While buying a car insurance policy is essential, many buyers make mistakes that put them at a higher expense or with inadequate coverage. Rushing through the process, ignoring policy details, or delaying your car insurance renewal can cause financial strain. Many also forget about the No Claim Bonus benefits or give incorrect information that may influence future claims.

Knowing these common mistakes helps you make better decisions and avoid extra expenses in the future. Whether you want to buy car insurance online or offline, knowing what to avoid gives you a perfect ride. Read on for the most significant blunders and ways to prevent them.

5 Mistakes to Avoid When Buying Car Insurance

Choosing the right car insurance policy ensures financial security and hassle-free claims. However, many buyers make avoidable mistakes that lead to higher premiums, claim rejections, or inadequate coverage. Here are the top five mistakes to avoid:

1. Not Comparing Car Insurance Policies

Many buyers choose the first policy on display instead of comparing other options. This leads to higher premiums and sometimes less coverage. Various insurers offer more or less in terms of benefits, claims processes, discounts on premiums, and so on.

So, compare appropriately before buying a car insurance policy to ensure you get the best one. Always go for comprehensive coverage, reasonable pricing, and easy claim settlement. When you purchase car insurance online, you can use several comparison tools to compare different plans.

Research into customer reviews and comparing claim settlement ratios would also help make the proper selection.

2. Ignoring Policy Coverage Details

Some buyers focus solely on a less expensive policy’s price and ignore coverage details. The cheaper policy may exclude essential benefits like roadside assistance, engine protection, or zero depreciation cover.

Additionally, taking third-party insurance would put one at risk of incurring personal expenses following an accident. Before purchasing a car insurance policy, the buyer must carefully read the inclusions and exclusions. Ensure they cover accidental damages, theft, natural calamities, and third-party liabilities.

If renewal is due, he should review his existing policy and add any required riders to enhance protection.

3. Missing Timely Renewal of Car Insurance

Set reminders for your policy expiry date and complete a car insurance renewal online before the deadline. It’s important to remember that a lapsed insurance policy means driving without insurance, and that’s both illegal and risky.

If you delay renewing your car insurance policy, you lose the benefits of the No Claim Bonus and will have to get your vehicle inspected before reactivating the policy. You can renew your car insurance online or offline at your convenience.

Online renewal is swift and easy, creates no unnecessary paperwork, and avoids fines for missed due dates. A careful watch for renewal dates will help you avoid legal and financial problems.

4. Overlooking No Claim Bonus (NCB)

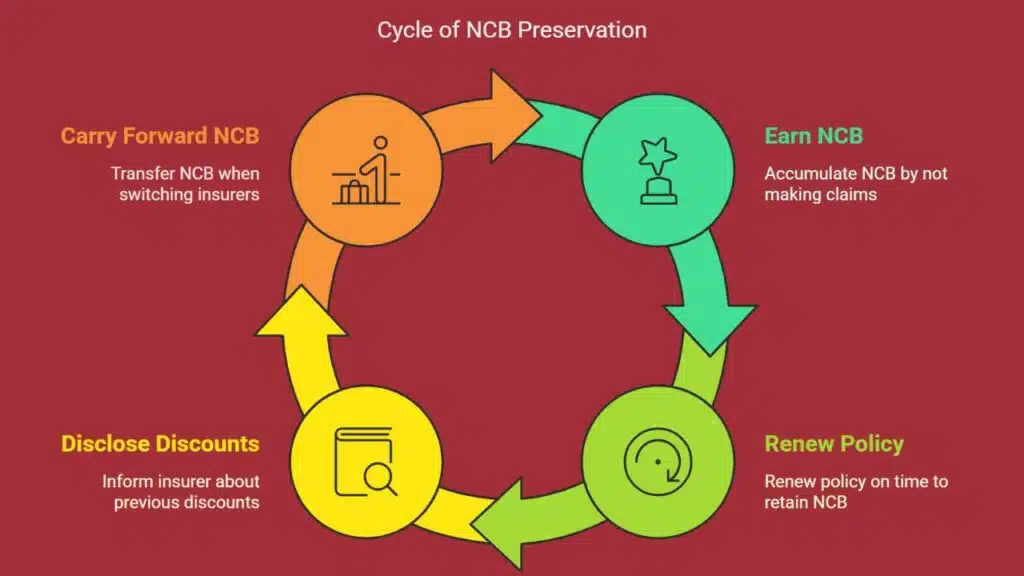

No Claim Bonus, or NCB, is the reward that is given for not making claims in a year of a policy. Most policyholders fail to claim their NCB discount while renewing a car insurance policy, doubling their premium rates.

Sometimes, switching insurers might even cost the insured their accumulated No Claim Bonus. To avoid losing the benefits of the No Claim Bonus, the insured must renew their policy on time and disclose previous discounts to the insurer.

The NCB in car insurance must be carried forward while switching insurers because doing this keeps the premiums low while covering the same amount.

5. Providing Incorrect Information

Incorrect information relating to personal or vehicle details can lead to claim rejection. Sometimes, buyers provide the wrong information when buying car insurance, either by mistake or to lessen premium costs.

However, insurance companies verify all details during claims, and discrepancies may result in rejection or delays. Therefore, always provide correct information about your name, vehicle registration number, and driving history.

If there are any discrepancies concerning the details after purchasing a car insurance policy, inform the insurer immediately. This will prevent causing complications when the claims are being processed.

Why Choosing the Right Car Insurance Matters?

Making the right decisions about car insurance policies is crucial. Most buyers focus mainly on the price, often disregarding key factors. This mistake can cause unexpected expenses and denied claims. Choosing a policy with the right coverage provides protection and benefits, such as:

- Protects against financial losses from accidents, theft, and natural disasters.

- Avoids unexpected expenses by ensuring adequate coverage.

- A comprehensive policy covers both vehicle damage and third-party liabilities.

- Choosing a reliable insurer ensures a smooth claim process.

- Helps maintain legal compliance and peace of mind.

- Timely car insurance renewal prevents policy lapse and loss of benefits.

- Making an informed choice ensures hassle-free protection and long-term savings.

The right car insurance policy can protect you from unexpected expenses. At the same time, common mistakes can lead to financial losses. Policy comparison, on-time renewal, claiming a No Claim Bonus, and providing precise information promise an uninterrupted experience.

If you seek a new policy or wish to renew your car insurance, avoiding these mistakes will help you avoid unnecessary costs or claim issues. Make informed decisions to ensure you have the best coverage for the price.