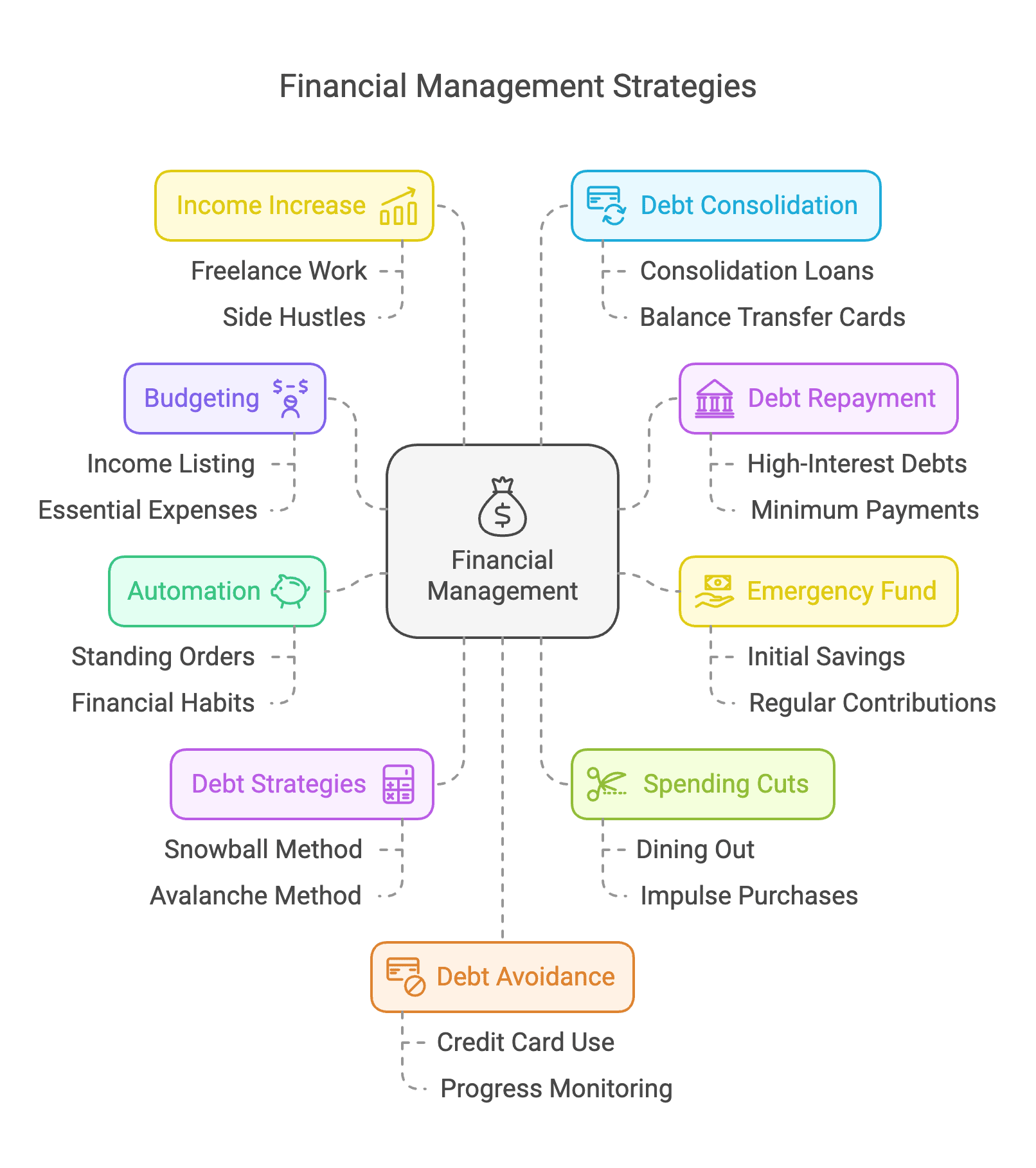

Managing debt while trying to save money can feel like an uphill battle, but it’s possible to achieve both with a balanced approach. While paying off debt is a priority, building savings at the same time offers financial security and prevents you from relying on credit when emergencies arise.

By adopting smart strategies like budgeting, prioritising high-interest debt, and automating your finances, you can reduce debt and grow your savings simultaneously. In this guide, we’ll explore practical tips on how to strike the right balance between saving money and paying off debt efficiently.

