The rise of cryptocurrency has been nothing short of revolutionary, offering a decentralized and innovative financial system that challenges traditional banking norms. However, as digital currencies like Bitcoin and Ethereum continue to gain traction, they also face significant legal hurdles.

These legal challenges are critical to address, as they directly impact the adoption, innovation, and future stability of the crypto world.

This article delves into the 5 legal challenges facing the crypto world, analyzing their implications and offering insights into how they shape the industry’s future.

By exploring these challenges, readers can gain a deeper understanding of the legal landscape surrounding cryptocurrencies and the steps required to overcome these obstacles.

Overview of Legal Complexities in the Crypto Industry

Cryptocurrency operates in a legally ambiguous space due to its decentralized nature. Unlike traditional financial systems, which are governed by centralized authorities, cryptocurrencies rely on blockchain technology and peer-to-peer networks.

This decentralized framework poses unique legal challenges, as governments and regulatory bodies struggle to keep pace with its rapid evolution.

The Need for Legal Clarity in Crypto

The absence of clear regulations creates uncertainty for businesses, investors, and consumers. For instance, a lack of consistent policies across different jurisdictions hinders the global adoption of cryptocurrency. Legal clarity is essential to:

- Foster innovation without compromising security.

- Ensure compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

- Build trust among users and investors.

5 Legal Challenges Facing the Crypto World

Here are top 5 legal challenges in crypto world.

1. Regulatory Uncertainty

One of the most pressing legal challenges facing the crypto world is regulatory uncertainty. Governments worldwide have adopted varying approaches to cryptocurrency regulation, ranging from outright bans to embracing it as legal tender. The lack of a unified approach leaves crypto businesses and users navigating a complex web of rules.

Examples of Global Regulatory Approaches:

| Country/Region | Approach to Regulation |

| United States | SEC classifies cryptocurrencies variably as securities or commodities. |

| European Union | MiCA framework seeks to unify crypto regulations. |

| China | Complete ban on cryptocurrency trading and mining. |

| El Salvador | Bitcoin adopted as legal tender. |

How It Affects the Industry

This patchwork of regulations creates confusion for businesses operating across borders. Companies face challenges such as:

- Navigating conflicting compliance requirements.

- Higher operational costs due to legal consultations.

- Risk of penalties or shutdowns in restrictive jurisdictions.

Case Study: MiCA’s Impact in the EU

The Markets in Crypto-Assets Regulation (MiCA) aims to provide a cohesive framework for cryptocurrencies in the EU. By offering clear definitions and compliance requirements, MiCA is expected to foster innovation while protecting users, setting a potential global benchmark.

2. Money Laundering and Fraud Concerns

Cryptocurrency’s pseudo-anonymous nature has made it an attractive tool for illicit activities, including money laundering, fraud, and tax evasion. While the blockchain’s transparency offers some degree of traceability, bad actors often exploit gaps in regulation and enforcement.

Government Actions

Governments and international organizations have introduced measures to combat financial crimes in the crypto world:

| Measure | Description |

| FATF Guidelines | Mandates compliance with the “Travel Rule.” |

| KYC/AML Requirements | Enforces customer identification protocols. |

| Blockchain Analytics Tools | Tools like Chainalysis track suspicious activities. |

Combating Financial Crimes

To address these issues, the industry is adopting advanced solutions:

- Blockchain Analytics Tools: Companies like Chainalysis and CipherTrace track suspicious activities on the blockchain.

- Global Collaboration: Cross-border cooperation among governments and organizations is crucial.

Practical Example: Tether’s Role in Financial Crimes

Tether, a popular stablecoin, has faced scrutiny over allegations of being used in money laundering schemes. By implementing stricter KYC/AML measures, exchanges handling Tether aim to minimize its misuse.

3. Taxation and Compliance Challenges

Taxation remains a significant legal challenge facing the crypto world. Many governments are still figuring out how to categorize and tax digital assets effectively, creating confusion for both businesses and individual investors.

