With the rise of blockchain technology, decentralized finance (DeFi) has emerged as a groundbreaking alternative to traditional banking and investment systems. Web3, the next generation of the internet built on blockchain principles, is at the core of this transformation. However, with great opportunities come significant risks.

Understanding how to start investing in Web3 DeFi safely is essential for anyone looking to explore this innovative financial ecosystem while mitigating potential pitfalls.

This guide provides an in-depth exploration of Web3 DeFi investments, covering benefits, risks, security measures, and emerging trends to ensure a well-informed and profitable journey.

Understanding Web3 and DeFi Investments

Investing in Web3 DeFi presents both opportunities and challenges. The promise of decentralized finance lies in its ability to empower users with financial control, eliminating intermediaries while increasing access to global financial services.

However, with high rewards come potential risks, including security threats and market volatility. Understanding the fundamental principles of Web3 and DeFi is crucial for making informed investment decisions and ensuring long-term financial success.

What is Web3 and How Does It Work?

Web3 represents a decentralized internet where blockchain technology and smart contracts replace traditional intermediaries. Unlike Web2 (the current internet, dominated by centralized platforms like Google and Facebook), Web3 empowers users with greater control over their data, identity, and digital assets.

It enhances transparency, security, and self-sovereignty while enabling seamless peer-to-peer transactions.

An Introduction to Decentralized Finance (DeFi)

DeFi refers to a financial ecosystem built on blockchain networks that offers services like lending, borrowing, staking, and yield farming without intermediaries.

Transactions in DeFi are executed via smart contracts, ensuring transparency and reducing costs. It eliminates the need for traditional banks, offering a permissionless, borderless, and more inclusive financial infrastructure.

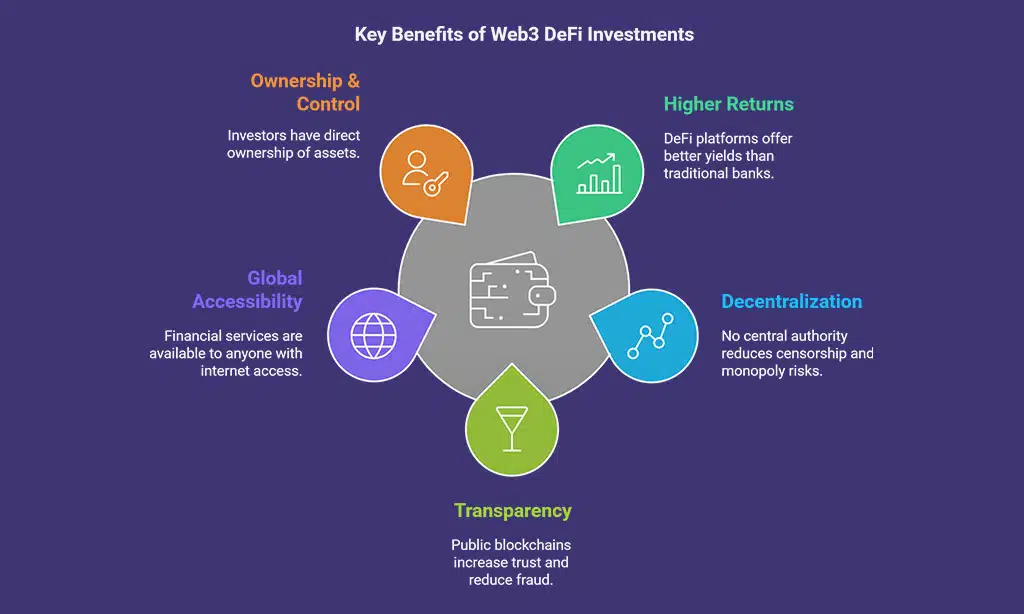

Key Benefits of Investing in Web3 DeFi

| Benefit | Description |

| Higher Returns | DeFi platforms often provide significantly better yields than traditional banks and financial institutions. |

| Decentralization | There are no central authorities controlling your funds, reducing the risk of censorship and monopoly. |

| Transparency | All transactions and smart contracts are recorded on public blockchains, increasing trust and reducing fraud. |

| Global Accessibility | Open to anyone with an internet connection, making financial services available worldwide. |

| Ownership & Control | Investors have direct ownership of their assets, reducing reliance on intermediaries. |

Essential Steps to Start Investing in Web3 DeFi

Navigating the world of decentralized finance can be overwhelming for beginners. With a wide range of platforms, protocols, and investment strategies available, knowing where to start is essential.

Understanding how to start investing in Web3 DeFi safely requires careful planning, security precautions, and a clear grasp of the fundamental principles involved. Below, we outline the key steps to help you embark on your journey with confidence.

Step 1: Educate Yourself on Web3 DeFi Basics

Before diving into investments, understanding fundamental concepts like:

- Blockchain technology – The backbone of Web3.

- Smart contracts – Self-executing contracts that automate transactions.

- Gas fees – Transaction costs paid to miners/validators.

- Liquidity pools – Essential for DeFi market efficiency.

- Decentralized exchanges (DEXs) – Platforms like Uniswap and SushiSwap facilitate direct peer-to-peer trades without intermediaries.

Step 2: Choose a Secure Wallet for Your Assets

Types of Wallets:

| Wallet Type | Description | Best Use |

| Hot Wallet | Internet-connected wallet | Convenient for frequent transactions |

| Cold Wallet | Offline hardware wallet | Best for long-term asset storage |

Recommended Wallets: MetaMask, Trust Wallet, Ledger Nano X, Trezor.

