You get constant calls from debt collectors, day or night. They call before eight a.m. or after nine p.m. You dread seeing your phone light up. You want to know when you can fight back and even win money.

Debt collectors may not call you before eight a.m. or after nine p.m. without your okay. We will lay out eight times you can sue a debt collector under the Fair Debt Collection Practices Act.

You will learn to use certified mail, track the statute of limitations, and demand debt validation. Read on.

Key Takeaways

- You can sue if a debt collector calls you before 8 a.m. or after 9 p.m., calls more than seven times in seven days, or uses threats or obscene language. The FDCPA lets you recover up to $1,000 in statutory damages, actual losses, and attorney fees. One man, Mark, sued for phone abuse and won.

- You can sue when collectors lie, use fake court papers, or inflate balances in credit card or medical debt cases. The law (15 U.S.C. §1692) lets you win $1,000 plus extra money for emotional distress and court costs.

- You can stop unwanted calls, texts, and emails by sending a debt-validation or “cease contact” letter by certified mail. If collectors break this rule, the Federal Trade Commission or Consumer Financial Protection Bureau can fine them.

- You can challenge attempts to collect time-barred debts, hidden fees, false credit-report information, or post-bankruptcy demands. You must file your FDCPA claim within one year of the last violation to win damages.

Harassment or Abuse by a Creditor

Harassing calls can feel like a storm you cannot outrun. Consumer rights under the FDCPA shield you from threats and obscene language. A debt collection agency may not chase you with more than seven calls in a seven-day period.

The Consumer Financial Protection Bureau and Federal Trade Commission enforce these rules. Certified mail or text messages that include threats also break federal law.

Victims of abuse can sue for actual damages and up to $1,000 in statutory damages, plus attorney fees. A judge will award costs for FDCPA violations in credit card debt or medical bills cases.

Claims must reach court within one year of the worst call or text. Mark saw a third-party collector push limits; he sued under fair debt collection practices and won.

False or Misleading Representations

Collectors sometimes lie. Some letters claim you owe more than you do. Some notices inflate balances after a partial payment or a debt settlement plan. Others pose as an initial lender or as a collection agent.

Fake court forms arrive in your mail. The code cites 15 U.S.C. 1692. Federal debt law bans those acts. It protects you from false identity and inflated balances. The rule bars bogus threats about time-barred debt.

It covers outside collectors and in-house teams.

Victims can report abuse to a federal watchdog or a consumer bureau. Enforcement agencies may investigate unfair practices. You may sue under fair debt law for deceptive collection tactics.

Statute allows up to one thousand dollars in statutory damages. You can add attorney fees and court costs to your claim. Sending a debt validation request by tracked mail helps. A judge may order payment for emotional distress too.

Legal action can halt rogue collection staff on the spot.

Illegal Communication Practices

Agents breach consumer rights under the fair debt collection practices act when they dial before 8 a.m. or after 9 p.m. A phone wakeup at 7 a.m. can derail work focus. Social media messages count as communication under federal law.

The CFPB logs each unwanted text or email when a consumer hits stop. A consumer can cut off all digital pings with one request.

Workplace calls feel like a punch to the gut if a borrower says no. Original creditors must shift to letters or private notes when the office ban kicks in. Third-party debt collectors cannot send new emails after a stop order.

They must use certified mail for debt validation instead. The FTC fines violators for these illegal communication infractions.

Failure to Validate Debt Upon Request

Third-party debt collectors face strict rules under the FDCPA. They must send a validation notice within five days of first contact. That notice must state the total amount owed, name the original creditor, and list the collector’s phone number and address.

You get 30 days to dispute after the notice arrives. Mark that window, then track their reply.

Collectors must stop all calls and letters until they verify your debt with proof. Federal law lets you win up to $1,000 in statutory damages, plus harm and attorney fees. A validation dispute sent by certified mail protects your consumer rights.

Filing a complaint at the CFPB adds even more bite if they still refuse to verify.

Attempting to Collect Time-Barred Debt

Creditors sometimes chase time-barred debt long after state limits end. Statutes of limitations range from three to 10 years, based on state law. Courts cannot force you to pay old balances.

Even a small payment or written promise can restart that clock. Collectors must follow the Fair Debt Collection Practices Act (FDCPA) or face penalties.

You can dispute a stale balance under consumer rights in the FDCPA by sending a debt validation request via registered mail. Delinquent debts stay on credit reports for seven years even if you do not pay.

Sending a clear dispute stops improper calls or letters from collection firms and outside debt collectors. The CFPB and FTC handle complaints about unfair practices. A court can award statutory damages and attorney fees when a collector breaks federal law.

Threatening Legal Action Without Intent

Collectors who threaten legal action they never plan to take break federal law. The fair debt collection practices act bans false threats of garnishing wages or suing off time-barred debt.