Key Issues in Crypto Taxation

| Taxation Challenge | Description |

| Capital Gains Tax | Applies to profits from trading or selling crypto. |

| Crypto-to-Crypto Transactions | Tax obligations arise even in non-cash transactions. |

| Reporting Requirements | Complex rules often confuse users, leading to non-compliance. |

Simplifying Tax Compliance

Tax agencies and platforms are developing frameworks to simplify compliance:

- Automated Reporting Tools: Platforms like CoinTracker assist users in calculating and reporting taxes.

- Educational Campaigns: Governments are raising awareness about crypto taxation laws.

Real-Life Example: IRS’s Approach to Crypto Taxation

The IRS in the United States has introduced guidelines requiring taxpayers to disclose their cryptocurrency holdings. Non-compliance can lead to penalties, emphasizing the importance of staying informed.

4. Security and Privacy Concerns

The crypto world faces significant security challenges, including hacking, phishing, and ransomware attacks. Moreover, the balance between maintaining user privacy and ensuring regulatory compliance remains delicate.

Risks to Security and Privacy

| Security Challenge | Impact |

| Cyberattacks | Billions lost through hacks (e.g., Mt. Gox, Bitfinex). |

| Data Breaches | Compromises sensitive user data stored by exchanges. |

| Ransomware Payments | Cryptocurrencies often used in ransomware schemes. |

Solutions to Enhance Security

The industry is investing in advanced technologies to mitigate risks:

- Smart Contracts: Automated, self-executing contracts reduce the risk of human error.

- Decentralized Identities: Enable users to control their personal data securely.

- Blockchain Protocols: Innovations like multi-signature wallets and zero-knowledge proofs enhance security.

Case Study: Binance’s Security Measures

Binance, one of the largest crypto exchanges, invests heavily in security protocols, including AI-driven fraud detection systems and multi-factor authentication, to safeguard its users.

5. Intellectual Property Rights in Blockchain Technology

Blockchain’s open-source nature has led to disputes over intellectual property rights, including patents and copyrights. These disputes can hinder innovation and collaboration within the crypto industry.

Key Challenges

| IP Challenge | Description |

| Patent Wars | Companies compete to patent blockchain innovations. |

| Copyright Issues | Determining ownership of content on decentralized platforms. |

Navigating IP in the Crypto Space

Legal precedents and collaborative efforts are shaping the future of intellectual property in blockchain:

- Case Studies: Disputes like Ripple Labs vs. SEC highlight the complexities.

- Industry Standards: Initiatives to create open-source agreements and licensing frameworks.

Example: Ethereum’s Open-Source Model

Ethereum’s commitment to open-source development fosters collaboration while encouraging fair use of its technology, serving as a model for the industry.

