Spain has long been a favorite destination for expats, offering a vibrant culture, stunning landscapes, and a high quality of life. Do you know how to get PR in Spain?

Securing Permanent Residency (PR) in Spain unlocks a world of opportunities, from free movement within the Schengen Zone to access to top-notch healthcare and education.

Whether you dream of retiring in Spain, furthering your career, or simply enjoying the Mediterranean lifestyle, understanding the PR process is crucial.

In this guide, we’ll walk you through every aspect of obtaining PR in Spain, ensuring you’re well-prepared for this life-changing journey.

Benefits of Permanent Residency in Spain

Permanent Residency in Spain comes with numerous advantages:

- Freedom to Live and Work: PR holders can live and work anywhere in Spain without restrictions.

- Access to Services: Enjoy access to Spain’s world-class healthcare system and public education.

- Travel Benefits: Move freely within the 26 Schengen Zone countries without needing a visa.

- Pathway to Citizenship: PR status can lead to Spanish citizenship after an additional period, typically five years.

| Benefits of PR |

Details |

| Freedom to Work | No job-related visa restrictions. |

| Healthcare Access | Full access to Spain’s healthcare system. |

| Education Opportunities | Free or low-cost public education. |

| Schengen Travel | Visa-free travel within the Schengen Zone. |

| Citizenship Pathway | Eligible for citizenship after 5 years of PR. |

Eligibility Criteria for PR in Spain

To qualify for PR in Spain, you must meet the following criteria:

- Residency Requirement: Live in Spain continuously for at least five years.

- Financial Stability: Provide proof of a stable income or sufficient funds.

- Clean Criminal Record: No criminal convictions in Spain or elsewhere.

- Valid Residency Permit: Hold a valid temporary residency permit during the qualifying period.

- Integration: Show evidence of integration into Spanish society, such as language proficiency and community involvement.

| Eligibility Criteria | Requirements |

| Residency Duration | 5 years continuous stay in Spain. |

| Financial Proof | Bank statements or income proof. |

| Criminal Record Check | Certificate of no criminal history. |

| Current Residency Permit | Valid temporary permit is mandatory. |

| Integration Evidence | Language proficiency or community involvement. |

Types of Residency Permits in Spain

Spain offers various residency permits, some of which can lead to PR:

- Temporary Residency: Initial permits for living in Spain.

- Golden Visa Program: For investors who purchase property or make substantial investments.

- Work and Study Permits: Often transition into PR after five years.

- Family Reunification: For family members of Spanish residents or citizens.

| Permit Type | Purpose |

| Temporary Residency | General residency for short-term stays. |

| Golden Visa | For property investors and high-net-worth individuals. |

| Work and Study Permits | For employment or academic purposes. |

| Family Reunification | For dependents of Spanish residents. |

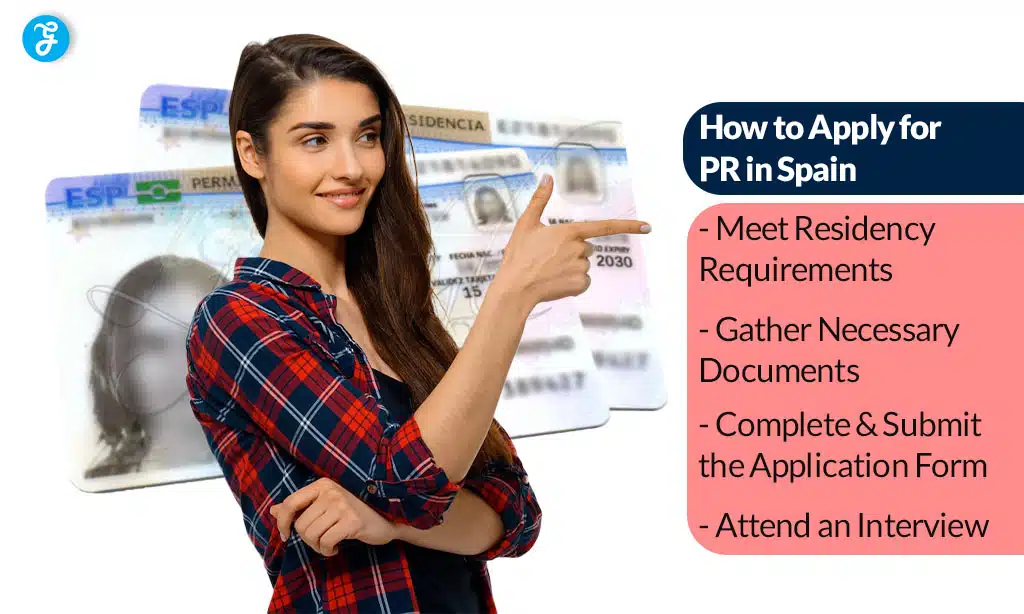

How to Apply for Permanent Residency (PR) in Spain

Applying for PR in Spain involves several detailed steps. Here’s an in-depth guide to help you through the process:

Step 1: Meet Residency Requirements

- Ensure you have legally resided in Spain for at least five consecutive years under a valid residency permit (e.g., work, study, or family reunification permits).

- Temporary absences are allowed but should not exceed six months per year or 10 months over five years unless justified (e.g., professional obligations).