1. Create a Realistic Budget

The foundation of any financial plan is a well-structured budget. Start by listing your income and all essential expenses, such as rent, utilities, groceries, and transportation. Then, allocate a portion of your income towards debt repayment and savings. A realistic budget ensures that you’re living within your means while addressing both your debt and savings goals.

By setting aside specific amounts for debt and savings, you’ll avoid overspending and gain better control of your finances. Regularly review and adjust your budget to ensure it reflects your current financial situation.

2. Prioritise Debt Repayment

When looking to save money, it’s important to prioritise debt repayment first. Debts such as credit card bills, short term loans, personal loans, etc., can quickly spiral out of control due to accumulating interest. Focus on paying off these high-interest debts first while maintaining minimum payments on lower-interest debts, like student loans or mortgages.

Reducing high-interest debt early saves you money in the long run, freeing up more income to build your savings. By tackling this debt aggressively, you can prevent it from growing and minimise the overall amount you pay in interest.

3. Build an Emergency Fund

While debt repayment is a priority, building a small emergency fund is equally important to avoid relying on credit during financial emergencies. Aim to set aside £500 to £1,000 initially to cover unexpected expenses, such as car repairs or medical bills. This prevents you from going deeper into debt when unforeseen costs arise.

Once your emergency fund is in place, continue contributing small amounts regularly while focusing on debt repayment. An emergency fund provides a safety net and helps you maintain financial stability as you work towards becoming debt-free.

4. Automate Savings and Debt Payments

Automating your savings and debt repayments is a simple yet effective way to stay on track without the temptation to spend the money elsewhere. Set up standing orders for both your debt payments and savings contributions so that the money is automatically transferred from your account each month.

This approach helps you prioritise your financial goals and ensures that both your debts and savings are being addressed regularly. Automating the process reduces the risk of missed payments and helps build good financial habits over time.

5. Use the Snowball or Avalanche Method

When tackling debt, the snowball and avalanche methods are two popular strategies. The snowball method involves paying off your smallest debts first, giving you a sense of accomplishment and motivation to continue. The avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first, saving you more money in the long run.

Choose the method that works best for your financial situation and personality. Both approaches are effective, and the key is to remain consistent and focused on reducing your overall debt.

6. Cut Back on Non-Essential Spending

Cutting back on non-essential spending is one of the most practical ways to free up more money for debt repayment and savings. Review your monthly expenses and identify areas where you can make adjustments, such as dining out, entertainment, or impulse purchases. Even small changes, like making coffee at home or reducing subscription services, can add up over time.

Redirect the money saved from these cutbacks towards your debt or savings goals. By being mindful of your spending habits, you’ll be able to accelerate debt repayment while still contributing to your savings.

7. Look for Ways to Increase Income

Increasing your income can give you a significant boost when trying to pay off debt and save simultaneously. Consider taking on freelance work, part-time jobs, or selling unused items to generate extra income. Any additional earnings can be directed towards your debt or savings, helping you achieve your financial goals faster.

Whether it’s starting a side hustle, asking for a raise, or finding ways to monetise your hobbies, even a small increase in income can make a big difference in your ability to pay off debt and build savings.

8. Consolidate Debt Where Possible

If you’re struggling with multiple debts, consolidating them into a single loan with a lower interest rate may be a good option. Debt consolidation simplifies your payments, making it easier to manage and often reduces the overall interest you pay.

Consolidation loans, balance transfer credit cards, or debt management plans are all possible solutions, depending on your circumstances. Be sure to research the best option for your situation and ensure that the new loan terms are favourable.

Consolidating your debt can make repayment more manageable and reduce financial stress.

9. Avoid New Debt and Monitor Progress

While paying off debt, it’s crucial to avoid taking on any new debt. Limit the use of credit cards and refrain from borrowing money unless absolutely necessary. Focus on living within your means and using your budget as a guide. Regularly monitor your progress by tracking both your debt reduction and savings growth.

Seeing your debt decrease and your savings increase can be motivating and help you stay committed to your financial plan. By avoiding new debt, you’ll be able to move closer to your goal of financial freedom.

Conclusion

Balancing debt repayment and saving money can be challenging, but it’s achievable with a thoughtful and disciplined approach. By prioritising high-interest debt, building an emergency fund, and cutting non-essential spending, you can reduce your debt while still growing your savings.

Automating your payments and using strategies like the snowball or avalanche method will keep you on track and ensure steady progress. Stay focused, be patient, and continue to make small but consistent efforts towards your financial goals, and you’ll see improvements over time.