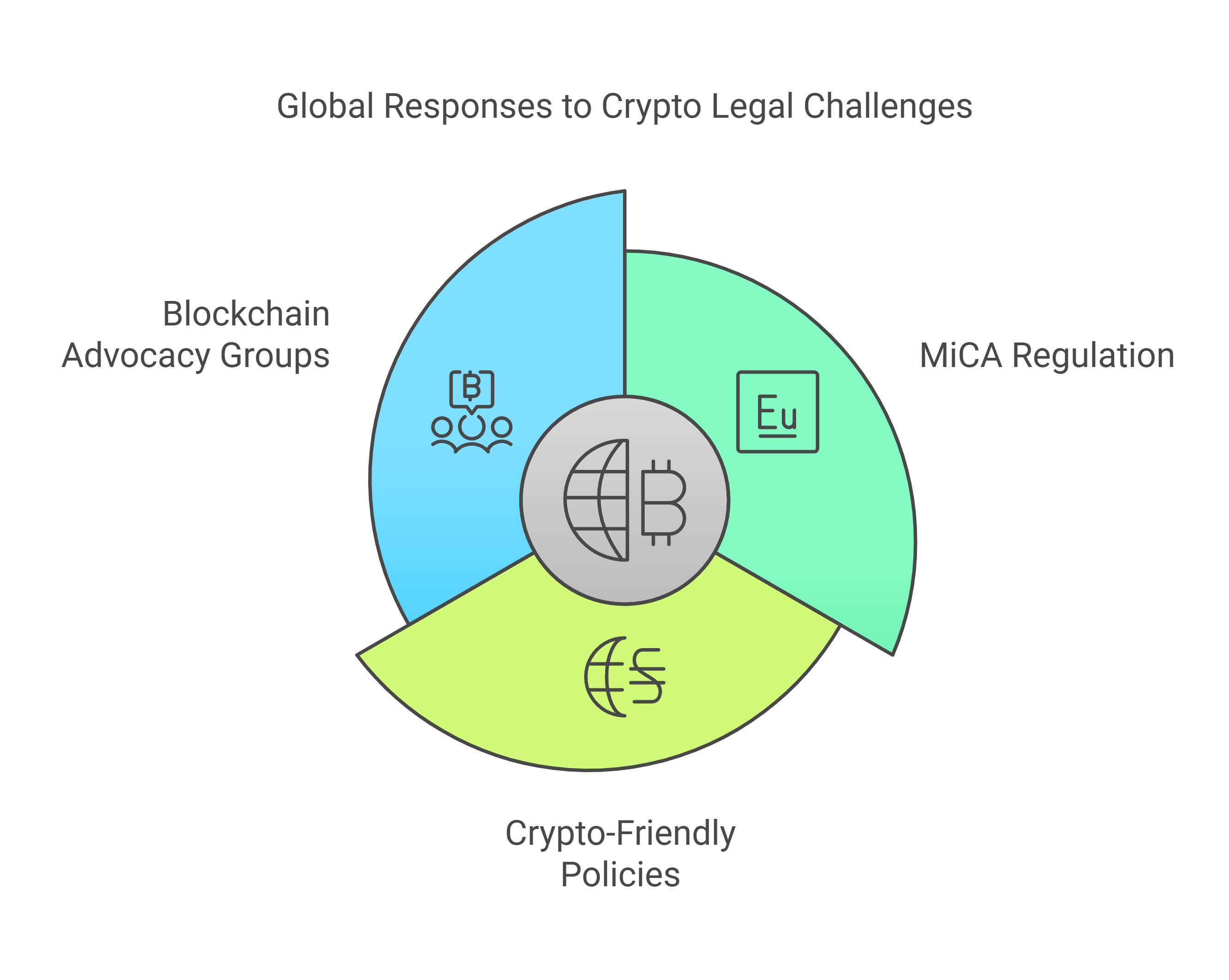

How Governments and Organizations Are Responding

Governments and organizations worldwide are working to address the legal challenges facing the crypto world. Some notable efforts include:

| Initiative | Description |

| MiCA Regulation | Unified framework for crypto assets in the EU. |

| Crypto-Friendly Policies | Examples include Switzerland and Singapore. |

| Blockchain Advocacy Groups | Organizations advocating for fair regulations. |

Future Outlook: Resolving Legal Challenges in the Crypto World

The future of cryptocurrency depends on addressing its legal challenges. Predicted trends include:

- Global Collaboration: Harmonizing regulations across jurisdictions.

- Technological Advancements: Leveraging blockchain technology to enhance transparency and compliance.

- Increased Consumer Protection: Laws ensuring safe and fair usage of cryptocurrency.

Industry leaders and policymakers must collaborate to create a sustainable and inclusive legal environment that fosters growth and innovation in the crypto world.

Takeaways

The 5 legal challenges facing the crypto world — regulatory uncertainty, money laundering, taxation, security concerns, and intellectual property disputes — are complex but solvable. By addressing these issues proactively, the crypto industry can pave the way for broader adoption and long-term success.

As the landscape continues to evolve, it’s vital for businesses, governments, and users to work together, ensuring the crypto world remains a secure, innovative, and legally compliant space. Let’s embrace the future of finance responsibly and advocate for clear and fair regulations.