Finding the next big crypto coin can feel like searching for a needle in a haystack. Markets change fast, new tokens pop up daily, and hype spreads quickly on social media. Many investors are left wondering which Web3 token will skyrocket next.

Web3 tokens with real utility, strong teams, and active communities often stand out. Some bring unique tech or tie into hot trends like decentralized apps or blockchain gaming. In this blog, you’ll learn tips to spot high-potential tokens before they explode in value.

Stay tuned—this guide could be your roadmap to smart crypto investments!

Key Takeaways

- Look for Web3 tokens with real-world use, strong teams, and active communities like Solaxy ($SOLX) or Protocol AI ($PROAI).

- Tools like CoinGecko and Binance help track new tokens. Over 50% of tokens in 2024 were flagged as scams, so research carefully.

- Check token supply and features, such as Fantasy Pepe’s cap of 125 billion tokens or staking rewards like Solaxy’s 130% APY.

- Monitor trends on platforms like Twitter or Discord. Hype often drives meme coins but can also hide scams.

- Avoid projects with no clear goals, low liquidity, or unrealistic promises to reduce risks when investing in cryptocurrencies.

Key Drivers Behind Cryptocurrency Surges

Crypto prices don’t just rise by chance. Big changes in tech, community buzz, and market moves often spark surges.

Market trends and hype

Big market moves often start with hype. Exciting tweets from people like Elon Musk can trigger buying frenzies. Social media platforms like X (Twitter) spread news fast, pumping tokens overnight.

Meme coins, such as Doge or Fantasy Pepe, thrive on this buzz alone.

Trends also follow macroeconomic events. Interest rate changes can push capital into digital assets like Bitcoin or Ethereum. In October 2023, Bitcoin hit $85,637.88 due to high demand and limited supply.

Hype builds quickly during bull markets but drops when a bear market settles in.

Technological advancements

New technologies drive Web3 tokens forward. Smart contracts on blockchain networks like Ethereum Virtual Machine enable automated actions, making processes faster and safer. AI-powered tools are shaping crypto assets too.

For example, “MIND of Pepe,” an AI-backed token, raised $9.28 million in funding.

Blockchain gaming is also growing with better decentralized applications. These games use NFTs and reward players through staking rewards or governance tokens. Advances in decentralized exchanges make trading smoother by adding liquidity pools and automated market makers (AMMs).

Community adoption and utility

A token’s success often hinges on its community. People buying, holding, and using the token can boost its value. For example, projects like Solaxy ($SOLX) raised $31.08 million due to strong backing.

Community trust grows when users see real-world utility in a token.

Tokens tied to decentralized apps or smart contracts attract attention fast. If a token powers DeFi platforms or gaming ecosystems, it often gains traction quicker. When people stake tokens for rewards or buy them for NFTs, adoption increases naturally over time.

How to Identify High-Potential Web3 Tokens

Spotting the next big token takes research, patience, and a sharp eye. Focus on what makes a project valuable, both now and in the long run.

Research use cases and technology

Dig into how a token works and what problems it solves. For example, Solaxy ($SOLX) is built for scaling the Solana blockchain, making it faster and cheaper. SpacePay ($SPY), on the other hand, focuses on crypto payments in retail.

Focus on tokens with clear goals like these.

Check the tech behind each project. Look at its blockchains, smart contracts, or staking rewards system. A strong foundation shows long-term potential. Avoid projects that seem too rushed or lack innovation.

Analyze the team and partnerships

Check the team’s background. Look for experts in blockchain technology, smart contracts, or decentralized finance (DeFi). Founders with past success in crypto projects often build trust.

For example, Protocol AI gained attention because of its skilled developers and clear goals.

Partnerships matter too. Strong links with top companies or exchanges like Binance Launchpad can boost a token’s value. A partnership with platforms such as PayPal shows real-world utility.

Weak connections or vague claims may signal red flags to avoid risky picks.

Study tokenomics and supply dynamics

Tokenomics shows how a token works, earns value, and pays users. Check the total supply—like Fantasy Pepe ($FEPE) with 125 billion tokens or SUBBD with only 1 billion. Low supply can mean higher demand, raising prices fast.

