If you understand how money functions, building wealth can be rather simple. You must ultimately grasp money management and investment strategies to benefit from your finances. And, no! You don’t have to be rich to start making money. In actuality, all you require is a wealthy attitude along with sound money-making techniques.

The internet is filled with the success stories of experts who started from scratch and are now maintaining their huge fortunes. Of course, they took the initiative somewhere;

- Some used good secured credit cards in Canada to build their credit; others shared practicing several budgeting rules to help them do that.

- Some started looking for ways to generate passive income, while others took the right investment approach to push the money cycle even further!

Of course, living lavishly or frugal is totally your choice. But a little helping hand won’t do any harm, right? Instead, it will only push you and motivate you to stay on the right path.

Idea Of Being Wealthy: Varies Individually

When it comes to having enough money, the goal of every individual varies. For some, owning one’s dream home is more than enough. While for others, even having a set amount for retirement doesn’t count. So, your idea of building wealth can vary depending on how you perceive money.

Generally, wealth can be defined in simple words:

“Wealth = Assets – Debts”

It might seem challenging to build wealth and have numerous assets in your name, but trust us, it’s not that difficult.

In fact, honestly, you don’t need any high salary or continuous income to turn your dreams into reality!

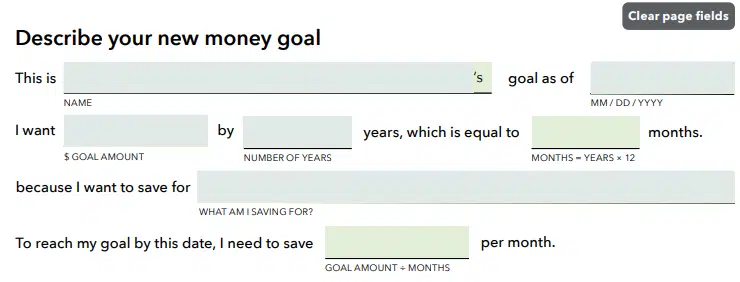

Yes, you can create a hefty sum in your name, nonetheless your age or wage. The only thing that matters is your dedication to doing that. For instance, you can start with the basic financial planning worksheet to set your wealth goal:

When you write what’s on your mind, it can give you a heads up of what you want to achieve and what you need to do for it. You can also take the spreadsheet task to a new level by breaking down what you earn from your different sources monthly.

Now that you know how to calculate the progress and totality of your wealth, it’s time to find out how you can build it using smart investment strategies.

Investment Tips To Build Your Wealth

Majority of Canadian people don’t even consider the idea of investment because of all the risk and pressure involved. However, you can easily find effective strategies experts used to increase their wealth and double the money they invested.

Yes, that’s true!

In fact, it won’t be wrong to say that even finance beginners can reduce business risk by implementing wise risk-proof plans.

Want to know how? Let us help you with these expert tips:

1. Be Bold & Go With The Gold

The world is currently coping with a severe state of inflation and instability.

This implies it has become even harder to deal with reduced income and limited wealth-building opportunities. However, investing in gold is one safe investment option that beats all.

In fact, it’s a common and popular investment approach from prehistoric times.

- Gold is a commodity with a real worth that most likely increases whenever inflation strikes.

- Of course, it may fluctuate depending on the market rate, but it’s almost guaranteed you’ll earn a profit whenever you try to sell it in bad times.

One thing to understand here is that gold investment also has pros and cons. However, no need to worry; the risks involved aren’t that bad.

|

Pros |

Cons |

|

Gold has high security of its worth and value |

You can’t consider the gold investment as a source of passive income |

|

It can add diversification to your investment portfolio |

Since gold is a physical asset, you might need to pay taxes and premiums for it |

2. Increase Your Stock Literacy!

One of the easiest and simplest ways to increase money is by purchasing a firm’s stock. You acquire ownership of the company by becoming a shareholder by purchasing shares. However, that’s not as simple as it may sound. If you put your money into the wrong company and it goes bankrupt. Boom, there goes your dream of building wealth.

Stocks have the highest return on investment despite being significantly riskier than other investments. You may reduce stock risks and increase profits with a well-informed strategic orientation.

- Stock investments usually offer guaranteed profits if you have done your homework about the company.

- You don’t need much on your hands to buy shares of a company. Yes, you can purchase a small percentage of what you can afford.

You can gradually increase the share, and your invested amount as your budget allows.

|

Pros |

Cons |

|

Buying shares is easy. Plus, it grows with the economy |

It involves several risks as the company’s loss will directly affect your money |

|

You don’t need to be rich or wealthy to buy stocks |

Finding a good company needs a lot of research and understanding |

3. Look For Productive Real Estate!

Investing in productive real estate can be a great way to start investing in your financial future. However, it needs quite a big chunk of money to initiate. Good news! You can always borrow from a bank for your investment plans and goals. Owning property allows people to have a chance to be their own boss, and many tax rules are advantageous to property owners in particular.