This rule covers time-barred debt under the statute of limitations. Debt collectors must plan to file a court case or face penalties. Consumers enjoy strong consumer rights under this federal rule.

You can report violations to your state legal office, the Federal Trade Commission (FTC), or the Consumer Financial Protection Bureau (CFPB). Send a debt validation request by certified mail to back your claim.

Some debt collectors use fake suit threats to scare people. Consumers may sue under the FDCPA for up to $1,000 in statutory damages. Judges may also award attorney fees and court costs.

This action stops unfair practices and false garnishment claims. File a simple complaint with your court and include proof of threats.

Unauthorized Fees or Charges Added to Debt

Debt collectors may try to tack on hidden fees to your account. Federal law, under the fair debt collection practices act (FDCPA), bars any charges not listed in the original agreement.

A promissory note or line of credit must spell out every cost. You have 30 days to dispute any extra fee in writing.

Send a debt validation notice via certified mail to original creditor or third party debt collection agencies. The Consumer Financial Protection Bureau and state attorney general offices can step in.

That sneaky fee is like a hidden tax on your wallet. A court award can include actual damages plus attorney fees under federal law, thanks to FDCPA. These steps protect your consumer rights and keep shady billing at bay.

Damage to Credit Reporting Due to False Information

Wrong details on a credit file can wreck your score in days. A single fake charge can drop points fast. Credit bureaus record your debts. You hold strong consumer rights under federal law.

You may file a debt dispute in writing or use an online dispute form. Sending a letter by certified mail adds proof. The Consumer Financial Protection Bureau accepts complaints too.

A 2021 study found one in five reports contains errors. Poor reporting can snag higher interest rates on credit card debt or medical bills.

FDCPA bars third-party debt collectors and original creditors from giving false data to credit reporting agencies. Suing over wrong details can net statutory damages of up to $1,000 per violation.

Courts may also award attorney fees. You do not need to show big out-of-pocket loss. Judges rely on the Fair Credit Reporting Act to set penalties. State attorney general offices back many cases.

Some folks win even without private counsel.

Creditor Violates Bankruptcy Protections

The debtor files chapter 7 bankruptcy and triggers the automatic stay under the Bankruptcy Code. Collection agencies must halt calls, letters, and wage garnishment at once. Ignoring this rule breaks federal law and the fair debt collection practices act.

Third-party debt collectors who press on, send mail, or try to seize Social Security violate consumer rights.

They can sue for sanctions, actual damages, statutory damages, and attorney fees. Courts award fees for certified mail used in debt validation. No garnishment can touch federal benefits like Social Security checks.

The CFPB, or a state attorney general, can step in and enforce consumer protection.

Emotional Distress Caused by Creditor’s Actions

Creditors pile on with harassing calls at dawn, leaving nasty voicemails that bruise your mind. Abusive debt collectors dare to curse, yell threats, or mock your bills. You lie awake, heart pounding, fearing holiday dinners or work events.

Harassment turns a simple debt collection into a trial by fire and chips away at your consumer rights.

Fair Debt Collection Practices Act (FDCPA) bans conduct that causes emotional distress and opens the door to a lawsuit. Consumer Financial Protection Bureau rules back that law. Plaintiffs get one year from the violation date under the statute of limitations to act.

You can also send a debt validation request by certified mail. Courts may grant actual damages, statutory damages up to $1,000, and attorney fees. Winning awards can fund a debt settlement and aid debt recovery.

