Money and politics often go hand in hand. People wonder how much U.S. senators make and where their money comes from. This curiosity extends to Jon Tester, a Democratic Senator from Montana.

His financial standing is a topic of interest for many voters.

Jon Tester net worth has been estimated at millions over the years. His money mainly comes from his farm, Senate salary, and investments. In this blog, we’ll explain key facts about his finances—his income sources, assets, and even criticisms he faces.

Stick around to understand more!

Jon Tester Net Worth and Financial Standing

Jon Tester net worth has shifted over time, reflecting his work in politics and farming. His public disclosures give a clearer picture of his assets and income sources.

Jon Tester net worth over the years

Understanding how wealth evolves over time gives clarity into financial stability. Jon Tester net worth has seen fluctuations, influenced by various factors like investments, income streams, and market conditions. Below is a breakdown of his estimated net worth across key years:

| Year | Estimated Net Worth | Senate Ranking |

|---|---|---|

| 2016 | $3,889,504 | 43rd |

| 2018 | $3,672,003 | 37th |

| 2020 | $3,392,000 | 39th |

| 2022 | $4,328,000 | 34th |

| 2024 | $4,603,000 | 31st |

The drop in net worth between 2016 and 2020 may reflect changes in investments or market conditions. His ranking among senators also shifted, moving from 43rd to 31st. These numbers highlight consistency in financial status, even with slight declines.

Key financial disclosures

Jon Tester’s financial reports show clear details about his wealth. His family farm land in Big Sandy was valued at $3,000,000 in both 2016 and 2018. T-Bone Farms Inc., connected to Tester, held a worth of $750,000 during these same years.

Public records highlight his transparency as a government official. These disclosures outline earnings from farming and land ownership alongside other assets like savings and investments.

Such information helps citizens understand the finances of U.S. Congress members like Tester.