Look for deflationary features like token burning. This reduces the number of tokens over time, creating scarcity. Tokens linked to passive staking rewards also attract investors looking for steady returns.

Evaluate market sentiment and community engagement

Check how often people talk about the token on social media platforms. High mentions often mean interest is growing. Look for hashtags like #btc, #BEST, or #PROAI and watch trends on Twitter, Discord, and Reddit.

A strong community can drive demand fast.

Read comments during AMAs. Strong backing from crypto influencers helps too. For example, Best Wallet Token raised $10.7 million in presales because of solid support online. Watch engagement levels to spot hidden gems before they grow big!

Tools and Platforms for Finding Emerging Web3 Tokens

Finding new Web3 tokens can be exciting and tricky. Use token trackers, exchanges, or even DeFi tools to spot hidden gems early.

CoinGecko and CoinMarketCap

CoinGecko and CoinMarketCap help track crypto tokens. They provide data like price, trading volume, and market cap. Over 10.8 million digital assets exist today, making these platforms crucial for research.

Both list new cryptos quickly, including meme coins like Fartcoin or more serious projects like Protocol AI.

Use their tools to spot trends in decentralized finance (DeFi), NFTs, or staking rewards. Check a token’s supply details on CoinGecko to avoid scams—over 50% of new tokens in 2024 were flagged as malicious.

Compare the listed exchanges for better liquidity options when investing through CoinMarketCap insights.

Leading crypto exchanges

Crypto exchanges play a huge role in finding Web3 tokens. Binance, the largest exchange, supports BNB ($BNB), which has a $49 billion market cap. It offers many crypto coins and initial exchange offerings (IEOs).

OKX is another key platform for trading cryptocurrency’s latest digital assets.

Uniswap ($UNI) stands out for its decentralized approach. Its daily trading volume hits around $1 billion. This makes it a top choice for swapping ERC-20 tokens and exploring decentralized finance (DeFi).

Both platforms help track new token sales and liquidity pools easily.

DeFi platforms and liquidity pools

DeFi platforms let users trade tokens without middlemen. Liquidity pools power these trades by pooling tokens from many users. They reward participants with fees or extra tokens for providing liquidity.

For example, a pool on Binance Smart Chain might pair Tether with another cryptocurrency.

Liquidity staking boosts profits by auto-compounding rewards over time. Established cryptocurrencies like Bitcoin offer smaller but stable returns in such pools, while newer tokens often provide higher yields.

Tokenomics and market demand can impact the success of these pools.

Crypto presales and Initial Coin Offerings (ICOs)

Crypto presales and Initial Coin Offerings (ICOs) offer early chances to buy tokens before they hit public markets. For example, the Solaxy ($SOLX) presale price is $0.001702, while BTC Bull Token ($BTCBULL) is priced at $0.002475 in its presale phase.

These prices often attract investors aiming for big returns if the token’s value rises after launch.

Presales usually happen on project websites or platforms like CoinGecko. They help raise funds for development while giving buyers a chance to enter low-cost positions early. But risks are high since projects can fail or be scams, so researching team details and tokenomics is key before investing in any cryptocurrency ecosystem deal!

Characteristics of Promising Web3 Tokens

Strong Web3 tokens offer utility, rewards, and cutting-edge features—stick around to learn how they stand out!

Real-world utility and long-term use cases

Tokens like SpacePay ($SPY) solve daily problems. $SPY enables fast, decentralized payments without middlemen. This makes it useful for both businesses and individuals. Decentraland ($MANA) shows another use case.

People can buy virtual land in its metaverse and build projects or events.

Utility tokens thrive with strong adoption. For example, smart contracts power transactions securely on the blockchain. Tokens linked to gaming or NFTs also have solid futures. They merge entertainment with earning potential, creating long-term interest among users worldwide.

Passive staking or reward opportunities

Staking rewards can boost your crypto earnings without much effort. Solaxy ($SOLX) offers up to 130% APY, which is massive compared to traditional investments. BTC Bull Token ($BTCBULL) also provides solid rewards with an 84% APY rate.

