Income protection insurance provides a financial safety net when life takes an unexpected turn. For many people, a sudden injury, illness, or disability can make it difficult to continue working, potentially causing a significant loss of income.

Thankfully, income protection insurance in India can help bridge this gap and offer peace of mind. However, the process of filing a claim can sometimes feel overwhelming, especially for those who may not be familiar with the requirements.

In this comprehensive guide, we’ll walk you through how to file an income protection insurance claim in India.

Whether you’re new to the process or need a refresher, this step-by-step guide will cover everything from understanding the basics of income protection insurance to navigating the claims process.

By the end of this article, you’ll feel confident in your ability to file a claim and protect your financial future.

Understanding Income Protection Insurance in India

Before diving into the steps of filing a claim, it’s essential to understand the basics of income protection insurance.

This section will provide a foundational understanding of what income protection insurance is, its benefits, and the eligibility criteria for making a claim in India.

What is Income Protection Insurance?

Income protection insurance is a type of policy that provides financial support in case you are unable to work due to illness, injury, or disability.

The primary purpose of this insurance is to replace a portion of your lost income and help cover day-to-day expenses, ensuring you can maintain your standard of living during tough times.

In India, income protection insurance is becoming increasingly popular, especially as more people recognize the importance of safeguarding their income in the face of unforeseen circumstances.

Eligibility Criteria for Filing a Claim

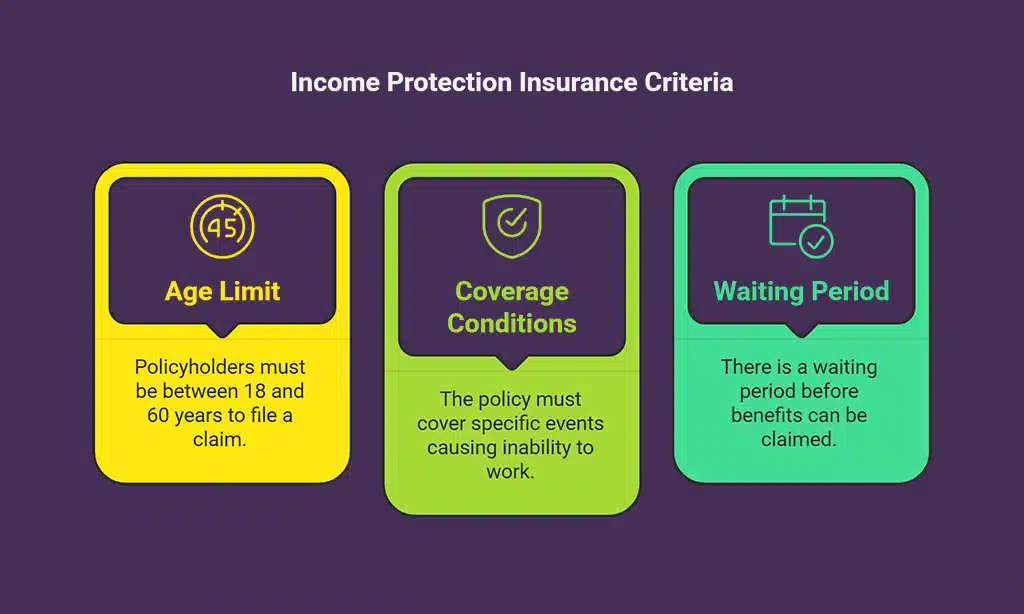

To file a claim under your income protection insurance policy, you need to meet specific eligibility criteria set by the insurer. These criteria may vary slightly depending on the insurance provider, but generally, the following conditions apply:

- Policyholder’s Age: Most income protection insurance policies in India have an age limit for coverage. Typically, policyholders must be between 18 and 60 years of age to file a claim.

- Coverage Conditions: The policy must cover the specific event or condition causing the inability to work, whether it’s an accident, illness, or disability.

- Waiting Period: Many insurance policies have a waiting period before you can claim benefits. This waiting period could range from a few weeks to several months.

- Medical Proof: You must provide medical evidence from a licensed healthcare professional that proves your inability to work.

Step-by-Step Process to File an Income Protection Insurance Claim in India

Now that you have a foundational understanding of income protection insurance, let’s dive into the detailed steps required to file a claim. This section provides you with a clear, actionable guide on how to proceed through each stage of the claim filing process.

Step 1: Review Your Policy Terms and Conditions

Before proceeding with the claim, you must fully understand the terms and conditions outlined in your insurance policy. This ensures you know what is covered, what is not, and how to file the claim correctly.

Familiarizing yourself with your policy can also help prevent common mistakes and frustrations later in the process.

| Important Aspects to Review | Explanation |

| Coverage | Understand what types of illness, injury, or disability are covered under your policy. |

| Exclusions | Look for exclusions such as pre-existing conditions or certain types of injuries that may not be covered. |

| Claim Process | Review the exact steps and documents required for filing your claim. |

| Payout Limit | Understand the maximum amount you can claim and how long the payments will continue. |

| Premium Payment Status | Verify that your premiums are up-to-date, as an unpaid premium can invalidate your claim. |

Actionable Tip: Take notes on important policy details, and if needed, reach out to your insurer’s customer service team to clarify any doubts before filing your claim.