Step 3: Select a Reputable DeFi Platform

Some of the safest and most popular DeFi platforms include:

- Uniswap (Decentralized Exchange) – Enables direct asset swaps without intermediaries.

- Aave (Lending/Borrowing) – Users can lend and borrow crypto assets with dynamic interest rates.

- Curve Finance (Stablecoin Liquidity Pools) – Focuses on low-slippage stablecoin trading.

- Compound (Yield Farming and Lending) – Offers algorithmic interest rates for crypto lending.

Step 4: Diversify Your Investments

| Diversification Strategy | Benefits |

| Allocate funds across multiple DeFi platforms | Reduces risk of losing all assets if one platform fails. |

| Invest in different DeFi strategies (staking, farming, lending) | Helps balance risk and maximize potential returns. |

| Monitor market trends and adapt | Ensures better decision-making based on data and insights. |

Ensuring Security While Investing in Web3 DeFi

Security is one of the most critical aspects when it comes to decentralized finance. While DeFi offers numerous advantages, it also exposes investors to various risks such as hacking, smart contract bugs, and fraudulent projects.

Knowing how to start investing in Web3 DeFi safely involves taking proactive measures to safeguard assets, conducting due diligence on platforms, and implementing best security practices. Below, we explore some of the most common risks and how to mitigate them.

Common Risks in Web3 DeFi Investments

- Smart contract vulnerabilities – Code bugs that hackers can exploit.

- Rug pulls – Fraudulent projects that vanish after collecting funds.

- Impermanent loss – Loss in liquidity pools due to price fluctuations.

- Phishing scams – Fake websites and apps designed to steal credentials.

How to Identify and Avoid Scams

- Verify audits: Ensure the platform has undergone security audits from reputable firms like CertiK or ConsenSys.

- Check for open-source code: Trustworthy projects usually have transparent codebases.

- Avoid unrealistic APYs: High returns often indicate potential scams.

- Engage with communities: Active Discord, Telegram, and Twitter discussions can signal a project’s legitimacy.

Best Security Practices for Safe Investing

| Security Measure | Impact |

| Enable two-factor authentication (2FA). | Adds an extra layer of security. |

| Use hardware wallets for storage. | Prevents online hacks and phishing attacks. |

| Never share private keys or seed phrases. | Keeps your assets safe from unauthorized access. |

| Use a VPN for an additional layer of privacy. | Helps protect your location and identity while transacting. |

Maximizing Returns While Managing Risks

Investing in Web3 DeFi offers lucrative opportunities, but managing risks effectively is key to sustaining long-term profitability. While returns can be high, factors like market volatility, security threats, and liquidity challenges must be considered.

Understanding how to start investing in Web3 DeFi safely involves strategic planning, risk assessment, and choosing the right investment options that align with your goals. In this section, we explore proven strategies for maximizing returns while keeping risks in check.

Staking, Yield Farming, and Liquidity Pools

| Feature | Staking | Yield Farming | Liquidity Pools |

| Risk Level | Low | Medium | High |

| ROI | Moderate | High | Variable |

| Time Commitment | Long-term | Active | Varies |

Monitoring Market Trends and Price Volatility

- Use tools like CoinGecko, DappRadar, and DeFi Pulse.

- Follow crypto influencers and expert analysts.

- Set stop-loss and take-profit limits to manage risk.

Future of Web3 DeFi and Investment Trends

As the decentralized finance landscape continues to evolve, new opportunities and challenges emerge for investors. Staying informed about technological advancements and regulatory developments is crucial for making strategic investment decisions.

Understanding how to start investing in Web3 DeFi safely will ensure that investors can navigate this dynamic ecosystem while mitigating risks and maximizing potential gains.

Emerging Technologies in Web3 DeFi

- AI-driven trading bots for automated investments.

- Cross-chain interoperability allowing seamless asset transfers.

- DeFi insurance to cover investment losses.

- NFT integration in DeFi to enhance asset utility and ownership rights.

Regulatory Developments and Compliance

- Governments worldwide are tightening DeFi regulations.

- Investors should:

- Stay updated on legal changes.

- Ensure compliance with tax laws.

- Use KYC-compliant platforms for enhanced security.

Would you like additional case studies or real-world examples integrated?

Takeaways

Web3 DeFi is revolutionizing the financial sector by offering unparalleled access to decentralized investment opportunities. While the potential for high returns is evident, it is equally important to approach investments with caution, prioritizing security and due diligence.

By understanding how to start investing in Web3 DeFi safely, investors can harness the benefits of decentralization while protecting their assets from emerging risks. Whether you’re a beginner or a seasoned investor, staying updated with industry trends, security best practices, and regulatory developments is key to long-term success in the DeFi space.

By leveraging the right tools, choosing reputable platforms, and adopting strategic risk management approaches, you can make the most of what Web3 DeFi has to offer while ensuring a secure and profitable investment journey.

As the decentralized finance landscape continues to evolve, new opportunities and challenges emerge for investors. Staying informed about technological advancements and regulatory developments is crucial for making strategic investment decisions.

Understanding how to start investing in Web3 DeFi safely will ensure that investors can navigate this dynamic ecosystem while mitigating risks and maximizing potential gains.