Step 2: Gather Necessary Documents

- Prepare all required documents. Ensure they are up-to-date, valid, and properly formatted. You may need translations and legalizations depending on your country of origin.

| Document | Purpose |

| Valid Passport | Proof of identity and travel document. |

| Current Residency Permit | Confirms legal status in Spain. |

| Proof of Residency | Utility bills, rental contracts, or empadronamiento certificate. |

| Financial Documents | Bank statements, payslips, or tax returns to prove financial stability. |

| Health Insurance Certificate | Confirms access to public or private healthcare. |

| Police Clearance Certificate | Confirms no criminal history in Spain or other countries. |

| Application Form (EX-11) | Official application for long-term residency. |

| Photographs | Recent passport-sized photos (per requirements). |

Step 3: Complete the Application Form

- Download and fill out the EX-11 form (solicitud de autorización de residencia de larga duración).

- Provide accurate details and ensure there are no errors.

- The form is available on Spain’s immigration website or at the local immigration office.

Step 4: Submit Your Application

- Visit your local Foreigner’s Office (Oficina de Extranjeros) or police station to submit your application in person.

- Provide all documents and completed forms. Originals and copies may be required.

- Pay the application fee (approximately €80-€120). You will receive a receipt of submission.

Step 5: Attend an Interview (If Required)

- In some cases, the immigration authorities may schedule an interview to verify your eligibility.

- Be prepared to discuss your integration into Spanish society (e.g., language skills, cultural understanding).

Step 6: Await Decision

- The processing time typically ranges from 20 days to 3 months, depending on the volume of applications.

- You may track your application status online or by contacting your local immigration office.

Step 7: Collect Your PR Card

- Once approved, you will receive notification to collect your Tarjeta de Identidad de Extranjero (TIE).

- Visit the designated office to pick up your PR card, which is valid for five years and renewable.

| Step | Details |

| Submission Confirmation | Keep the receipt of your application safe. |

| Processing Period | Typically takes 20 days to 3 months. |

| TIE Collection | Pick up your PR card upon approval. |

Step 8: Register and Update Details

- Register your PR status with the local authorities.

- Update your address and other personal details if necessary.

Costs Associated with PR in Spain

Obtaining PR in Spain involves various costs:

- Application Fee: Approximately €80-120.

- Document Translation: Costs for official translations.

- Legalization of Documents: Additional fees may apply.

- Miscellaneous Expenses: Travel to offices, photocopying, etc.

| Cost | Estimated Amount |

| Application Fee | €80-120 |

| Translation Services | €20-50 per document |

| Document Legalization | Varies based on country of origin. |

| Miscellaneous | €50-100 |

Challenges and How to Overcome Them

Common challenges include:

- Language Barriers: Consider hiring a translator or learning basic Spanish.

- Bureaucratic Delays: Patience and regular follow-ups can help.

- Document Errors: Double-check all paperwork for accuracy.

| Challenge | Solution |

| Language Barriers | Hire a translator or learn Spanish basics. |

| Bureaucratic Delays | Regularly follow up with authorities. |

| Document Issues | Double-check for errors or omissions. |

Maintaining Your PR Status

To keep your PR status:

- Renewal: Renew your PR card every five years.

- Residency Compliance: Avoid staying outside Spain for extended periods.

- Legal Obligations: Pay taxes and adhere to Spanish laws.

| Requirement | Details |

| PR Card Renewal | Every 5 years. |

| Residency Compliance | Reside primarily in Spain. |

| Tax Compliance | Fulfill Spanish tax obligations. |

Alternative Pathways to Spanish Citizenship

After holding PR for five years, you may apply for citizenship:

- Naturalization Requirements:

- Continuous residency.

- Basic Spanish language skills.

- Knowledge of Spanish culture and laws.

- Dual Citizenship: Spain does not allow dual citizenship with all countries.

| Citizenship Pathway | Details |

| Naturalization Process | 5 years of PR and fulfilling criteria. |

| Language Requirement | Basic proficiency in Spanish. |

| Cultural Knowledge | Pass a test on Spanish culture and laws. |

Tax Implications for PR Holders in Spain

As a permanent resident in Spain, you are required to adhere to the country’s tax laws. Here are the key points to consider:

- Tax Residency Status: You are considered a tax resident if you spend more than 183 days in Spain in a calendar year or if Spain is the center of your economic interests.

- Income Tax: Spain’s progressive tax system applies to worldwide income if you are a tax resident. Non-residents are taxed only on income earned in Spain.

- Wealth Tax: PR holders may be subject to Spain’s wealth tax, which applies to individuals with assets exceeding a certain threshold (varies by region).

- Double Taxation Agreements: Spain has agreements with many countries to avoid double taxation. Check if your country has such an agreement with Spain to understand your tax obligations.

- Tax Returns: Tax residents must file annual income tax returns, typically by June of the following year.

| Tax Type | Details |

|---|---|

| Income Tax | Progressive rates (up to 47% for high income). |

| Wealth Tax | Regional thresholds apply to high-value assets. |

| Double Taxation Relief | Check bilateral agreements to avoid double taxation. |

| Filing Deadline | Usually by June for the previous year’s income. |

Maintaining Compliance

- Keep Records: Maintain documentation of income, assets, and any tax payments.

- Hire a Tax Advisor: Professional guidance can help ensure compliance and optimize your tax strategy.

- Notify Changes: Inform the tax authorities of any changes to your address or financial circumstances.

Resources and Contacts

For additional help:

- Official Government Portal: www.migraciones.es

- Immigration Lawyers: Consult local experts.

- Expat Forums: Join communities for shared experiences.

Takeaways

Securing a permanent residency in Spain is a significant step towards building a future in this beautiful country.

By understanding the process, gathering the required documents, and following the steps outlined here, you can make your PR application smoother and more successful.

Spain offers unparalleled opportunities for those ready to embrace its culture and lifestyle. Start your journey today and unlock a brighter future in Spain.