Step 2: Gather Required Documents

Once you are clear on your policy’s terms, the next step is to gather the necessary documents. Each insurance provider may have its own document requirements, but here is a list of the most common documents needed to file an income protection insurance claim:

| Document | Purpose |

| Claim Form | A form provided by your insurance provider that details your claim request. |

| Medical Certificate | A document from a licensed healthcare provider that confirms your condition. |

| Proof of Income | Recent salary slips, tax returns, or bank statements to establish your pre-illness income. |

| Policy Document | A copy of your original policy document. |

| Proof of Identity | A government-issued ID like Aadhar, PAN card, or voter ID for identity verification. |

| Other Medical Records | Any other relevant medical documents, such as hospital bills, diagnostic reports, or prescriptions. |

Real-Life Example: Amit, an employee at a multinational corporation, faced an accident that rendered him unable to work for six weeks. He promptly gathered his medical certificate, his bank statements, and his employer’s verification of his monthly income. This ensured that his claim was processed swiftly without delays.

Pro Tip: Maintain both physical and digital copies of all documents to avoid losing any important paperwork. Digital submissions often expedite the process.

Step 3: Contact Your Insurance Provider

Once you have everything in order, the next step is to contact your insurance provider to initiate the claim process. Many insurers offer multiple channels to file a claim, such as online portals, phone support, and assistance from insurance agents.

| Method of Contact | Details |

| Online Portal | Most insurers now offer a user-friendly online platform for filing claims. |

| Phone or Email | Reach out to customer support to discuss your claim process and clarify any doubts. |

| Insurance Agent | If you purchased your policy through an agent, they can assist in submitting the claim. |

Actionable Tip: When contacting your insurer, ask them to provide a clear timeline for the claim process. This will help you manage expectations and stay informed.

Step 4: Complete the Claim Form

Filling out the claim form is a crucial step. A well-completed form can save time, prevent rejections, and ensure faster processing.

How to Fill the Claim Form:

| Section | Details |

| Personal Details | Provide accurate personal details such as your full name, address, and contact information. |

| Incident Details | Describe your injury, illness, or condition in detail. Be clear and precise. |

| Medical Information | Include details about treatments, doctor visits, and medical history. |

| Income Details | Include accurate income details, such as salary slips or bank statements. |

| Declaration | Sign the declaration confirming the accuracy of the information provided. |

Example: Neha, a teacher, had a car accident and was unable to work for two months. When filling out her claim form, she made sure to describe the accident in detail, provide her medical history, and attach her recent salary slips. Her thorough and accurate submission ensured that her claim was processed quickly.

Step 5: Submit the Claim and Track Progress

After completing the form and gathering all necessary documents, the final step is to submit your claim. Depending on your insurer, you can choose from the following submission methods:

| Submission Method | Details |

| Online Submission | Submit via your insurer’s online portal for faster processing. |

| Postal Submission | If you prefer physical submission, mail all documents to your insurer’s office. |

| Agent Submission | Submit your claim through your insurance agent for assistance. |

Once submitted, keep track of your claim’s status. Most insurers offer an online tracker that updates you on the progress of your claim.

Be sure to follow up if you haven’t received an update in the specified time frame (usually 30-60 days).

Pro Tip: If you haven’t received an update in the expected time frame, don’t hesitate to contact customer support and ask for an update.

Common Challenges in Filing an Income Protection Insurance Claim

While the process is relatively straightforward, there are common issues that may cause delays or claim rejections. Here’s what to watch out for:

Delays in Processing

Delays are often caused by:

- Incomplete Documentation: Missing paperwork or incorrect information can result in processing delays.

- High Claim Volume: During peak times, such as flu season, insurers may experience a backlog of claims.

- Verification Process: Claims that involve long-term illnesses or injuries may require extensive verification, causing delays.

Rejection of Claims

Rejection may occur due to:

- Exclusions: If your condition falls under the policy’s exclusions, your claim may be denied.

- Late Submission: Claims submitted after the specified deadline are often rejected.

- Non-Disclosure: Failure to disclose pre-existing conditions or pertinent details when purchasing the policy can lead to rejection.

Actionable Tip: Always check the exclusions in your policy and submit your claim as soon as possible to avoid rejection.

Tips for a Successful Claim Filing Experience

To ensure a smooth and successful claim filing experience, follow these additional tips:

- Be Transparent and Honest: Provide accurate details about your condition. False information can delay or invalidate your claim.

- Maintain Proper Documentation: Keep copies of all your documents, including medical records, claim forms, and communication with your insurer.

- Stay Proactive: Don’t hesitate to contact your insurer if you need clarification on the process or if you haven’t received an update in a reasonable amount of time.

Real-Life Example: Sunil, a business owner, was able to receive a timely payout after his surgery because he kept meticulous records of his medical visits, kept his insurer updated, and was proactive in checking the status of his claim.

Takeaways

Filing an income protection insurance claim in India doesn’t have to be complicated. By following the step-by-step guide outlined above, gathering the necessary documents, and ensuring timely submission, you can protect your financial well-being during difficult times.

Remember, the key to a smooth claim process is preparation, transparency, and communication with your insurer.

Income protection insurance is designed to provide peace of mind in times of need, ensuring that you can focus on recovery rather than worrying about finances. Review your policy today and be ready to take action when the unexpected happens.