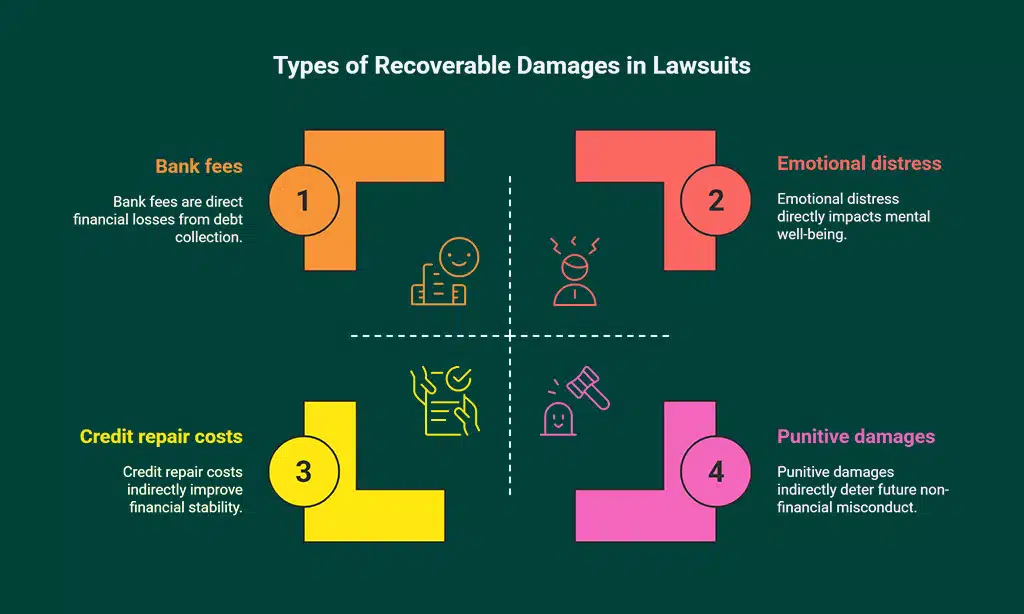

Compensation You Can Recover in a Lawsuit

You can claim real losses, like bank fees. You can win up to $1,000 for each FDCPA breach.

- Actual damages: A court can pay for bank fees, wage garnishments or extra interest on credit card debt. It can also cover late charges on medical bills or loaned money.

- Statutory damages: A judge may award up to $1,000 per breach under the fair debt collection practices act. Each violation can trigger a payout for calls, letters or unfair demands.

- Court costs: A suit can return filing fees, service fees and certified mail costs. You avoid paying these out of pocket.

- Attorney fees: Recover fees under federal law for debt validation or debt collection disputes. Legal representation costs, such as paralegal time or hearing prep, can come back to you.

- Emotional distress: Seek money for anxiety, stress or sleepless nights from abusive calls or unfair demands. A jury may weigh how debt collectors hurt your peace of mind.

- Punitive damages: Add extra fines when a collector acts in bad faith or uses profane language. Courts set high penalties to punish harmful unfair practices.

- Restitution of unauthorized fees: Win back hidden service charges or extra fees that a collector or lender added without consent. Return also covers add-ons from collection agencies or third-party debt collectors.

- Credit repair costs: Claim fees paid to fix a false credit report flagged by the CFPB or FTC. That award aids in lifting a wrong hit on your credit file to avoid wage garnishment or credit card denial.

Steps to Take Before Filing a Lawsuit Against a Creditor

You must prepare your case before you sue a creditor. Sort medical bills, credit card notices, promissory notes and collection papers.

- Gather all letters, bills, and account statements from the original creditor, third party collectors, and collection agencies.

- Check statute of limitations dates on credit card debt and medical bills to spot expired claims.

- Mail a debt validation letter by certified mail with return receipt so debt collectors must verify the debt.

- Draft a cease contact letter and send it by certified mail to halt abusive calls.

- File a complaint with the state attorney general, FTC or CFPB. Cite FDCPA and consumer rights violations.

- Track each phone call, email and text with notes, dates and times to build a clear log.

- Consult a litigation attorney or visit LawHelp.org for pro bono or low cost legal advice.

- Estimate statutory damages, attorney fees and actual losses under the FDCPA to know your potential award.

- Explore debt settlement options or mediation before court to save time and money.

Takeaways

This guide shows eight times you can sue a creditor and win money. You learn about FDCPA rights, debt validation steps, and the statute of limitations. Even collection agencies cannot cross the line or add hidden fees.

Use certified mail to lock in proof. Chat with a CFPB rep or hire an attorney. Take your case to court with confidence.

FAQs on Legal Reasons to Sue a Creditor and Claim Damages

1. When can I sue a debt collector under the fair debt collection practices act?

If a third-party debt collector calls at night, lies, or threatens arrest, they break the FDCPA. It feels like a game without rules. You can sue under federal law, ask for statutory damages, get attorney’s fees, and file a complaint with the consumer financial protection bureau, or CFPB.

2. Can I sue if they chase old debt past the statute of limitations?

Yes. When the debt age passes state limits it is time-barred debt. If they still call or report it to credit, you can sue to protect your consumer rights. Send a debt validation letter by certified mail. You can win money damages.

3. What if they mix up my credit card debt with medical bills?

Say a collection agency jumbles your bills, it feels like chasing a runaway balloon. They must do proper debt verification. If they skip this step they break debt collection regulations. You can sue for wrong debt validation and win.

4. Can I sue over illegal wage garnishment?

If a creditor takes pay from your job or social security benefits without a court order, they rush in without a map. You can file a debt dispute, sue for unfair wage garnishment, get your money back, and recover attorney’s fees.

5. When do deceptive or unfair practices let me sue?

If a creditor lies about your balance, uses fake court papers, or ignores your debt validation request, they break consumer protection law. You can sue under federal law, get statutory damages, and attorney fees.

6. Will I recover attorney fees and other costs if I win?

Yes. A judge can make the creditor pay your legal fees and set statutory damages. Keep good records, use certified mail, and get legal representation early to strengthen your case.