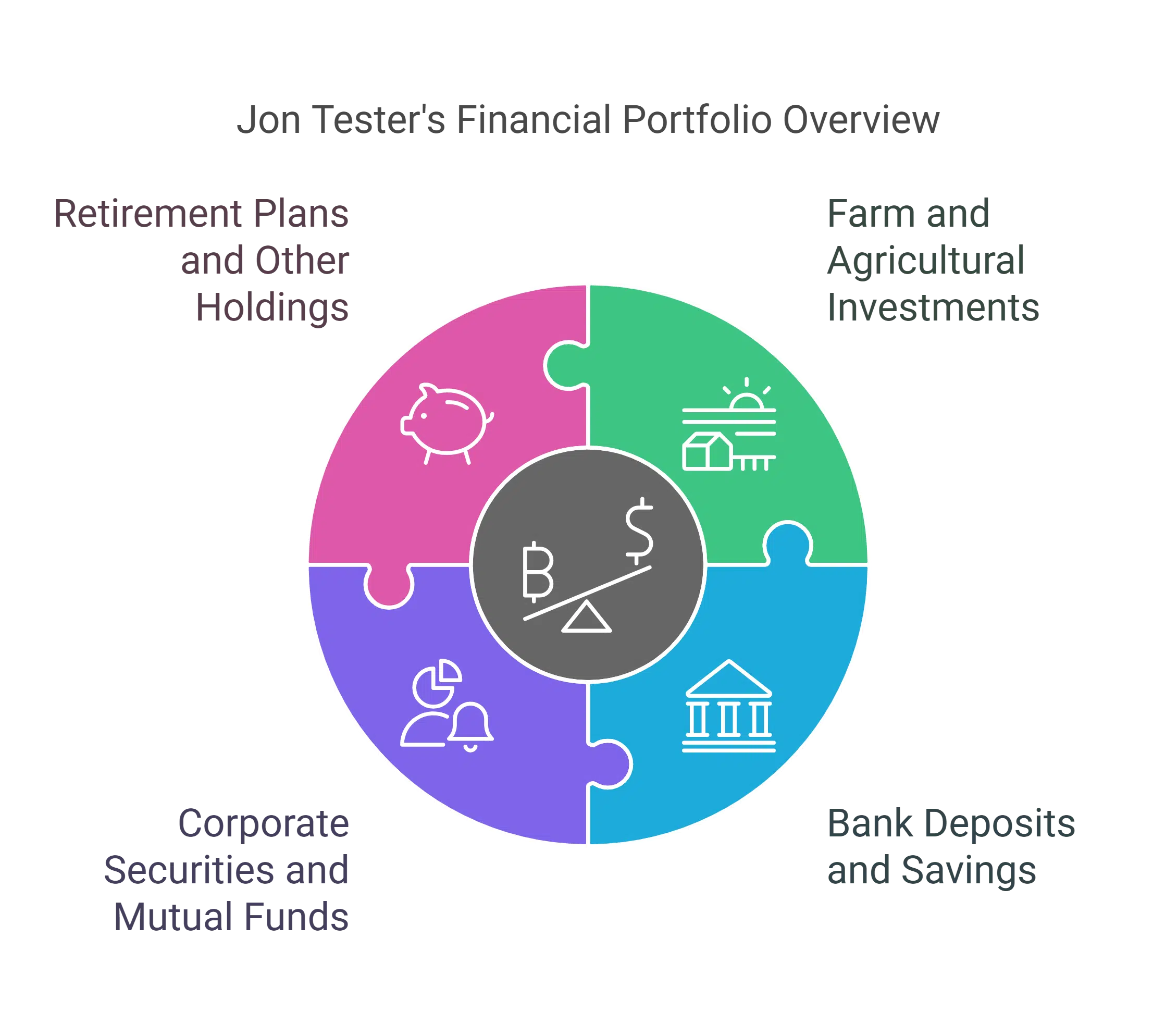

Breakdown of Jon Tester Net Worth

Jon Tester has built his wealth through various sources. His investments and savings show a focus on practical financial planning. Jon Tester net worth is estimated at $4.5 million in 2025.

Farm and agricultural investments

The family farm in Big Sandy held great value. In 2016, it was worth $3,000,000. By 2018, that value remained steady at $3,000,000. This farmland plays a big role in his financial standing.

Crop production and basic processing likely add to this investment’s success. Land ownership income from farming is another strong source of earnings. These assets tie deeply into rural and agricultural policies he often supports.

Bank deposits and savings

Jon Tester likely holds a portion of his wealth in bank deposits and savings accounts. These accounts provide a secure way to store money while earning minimal interest. Members of Congress often disclose such details as part of their financial transparency.

Savings allow him to manage daily expenses and emergencies. They also serve as a stable asset, unlike investments that might fluctuate. For someone like Tester, balancing liquid cash with other holdings helps maintain financial stability.

Corporate securities and mutual funds

Jon Tester owns corporate securities and mutual funds. These investments add to his total net worth. His financial portfolio shows diversity, which helps reduce risks. By holding these assets, he benefits from long-term growth opportunities.

The value of his corporate securities and mutual funds is a key part of understanding his finances. These holdings show smart planning in wealth management. They also point to a stable approach toward building financial security over time.

Retirement plans and other holdings

Tester likely has funds in retirement accounts. These may include basic savings plans or government-backed options. Such accounts can grow over time, thanks to his long career.

His other holdings might involve smaller investments or personal assets. Bank deposits and mutual funds could add extra value to his financial portfolio. Members of Congress often maintain diverse holdings for stability.

