off Credit Card Balances in Full Each Month

Paying off your credit card balances in full each month is a game-changer, folks. It minimizes ongoing debt, keeping you free from those pesky interest charges. Plus, it shows lenders you’re on top of your financial decisions.

Think of it as a pat on the back for responsible credit management.

Wiping out that balance monthly also saves you from high-interest debt piling up. It’s like dodging a pricey bullet, trust me. Focus on clearing those credit card balances to reduce your financial burden fast.

This habit boosts your credit score and keeps your wallet happy.

Set Up Automatic Payments to Avoid Missed Due Dates

Let’s talk about a simple trick to keep your credit score shining. Setting up automatic payments can save you from the stress of missed due dates.

- First, know that automatic payments help you stay on track with bills. They pull money from your checking account on the due date, so you never miss a beat. This is huge since payment history makes up 35% of your FICO credit score. No more late fees or dings on your credit report from forgotten deadlines.

- Next, grab peace of mind with this setup. By linking your credit card or personal loan payments to auto-pay, you build an excellent payment record. It’s like having a trusty sidekick who always reminds you to pay on time. Missed payments can hurt your score, but this stops that cold.

- Also, consider how this saves time and worry. Automatic payments mean you don’t have to log in monthly to handle credit card balances. Just double-check your account has enough cash to avoid overdrafts. This keeps your financial decisions smooth and your credit history spotless.

- Then, think about the boost to your score. On-time payments are key to high credit scores, and auto-pay makes it easy. Since payment history is such a big chunk of credit scoring models, this habit can push you closer to that 800+ mark.

- Finally, set it up through your bank or credit card provider. Most offer this for free, whether it’s for revolving credit or installment loans. Make sure to review statements for errors, though. This way, you dodge any surprise fees and keep your credit approval odds high.

Become an Authorized User on a Trusted Account

Hey there, want a neat trick to boost your credit score? Try becoming an authorized user on a trusted account, like a family member’s credit card. This lets you piggyback on their good payment history, which shows up on your credit report.

It’s a simple way to build your credit history without opening a new account.

Just pick someone with solid on-time payments. Their habits, good or bad, will reflect on your credit profile. So, choose wisely, and watch how this little step can lift your credit score over time.

Use Credit-Building Tools, Such as Secured Credit Cards or Loans

Let’s talk about building your credit the smart way. Using tools like secured credit cards or credit-builder loans can launch your path to a strong credit score.

- To start, consider a secured credit card, which often requires a small deposit, like $200, as a safeguard for the lender. This deposit sets your credit limit, providing a backup if things go off track. It’s an excellent way to demonstrate you can manage revolving credit with minimal risk. Plus, with consistent responsible use, many banks will transition you to an unsecured credit card over time. That’s a great boost for your credit history!

- Next, think about credit-builder loans, particularly from credit unions. These are ideal for establishing a record of on-time payments over 6 to 24 months. You make regular payments during this period, showing lenders you’re committed to managing installment loans. This strengthens your standing with credit bureaus and significantly improves your payment history.

- Also, understand that both these tools are aimed at people with limited or no credit. They’re like a supportive guide for your financial choices, helping you stay balanced before managing on your own. Secured cards and loans are reported to credit agencies, so every positive step increases your credit score.

- Don’t overlook how these options help you avoid high-interest debt pitfalls like payday loans. Unlike those deceptive, sky-high interest rates, secured cards and credit-builder loans keep expenses manageable. You’re improving your credit without draining your finances, which is crucial for sustained success.

- Lastly, use these tools carefully to prevent missed payments. Set up alerts or automatic payments to stay on top of your credit card balances or loan obligations. This practice not only supports your credit utilization ratio but also shows future lenders that you’re dependable.

Protect Your Personal Information to Avoid Fraud

Guarding your personal info is like locking your front door, folks. You wouldn’t leave your house wide open, right? Same goes for your financial details. Identity theft can trash your credit score faster than a bull in a china shop.

It messes with your financial health too, leaving you in a real pickle. So, start by using a password manager to keep your logins safe and sound. Don’t reuse passwords, no matter how tempting it is to stick with “Fluffy123” everywhere.

Mix it up and stay secure.

Steer clear of public Wi-Fi for financial transactions, my friends. Those free hotspots at the coffee shop? They’re like a thief’s playground for stealing your data. If you must log in, use a secure connection or wait till you’re home.

Also, keep tabs on your credit score with free services out there. Regularly check your credit report for sneaky errors or fraud. Identity theft is no joke, and catching it early can save your bacon.

Stay sharp, and protect that credit history like it’s your secret recipe.

Takeaways

Hey there, let’s wrap up this credit score journey with a bang! Keeping that 800+ score is like tending a garden; it takes steady care. Stick to these 12 solid tips, from on-time payments to watching your credit utilization ratio, and you’re golden.

Got a question or a funny credit tale? Drop it below, and let’s chat about nailing those high credit scores together!

FAQs on Maintain a Perfect Credit Score

1. How can I keep my credit score above 800 with on-time payments?

Hey, paying your bills right on the dot is a game-changer for your payment history. It shows credit bureaus you’re reliable, boosting those high credit scores. Keep up with every credit card and personal loan due date, and you’re golden.

2. Why does my credit utilization ratio matter so much for a good credit score?

Listen up, your credit utilization rate is like the heartbeat of your credit report. Keep it low, under 30 percent of your credit limit, to show you’re not maxing out revolving credit like credit card balances.

3. Can becoming an authorized user help my credit history?

Absolutely, tagging along as an authorized user on someone’s solid credit card account can lift your own credit history. It’s like borrowing their good vibes, as long as they avoid missed payments. Just watch for any hard inquiry that might sneak in.

4. How do I dodge credit report inaccuracies to protect my FICO credit scoring?

Yo, mistakes on your credit report can tank your average consumer credit score faster than you think. Check annualcreditreport.com often to spot errors, and dispute them quick with the credit bureaus to keep your record clean.

5. Should I mix up my credit mix with installment loans and revolving debt?

Hey there, having a blend of credit types, like installment loans for car loans and revolving accounts like a line of credit, can perk up your credit scoring models. It’s like showing you can juggle different financial decisions without dropping the ball. Just don’t overdo new credit, or those exorbitant interest rates might bite.

6. How does credit monitoring save me from high-interest debt headaches?

Buddy, keeping tabs on your credit utilization and overall debt-to-income ratio with credit monitoring is a lifesaver. It helps you avoid piling up high credit card balances or falling into traps with crazy APRs and services charge fees from a debt collector. Stick with it, maybe even chat with a credit counselor, to steer clear of financial potholes.