These tokens reward holders for locking their assets in a staking program. This process helps secure the blockchain while you earn passive income. Look out for projects like these that promise high returns and steady gains through staking programs or bonuses.

Integration with NFTs, GameFi, or AI

Tokens tied to NFTs, GameFi, or AI often gain strong market interest. Fantasy Pepe ($FEPE) is an example. It combines Web3 gaming with AI-driven football simulations. This mix creates high user engagement and a solid use case for its token.

Harry Hippo ($HIPO), a meme coin, links play-to-earn gaming and artificial intelligence. These features attract gamers while adding fun utility beyond trading. Tokens like these show how blending tech and entertainment boosts adoption in the cryptocurrency ecosystem.

Top Categories of Web3 Tokens to Watch

Some tokens are shaking up digital finance and gaming. Others focus on speed, security, or linking different blockchains.

Layer-2 scaling solutions

Layer-2 scaling solutions make blockchain faster and cheaper. Solaxy ($SOLX) boosts Solana with next-gen scalability. Arbitrum ($ARB), worth $2.6 billion, helps Ethereum handle more transactions without slowing down.

These tokens reduce costs, speed up processes, and improve user experience.

They also lower gas fees for smart contracts and decentralized finance (DeFi). By using off-chain methods, they take pressure off main blockchains like Ethereum or Solana. This creates a smoother cryptocurrency ecosystem for trading, staking rewards, or blockchain gaming growth.

Decentralized payment protocols

Decentralized payment protocols let users send money without banks or middlemen. These systems use smart contracts to process transactions securely and quickly on blockchain networks.

Many, like Bitcoin and Ethereum, are safe from inflation since no single entity controls them. They can cut costs for businesses by lowering transaction fees compared to credit cards or banks.

Tokens tied to these protocols often gain value when adoption grows. For example, SpacePay ($SPY) raised $907,000 during its presale at just $0.003181 per token. Such projects offer staking rewards too, giving holders ways to earn passive income while reducing reliance on traditional finance systems like stock markets or futures trading platforms.

AI-driven platforms

AI-driven platforms like Protocol AI ($PROAI) are changing how decentralized applications (dApps) are built. They use smart technology to improve blockchain performance and lower costs.

These platforms help developers create tools with better speed and security.

Some tokens, like MIND of Pepe ($MIND), combine artificial intelligence with meme coin features. This mix adds fun while offering advanced solutions in the cryptocurrency ecosystem.

Integration with NFTs or blockchain gaming boosts their appeal further.

Gaming and metaverse tokens

Gaming and metaverse tokens are reshaping digital spaces. Decentraland ($MANA) is a key player, letting users buy virtual land or gear with $MANA. This token powers in-game purchases, blending gaming and blockchain tech.

Fantasy Pepe ($FEPE), with its supply capped at 125 billion tokens, taps into the meme coin craze while linking it to gaming.

These tokens often reward players through staking rewards or token burning mechanics. Blockchain gaming creates ownership of in-game items as non-fungible tokens (NFTs). Platforms like these gain traction fast due to their mix of fun, utility, and financial incentives.

Cross-chain ecosystems

Cross-chain ecosystems make tokens work across blockchains. They connect networks, letting digital assets move freely. For example, United Nations of Memes ($UNOM) allows cross-chain trading with AI features.

This unlocks more uses for cryptocurrency and boosts liquidity.

These systems help decentralized finance (DeFi) projects grow faster. By reducing gaps between chains like Solana or Ethereum, they improve access to blockchain gaming and staking rewards.

As tech evolves, expect these ecosystems to gain massive adoption in the cryptocurrency ecosystem.

