Hey there, are you worried about getting a fair deal on a loan for your real estate project? Maybe you’ve heard some scary stories about private lenders, like hidden fees or bad customer service, and now you’re second-guessing who to trust with your money.

Let’s talk about a big name in this game: Kennedy Funding. There’s a lot of buzz around the Kennedy Funding Ripoff Report, pointing fingers at their lending practices with claims of sneaky costs and unclear loan terms.

But, here’s a key fact, not every story out there paints them as the bad guy; some folks have had good experiences too. So, what’s the real deal?

In this blog, we’re breaking it all down for you. We’ll dig into the allegations, check out Kennedy Funding’s response, and help you spot red flags in private lending. Plus, we’ll toss in tips to protect yourself and show you other lending options if you’re looking for alternatives to Kennedy Funding.

Stick around, we’ve got the truth waiting!

Key Takeaways

- Kennedy Funding, a major real estate lender, offers loans from $1 million to $50 million for commercial properties.

- The Kennedy Funding Ripoff Report, started by Ed Magedson in 1998, highlights complaints about hidden fees and unclear loan terms.

- Borrowers report excessive fees and poor customer service, including delayed responses from Kennedy Funding.

- Kennedy Funding denies unethical practices and claims compliance with U.S. lending laws, especially in New Jersey.

- Investigations found no illegal activity but noted sneaky practices, damaging Kennedy Funding’s reputation.

Understanding the Kennedy Funding Ripoff Report

Let’s talk about the Kennedy Funding Ripoff Report, folks. This online platform, started by Ed Magedson in 1998, shines a light on consumer complaints. It’s all about keeping permanent records online for everyone to see.

The report has raised some serious flags about Kennedy Funding, a big name in real estate financing. They offer loans from $1 million to $50 million, mainly for commercial property deals.

But, the Ripoff Report claims there are issues with their lending practices.

Now, digging into this “Kennedy Funding Ripoff Report” shows it’s not just random chatter. Many complaints stem from misunderstandings or hidden fees, as highlighted in the Ripoff Report.

It’s like finding a sneaky fee in your bank statement, frustrating, right? Borrowers must do their due diligence before signing any loan agreement with a lender like Kennedy Funding.

Check reviews on platforms like Ripoff Report to separate fact from fiction. Stick with me as we uncover more about these concerns.

Key Allegations in the Ripoff Report

Hey there, let’s chat about some serious claims popping up online about Kennedy Funding. People are buzzing with stories that might make you think twice before signing any deal!

Hidden fees and costs

Let’s talk about hidden fees and costs tied to the Kennedy Funding Ripoff Report. Many borrowers have shared shocking stories. They claim fees were not disclosed upfront. These unexpected charges hit them hard after signing the deal.

Imagine thinking you’ve got a fair loan, only to find extra costs piling up like uninvited guests at a party.

Beyond that, allegations point to excessive fees and sky-high interest rates. Some folks reported being blindsided by these added expenses. It’s like ordering a cheap burger, then getting a bill for a gourmet meal.

If you’re considering Kennedy Funding, watch out for these hidden traps in the loan process. Dig deep into the terms and conditions before you commit.

Unclear loan terms

Hey there, readers, let’s chat about a big issue with Kennedy Funding: unclear loan terms. Many folks have stumbled into trouble because the agreements aren’t as clear as day. Some borrowers even say the terms get tweaked after signing, which feels like a sneaky curveball.

It’s a real headache when you think you’ve got the deal figured out, only to find hidden twists.

Digging into the Kennedy Funding ripoff report, allegations of vague or misleading loan terms pop up a lot. This isn’t just small print nonsense; it can mess up your whole plan, especially with high-risk loans.

The Truth in Lending Act, or TILA, governs these deals to protect you. So, always read every line of that loan agreement with a sharp eye before you sign anything with Kennedy Funding, or any private lender, for that matter.

Customer service complaints

Let’s talk straight about Kennedy Funding’s customer service complaints. Many borrowers have shared their frustration over poor support. They say the responses are often unhelpful, leaving them stuck with problems.

It’s like calling for help and getting a shrug in return.

On top of that, delayed communication is a big issue surrounding Kennedy Funding. Clients report waiting far too long for answers, which can mess up real estate projects. The company admits this is a problem and claims they’re working on better transparency.

They want to fix how they talk to potential clients, but many still feel let down by Kennedy Funding’s customer service.

Kennedy Funding’s Official Response

Hey there, readers, let’s chat about how Kennedy Funding has responded to the ripoff report mess. They’re not just sitting quiet, no way. The company flat-out denies any unethical practices, standing firm on their ground.

They claim full compliance with lending laws across the United States, especially in their home base of New Jersey. Plus, they’re shouting from the rooftops about their commitment to better transparency and communication with clients.

That’s a big deal when trust is on the line in the financial world.

Now, here’s the kicker, they’re also working hard to boost Kennedy Funding’s customer service. Think quicker responses and clearer answers for folks seeking financial assistance.