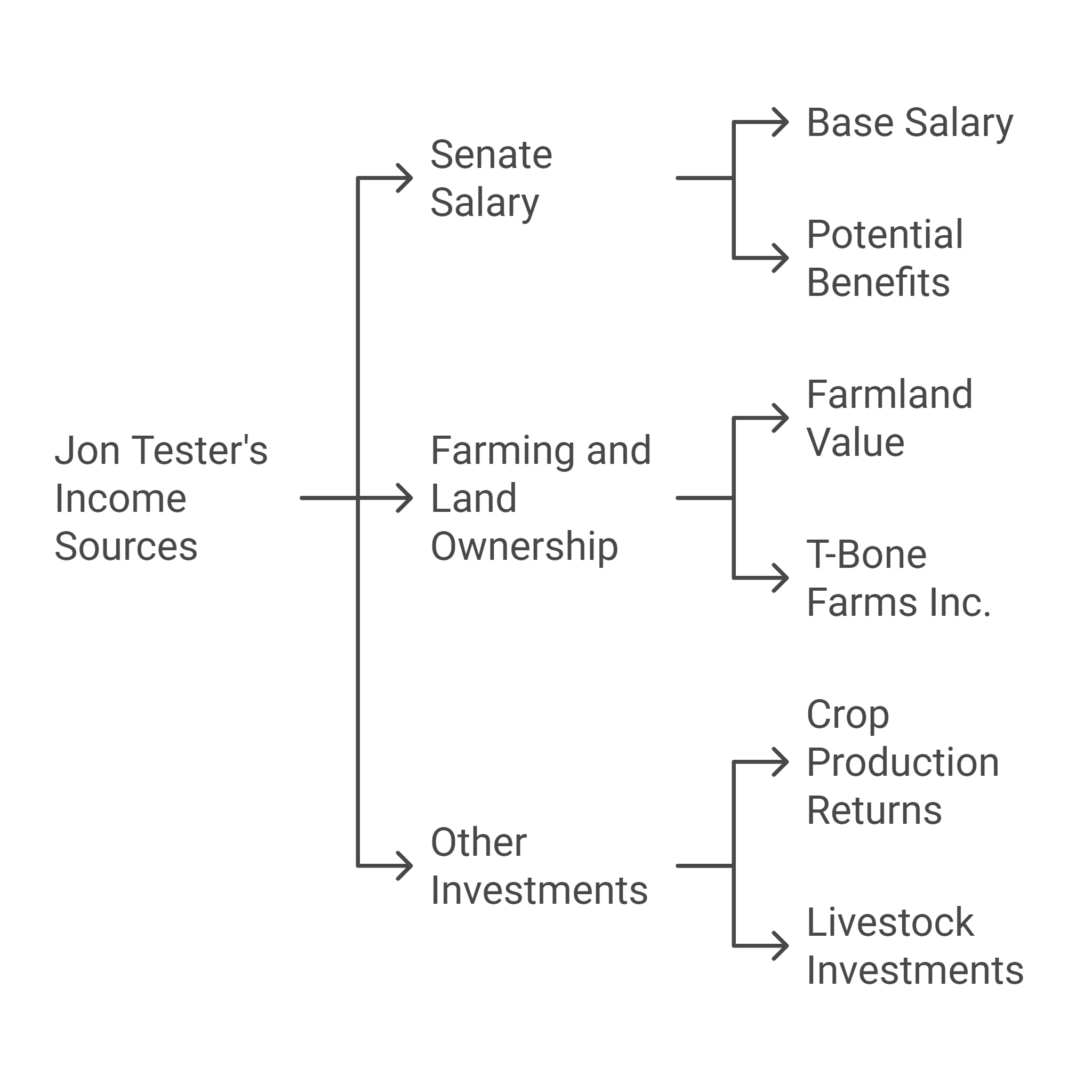

Jon Tester Income Sources

Jon Tester earns money from multiple sources, shaping both his lifestyle and political influence—explore how these streams affect his financial profile.

Senate salary

A U.S. Senator earns $174,000 per year as their base salary. This amount has stayed the same since 2009. Serving in the United States Senate since January 3, 2007, Tester’s government salary is a steady source of income.

While senators like Jon Tester earn this set amount, it doesn’t include benefits. These benefits could boost total compensation with health plans or retirement options. His current term ends January 3, 2025.

Farming and land ownership income

Jon Tester earns income from his farm and land. His farmland was worth $3,000,000 in 2018. He also owns T-Bone Farms Inc., valued at $750,000 that year. These assets contribute significantly to his finances.

Crop production and basic processing likely play a role in this income. Being a Montana farmer gives Tester steady returns from agriculture. Farming remains one of his key financial sources outside of politics.

Other investments and returns

He earned $3,000,000 from crop production and basic processing in both 2016 and 2018. Livestock investments added another $750,000 to his portfolio in 2016.

These returns show the importance of agriculture in his finances. His farming background directly impacts his wealth through steady income sources like these.

Investments and Financial Trends

Jon Tester has put money into different areas over the years. His choices give a peek at his strategy and priorities in business.

Sectors invested in 2016

Investments made in 2016 give insight into financial choices. They show areas of interest that shape economic decisions.

- Agriculture was a key focus. Crop production and basic processing made up $3,000,000 of investments that year.

- Livestock investments were valued at $750,000. This highlighted strong ties to farming and land use.

- Banking appeared significant with savings in financial institutions holding steady value over time.