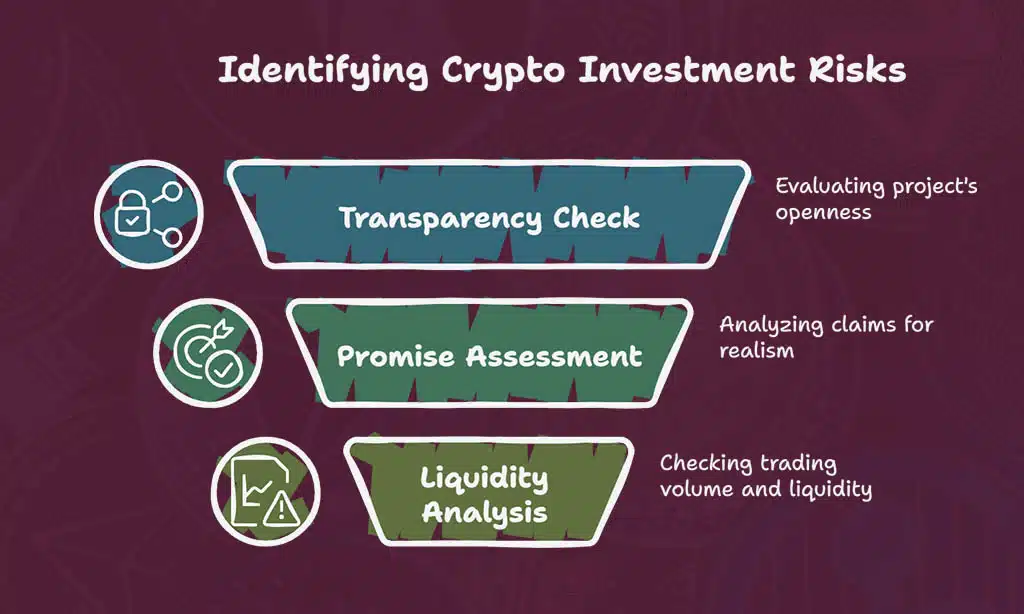

Red Flags to Avoid When Choosing a Token

Watch out for projects that overpromise or feel too flashy. Be cautious of tokens with unclear goals or shady backgrounds.

Lack of transparency in the project

Projects hiding details raise red flags. Over 50% of tokens launched in 2024 were reported as scams. Shady developers often avoid sharing clear goals or progress updates. If a team hides tokenomics, partnerships, or smart contract audits, think twice before investing.

Crypto scams thrive on hype and secrecy. No clear roadmaps? It’s a warning sign. Tokens like fantasy pepe may sound exciting but could lack real backing. Check for active social media platforms and ask me anything (AMA) sessions with creators to spot trustworthy projects.

Unrealistic promises and hype

Bold claims can mislead many. Tokens with “guaranteed” returns or extravagant promises often fail. Be wary of projects boasting instant wealth or endless growth without substance.

Crypto scams thrive on hype, creating fake excitement to lure investors.

BTC Bull Token shows a smarter path with clear milestones, like token burns at $125K and $175K Bitcoin prices. It skips hype and sticks to facts, offering airdrops tied to real Bitcoin price points: $150K and $200K.

Always check for real plans, not just loud marketing strategies or buzzwords like meme coins floating around social media platforms.

Low liquidity and trading volume

Low liquidity makes it hard to buy or sell tokens quickly. If trading volume is low, prices can swing wildly with even small trades. This could trap investors trying to cash out.

Tokens like Harry Hippo ($HIPO) or Protocol AI ($PROAI) might face slow trade action if not enough users join in early. New projects raising funds through crypto presales, such as SUBBD or SpacePay ($SPY), may see better activity due to hype but still risk limited liquidity long-term.

Always check trading stats before investing.

Examples of High-Potential Web3 Tokens

Some tokens gain fame due to strong use cases and tech upgrades. Others shine with major partnerships, real utility, or active communities.

Solana ($SOL)

Solana ($SOL) is a blockchain known for its speed and low costs. It processes over 65,000 transactions per second. This makes it one of the fastest networks today. Its $50 billion market cap shows strong investor interest.

It trades at a 55% discount from its all-time high. Developers use Solana to create decentralized finance (DeFi) apps, non-fungible tokens (NFTs), and more. The network’s growing adoption adds value to the token in the cryptocurrency ecosystem.

Chainlink ($LINK)

Chainlink ($LINK) connects smart contracts with real-world data. Its market cap sits at $12 billion, showing strong investor interest. It trades 60% lower than its all-time high, offering room for growth.