On top of that, they’ve started internal reviews to tackle any hidden issues head-on. Their policies are getting a fresh update too, making costs and loan terms crystal clear for anyone considering Kennedy Funding, or any private lender specializing in bridge loans for commercial real estate.

Stick with me as we dig deeper into this story!

Investigations and Findings

Dig into this, folks. Investigations into the Kennedy Funding ripoff report turned up no solid proof of illegal activity. That’s a big deal, right? But, hold on, they did spot some sneaky practices.

These tricks show a real need for better borrower education. People must know what they’re signing up for with private loans. If you’re considering Kennedy Funding, or any lender, this gap in understanding could trip you up.

Now, let’s chat about the fallout. Ripoff reports have hurt Kennedy Funding’s reputation quite a bit. On top of that, there’s tighter regulatory scrutiny on how they operate.

This means eyes are on them, watching every move. It’s like having a strict teacher looking over your shoulder. So, while no laws were broken, the negative reviews and hidden fees chatter still stir up doubts for folks seeking fast funding for real estate deals.

How to Protect Yourself from Private Lending Issues

Hey there, wanna dodge the traps in private lending? Stick around, and let’s chat about some smart moves to keep your wallet safe!

Conduct thorough research

Dig into every detail before choosing a lender like Kennedy Funding. Look for reviews online, hunt down complaints, and check for any legal issues tied to the company. This step can save you from hidden fees and terrible customer service surprises.

Scour the internet to see if Kennedy Funding operates fairly, and compare them with others. Check out traditional banks, peer-to-peer lending options, and even government-backed loans.

Make sure the lender follows state and federal laws, so you can trust your financial transactions.

Seek legal advice

Hey there, let’s talk about a smart move when dealing with loans like those from Kennedy Funding. Seeking legal advice can save you from a real mess, especially if loan terms seem murky or confusing.

Don’t skip this step, folks; a lawyer can break down the fine print and spot red flags. With help, you can understand the loan fully and dodge vague terms that might trip you up.

The Federal Trade Commission also backs you up if predatory lending creeps in, so tap into that support. It’s like having a trusty map in a tricky maze of finance.

Alternatives to Kennedy Funding

Let’s explore options if you’re considering alternatives to Kennedy Funding. There are reliable financing choices available to meet your needs.