- Mutual funds were part of diversified holdings for long-term growth potential—adding stability to the portfolio.

- Farming-related equipment was another area linked to agricultural activities, enhancing productivity and returns.

These investment areas underline a preference for agriculture, finance, and steady growth sectors in 2016.

Sectors invested in 2018

Jon Tester invested in different sectors in 2018. His choices reflected his background and priorities.

- Agriculture: Tester focused on crop production, which made him $3 million.

- Banking: He also held bank deposits and savings accounts for steady growth.

- Mutual funds: These provided a mix of stability and long-term profit potential.

- Land ownership: Income also came from farming activities tied to his landholdings.

Financial Transparency and Criticism

Jon Tester has shared his financial records as required by law. Some critics question if his wealth aligns with his image as a moderate Democrat.

Public financial disclosures

Public financial disclosures show details about Tester’s assets and income. These reports list high-value holdings like farmland and T-Bone Farms Inc. They also include information on bank deposits, retirement accounts, and investments.

Government officials must file these disclosures to ensure transparency. This process helps voters see possible conflicts of interest. Tester’s records often highlight his role in crop production and basic processing linked to his farming business.

Criticism regarding millionaire status

Critics often point to Jon Tester’s millionaire status while questioning his stance on issues affecting working-class Americans. His net worth, estimated at $3,889,504 in 2016 and $3,672,003 in 2018, has fueled this debate.

Some argue that being a millionaire creates a disconnect from everyday struggles like rising costs or stagnant wages. They feel it’s hard for wealthy senators like Tester to truly understand these challenges.

Others bring up the source of his wealth—mainly farm income and investments. They highlight possible conflicts between personal finances and public policies related to agriculture or economic measures.

Though Tester provides financial disclosures as required by Congress, critics continue to examine how his holdings could influence decisions on Capitol Hill. These concerns add pressure for greater transparency among government officials with significant assets.

Comparison to Other Senators’ Net Worth

Jon Tester net worth is not as high as some of his Senate peers. However, he stands apart due to his farming background and simpler financial assets.

Average net worth in the Senate

The average net worth in the Senate varies greatly. Some senators are millionaires, while others have modest finances. In 2018, Jon Tester ranked 37th with a net worth of $3,672,003.

Back in 2016, he was ranked 43rd with $3,889,504. These numbers show only slight changes over two years.

Senators’ personal finances often reflect their investments and other income sources like farming or real estate holdings. Comparisons highlight financial diversity among government officials in Washington, DC.

Some senators handle millions in corporate securities or mutual funds; others focus on local business ventures or agriculture—like Tester’s crop production investments on his Montana farm.

Tester’s financial standing in context

Jon Tester ranked 43rd in the Senate with a net worth of $3,889,504 back in 2016. By 2018, his standing shifted to 37th place, showing a net worth of $3,672,003.

Compared to other senators during these years, his financial position was modest but notable. While many lawmakers had vast fortunes or higher rankings, Tester’s wealth mostly came from farming and land income rather than huge corporate investments or high-value assets linked to lobbying groups or major industries.

Impacts of Financial Standing on Political Career

Jon Tester’s wealth influences his campaign strategies and resources. It shapes how he connects with voters and handles political challenges.

Campaign funding and personal contributions

Campaign funding plays a big role in Jon Tester’s political career. He has received strong support from top industries like Crop Production and Basic Processing, which invested $3 million in 2018.

These contributions help cover campaign costs for U.S. elections.

Tester also makes personal contributions to his campaigns. His farming income and investments provide extra funds when needed. This financial backing strengthens his presence among Senate Democrats and the Democratic Party during key government elections.

Relationship with lobbying groups

Tester has ties to groups tied to agriculture, like Crop Production & Basic Processing. These sectors often support him because of his farming background. OpenSecrets shows campaign contributions linked to these industries over the years.

Some critics mention lobbying efforts influencing funding for policies he supports. His financial disclosures also point to backing from Livestock-related entities. This connection reflects his home state’s strong focus on farming and ranching activities.

Takeaways

Jon Tester net worth story shows how farming and politics mix at times. His farmland and Senate role shaped his earnings over the years. Compared to other senators, he stands out but not as one of the richest.

His money choices reflect both personal values and political pressures. Understanding this balance helps explain his career path and decisions in Washington, D.C.