This token powers decentralized finance (DeFi) by providing reliable oracles for accurate data feeds. Many blockchain technologies use Chainlink’s services to strengthen their systems.

As more platforms adopt this technology, the demand for $LINK could rise sharply over time.

Arbitrum ($ARB)

Arbitrum ($ARB) is a game-changer in blockchain technology. It helps Ethereum work faster by reducing congestion. With over $173 billion in bridged tokens, it’s one of the top players in Layer-2 scaling solutions.

Its current market cap stands at $2.6 billion, showing strong growth potential.

This cryptocurrency focuses on decentralized payment protocols and smart contracts. Many developers use Arbitrum for building dApps due to its low fees and speed. Staking rewards from $ARB also attract crypto wallets looking for passive income opportunities.

Protocol AI ($PROAI)

Protocol AI ($PROAI) stands out as an AI-powered platform. It helps build decentralized applications with cutting-edge tools. The token offers staking rewards as high as 98% APY, making it appealing to investors seeking passive income.

Its focus on artificial intelligence boosts innovation in Web3 technology.

$PROAI integrates smart contracts and supports decentralized finance (DeFi). This improves its utility across blockchain ecosystems. With rising interest in AI-driven platforms, it could gain traction fast in the cryptocurrency market.

Harry Hippo ($HIPO)

Harry Hippo ($HIPO) is a meme coin blending play-to-earn gaming with AI. It stands out for its engaging concept and tech focus. The project has a total supply of 3 billion tokens, with 30% reserved for crypto presales.

This setup attracts both gamers and crypto investors looking for early opportunities.

Its playful branding hides powerful features like staking rewards and utility tokens designed to grow within the cryptocurrency ecosystem. $HIPO also taps into NFT trends, making it attractive in blockchain gaming spaces.

Strong community engagement drives excitement around this decentralized asset. Keep an eye on its liquidity pools during presale phases to catch possible growth waves early on!

Best Practices for Investing in Web3 Tokens

Set limits on how much you invest, and stick to them. Stay sharp by watching trends, social media chatter, and expert tips.

Diversify your portfolio

Spread your investments across various Web3 tokens. Include tokens with utility like BTC Bull Token ($BTCBULL) or MIND of Pepe ($MIND). Add projects tied to decentralized finance (DeFi), blockchain gaming, and governance tokens.

This reduces risk if one project fails.

Balance between meme coins and serious utility tokens. Meme coins, like Harry Hippo ($HIPO), may bring quick gains but carry high risks. Combine them with stable options offering staking rewards or token burning features for long-term growth.

Set a clear entry and exit strategy

Decide your investment goals before buying any cryptocurrency coin. Set an entry price where you think the token is undervalued. Pick an exit price to secure profits or cut losses if things go south.

Stick to these limits, no matter market hype or crypto influencers’ opinions. For example, if you buy Protocol AI at $10 and aim to sell at $20, don’t get greedy beyond that point.

A clear plan keeps emotions in check during wild market swings.

Monitor market trends and news

Stay alert to the latest cryptocurrency news. Follow platforms like Twitter, Reddit, and Telegram for updates on tokens like Protocol AI or Harry Hippo. Watch for announcements from DeFi projects or blockchain gaming teams.

Major market trends can signal opportunities. For example, meme coins like Doge Meme gained popularity due to online hype.

Use tools such as CoinGecko and Binance Launchpad to track token performance. Keep an eye on capital inflows and trading volumes of utility tokens or governance tokens. Sudden surges might mean rising interest in a specific project or category, such as decentralized payment protocols or NFTs linked with AI-driven platforms.

Risks of Investing in New Cryptocurrencies

Investing in new cryptocurrencies can feel like playing with fire—exciting but risky; read on to avoid getting burned.

Market volatility

Crypto prices can swing fast. Bitcoin, for example, hit $85,637.88 recently with a market cap of $1.7 trillion but often drops sharply too. Ethereum stands at $2,234.12 now and faces similar ups and downs due to changing trends.

Hype from crypto influencers or new token launches like meme coins affects these moves greatly. Events like token burning or laws by governments also push prices in wild directions.

Sticking to strategies like dollar-cost averaging can help lower risks during such uncertainty.