Furthermore, owning high-quality, profitable real estate can be a good way to expand your investment portfolio and build wealth. Just like owning successful businesses, commercial real estate typically performs positively throughout a global recession. To summarize, It’s frequently considered a more secure investment than buying shares or stocks.

- Investing in corporate projects for real estate development is actually simpler than ever right now.

- Legislation passed in recent years has made it acceptable for real estate developers to raise money through crowdfunding.

- As a result, private investors who wanted to invest in property development raised billions of dollars in funding.

|

Pros |

Cons |

|

You can buy a property at a less price and then wait for a few years to make the amount double |

Huge amount of money is tied to one asset that’s not giving you any income monthly |

|

You can get several tax benefits from your real estate property |

It’s a long-term investment that requires patience and time to build and grow |

|

Also, the rental income is not subjected to self-employment tax |

Low liquidity as you can’t sell the property immediately in case of an emergency |

4. Money Market Fund That Never Grows Old!

During times when the investment industry is exceptionally unstable and investors are unclear about where to put their money, the stock market can be a safe option. Why? mainly because compared to other stock and bond alternatives, money market funds are generally believed to have lower risk elements. The goal of money market funds is to offer investors high liquidity and low risk.

The risk factor is usually low as these funds invest money into the following sections:

- Treasury Bills (T-Bills),

- Certification of Deposit (CDs),

- And short-term (CP) commercial papers.

It is a mutual managed fund that puts money into short-term but distinctly liquid securities. The money market additionally typically provides investors with returns in the low single digits, which can nevertheless be very appealing during a market slump.

|

Pros |

Cons |

|

They are safe, secure, and doesn’t involve any complicated process |

As compared to other investment types, money market funds are not safe from inflation. So, your profit might fluctuate depending on economy |

|

No minimum amount is required for the investment |

During high inflation, your expense power and the profit rate may suffer |

Money market funds aren’t FDIC approved, so one must understand the risks and cons it has before investing the money. As we said earlier, all the investment strategies may fail if you haven’t done proper homework about them.

What Is The Safest Investment With The Highest Return?

The high pace of global inflation has prompted the Federal Reserve to begin hiking interest rates. Because since upcoming months are probably going to be difficult, investors must keep their focus. By integrating at least certain assets with lesser risk, portfolio construction can help you cope with economic uncertainty.

So, to help you increase your wealth, here are some low-risk investments you may make.

1. Saving Accounts

Despite not being considered investments, savings accounts offer a decent return on the investment. If you do your homework, you can locate the greatest solution both online and offline. A comparison of the costs and returns will help you identify the options that will produce the highest returns.

Pros: There’s almost no chance of losing money. The reason is your money is right there in the account and will most likely remain there with the benefit of giving a high yield.

Cons: The withdrawal limit of every account depends on your lender. The profit also fluctuates and can’t be considered a perfect investment option for long-term profit.

2. Saving Bonds

If you don’t want the fluctuating inflation to affect your profit or loss, the I-saving bonds might be your best pick. Moreover, when inflation increases, so does the profit but when inflation reduces, so makes your profit.

Pros: It can offer a profit return of up to 9.6%. Of course, you do have to find the best lender for that. In fact, it’s best if you register with a government-supported account.

Cons: The profit depends on the high or low inflation rate. This implies the dependency of your I-saving account series directly on inflation.

Click to know more about the inflation-protected saving bonds.

3. Short-Term CDs

It can be considered the best investment option with the lowest risk value. However, the scenario can be changed entirely if you take out the money early. A no-penalty CD is an alternate to a short-term CD that allows you to avoid the customary early cash withdrawal penalty. In order to avoid the customary fees, you can withdraw your money and transfer it to a CD that pays a greater interest rate.

Pros: You can earn a fixed or specific rate of interest rates during your CD period. However, you might want to deposit more money if you want to have more profit.

Cons: Withdrawing the money before the maturity date might cost you a chunk of your own money. Moreover, the bank might also hit you with a deduction cost that’s another loss.

Bottom Line

We all know how important it is to build your wealth if you want financial freedom and a secure golden period.

But, how many people know how to do that? Yes, the number is quite limited.

We know we need to save more but don’t know how much to cut back. We know we need to invest daily but don’t know how to do that. Argh, there are so many questions but no answers. Not anymore!

This is one complete guide that will give you an insight into everything you need to know to build your wealth and how to invest. Don’t believe it? Read it yourself!