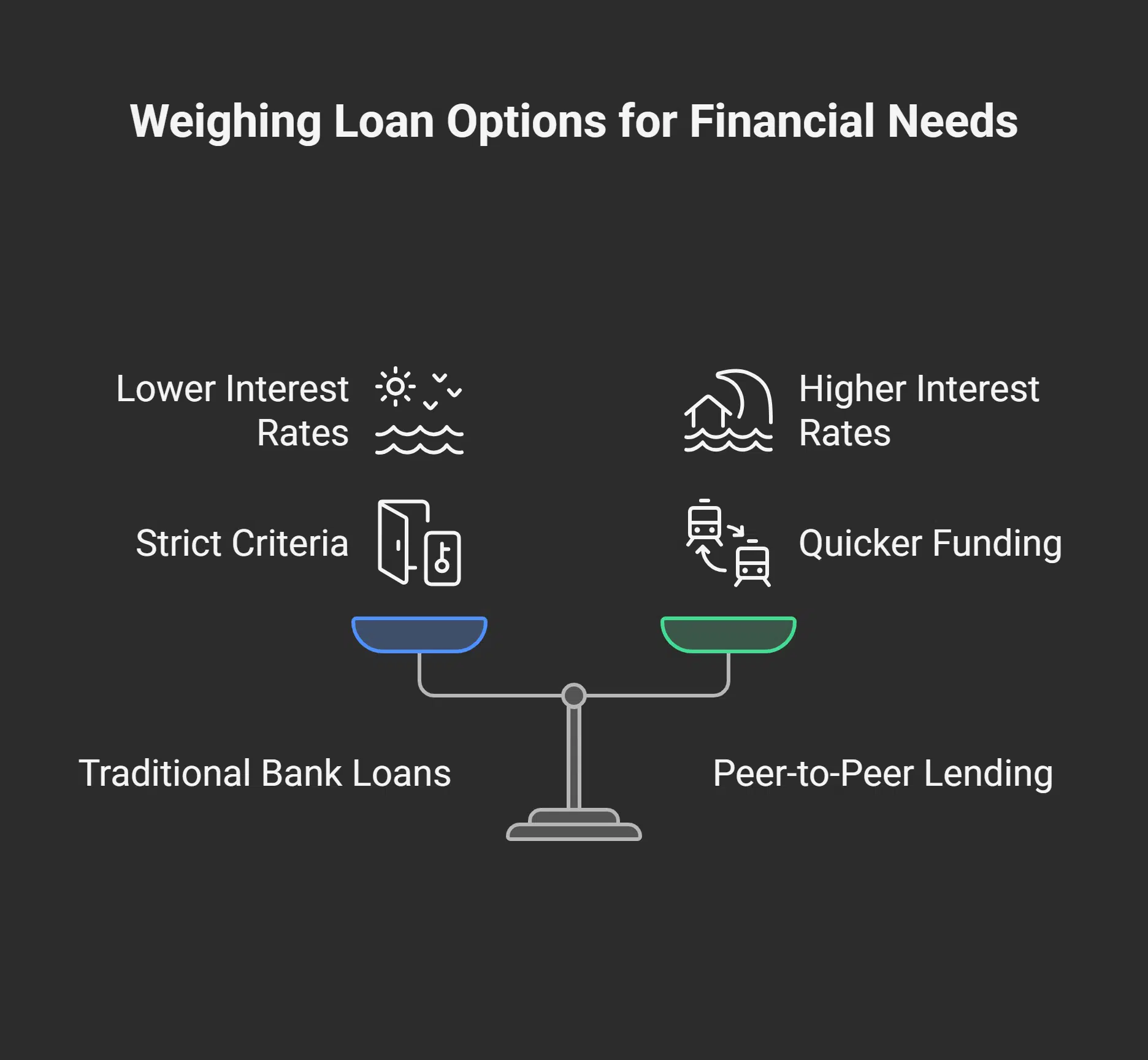

- Traditional Bank Loans: These often offer lower interest rates, which can help you save money in the long run. Keep in mind, they come with strict criteria, such as a solid credit score, and the application process might take weeks or even months. If you have the time and a strong financial background, this could be a dependable choice for funding solutions.

- Peer-to-Peer Lending: This approach links you directly with individual investors through online platforms, often resulting in quicker funding compared to banks. Be cautious, as the interest rates can be higher, sometimes significantly more than traditional loans. It’s an excellent option if you need funds fast and are comfortable with the added cost.

- High-Risk Loans: These are intended for individuals with lower credit scores or those in immediate need of funds. They can provide money quickly, often rivaling the pace of companies like Kennedy Funding, sometimes within days. Be mindful, as the conditions can be challenging, with high rates that could create issues down the line.

- Credit Unions: These member-driven organizations often provide loans at more favorable rates than large banks. They prioritize supporting their community, so you might experience more personalized assistance during financial dealings. Consider one if you’re looking at Kennedy Funding, or any private lender, for a more welcoming atmosphere.

- Online Lenders: Numerous digital platforms offer fast loans with fewer hurdles than traditional banks. They’re a straightforward private lending choice focused on efficiency, much like Kennedy Funding operates as a private option. Be sure to review their conditions carefully to steer clear of unexpected costs, akin to concerns raised in some critical feedback.

Takeaways

Hey there, folks, let’s wrap this up with some straight talk. Digging into the Kennedy Funding Ripoff Report shows there’s a lot to chew on. Some claims sting like a bee, but not all stories match up.

So, stay sharp and do your homework before jumping into any deal. Trust your gut, ask tough questions, and keep your money safe!

FAQs on Kennedy Funding Ripoff Report

1. What’s the deal with unveiling the truth about the Kennedy Funding Ripoff Report?

Hey, let’s cut to the chase. This whole “ripoff report” mess is about hidden fees and shady claims swirling around Kennedy Funding, a direct private lender specializing in quick financing options. Stick with me, and we’ll dig into whether Kennedy Funding, or any private outfit like it, is worth your trust.

2. Why should I care about the Kennedy Funding Ripoff Report when considering financing?

Listen up, pal, navigating the complexities of financial transactions ain’t no walk in the park. The Kennedy Funding Ripoff Report serves as a heads-up about common complaints like false advertising or sneaky costs. It’s your ticket to make informed decisions before signing any dotted line.

3. Are the negative reports about Kennedy Funding legit, or just hot air?

Well, examining Kennedy Funding’s response to the Ripoff Report can shed some light, my friend. Some say the report is about hidden fees and poor transparency in behavior, while Kennedy Funding also pushes back with their side of the story. You’ve gotta weigh the evidence, both positive and negative, to know if the company is a scam or just misunderstood.

4. How do I dodge pitfalls when looking at Kennedy Funding, or similar lenders?

Don’t just jump in blind, folks. Start by conducting thorough research on any creditor or debtor deals, and chat with a financial advisor to avoid getting burned by refinancing traps or collateral finance issues. It’s like checking the weather before a hike; better safe than sorry.

5. What if I stumble on a lawsuit or scam claim in the Ripoff Report about Kennedy Funding?

Hey, don’t panic just yet. Dig into the information and see if there’s solid proof behind these negative reports, because the Ripoff Report often stirs up drama that might not hold water.

6. How can I make informed decisions with all this Ripoff Report noise around Kennedy Funding?

Alright, let’s break it down real simple. When considering Kennedy Funding, or any private lender, sift through both the good and bad vibes in reports, and double-check every investment detail for clarity. It’s like panning for gold; you gotta filter out the dirt to find the shiny truth.