Regulatory challenges

Regulations can hit new tokens like a storm. Governments are cracking down on unsafe projects. Over 50% of tokens launched in 2024 were flagged as scams. Strict laws aim to protect users from such traps but can also limit innovation.

Meme coins and decentralized payment protocols often face extra scrutiny. Some countries ban certain tokens or enforce high taxes, making trading tricky. Understanding local rules is key before jumping into cryptocurrency trading or staking rewards strategies.

Security vulnerabilities

Hackers target smart contracts in Web3 tokens. Poor coding, bugs, or exploits can put digital assets at risk. In 2022 alone, crypto hacks caused losses of over $3 billion. Meme coins and new tokens with rushed development often face such problems.

Projects without strong blockchain security draw bad actors. Low liquidity makes attacks easier too, like “rug pulls” where creators vanish with investor funds. Always research token audits and use a trustworthy cryptocurrency wallet for better safety.

Future Trends in Web3 Tokens

Web3 tokens are blending with AI and reshaping digital assets. Gaming, finance, and social media tokens continue to spark investor excitement.

Increased integration with AI and machine learning

AI is reshaping crypto. Tokens like Protocol AI ($PROAI) use machine learning for smarter apps. This tech improves decentralized applications by predicting trends and automating tasks.

MIND of Pepe ($MIND) shows how AI boosts meme coins. It blends fun with advanced algorithms, standing out in the cryptocurrency ecosystem. These projects prove AI drives innovation in Web3 tokens.

Growth of decentralized finance (DeFi) ecosystems

DeFi ecosystems are growing fast. They let users trade, lend, and earn rewards without banks. Platforms like Uniswap and Aave make this possible using smart contracts. In 2022, DeFi locked over $100 billion in total value across different projects.

New tokens tied to DeFi can give big returns. Decentralized payment protocols simplify transactions across borders. Staking rewards also attract more users to these platforms. Tokens like Solana’s Solaxy ($SOLX) or Arbitrum ($ARB) often lead the charge in scaling solutions for popular blockchains.

Expansion of metaverse and gaming platforms

Metaverse and gaming platforms are growing fast. Decentraland ($MANA) lets users buy virtual land using digital assets like non-fungible tokens (NFTs). People can build, trade, and explore inside its virtual space.

Blockchain gaming is merging with AI to improve gameplay. Fantasy Pepe ($FEPE) uses AI for football simulations on its Web3 platform.

These platforms combine social media features and decentralized finance (DeFi). Players earn staking rewards or use utility tokens for in-game items. Gaming tokens tied to the metaverse often see high demand, boosting network effects.

Both $FEPE and $MANA show how these projects reshape digital experiences while offering real-world value through cryptocurrency ecosystems.

Takeaways

Spotting the next big Web3 token takes effort, but it can be rewarding. Research its use, team, and community buzz. Watch market trends and check tools like CoinGecko. Avoid hype traps or low-liquidity coins.

Stay sharp, stay curious—success favors prepared minds!

FAQs

1. What is a Web3 token, and how does it work?

A Web3 token is a digital asset used in decentralized systems like blockchain gaming or decentralized finance (DeFi). It can have utility, such as staking rewards or governance rights.

2. How do I spot the next big meme coin before it takes off?

Watch for trends on social media platforms and follow crypto influencers. Tokens like Mind of Pepe or Harry Hippo often gain traction through hype.

3. Are crypto presales worth exploring?

Yes, they can offer early access to tokens with growth potential. Look for projects with strong teams, clear goals, and smart contracts that ensure security.

4. What role do utility tokens play in the cryptocurrency ecosystem?

Utility tokens power specific functions within their ecosystems, such as enabling payments through decentralized payment protocols or accessing features in blockchain-based apps.

5. How can I avoid falling for crypto scams while investing?

Stick to trusted wallets like Best Wallet Token and reputable exchanges offering exchange-traded funds (ETFs). Be cautious of unrealistic promises from unknown projects.

6. Does token burning impact value growth?

Yes, reducing supply through token burning can make assets more scarce, which might drive demand if paired with bullish market sentiment or venture capital interest.